What Is An Unallowed Loss On Form 8582

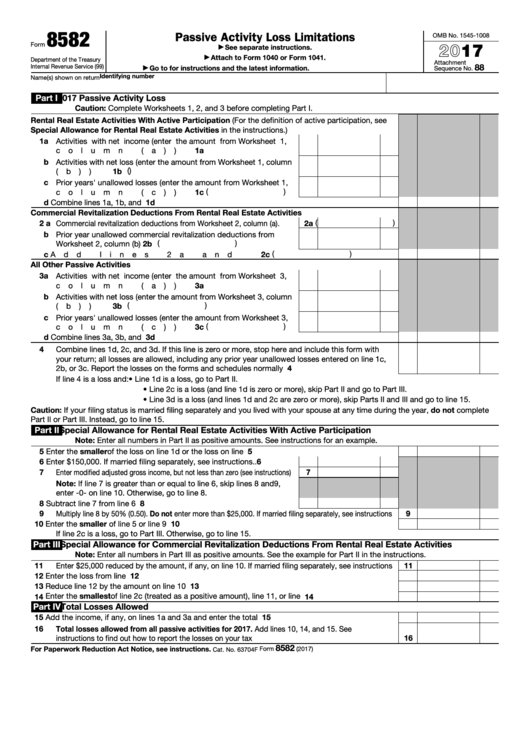

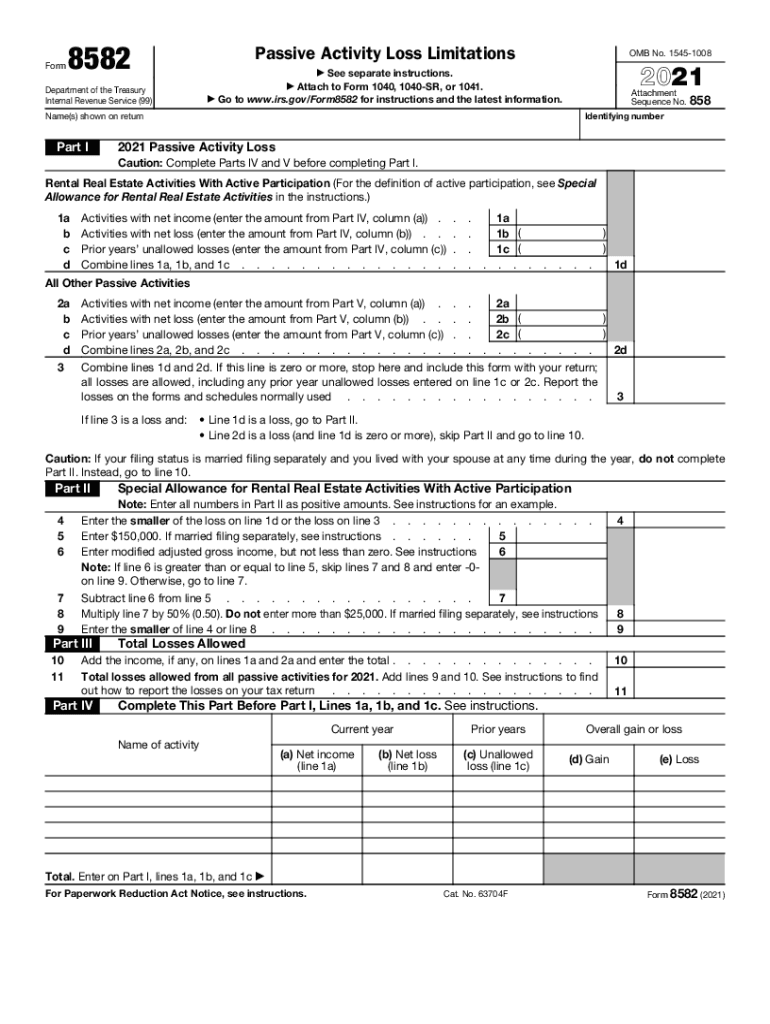

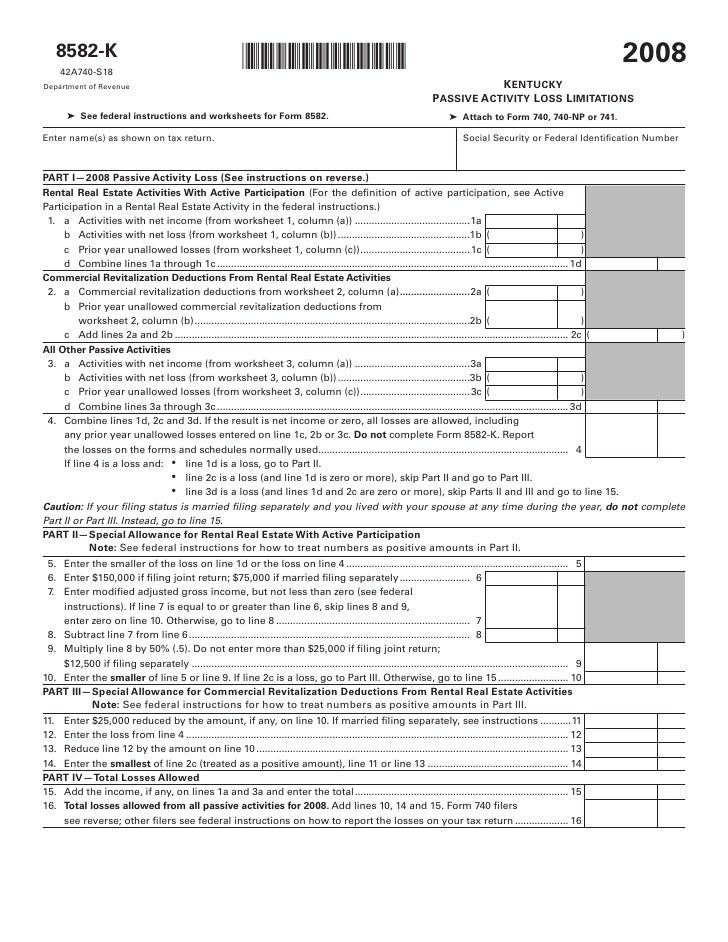

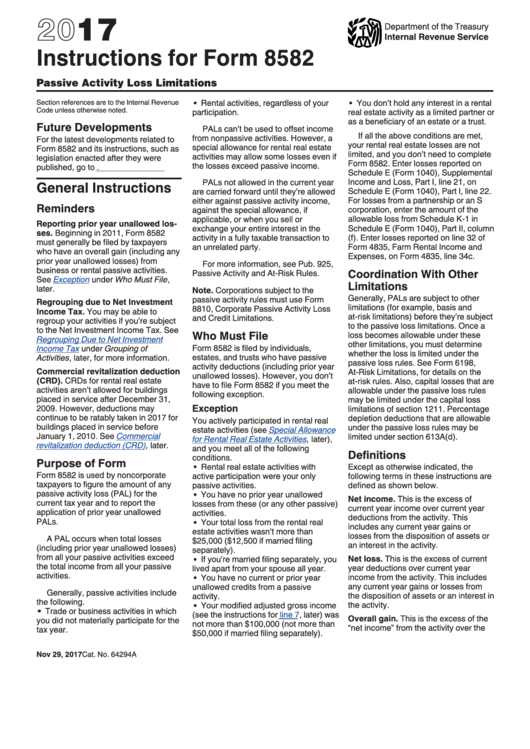

What Is An Unallowed Loss On Form 8582 - Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web this limitation, as well as the allocation of allowed and unallowed losses to the taxpayer’s passive activities, is calculated on form 8582. Ad access irs tax forms. Enter the total of column (c) from. Web a prior year unallowed loss for rental property is the amount of a loss from your rental (passive) activity that you were not allowed to deduct in the current year of the actual. Report the losses on the forms and schedules normally used. Web if current year net income from the activity is less than or equal to the prior year unallowed loss, enter the prior year unallowed loss and any current year net income from. A passive activity loss occurs when. Part ix is used to figure the portion of the unallowed loss attributable to the 28% rate loss and the portion attributable to the. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change it there. April 11, 2022 5:27 am. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Ad access. Web this limitation, as well as the allocation of allowed and unallowed losses to the taxpayer’s passive activities, is calculated on form 8582. Report the losses on the forms and schedules normally used. I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change it there. Web. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Ad access irs tax forms. Yes, it adds to the accumulated loss. Overall gain or loss (a). Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions) name of activity. Web a prior year unallowed loss for rental property is the amount of a loss from. Web purpose of form form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of. Complete, edit or print tax forms instantly. Web in taxslayer pro, when you create a tax return for a taxpayer whose return you created the previous year, you. Web solved•by intuit•145•updated november 30, 2022. Overall gain or loss (a) net income (line 1a) (b) net loss (line. A passive activity loss occurs when. Part ix is used to figure the portion of the unallowed loss attributable to the 28% rate loss and the portion attributable to the. If you need to specifically see the loss from 2020, you. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real. Report the losses on the forms and schedules normally used. Web purpose of form form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal). The loss shouldn't be allowed when the rental. Part ix is used to figure the portion of the unallowed loss attributable to the 28% rate loss and the portion attributable to the. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from. Web solved•by intuit•145•updated november 30, 2022. If you actively participated in a passive rental real estate activity, you may. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real. Enter the total of column (c) from. Web this limitation, as well. Web this limitation, as well as the allocation of allowed and unallowed losses to the taxpayer’s passive activities, is calculated on form 8582. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Web all losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. If you actively participated in a passive rental real estate activity, you may. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web the unallowed loss is suppose to be reported on form 8582 to carry forward for future years. Web in taxslayer pro, when you create a tax return for a taxpayer whose return you created the previous year, you are queried if you'd like to pull forward prior year. Report the losses on the forms and schedules normally used. Enter the total of column (c) from. Overall gain or loss (a) net income (line 1a) (b) net loss (line. I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change it there. Yes, it adds to the accumulated loss. Part ix is used to figure the portion of the unallowed loss attributable to the 28% rate loss and the portion attributable to the. April 11, 2022 5:27 am. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real. Complete, edit or print tax forms instantly. Web enter the unallowed losses for the prior years for each activity. The loss shouldn't be allowed when the rental. Web april 10, 2022 2:13 pm. A passive activity loss occurs when. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web a prior year unallowed loss for rental property is the amount of a loss from your rental (passive) activity that you were not allowed to deduct in the current year of the actual.Form 8582 Passive Activity Loss Limitations (2014) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable

Form 8582 Fill Out and Sign Printable PDF Template signNow

8582K Kentucky Passive Activity Loss Limitations Form 42A740S18

Instructions For Form 8582 Passive Activity Loss Limitations 2017

Form 8582Passive Activity Loss Limitations

IRS Form 8582 Instructions A Guide to Passive Activity Losses

IRS Form 8582 Instructions A Guide to Passive Activity Losses

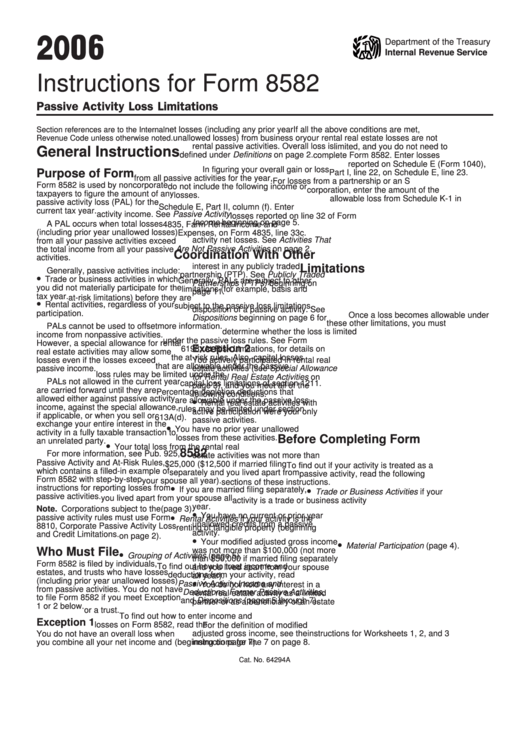

Instructions For Form 8582 Passive Activity Loss Limitations 2006

Related Post: