Form 8958 Irs

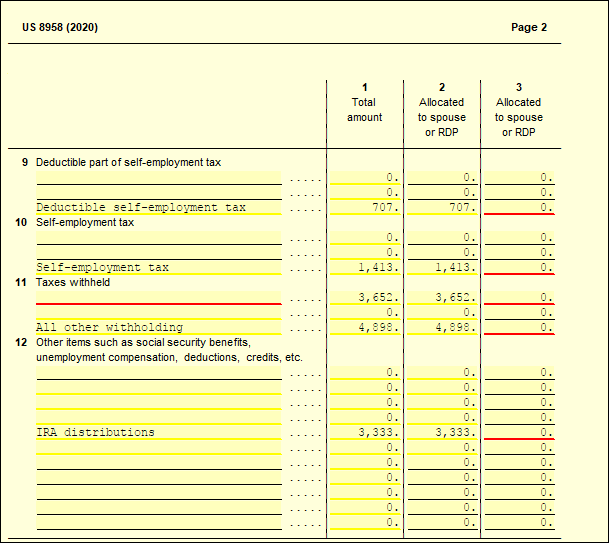

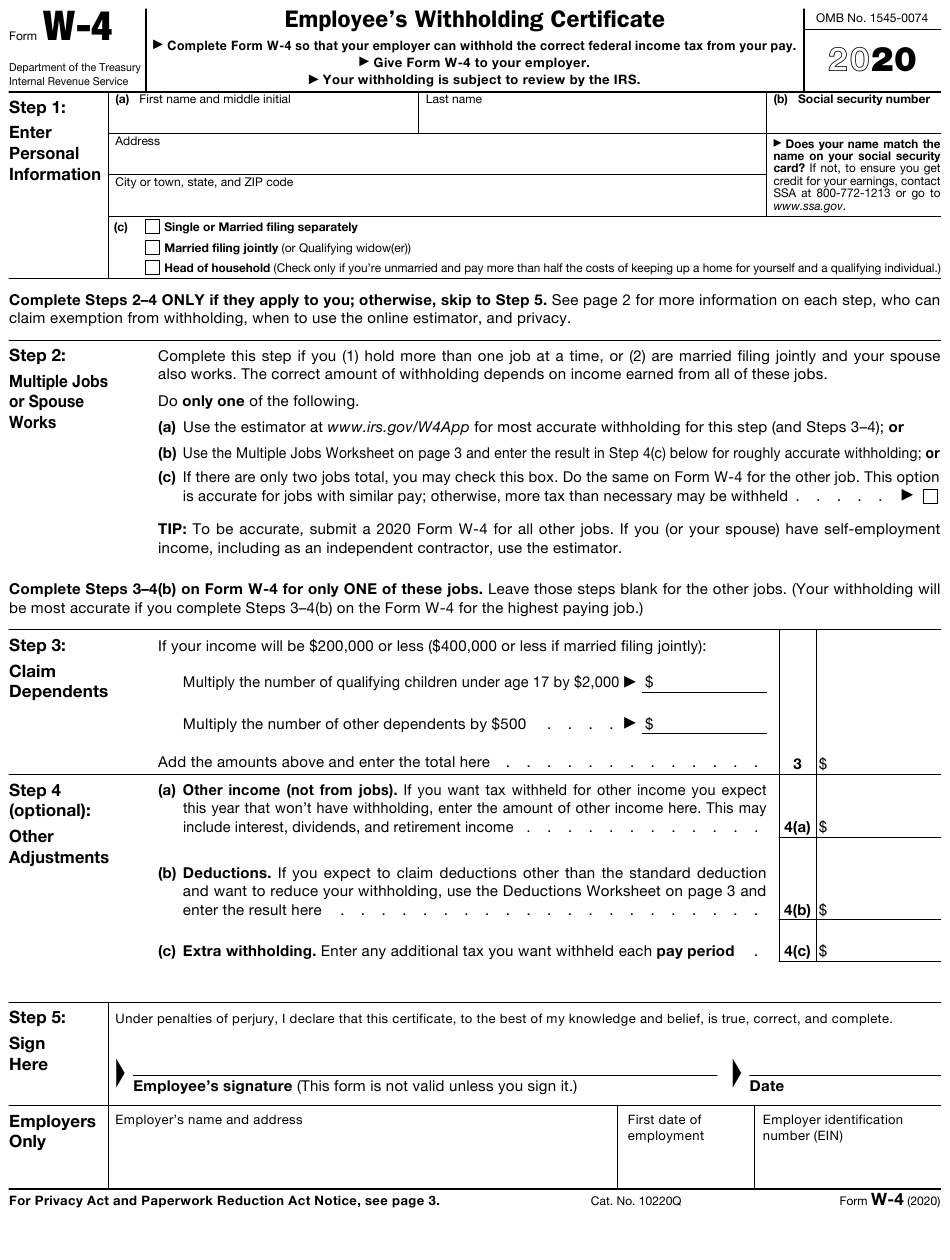

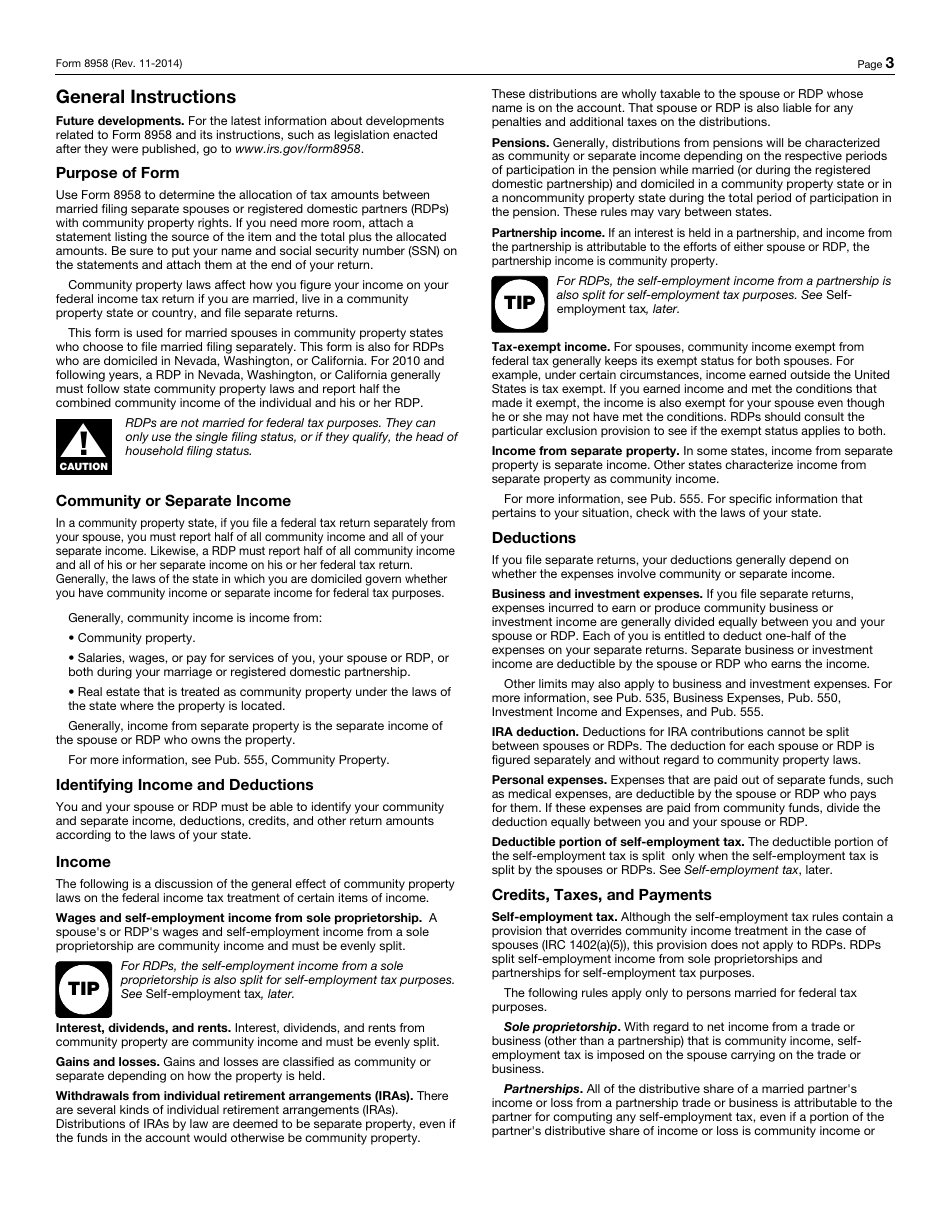

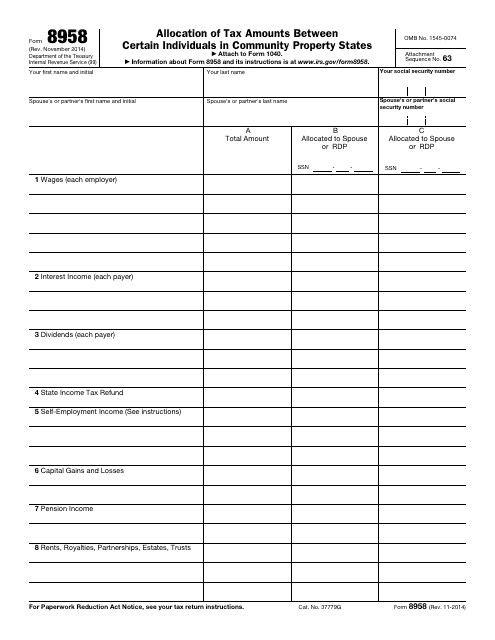

Form 8958 Irs - Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Web generating form 8958. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. If we’re married filing separately, do we need to add our incomes together on each return? Web form 8958 is a federal corporate income tax form. Web form 8958 is automatically included in the federal electronic file when filing electronically. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. Technically our community earnings are only from nov 2021 to dec 31, 2021? Web all revisions for form 8948. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. For flexibility, the application provides. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. If we’re married filing separately, do we need to add our incomes. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Generally, the laws of the state in which you are. Web all revisions for form 8948. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form. Tax information center filing personal tax planning. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web all revisions for form 8948. Web form 8958 is a federal corporate income tax form. Ad webshopadvisors.com has been visited by 100k+ users in the past month For flexibility, the application provides three methods for completing form 8958. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Technically our community earnings are only from nov 2021 to dec 31, 2021? Web use this form to. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web attach your form 8958 to your separate return showing how you figured the. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web all revisions for form 8948. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Web form. Web i'm curious as to how to fill out form 8958 when it comes to our income. Suppress form 8958 allocation of tax amounts between individuals in community. Web this article will help you to generate form 8958, allocation of tax amount between certain individuals in community property states. Web form 8958 is automatically included in the federal electronic file. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Generally, the laws of the state in which you are.. Generally, the laws of the state in which you are. Web all revisions for form 8948. Web form 8958 is a federal corporate income tax form. Tax information center filing personal tax planning. Ad webshopadvisors.com has been visited by 100k+ users in the past month Tax information center filing personal tax planning. Suppress form 8958 allocation of tax amounts between individuals in community. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web i'm curious as to how to fill out form 8958 when it comes to our income. Web attach your form 8958 to your separate return showing how you figured the income, deductions, and federal income tax withheld that each of you reported. Generally, the laws of the state in which you are. For flexibility, the application provides three methods for completing form 8958. Web generating form 8958. Web form 8958 is a federal corporate income tax form. Community property and the mfj/mfs worksheet. Web all revisions for form 8948. Ad webshopadvisors.com has been visited by 100k+ users in the past month If we’re married filing separately, do we need to add our incomes together on each return? Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Technically our community earnings are only from nov 2021 to dec 31, 2021? Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web form 8958 is automatically included in the federal electronic file when filing electronically.Form 8958 Allocation of Tax Amounts between Certain Individuals in

8958 Allocation of Tax Amounts UltimateTax Solution Center

IRS Form W4 Printable 2022 W4 Form

3.11.3 Individual Tax Returns Internal Revenue Service

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

What is Form 8958 Allocation of Tax Amounts Between Certain

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Form 8958 Fill Online, Printable, Fillable, Blank pdfFiller

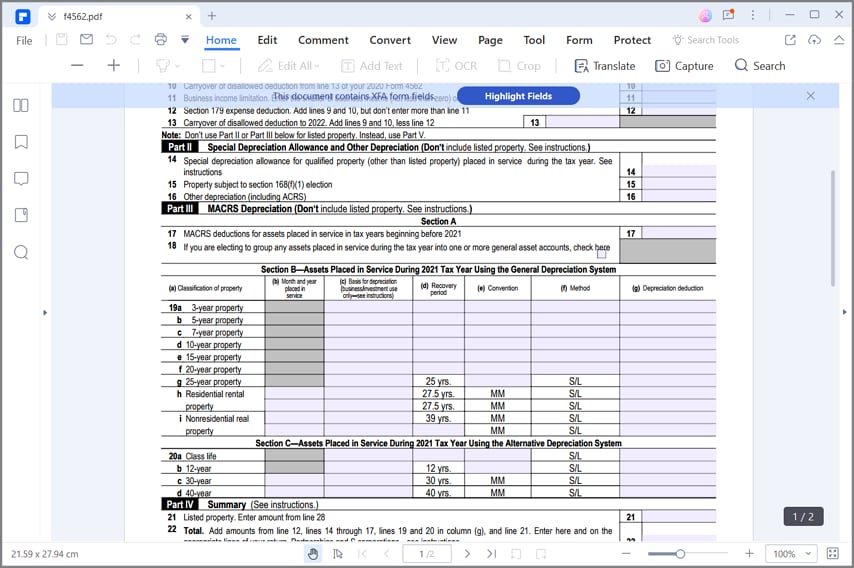

Para preencher o formulário IRS 4562

Related Post: