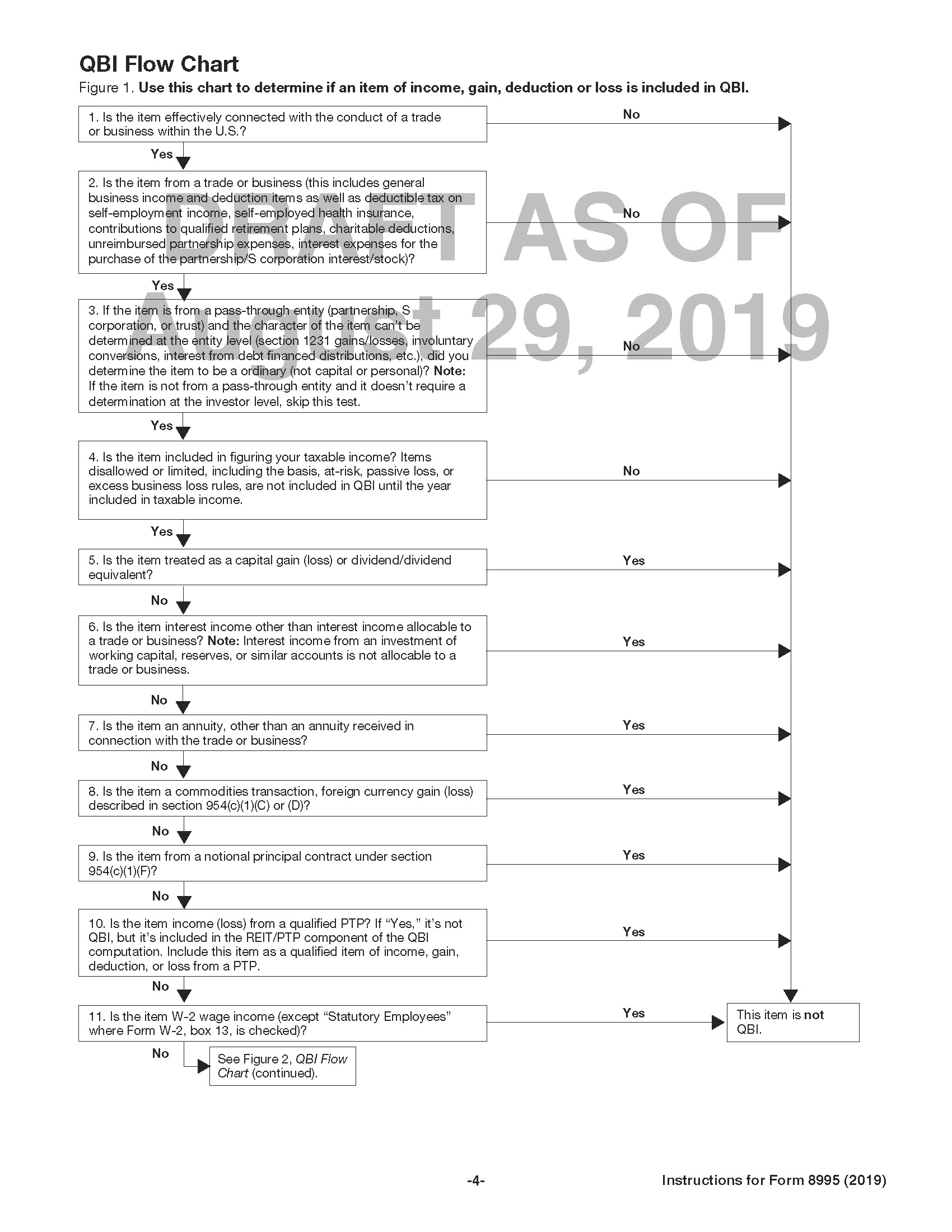

Form 8995 Instructions

Form 8995 Instructions - And your 2019 taxable income. When losses or deductions from a ptp are suspended in the year incurred,. Use this form to figure your qualified business income deduction. Web qualified business income deduction simplified computation. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. Include the following schedules (their specific instructions are shown later),. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web before jumping into the 2022 irs form 8995, make sure you're eligible for the qbi deduction. Web electing small business trusts (esbt). Web before jumping into the 2022 irs form 8995, make sure you're eligible for the qbi deduction. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. Web use form 8995 if: You have qualified business income, qualified reit dividends, or qualified ptp. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax. Web electing small business trusts (esbt). Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. And your 2019 taxable income. Form 8995 may be used in. Web qualified business income deduction simplified computation. Department of the treasury internal revenue service. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. Use separate schedules a, b, c, and/or d, as. Use this form to figure your qualified business income deduction. Qualified business income deduction simplified. Web electing small business trusts (esbt). Web before jumping into the 2022 irs form 8995, make sure you're eligible for the qbi deduction. Use separate schedules a, b, c, and/or d, as. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Web use form 8995 if: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. You have qbi, qualified reit dividends, or qualified ptp income or loss; •. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Web electing small business trusts (esbt). Qualified business income deduction simplified. Use separate schedules a, b, c, and/or d, as. Department of the treasury internal revenue service. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Web use form 8995 if: Department of the treasury internal revenue service. Web before jumping into the 2022. Use separate schedules a, b, c, and/or d, as. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. And your 2019 taxable income. Web electing small business trusts (esbt). The form 8995 used to compute the s portion’s qbi deduction. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax. Form 8995 may be used in. When losses or deductions from a ptp are suspended in the year incurred,. Web before jumping into the 2022 irs form 8995, make sure you're eligible for the qbi deduction. Web 2022 irs. Web qualified business income deduction simplified computation. Include the following schedules (their specific instructions are shown later),. Web use form 8995 if: Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web before jumping into the 2022 irs form 8995, make sure you're eligible for the qbi deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. Qualified business income deduction simplified. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax. When losses or deductions from a ptp are suspended in the year incurred,. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. And your 2019 taxable income. Department of the treasury internal revenue service. Use this form to figure your qualified business income deduction. Form 8995 may be used in. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Use separate schedules a, b, c, and/or d, as. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web electing small business trusts (esbt). Review the form instructions and ensure your business type and revenue.Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

2021 Form IRS 8995Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 8995 Instructions Your Simplified QBI Deduction

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

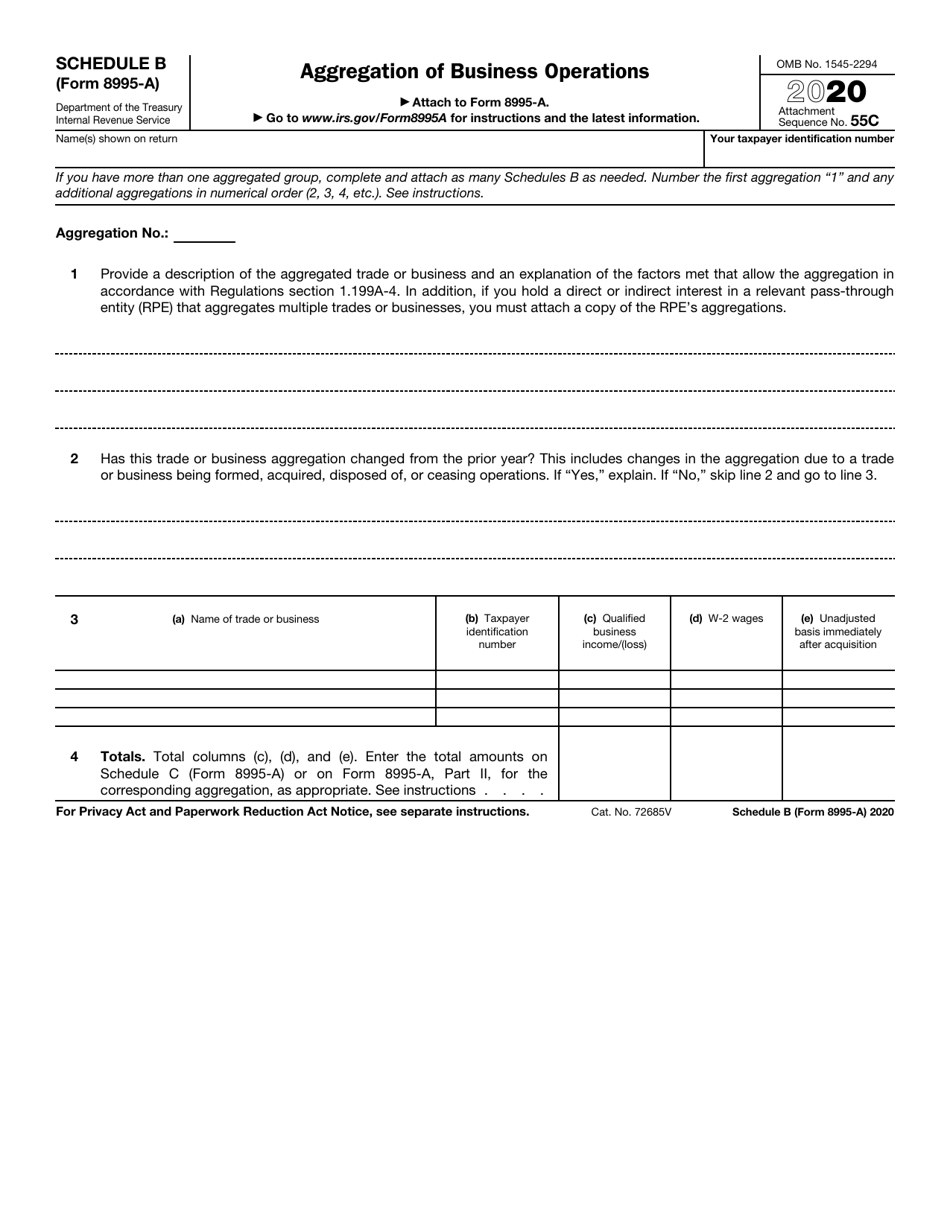

Irs Form 8995a Schedule B Download Fillable Pdf Or Fill Online

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

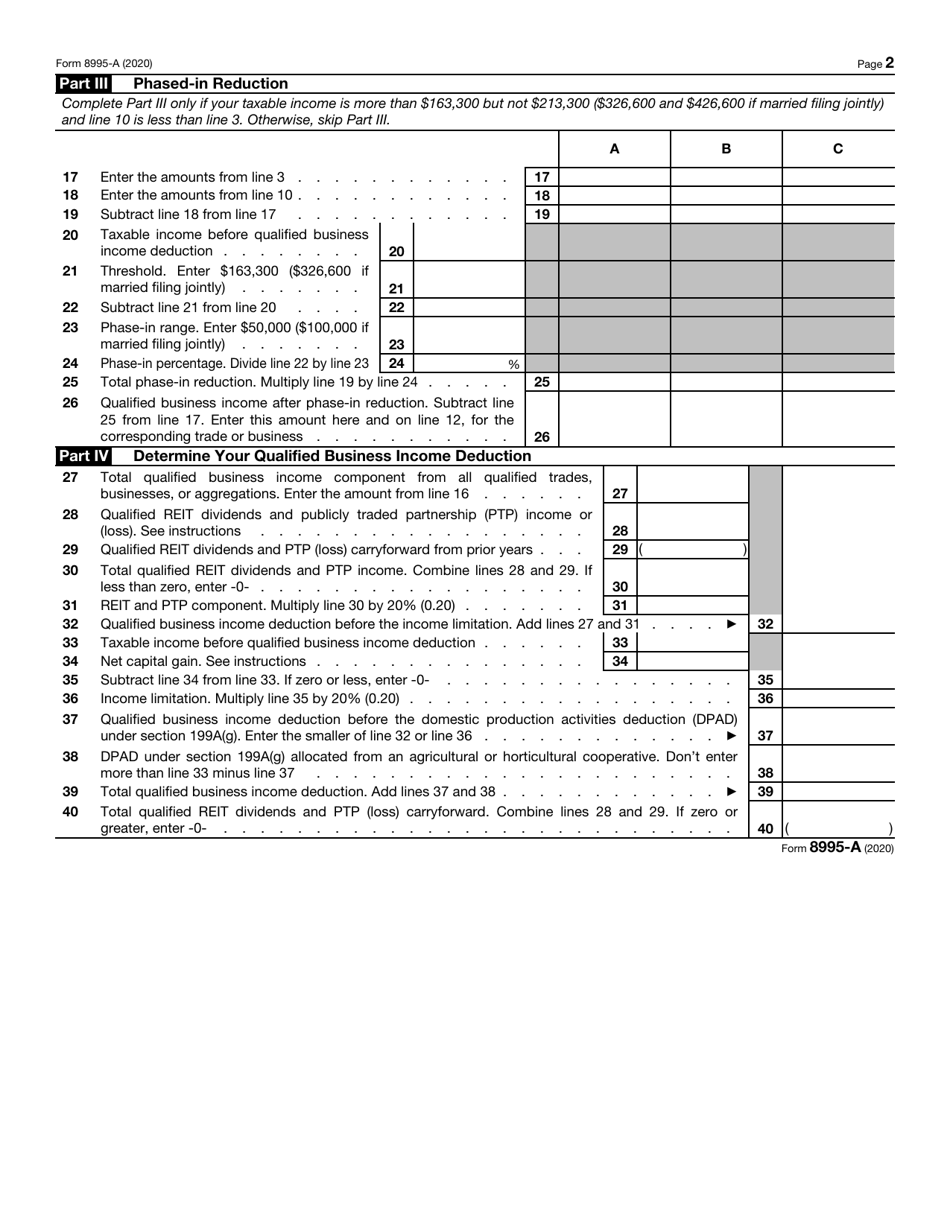

Download Instructions for IRS Form 8995A Deduction for Qualified

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Related Post: