Form 1065 Schedule K 1 Codes

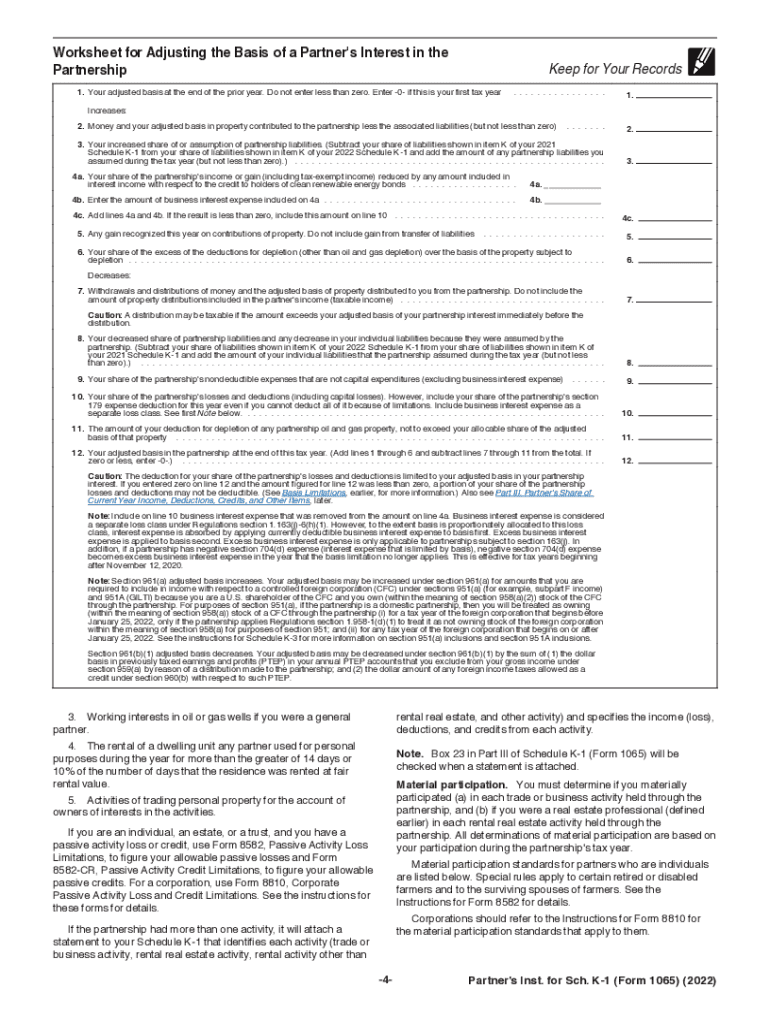

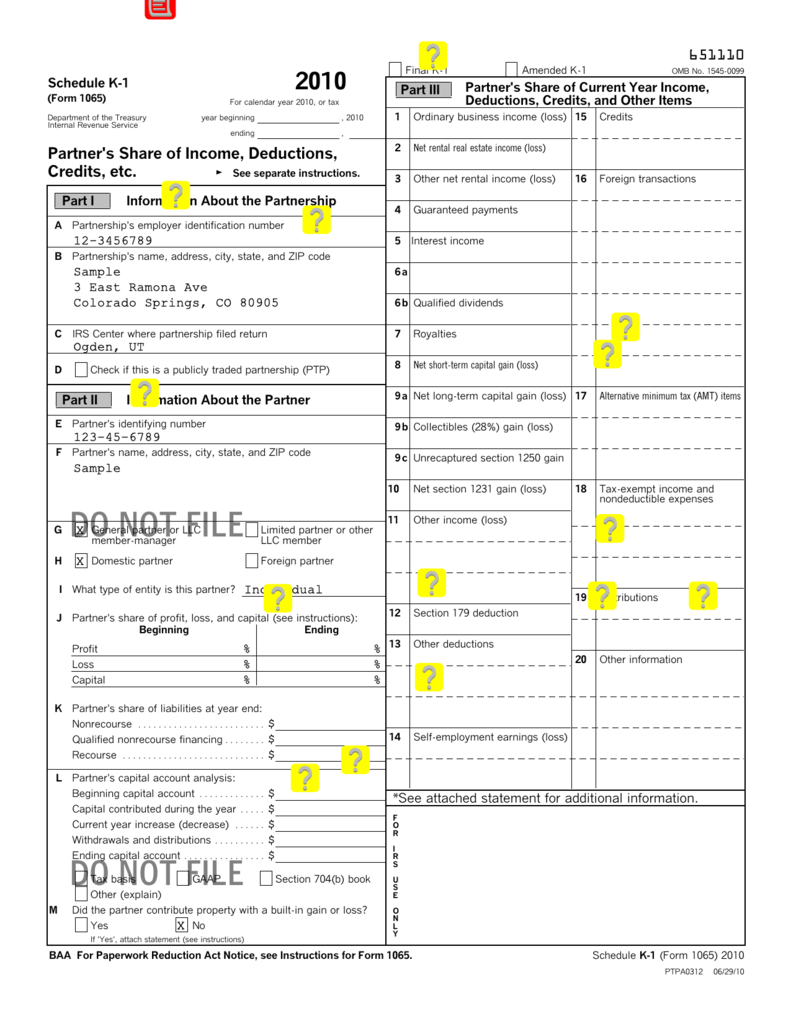

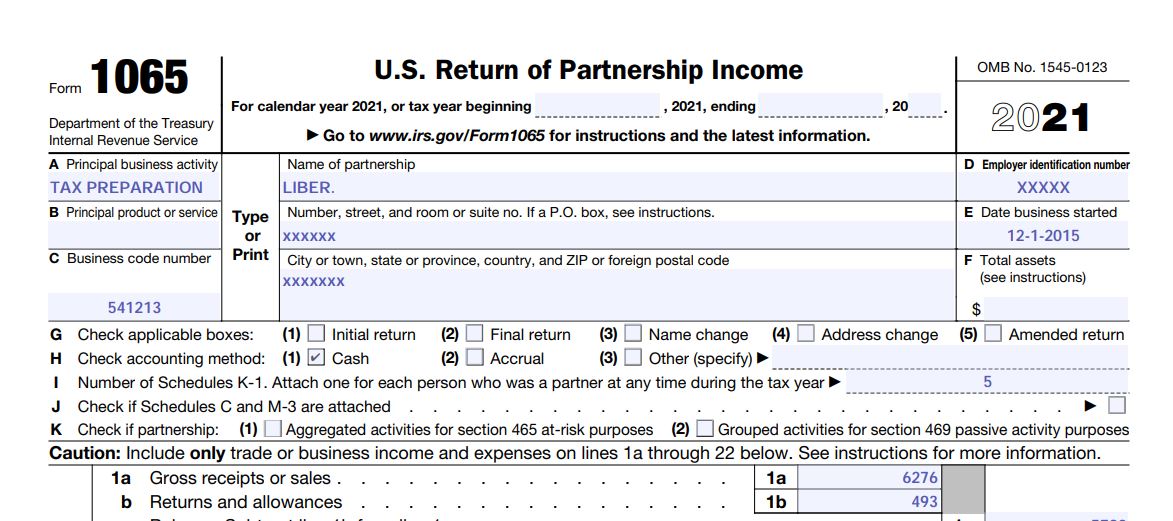

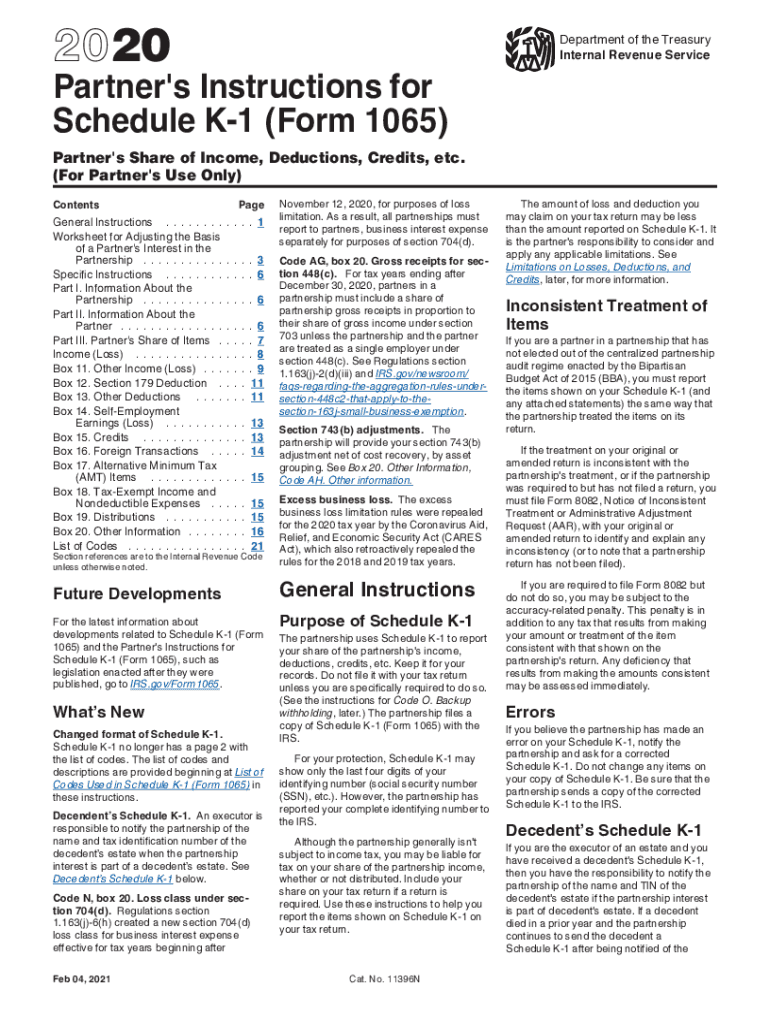

Form 1065 Schedule K 1 Codes - 4 digit code used to identify the software developer whose application produced the bar code. Determine whether the income (loss) is passive or. Under section 754, a partnership may elect to adjust the basis of partnership property when property is. If there is a positive amount reported to you in this box, please report the amount as it is reported to you. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: For calendar year 2022, or tax year beginning / / 2022. Web solved•by intuit•141•updated may 18, 2023. Ending / / partner’s share of. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Total assets (see instructions) $ g. Per the worksheet instructions for form 1040, schedule 1, line 16: For calendar year 2022, or tax year beginning / / 2022. (1) initial return (2) final. This code will let you know if you should. Department of the treasury internal revenue service. Ending / / partner’s share of. Department of the treasury internal revenue service. This article is tax professional approved. For calendar year 2021, or tax year beginning / / 2021. Web solved•by intuit•141•updated may 18, 2023. Ending / / partner’s share of. Department of the treasury internal revenue service. If there is a positive amount reported to you in this box, please report the amount as it is reported to you. Department of the treasury internal revenue service. Total assets (see instructions) $ g. This article is tax professional approved. Determine whether the income (loss) is passive or. If there is a positive amount reported to you in this box, please report the amount as it is reported to you. (1) initial return (2) final. Page numbers refer to this instruction. For calendar year 2021, or tax year beginning / / 2021. Web solved•by intuit•141•updated may 18, 2023. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: Under section 754, a partnership may elect to adjust the basis of partnership property when property is. If you were a more. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. If you were a more. Ending / / partner’s share of. Total assets (see instructions) $ g. This article is tax professional approved. Department of the treasury internal revenue service. Under section 754, a partnership may elect to adjust the basis of partnership property when property is. If you were a more. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: 4 digit code used to identify the software developer whose application produced the bar. Code y is used to report information related to the net investment income tax. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: Ending / / partner’s share of. For calendar year 2021, or tax year beginning / / 2021. This article is tax professional approved. Total assets (see instructions) $ g. Under section 754, a partnership may elect to adjust the basis of partnership property when property is. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. This article is tax professional approved. Web solved•by intuit•141•updated may 18, 2023. (1) initial return (2) final. Determine whether the income (loss) is passive or. This article is tax professional approved. Web solved•by intuit•141•updated may 18, 2023. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of. Web to enter box 13, codes a, b, c, d, e, f, g, i, k, l, m, o, or q. If there is a positive amount reported to you in this box, please report the amount as it is reported to you. For calendar year 2021, or tax year beginning / / 2021. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Determine whether the income (loss) is passive or. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web solved•by intuit•141•updated may 18, 2023. Page numbers refer to this instruction. Department of the treasury internal revenue service. Per the worksheet instructions for form 1040, schedule 1, line 16: This article is tax professional approved. Total assets (see instructions) $ g. Per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), starting on page 5: Income tax liability with respect to items of. Web arizona administrative code; (1) initial return (2) final. Department of the treasury internal revenue service.IRS Instruction 1065 Schedule K1 20202022 Fill out Tax Template

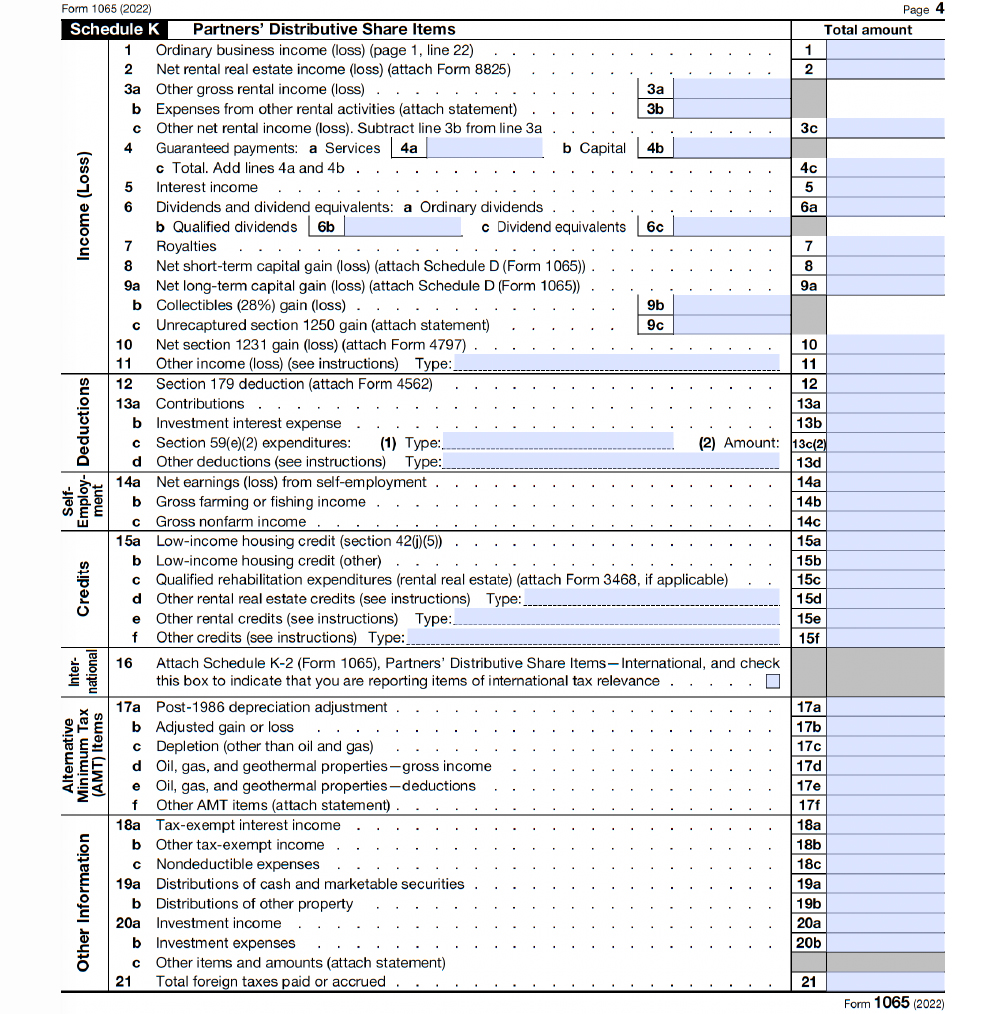

Form 1065 Instructions U.S. Return of Partnership

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

How to fill out an LLC 1065 IRS Tax form

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

1How to complete 2021 IRS Form 1065 and Schedule K1 For your LLC

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

Box 14 [Code A] of IRS Schedule K1 (Form 1065) outlined

Related Post:

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)