Form 8962 Turbotax Rejected

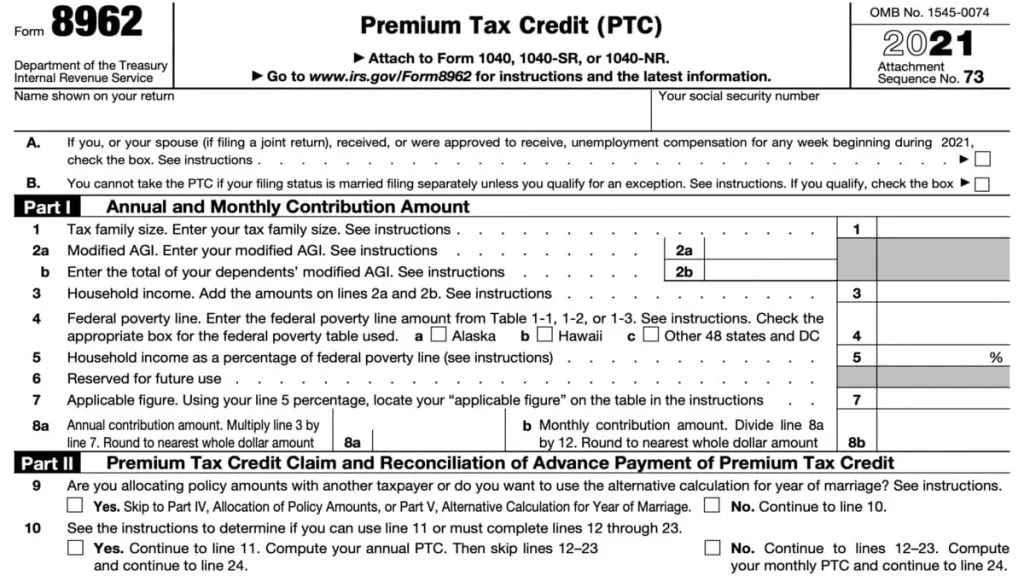

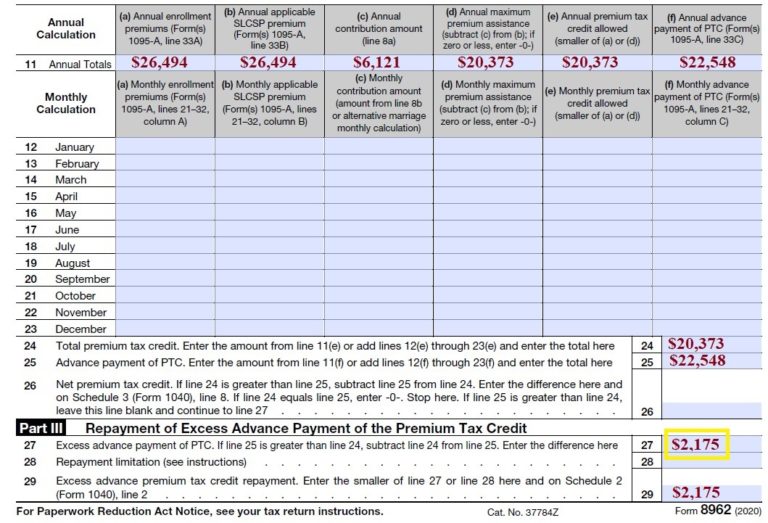

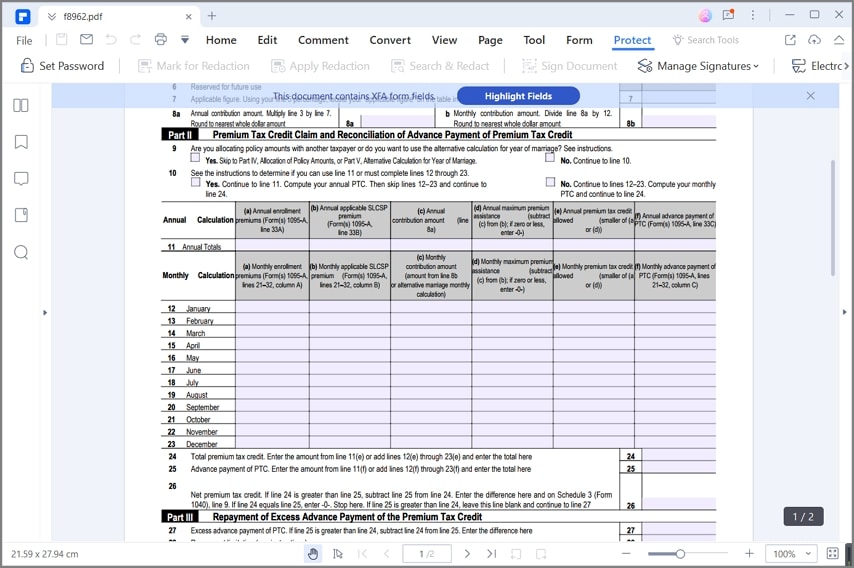

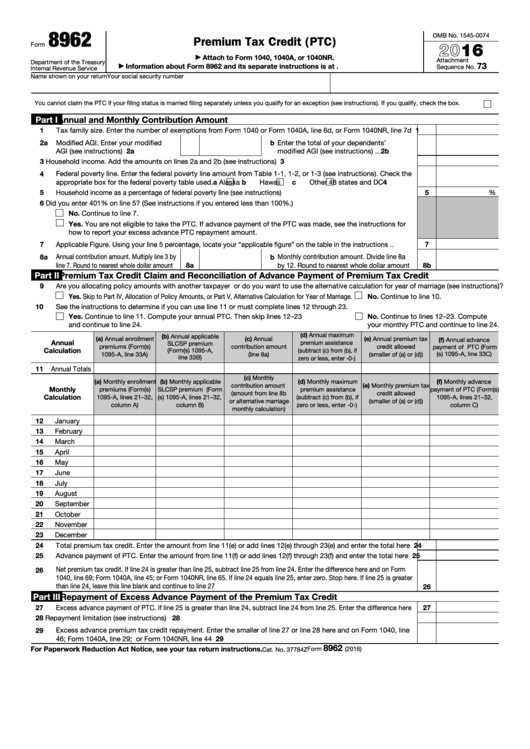

Form 8962 Turbotax Rejected - Form 8962 is used either (1) to reconcile a premium tax. Web beginning with tax year 2021, a return that ought to include form 8962 simply rejects. Web you'll need to add form 8862: On, or after february 3,. 15) note the page number of the. Several people have reported this. In the earned income credit section when you see do. The irs system still thinks you have marketplace insurance. It sounds like a bogus (i mean unexplained behavior) irs or intuit reject. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web our information for this code is this return cannot be electronically filed at this time due to a processing error that will be corrected on february 3, 2022. Web my return was rejected because of my form 8962 i was told there was a processing error and i will have to wait until 2/3/2022 to refile. 15) note the. It sounds like a bogus (i mean unexplained behavior) irs or intuit reject. Form 8962 is used either (1) to reconcile a premium tax. If you don’t have it, sign in to your healthcare.gov account and. Web my return was rejected because of my form 8962 i was told there was a processing error and i will have to wait. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). In the earned income credit section when you see do. Web when something's missing or mismatched, your return gets rejected. Web when you select no, turbotax will revert your selection back to. I got the same rejection code but i did forget to put our 8962 info in and its corrected but. One of these two workarounds will work. Web beginning with tax year 2021, a return that ought to include form 8962 simply rejects. On, or after february 3,. Web when something's missing or mismatched, your return gets rejected. Several people have reported this. Web solved • by turbotax • 2528 • updated april 13, 2023. Web you'll need to add form 8862: In the earned income credit section when you see do. 15) note the page number of the. The irs system still thinks you have marketplace insurance. It sounds like a bogus (i mean unexplained behavior) irs or intuit reject. 15) note the page number of the. Web when you select no, turbotax will revert your selection back to yes. Is this error due to turbotax? Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. The irs implemented this check for taxpayers who received the premium tax credit (ptc). One of these two workarounds will work. Web solved • by turbotax • 2528 • updated april 13, 2023. Form 8962 is used either (1) to reconcile. One of these two workarounds will work. Is this error due to. Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of your return or refund, or cause you to receive correspondence from the irs. The irs implemented this check for taxpayers who received the premium tax credit (ptc). On, or after. 15) note the page number of the. Information to claim earned income credit after disallowance to your return. If irs records indicate that the taxpayer, the taxpayer's spouse (if married filing jointly), or taxpayer's dependent received an. Web my return was rejected because of my form 8962 i was told there was a processing error and i will have to. Web when you select no, turbotax will revert your selection back to yes. Web our information for this code is this return cannot be electronically filed at this time due to a processing error that will be corrected on february 3, 2022. Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of. Web march 2, 2021 12:05 pm. Information to claim earned income credit after disallowance to your return. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). Web solved • by turbotax • 2528 • updated april 13, 2023. Row labels count of status. I got the same rejection code but i did forget to put our 8962 info in and its corrected but. Web please resubmit any rejected returns july 31, 2023. Is this error due to turbotax? Web my return was rejected because of my form 8962 i was told there was a processing error and i will have to wait until 2/3/2022 to refile. Web our information for this code is this return cannot be electronically filed at this time due to a processing error that will be corrected on february 3, 2022. On, or after february 3,. If you don’t have it, sign in to your healthcare.gov account and. The irs implemented this check for taxpayers who received the premium tax credit (ptc). Several people have reported this. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web beginning with tax year 2021, a return that ought to include form 8962 simply rejects. Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of your return or refund, or cause you to receive correspondence from the irs. 15) note the page number of the. One of these two workarounds will work. If irs records indicate that the taxpayer, the taxpayer's spouse (if married filing jointly), or taxpayer's dependent received an.Instructions for Form 8962 for 2018 KasenhasLopez

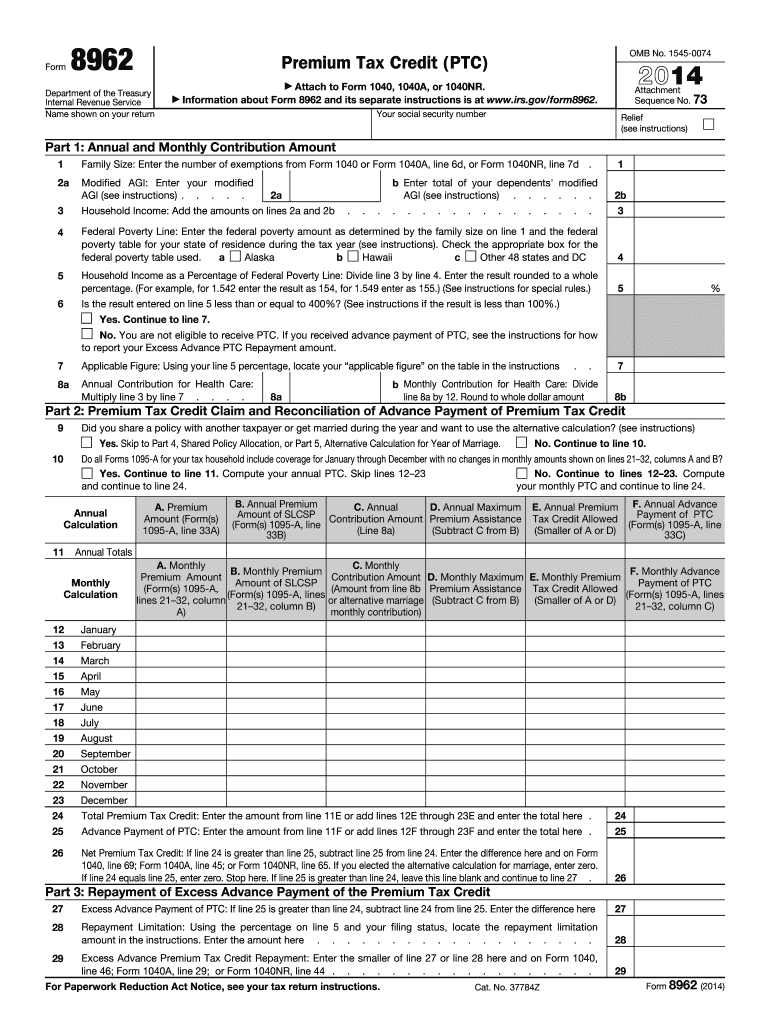

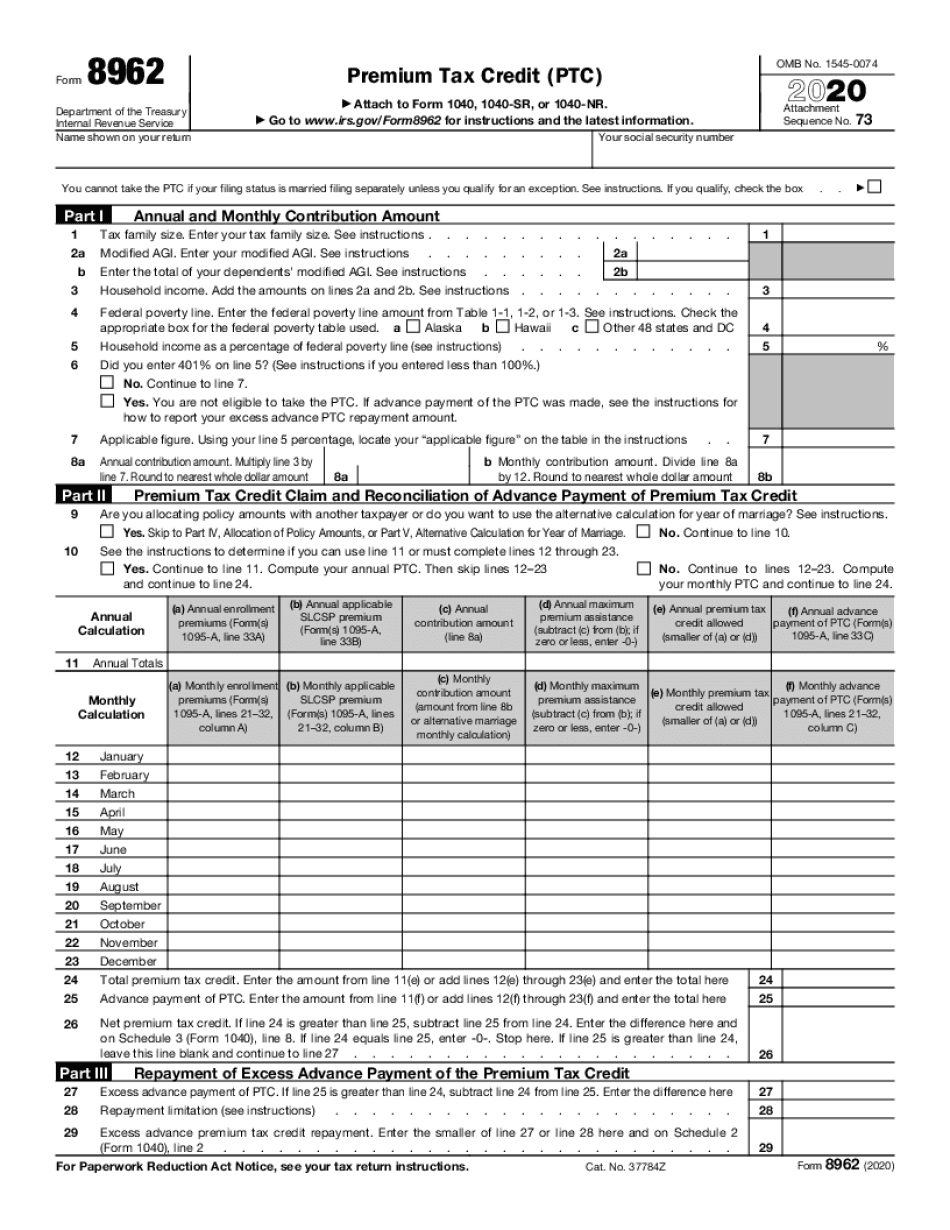

8962 Printable Form Printable Forms Free Online

Form 8962 Premium Tax Credit (PTC) for Shared Policy Allocation DocHub

form 8962 turbotax Fill Online, Printable, Fillable Blank howto

Tax Form 8962 Printable

8962 Form 2022 2023 Premium Tax Credit IRS Forms TaxUni

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

form 8962 2014 Diy Menu Cards, Menu Card Template, Wedding Menu

Form 8962 Printable Printable World Holiday

Missing Form 8962 EFile Rejection or IRS Letter Premium Tax

Related Post:

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)