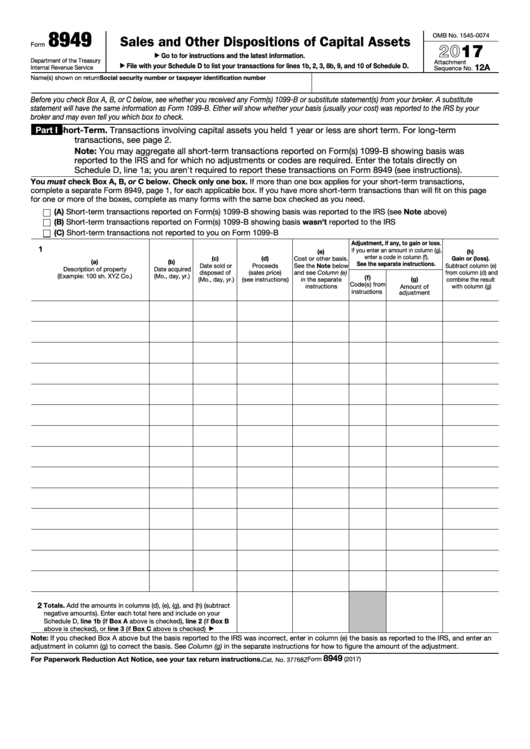

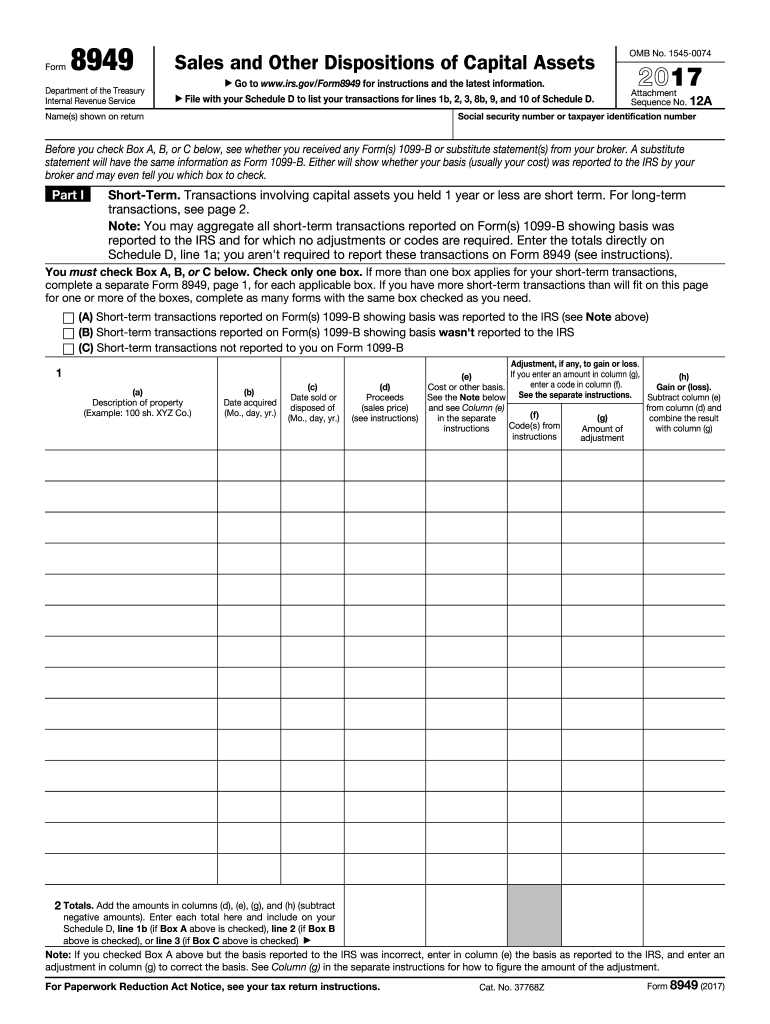

Form 8949 Box F

Form 8949 Box F - Ad pdffiller.com has been visited by 1m+ users in the past month Sales and other dispositions of capital assets. Solved•by turbotax•6711•updated 6 days ago. Web on form 8949, part ii, check box f at the top. Ad get ready for tax season deadlines by completing any required tax forms today. File form 8949 with the schedule d for the return you are filing. File form 8949 with the schedule d for the return you are filing. Web if the gain or loss is long term, report it in part ii of form 8949 with box f checked. Enter “eh” in column (f). Form 8949(sales and other dispositions of capital assets) records the details of. Enter “eh” in column (f). Web the transactions taxpayers must report on form 8949. Web solved•by intuit•239•updated 1 year ago. It's used in calculating schedule. Enter $320,000 in column (d) and $100,000 in column (e). If you had a gain and can exclude part or all of it, enter “h” in column (f) of form 8949. It's used in calculating schedule. Web solved•by intuit•239•updated 1 year ago. An internal revenue service form implemented in tax year 2011 for individual taxpayers to report capital gains and losses from investment activity. File form 8949 with the schedule. This basically means that, if you’ve sold a. Enter “eh” in column (f). Web on form 8949, part ii, check box f at the top. Enter $320,000 in column (d) and $100,000 in column (e). The irs form 1099 b is for. File form 8949 with the schedule d for the return you are filing. It's used in calculating schedule. File form 8949 with the schedule d for the return you are filing. Sales and other dispositions of capital assets. Enter “eh” in column (f). If you had a gain and can exclude part or all of it, enter “h” in column (f) of form 8949. Complete columns (a), (b), and (c). Web if the gain or loss is long term, report it in part ii of form 8949 with box f checked. Enter “eh” in column (f). An internal revenue service form implemented in. An internal revenue service form implemented in tax year 2011 for individual taxpayers to report capital gains and losses from investment activity. Enter “eh” in column (f). This basically means that, if you’ve sold a. Solved•by turbotax•6711•updated 6 days ago. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. The irs form 1099 b is for. File form 8949 with the schedule d for the return you are filing. It's used in calculating schedule. Enter $320,000 in column (d) and $100,000 in column (e). This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Go to www.irs.gov/form8949 for instructions and the latest information. It's used in calculating schedule. File form 8949 with the schedule d for the return you are filing. Solved•by turbotax•6711•updated 6 days ago. Complete columns (a), (b), and (c). Web department of the treasury internal revenue service. Solved•by turbotax•6711•updated 6 days ago. File form 8949 with the schedule d for the return you are filing. Enter $320,000 in column (d) and $100,000 in column (e). Ad get ready for tax season deadlines by completing any required tax forms today. The irs form 1099 b is for. Solved•by turbotax•6711•updated 6 days ago. Web solved•by intuit•239•updated 1 year ago. It's used in calculating schedule. Enter $320,000 in column (d) and $100,000 in column (e). It's used in calculating schedule. Web the transactions taxpayers must report on form 8949. File form 8949 with the schedule d for the return you are filing. An internal revenue service form implemented in tax year 2011 for individual taxpayers to report capital gains and losses from investment activity. Solved•by turbotax•6711•updated 6 days ago. The irs form 1099 b is for. Ad get ready for tax season deadlines by completing any required tax forms today. Web • if you’ve checked the box to exclude the entire gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis. Sales and other dispositions of capital assets. Web if the gain or loss is long term, report it in part ii of form 8949 with box f checked. This basically means that, if you’ve sold a. Enter “eh” in column (f). Web solved•by intuit•239•updated 1 year ago. Web appropriate part of form 8949. Complete columns (a), (b), and (c). Form 8949(sales and other dispositions of capital assets) records the details of. Enter $320,000 in column (d) and $100,000 in column (e). This article will help you generate form 8949, column (f) for various codes in intuit lacerte. If you had a gain and can exclude part or all of it, enter “h” in column (f) of form 8949. Complete, edit or print tax forms instantly.Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Fillable Irs Form 8949 Printable Forms Free Online

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Form 8949 Fillable Printable Forms Free Online

Fillable Irs Form 8949 Printable Forms Free Online

Irs Form 8949 Reduce errors airSlate

Form 8949 and Sch. D diagrams I did a cashless exercise with my

Printable Form 8949 Printable Forms Free Online

The Purpose of IRS Form 8949

Related Post:

:max_bytes(150000):strip_icc()/Form8949new-3f73ef5350834ea6b358cb9859843cc1.jpg)