Form 990 Ez Schedule O

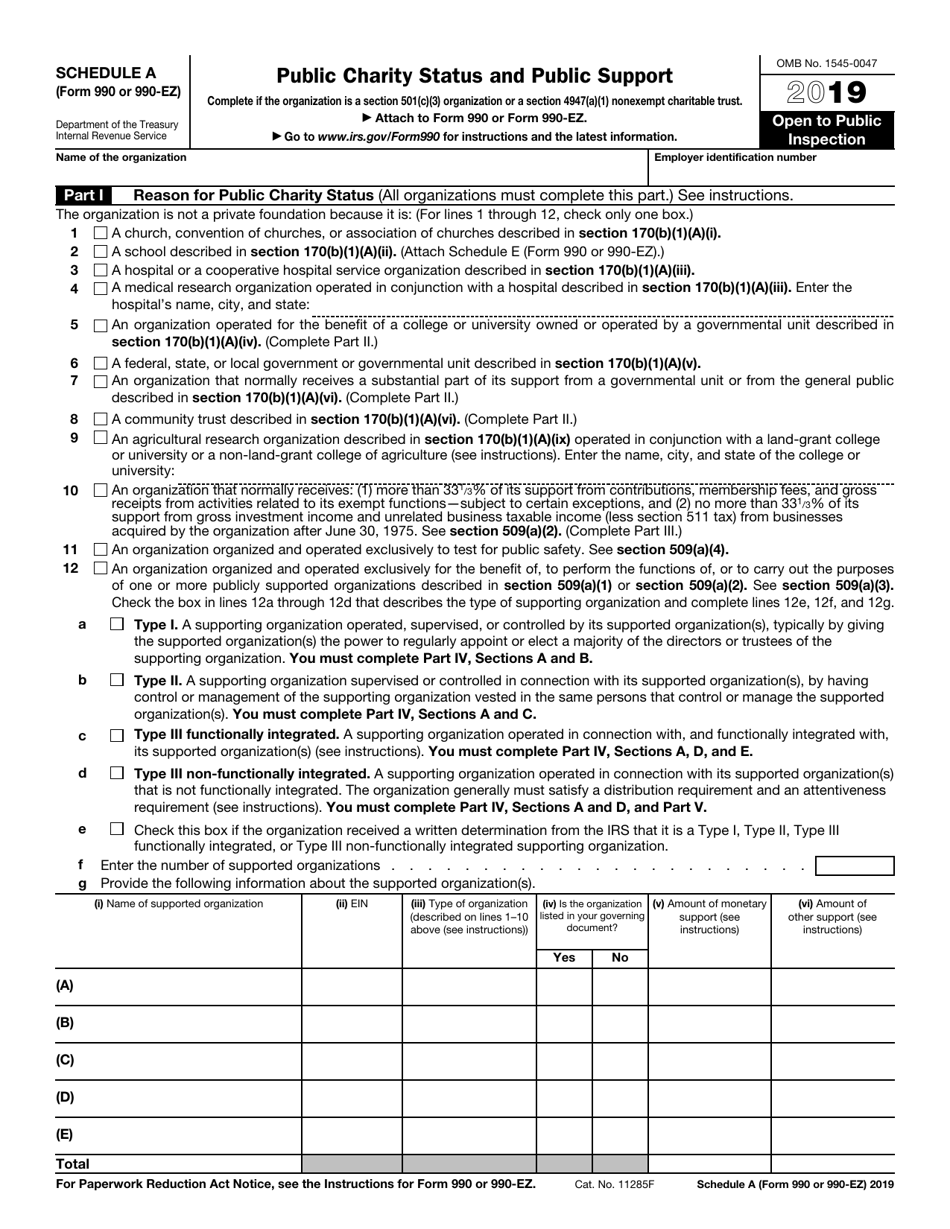

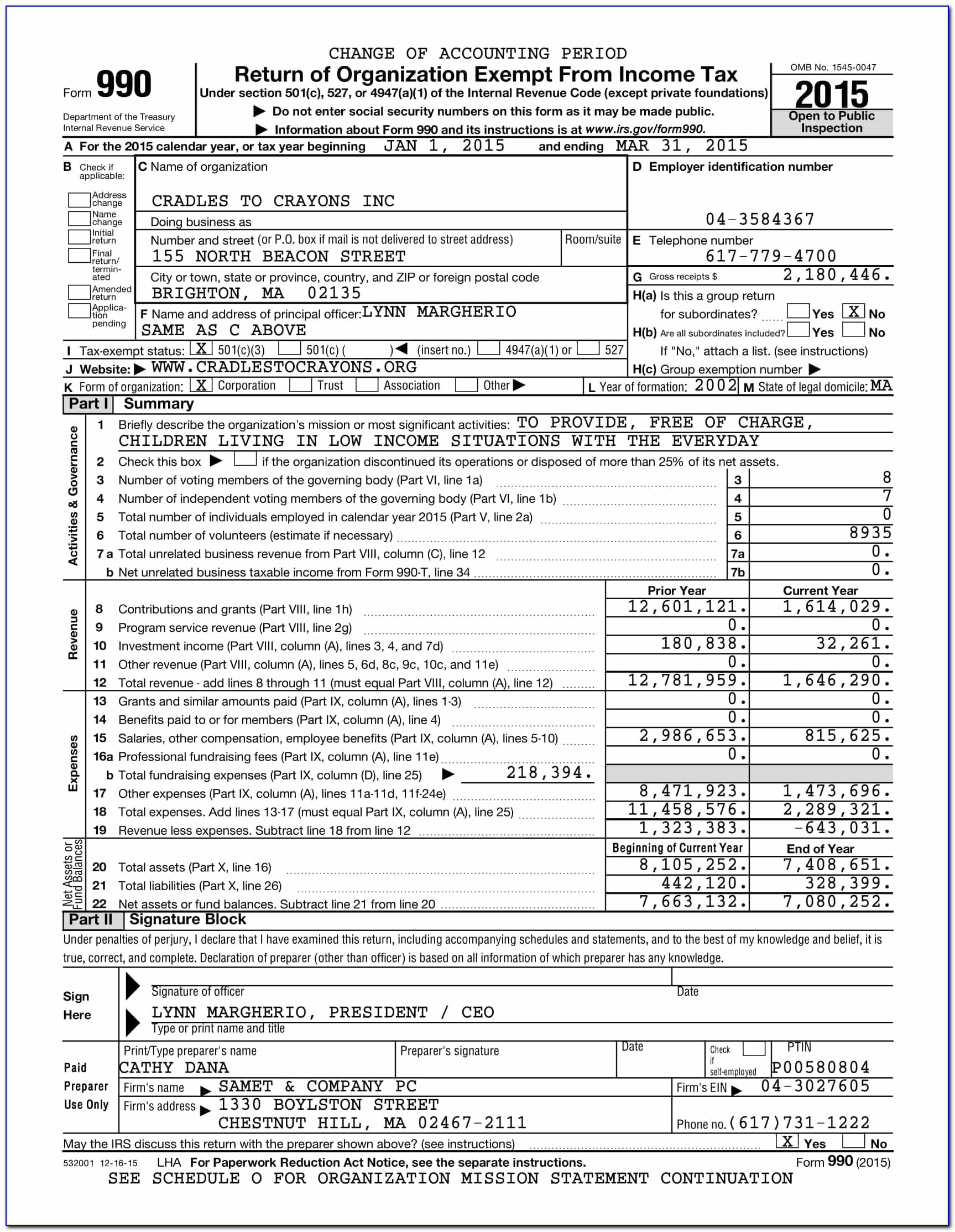

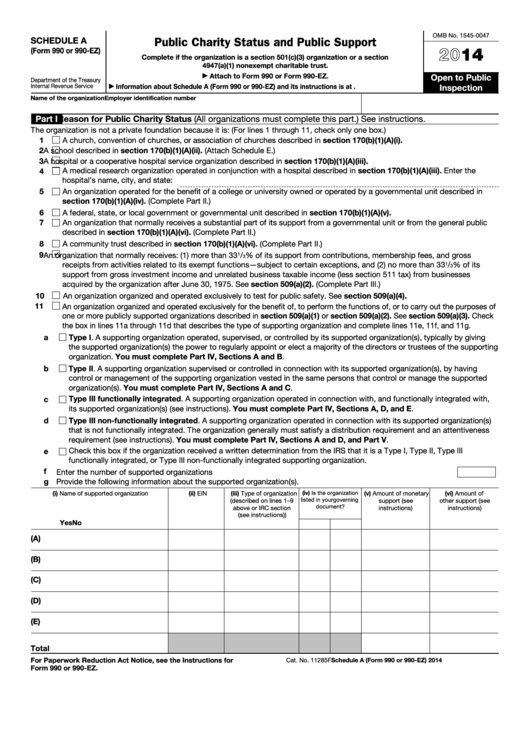

Form 990 Ez Schedule O - $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions. Form 990 (schedule o), supplemental. Web public charity status and public support. Get ready for tax season deadlines by completing any required tax forms today. Schedule o is used to provide the irs with detailed information and explanations for certain responses given on form 990. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Provide the irs with narrative information required for responses to specific questions on. Complete, edit or print tax forms instantly. Web short form return of organization exempt from income tax. Who must file all organizations that file form 990 and certain. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. It appears you don't have a pdf plugin for this browser. Web an organization should use schedule o (form 990), rather than separate attachments, to: Schedule o is used to provide the irs. Web public charity status and public support. Ad download or email irs 990 so & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web public charity status and public support. It appears you don't have a pdf plugin for this browser. Attach to form 990 or. The organization can file an amended return at. Get ready for tax season deadlines by completing any required tax forms today. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web public charity status and public support. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Web an organization should use schedule o (form 990), rather than separate attachments, to: Complete, edit or print tax. Web an organization should use schedule o (form 990), rather than separate attachments, to: Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Attach to form 990 or. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. It appears you don't have a pdf plugin for this browser. Get ready for tax season deadlines by completing any required tax forms today. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Ad access. Web public charity status and public support. Form 990 (schedule o), supplemental. It appears you don't have a pdf plugin for this browser. Web short form return of organization exempt from income tax. Each of the other schedules. Each of the other schedules. Attach to form 990 or. Web public charity status and public support. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Optional for others.) balance sheets(see the instructions for part. Complete, edit or print tax forms instantly. Web an organization should use schedule o (form 990), rather than separate attachments, to: Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social. Each of the other schedules. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Provide the irs with narrative information required for responses to specific questions on. The organization can file an amended return at. Each of the other schedules includes a separate part for supplemental information. It appears you don't have a pdf plugin for this browser. Get ready for tax season deadlines by completing any required tax forms today. A schedule or part will be automatically added to your return depending on your answers to questions. Complete, edit or print tax forms instantly. Attach to form 990 or. The organization can file an amended return at. Attach to form 990 or. Form 990 (schedule o), supplemental. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Who must file all organizations that file form 990 and certain. It appears you don't have a pdf plugin for this browser. Optional for others.) balance sheets(see the instructions for part. Web short form return of organization exempt from income tax. Web public charity status and public support. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. $ part i revenue, expenses, and changes in net assets or fund balances (see the instructions. Web an organization should use schedule o (form 990), rather than separate attachments, to: Web public charity status and public support. Provide the irs with narrative information required for responses to specific questions on. Each of the other schedules. Schedule o is used to provide the irs with detailed information and explanations for certain responses given on form 990.Printable Form 990ez 2019 Printable Word Searches

IRS 990 Schedule O 2019 Fill and Sign Printable Template Online

Printable Form 990ez 2019 Printable Word Searches

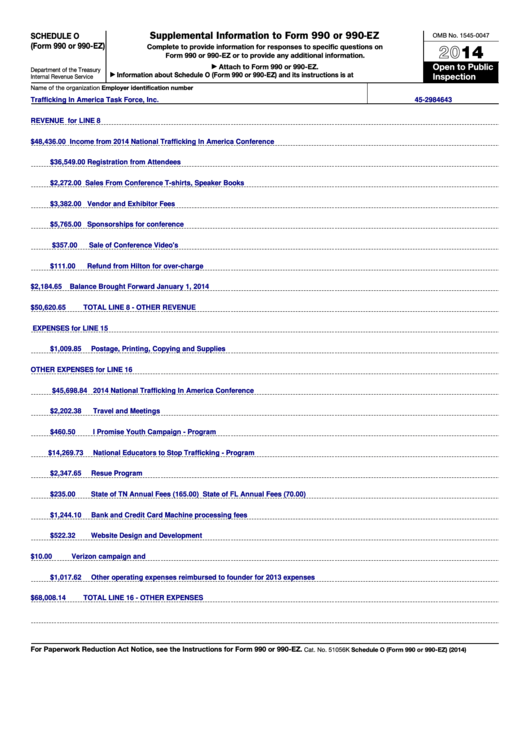

2014 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Fillable Schedule O 2014 Supplemental Information To Form 990 Or 990

Fillable IRS Form 990EZ Printable PDF Sample FormSwift

990 ez schedule o 2017 form Fill out & sign online DocHub

Printable Form 990ez 2019 Printable Word Searches

Irs Form 990 Ez 2015 Schedule O Form Resume Examples qQ5M9wJ5Xg

Fillable Schedule A (Form 990 Or 990Ez) Public Charity Status And

Related Post: