Form 8949 Too Many Transactions

Form 8949 Too Many Transactions - How do i go about filing form 8949 if i have over 10000 financial transactions? Web file form 8949 with the schedule d for the return you are filing. Web form 8949 provides a method for reporting a summary of multiple transactions. Ad complete irs tax forms online or print government tax documents. Including each trade on form 8949, which transfers to. Web if you are filing a joint return, complete as many copies of form 8949 as you need to report all of your and your spouse's transactions. Get ready for tax season deadlines by completing any required tax forms today. Printing the form would be more than 500 pages. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Web we would like to show you a description here but the site won’t allow us. Web file form 8949 with the schedule d for the return you are filing. Web how do i go about filing form 8949 if i have over 10000 financial transactions? Regarding reporting trades on form 1099 and schedule d, you must report each trade separately by either: Web for form8949.com users, if you have more than 2000 transactions (or choose. Printing the form would be more than 500 pages. Ad complete irs tax forms online or print government tax documents. Form 8949 shows the details of your capital asset (investment) sales and exchanges. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Web form 8949 provides a method for reporting a summary of multiple transactions. How do i go about filing form 8949 if i have over 10000 financial transactions? This method would be used if the transactions do not qualify for schedule d direct reporting. Printing the form would be more than 500 pages. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Web if you have more than 2,000 stock. Web form 8949 provides a method for reporting a summary of multiple transactions. Web what is form 8949? How do i go about filing form 8949 if i have over 10000 financial transactions? Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Including each trade on form 8949, which transfers to. Web if you have more than 2,000 stock transactions, or you received a form 8949, you can use the form 8949 attachment option to report the summary totals. Web form 8949 is used to list all capital gain and loss transactions. Including each trade on form 8949, which transfers to. Use form 8949 to report sales and exchanges of capital. Web if you have more than 2,000 stock transactions, or you received a form 8949, you can use the form 8949 attachment option to report the summary totals. Get ready for tax season deadlines by completing any required tax forms today. If you summarize category a or category d, form 8949 is not needed for transactions without adjustments. Form 8949. Web form 8949 provides a method for reporting a summary of multiple transactions. Form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Web form 8949 provides a method for reporting a summary of multiple. Web for form8949.com users, if you have more than 2000 transactions (or choose not to import your transactions into your taxact return), you can enter your summary totals by. Web what is form 8949? Web complete as many copies of form 8949 as necessary to include all transactions made by both you and your spouse if you're married and filing. Web file form 8949 with the schedule d for the return you are filing. Web form 8949 is a list of every transaction, including its cost basis, its sale date and price, and the total gain or loss. Including each trade on form 8949, which transfers to. Web overview of form 8949: How do i go about filing form 8949. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Web what is form 8949? Get ready for tax season deadlines by completing any required tax forms today. If your number of transactions is greater than 2,000, attach a summary. Web if you have more than 2,000 stock transactions,. Web complete as many copies of form 8949 as necessary to include all transactions made by both you and your spouse if you're married and filing a joint tax. This method would be used if the transactions do not qualify for schedule d direct reporting. Web form 8949 provides a method for reporting a summary of multiple transactions. Web what is form 8949? Web form 8949 is a list of every transaction, including its cost basis, its sale date and price, and the total gain or loss. How do i go about filing form 8949 if i have over 10000 financial transactions? Printing the form would be more than 500 pages. Form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Web form 8949 provides a method for reporting a summary of multiple transactions. If you summarize category a or category d, form 8949 is not needed for transactions without adjustments. You and your spouse may list your. Web we would like to show you a description here but the site won’t allow us. Ad complete irs tax forms online or print government tax documents. Regarding reporting trades on form 1099 and schedule d, you must report each trade separately by either: Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Web if you are filing a joint return, complete as many copies of form 8949 as you need to report all of your and your spouse's transactions. Web how do i go about filing form 8949 if i have over 10000 financial transactions? Get ready for tax season deadlines by completing any required tax forms today. This method would be used if the transactions do not qualify for schedule d direct reporting. Sometimes it is necessary to mail the form to the irs even if you file.How to list more Transactions on 8949 UltimateTax Solution Center

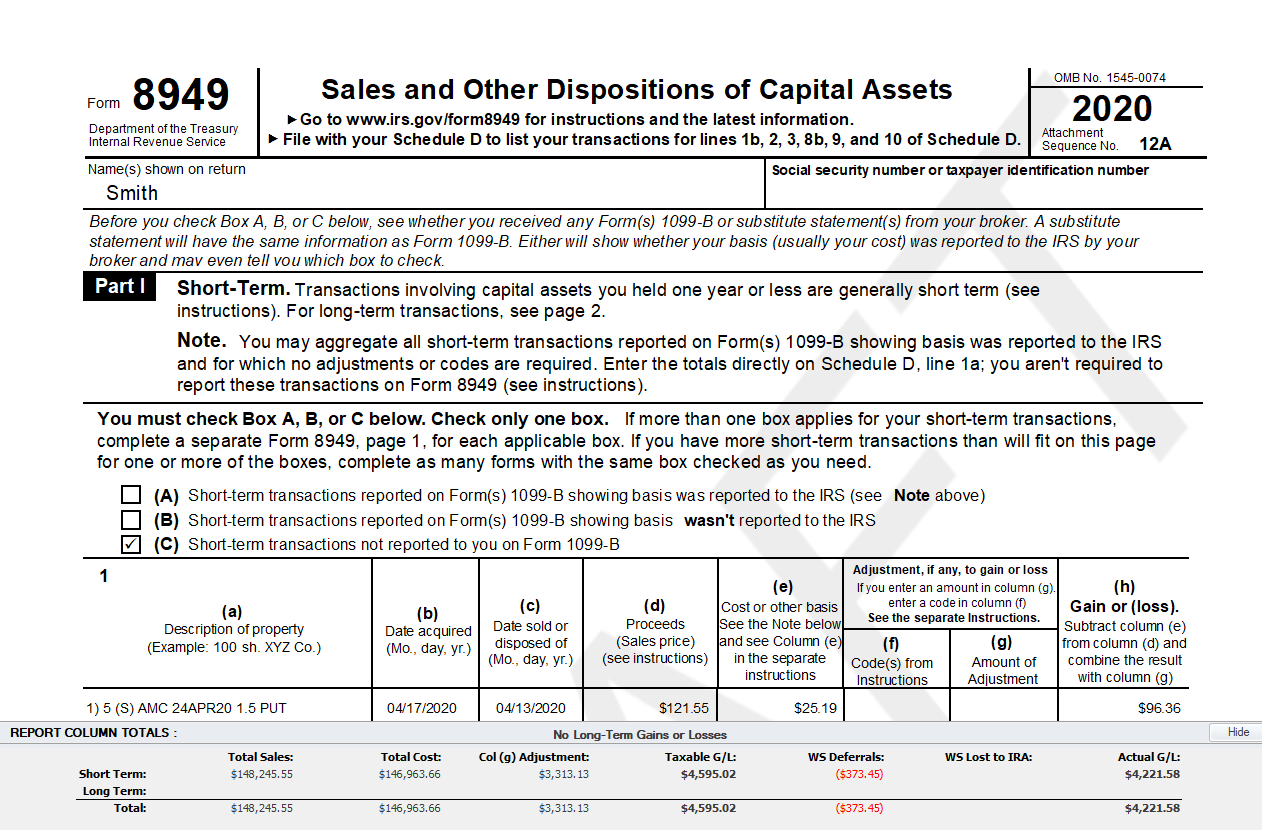

To review Tess's completed Form 8949 and Schedule D IRS.gov

Generating Form 8949 for Tax Preparation TradeLog Software

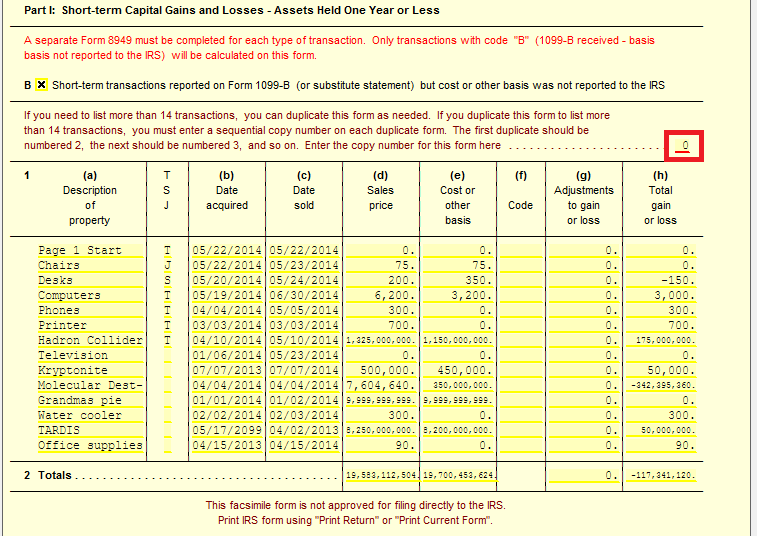

In the following Form 8949 example,the highlighted section below shows

Form 8949 Exception 2 When Electronically Filing Form 1040

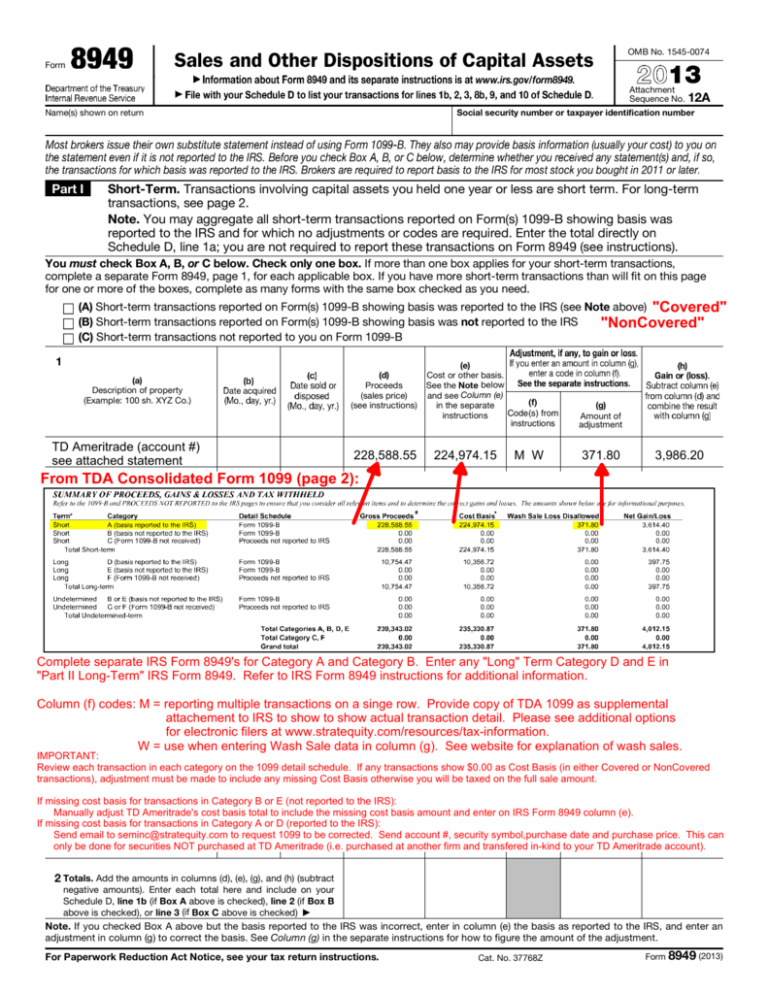

IRS Form 8949 TradeLog Software

IRS Form 8949 SAMPLE 2013

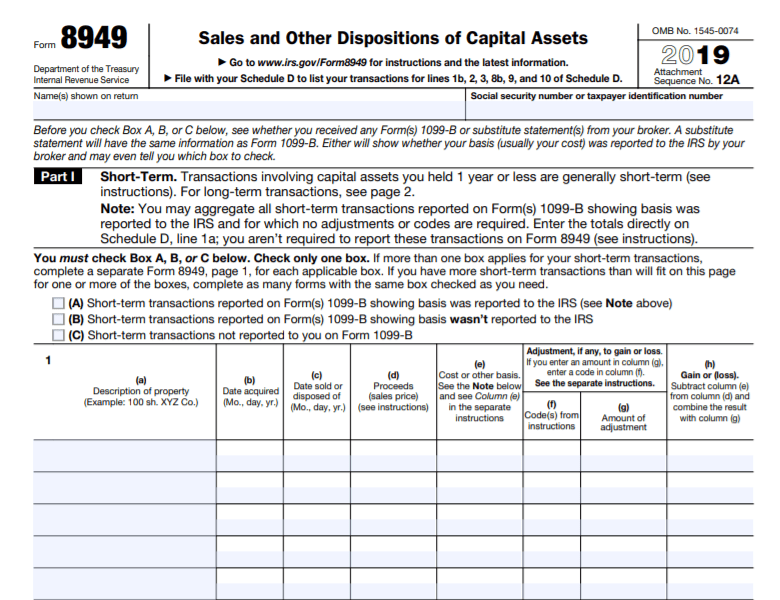

Form 8949 schedule d Fill online, Printable, Fillable Blank

Form 8949 Fillable Printable Forms Free Online

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Related Post: