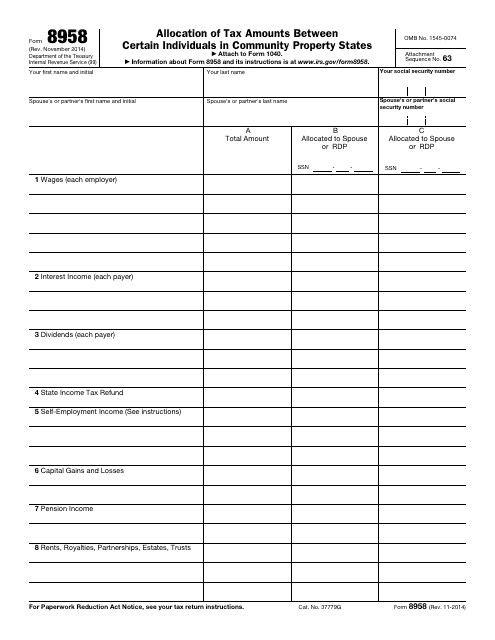

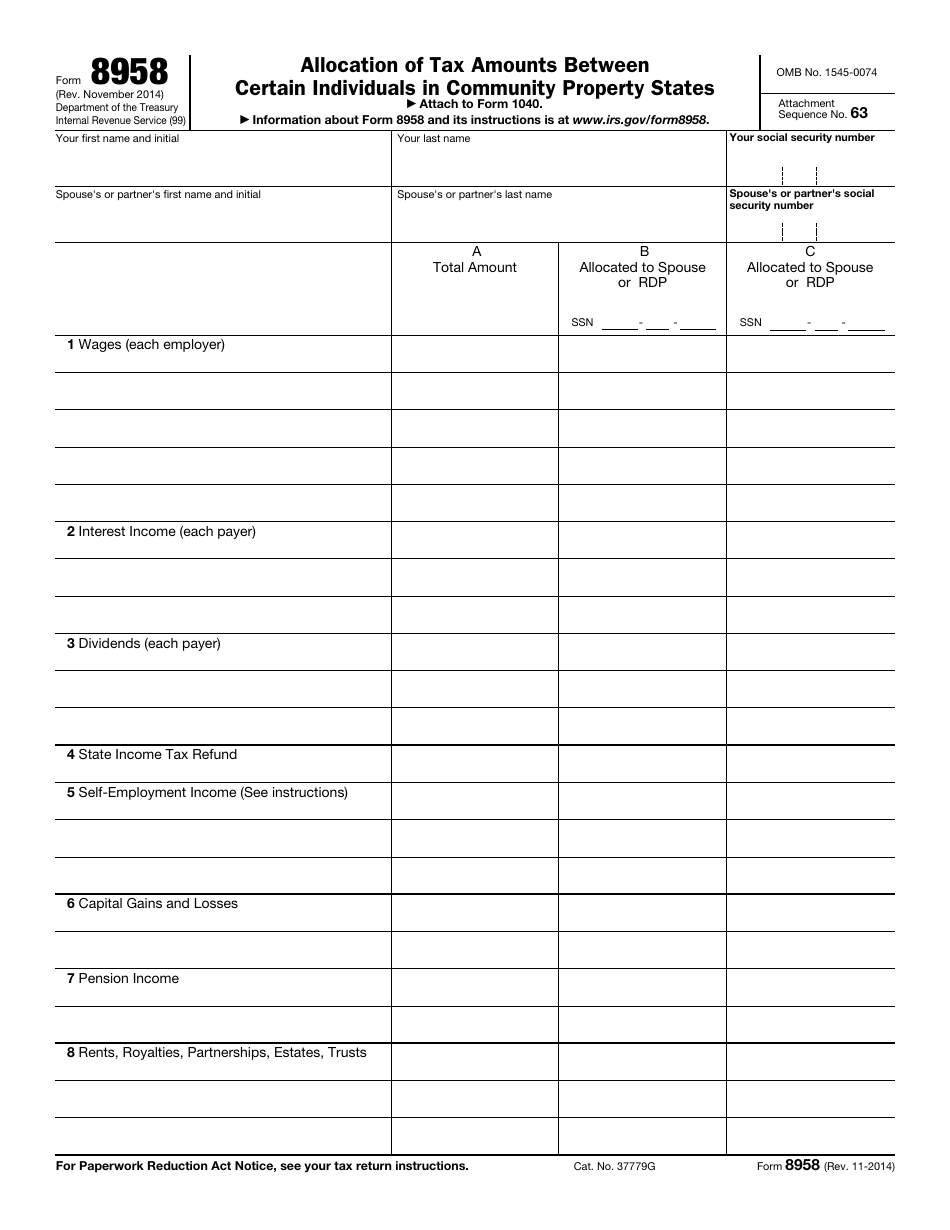

Form 8958 California

Form 8958 California - Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Gather all necessary information and documents, such as your personal information, income details, and any applicable tax treaties. Here is an example of. Web per the form 8958 instructions: Web form 8958 must be completed if the taxpayer: Community property and the mfj/mfs worksheet. Select the state of residence during current tax year from the drop down menu at the top of the form: Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. This form is used for married spouses in community property states who choose to file married filing separately. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. See how to get tax help at the end of this publication for information about getting. Web form 8958 is used for married spouses in community property states who choose to file married. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Go to the form 8958. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Suppress form 8958 allocation of tax amounts between individuals in community.. For instructions on how to complete. See how to get tax help at the end of this publication for information about getting. Form 8958 is also used for registered domestic partners who. Web up to $40 cash back how to fill out form 8958: Web generating form 8958. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. See how to get tax help at the end of this publication for information about getting. Web form 8958, allocation of tax amounts between certain individuals in community property states, is used to determine the. Community property and the mfj/mfs worksheet. For instructions on how to complete. Web to allocate tax amounts, do the following: Web nevada, washington, and california domestic partners. Web up to $40 cash back form 8958 is used to calculate and allocate the allowable premium tax credit (ptc) based on the taxpayer's household income and family size. Web generating form 8958. Web nevada, washington, and california domestic partners. Web to allocate tax amounts, do the following: Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Here is an example of. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. See how to get tax help at the end of this publication for information about getting. Form 8958 is also used for registered domestic partners who. Web form 8958, allocation of tax amounts between certain. Gather all necessary information and documents, such as your personal information, income details, and any applicable tax treaties. Form 8958 is also used for registered domestic partners who. Suppress form 8958 allocation of tax amounts between individuals in community. This form is used for married spouses in community property states who choose to file married filing separately. Web if your. Web nevada, washington, and california domestic partners. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web generating form 8958. Web to allocate tax amounts, do the following: Select the state of residence during current tax year from the drop down menu at the. A registered domestic partner in nevada, washington, or california generally must report half the combined community. Ad iluvenglish.com has been visited by 10k+ users in the past month Web the states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico,. Go to the form 8958. Web 8958 allocation of tax amounts between certain individuals in community. Web generating form 8958. Web nevada, washington, and california domestic partners. Web up to $40 cash back how to fill out form 8958: Community property laws apply to married individuals or registered domestic partners. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web up to $40 cash back form 8958 is used to calculate and allocate the allowable premium tax credit (ptc) based on the taxpayer's household income and family size. Go to the form 8958. Web the states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico,. Web per the form 8958 instructions: Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Select the state of residence during current tax year from the drop down menu at the top of the form: Form 8958 is also used for registered domestic partners who. Web 8958 allocation of tax amounts between certain individuals in community property states. See how to get tax help at the end of this publication for information about getting. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Gather all necessary information and documents, such as your personal information, income details, and any applicable tax treaties. For instructions on how to complete. Web to allocate tax amounts, do the following:IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Citas Para Adultos En Cataluna Home

Tax Form California Free Download

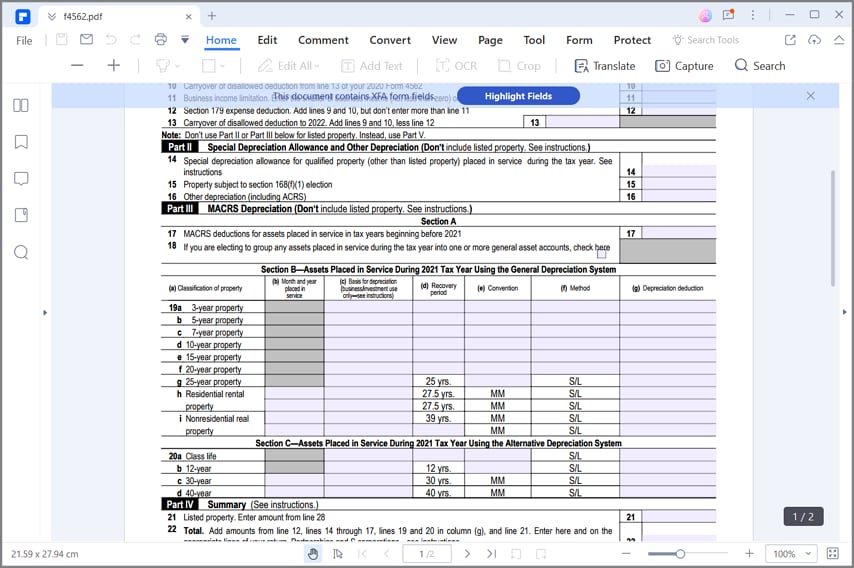

Para preencher o formulário IRS 4562

Americans forprosperity2007

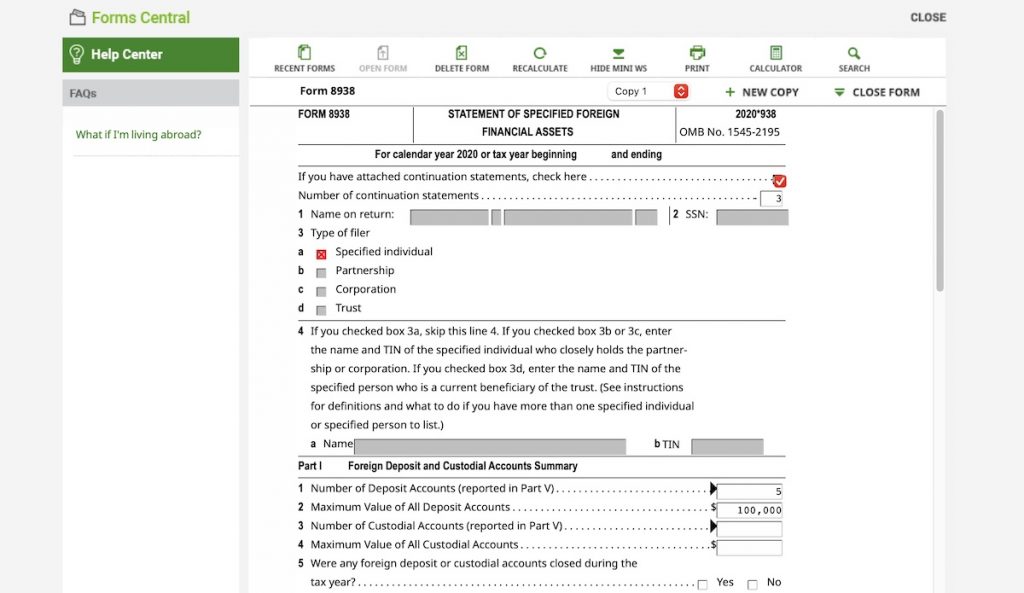

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

p555 by Paul Thompson issuu

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Related Post: