Form 943 Instructions

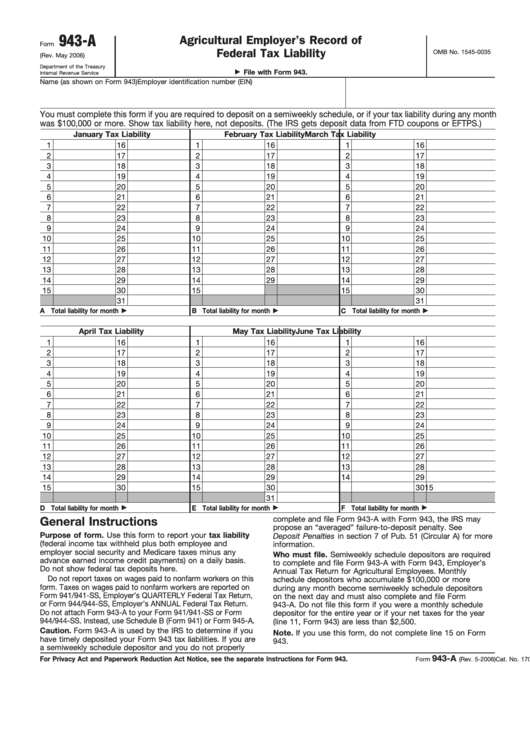

Form 943 Instructions - Web irs form 943: Complete, edit or print tax forms instantly. These instructions give you some background information about form 943. Web purpose of form 943. Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. Select form 943 and enter. Line by line instruction for 2022. As an agricultural employer, it's important to. Department of the treasury internal revenue service. To determine if you're a semiweekly schedule. Select form 943 and enter. As an agricultural employer, it's important to. Web purpose of form 943. Web employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or social security and medicare taxes. Web simply follow the steps below to file your form 943: Department of the treasury internal revenue service. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. How should you complete form 943? As an agricultural employer, it's important to. Form 943 (employer’s annual federal tax. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. Web employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or social security and medicare taxes. Employer’s annual federal tax return for agricultural. You must file your form 940 for 2022 by january 31, 2023. Web irs form 943 instructions. Select form 943 and enter. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. To determine if you're a semiweekly schedule. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Employer’s annual federal tax return for agricultural employees. Instructions for the employer's annual federal tax return for agricultural employees. Like many tax forms, form 943 requires you to include various information and calculations on different lines. Web irs form 943 instructions. Complete, edit or print tax forms instantly. To fill out form 943, you need your employer identification number (ein), your legal name, and your business. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent. Select form 943 and enter. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. The instructions include five worksheets similar to those in form. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on. Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. Form 943 (employer’s annual federal tax. Missouri tax identification number, federal employer identification number, or charter number. Ad access irs tax forms. Employer’s annual federal tax return for agricultural employees. Web employers cannot use form 843 to request an abatement of fica tax, rrta tax, or income tax withholding. How should you complete form 943? These instructions give you some background information about form 943. Web irs form 943 instructions. Exception for exempt organizations, federal,. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web irs form 943: Web employers who paid wages to agricultural employees (farmworkers) that are subject to federal income tax withholding or social security and medicare taxes. Web what information do you need to fill out. Complete, edit or print tax forms instantly. Exception for exempt organizations, federal,. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. These instructions give you some background information about form 943. Form 943 (employer’s annual federal tax. Complete, edit or print tax forms instantly. Who must file form 943? Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. They tell you who must file form 943, how to complete it line by line, and when and where to file it. To determine if you're a semiweekly schedule. You must file your form 940 for 2022 by january 31, 2023. Web irs form 943 instructions. For purposes of column (a), if the ale member offered. Click the link to load. Employer’s annual federal tax return for agricultural employees. Ad access irs tax forms. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Select back to form to get back to. The instructions include five worksheets similar to those in form. Department of the treasury internal revenue service.2023 Form 943 instructions Fill online, Printable, Fillable Blank

Download Instructions for IRS Form 943X Adjusted Employer's Annual

Instructions For Form 943X 2009 printable pdf download

2020 form 943 instructions Fill Online, Printable, Fillable Blank

Instructions For Form 943X printable pdf download

Download Instructions for IRS Form 943 Employer's Annual Federal Tax

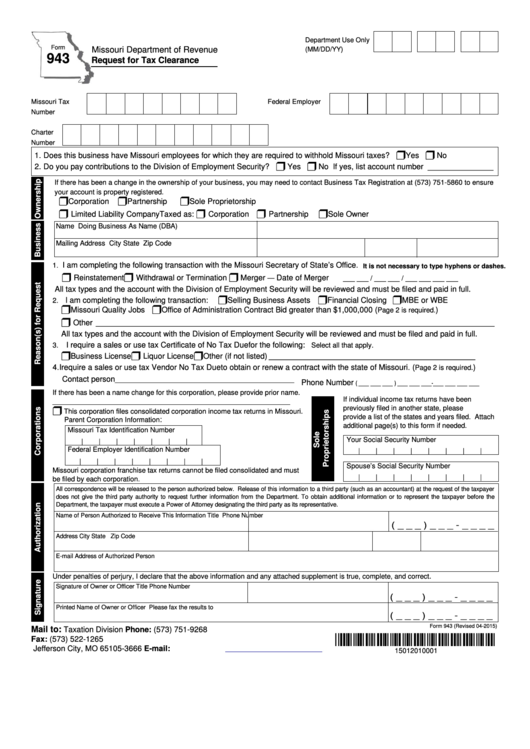

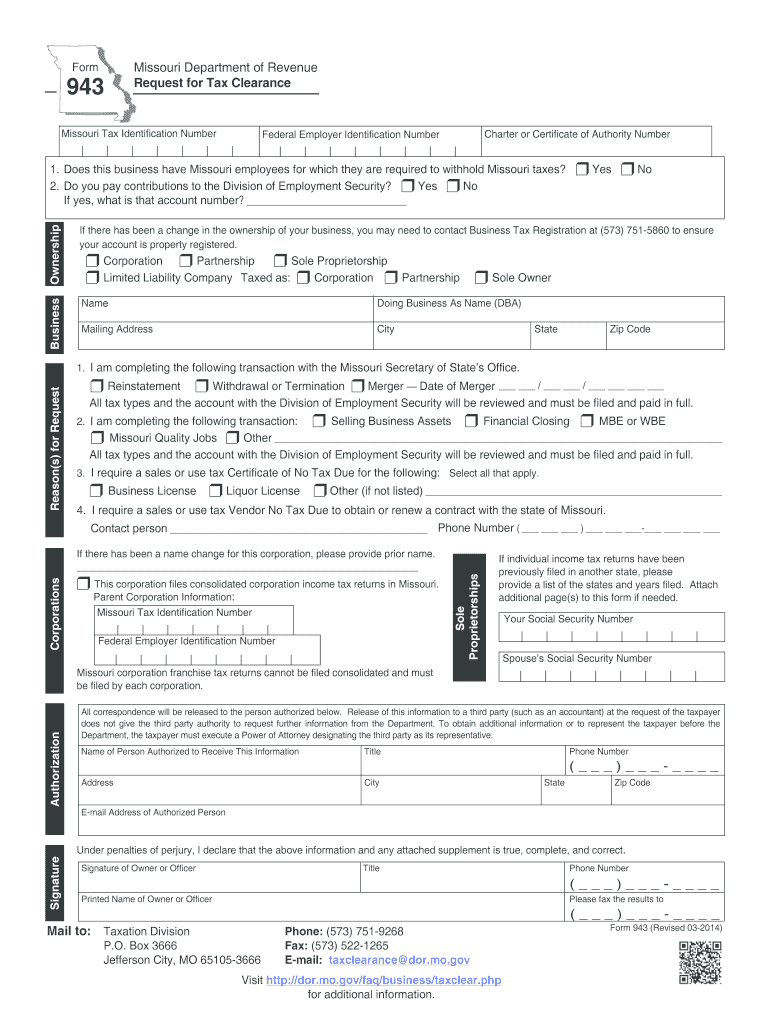

Fillable Form 943 Request For Tax Clearance printable pdf download

Form 943 missouri 2011 Fill out & sign online DocHub

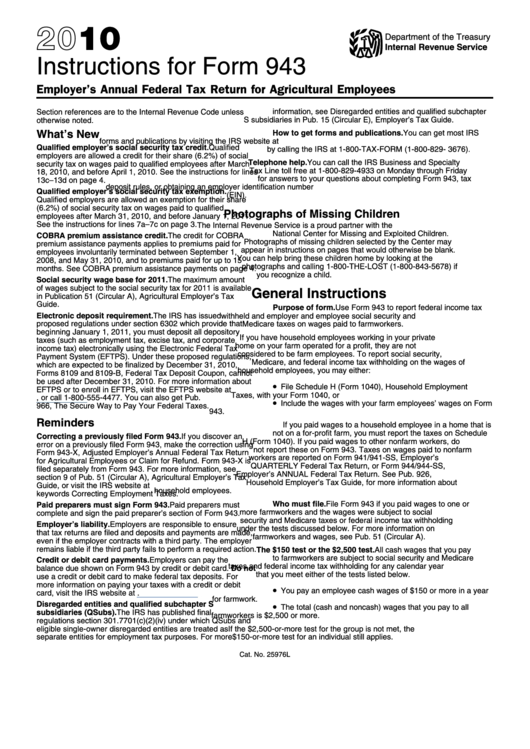

Instructions For Form 943 2010 printable pdf download

Fillable Form 943 Printable Forms Free Online

Related Post: