Form 940 Instructions

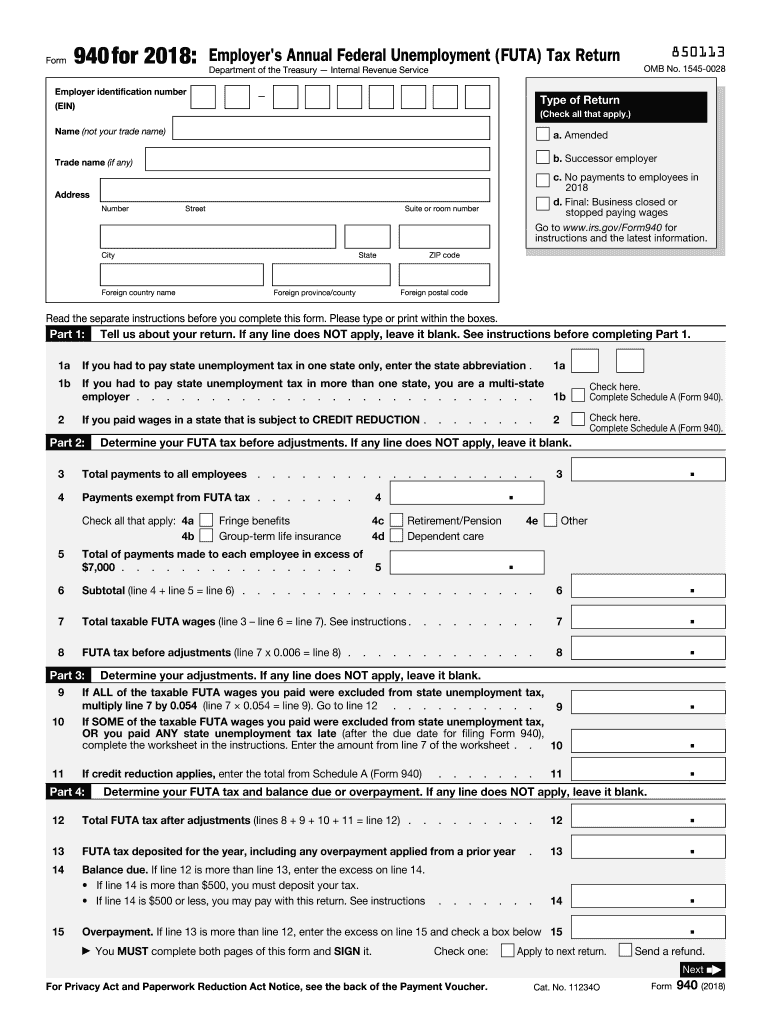

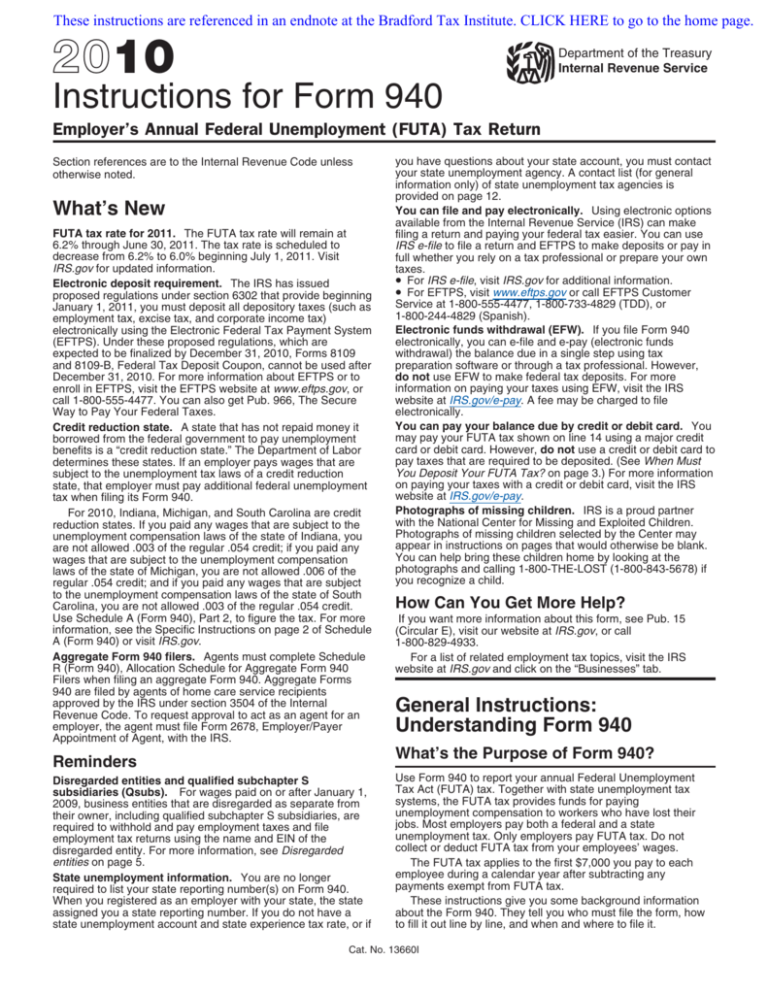

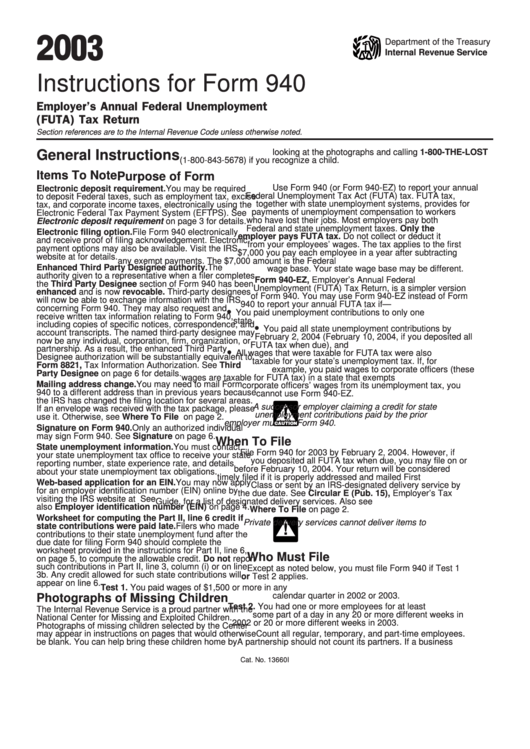

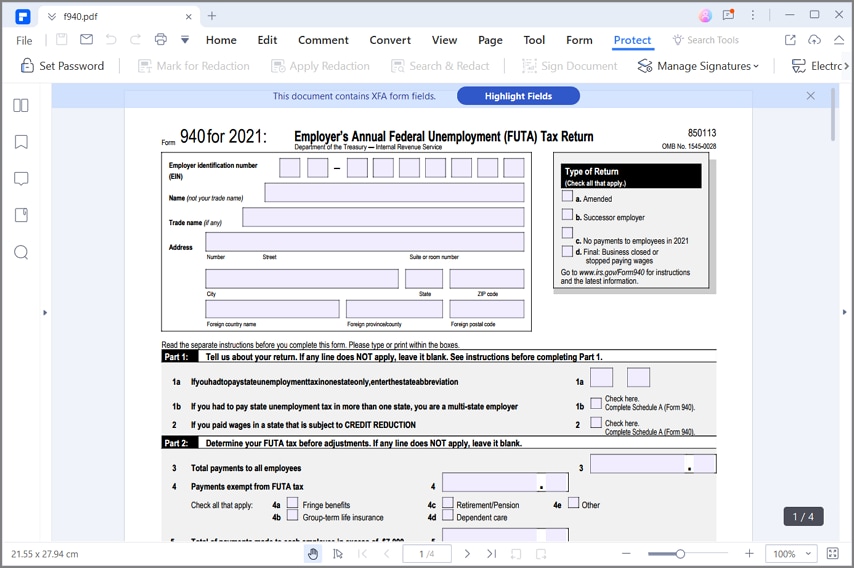

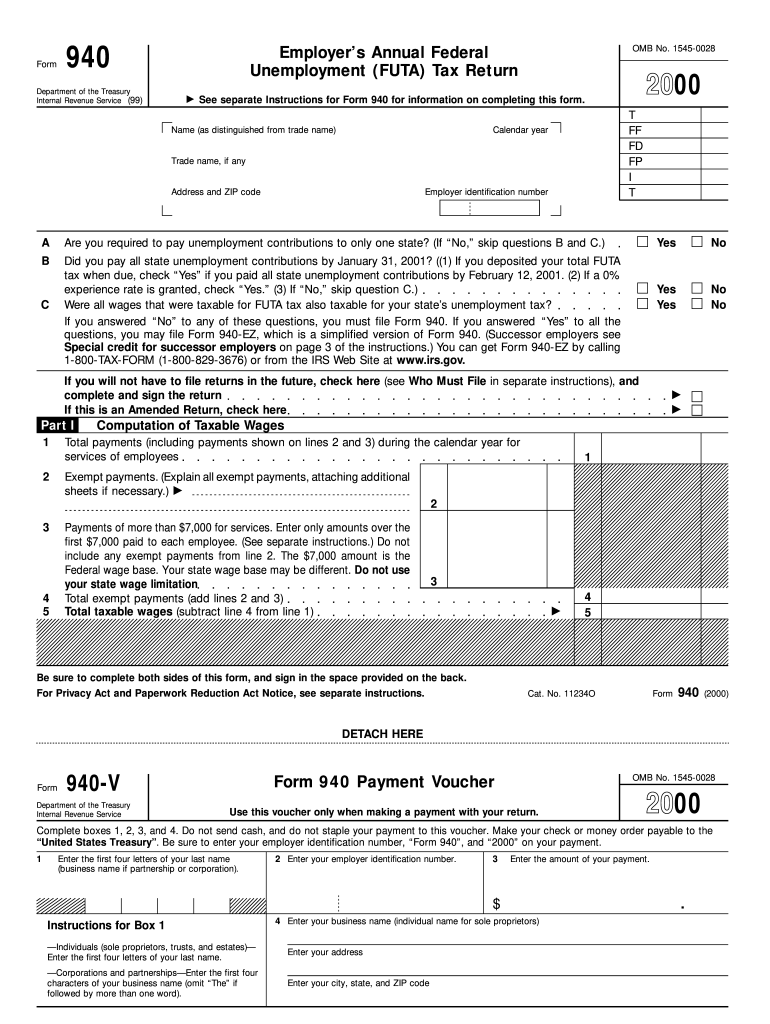

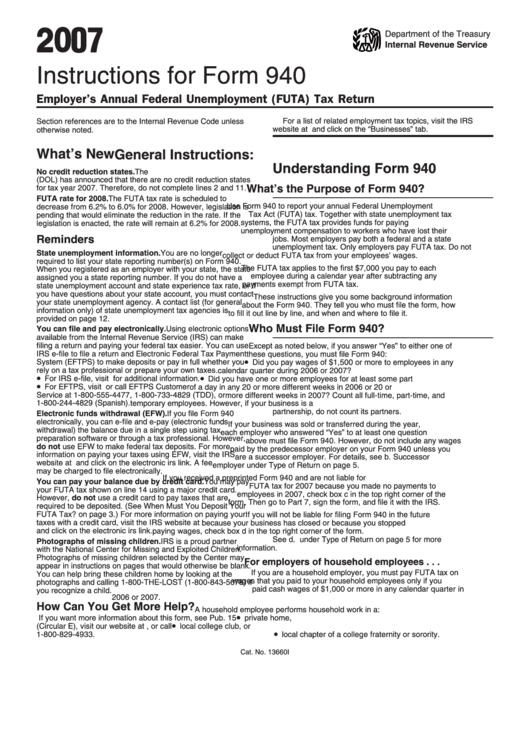

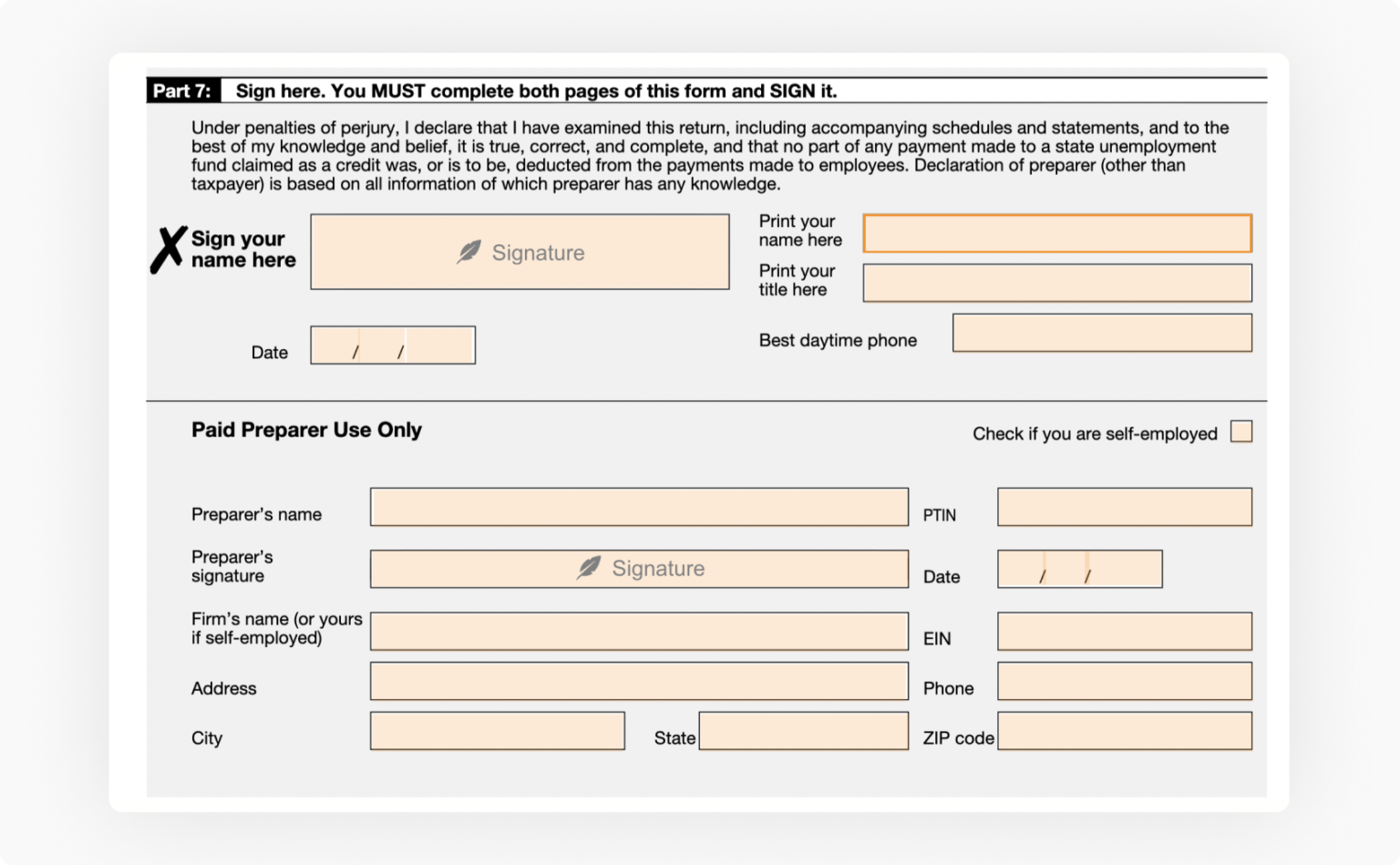

Form 940 Instructions - Try it for free now! If you deposited all the futa. Web we need it to figure and collect the right amount of tax. Irs form 940 is the federal unemployment tax annual report. Use form 940 to report your annual federal. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Businesses with employees file irs form 940 to report their obligations under futa—the federal unemployment tax act. Web how and when to pay unemployment taxes. They tell you who must file the form, how to fill it out line by line, and when and where to file it. Web what is irs form 940? This return is for a single state filer, and uses the most current copies of form 940 and. Employers pay federal unemployment tax on the first. Web what's the purpose of form 940? You paid wages of $1,500 or more to employees during the. Web use schedule a (form 940) to figure the credit reduction. Employers pay federal unemployment tax on the first. You paid wages of $1,500 or more to employees during the. Web 406 rows instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: There are currently seven parts that need to be completed for a 940. These instructions give you some background information about form 940. Here are the line by line. Web use schedule a (form 940) to figure the credit reduction. There may be earlier payment deadlines,. Try it for free now! Web we need it to figure and collect the right amount of tax. Employers pay federal unemployment tax on the first. Web popular forms & instructions; Employers must pay unemployment tax (futa tax), based on employee wages, and must submit form. Web use schedule a (form 940) to figure the credit reduction. Web what is irs form 940? Use form 940 to report your annual federal. Web what's the purpose of form 940? There are currently seven parts that need to be completed for a 940. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Employers. Web employment tax forms: Employers must pay unemployment tax (futa tax), based on employee wages, and must submit form. If you paid wages in a state that is subject to credit reduction. Individual tax return form 1040 instructions; Web we need it to figure and collect the right amount of tax. Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. If you deposited all the futa. Web • form 940 • form 940 schedule r. Form 940, employer's annual federal unemployment tax return. There are currently seven parts that need to be completed for a 940. Employers must report and pay unemployment taxes to the irs for their employees. There may be earlier payment deadlines,. Individual tax return form 1040 instructions; Web what is irs form 940? Web how and when to pay unemployment taxes. This return is for a single state filer, and uses the most current copies of form 940 and. Individual tax return form 1040 instructions; Web how and when to pay unemployment taxes. Employers must pay unemployment tax (futa tax), based on employee wages, and must submit form. You paid wages of $1,500 or more to employees during the. Web popular forms & instructions; Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. If you deposited all the futa. You paid wages of $1,500 or more to employees during the. If you paid wages in a state that is subject to credit reduction. Web we need it to figure and collect the right amount of tax. Web schedule a (form 940) for 2022: Upload, modify or create forms. Here are the line by line. Web • form 940 • form 940 schedule r. Web employment tax forms: Web what's the purpose of form 940? Individual tax return form 1040 instructions; Web how and when to pay unemployment taxes. Complete schedule a (form 940). Employers must report and pay unemployment taxes to the irs for their employees. There are currently seven parts that need to be completed for a 940. Use form 940 to report your annual federal. If you deposited all the futa. If you paid wages in a state that is subject to credit reduction. Irs form 940 is the federal unemployment tax annual report. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web popular forms & instructions; Web complete schedule a (form 940).Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Irs Forms 940 For 2015 slidesharedocs

Instructions for Form 940

Instructions For Form 940 Employer'S Annual Federal Unemployment

Formulaire IRS 940 Instructions de remplissage

Form 940 Instructions How to Fill It Out and Who Needs to File It

Free Printable 940 Annual Form Printable Forms Free Online

Instructions For Form 940 Employer'S Annual Federal Unemployment

IRS Publication Form Instructions 940 Employee Benefits Employment

form940instructionsfutataxrate202108 pdfFiller Blog

Related Post: