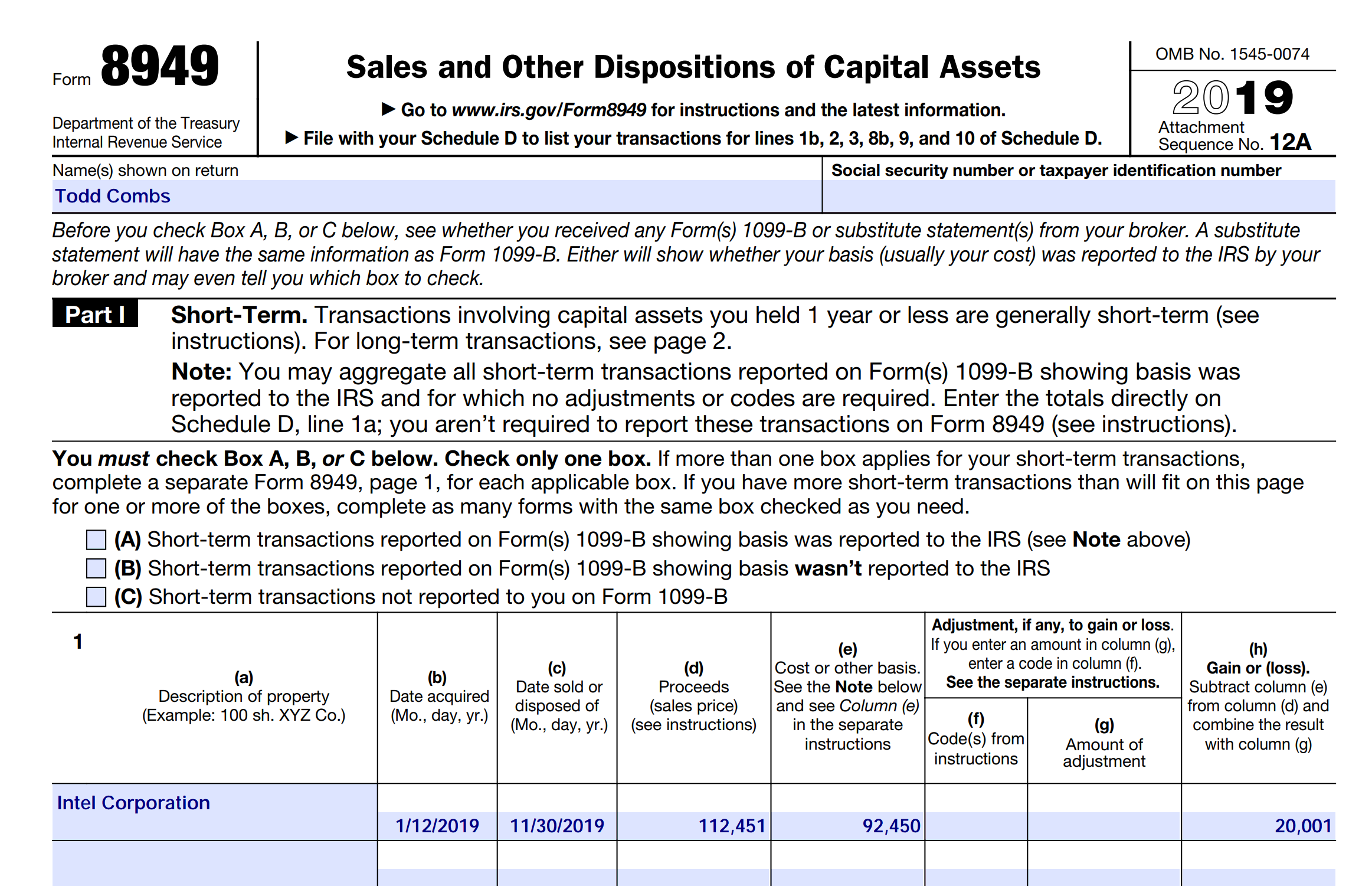

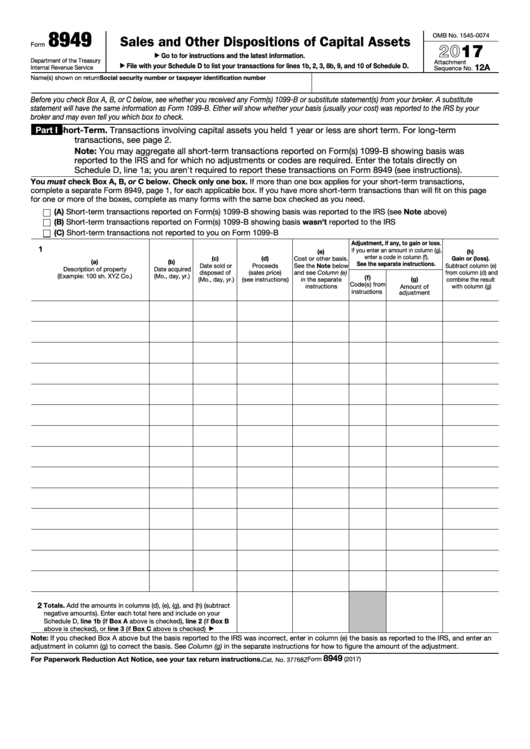

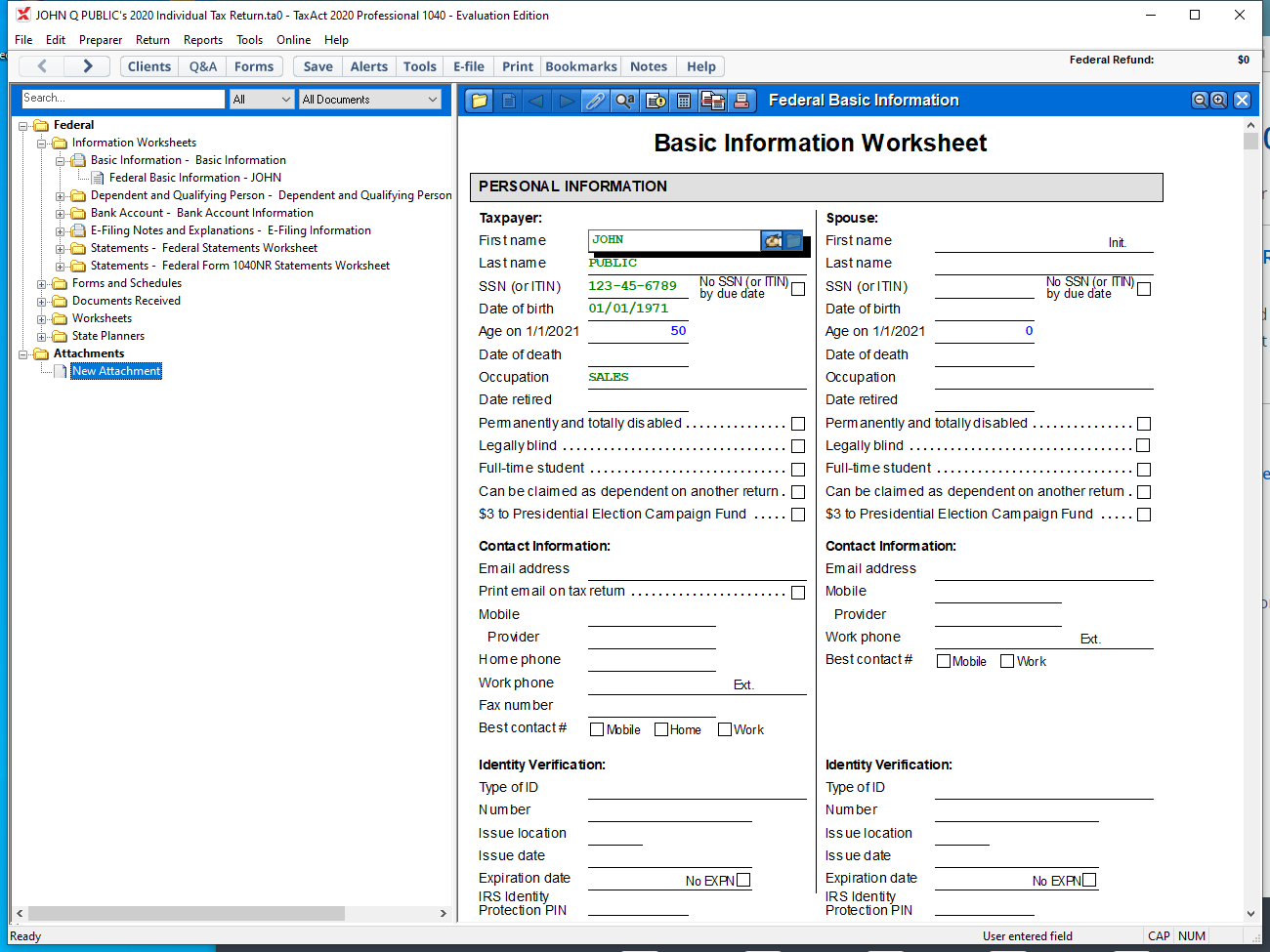

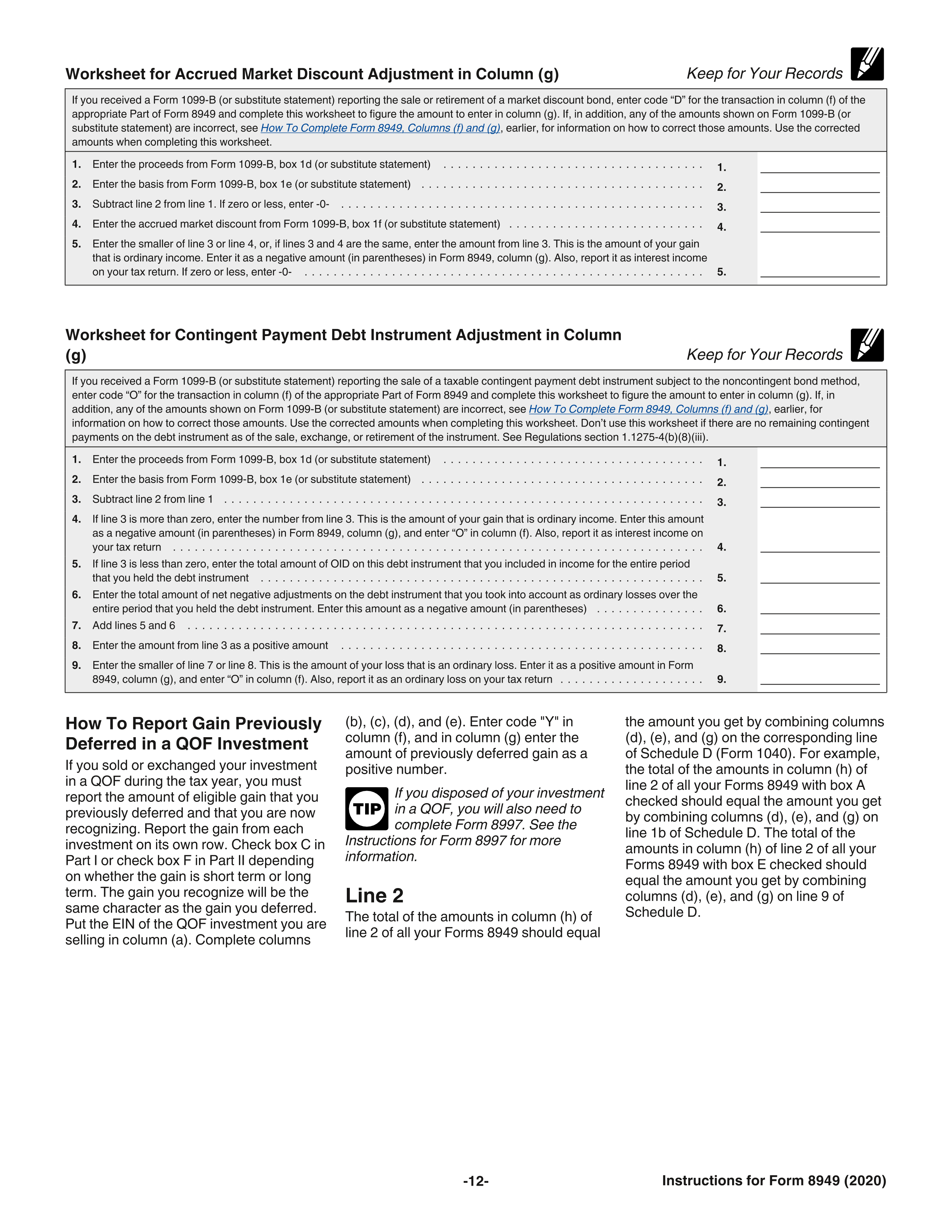

Form 8949 Attachment

Form 8949 Attachment - Go to www.irs.gov/form8949 for instructions. Web the transactions taxpayers must report on form 8949. Web this article will walk you through reporting multiple disposition items as a single summary statement for an individual return schedule d or form 8949. Web so, if you are being prompted to mail further statements, form 8453 says to attach form 8949, sales and other dispositions of capital assets ( or a statement with. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Web to understand better how pdf attachments are supported for form 8949, follow the steps below to view the form. Web to enter the information for each form 8949 attachment information summary form (each form created would then be represented by a pdf which would be attached to the. Suggested file names can be found at the bottom of screen 8949. No, you are not able to. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web if you have a form 8949 statement, you can enter the summary totals in taxact, and attach the form 8949 statement to your return (if you need help attaching the statement to. (form 1040) department of the treasury internal revenue service (99) capital gains and losses. Sales and other dispositions of capital assets. Complete, edit or print tax forms. Multiple copies of this summary form can be created in the. Web to understand better how pdf attachments are supported for form 8949, follow the steps below to view the form. Ad iluvenglish.com has been visited by 10k+ users in the past month Web taxact® will complete form 8949 for you and include it in your tax return submission. No,. Suggested file names can be found at the bottom of screen 8949. Department of the treasury internal revenue service. Go to www.irs.gov/form8949 for instructions and the latest information. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Get ready for tax season deadlines by completing any required tax forms today. Web what is form 8949 used for? The irs form 1099 b is for. Suggested file names can be found at the bottom of screen 8949. Web so, if you are being prompted to mail further statements, form 8453 says to attach form 8949, sales and other dispositions of capital assets ( or a statement with. No, you are not. Use form 8949 to report sales and exchanges of capital assets. Go to www.irs.gov/form8949 for instructions. Ad iluvenglish.com has been visited by 10k+ users in the past month Web if you have a form 8949 statement, you can enter the summary totals in taxact, and attach the form 8949 statement to your return (if you need help attaching the statement. Web to understand better how pdf attachments are supported for form 8949, follow the steps below to view the form. Web so, if you are being prompted to mail further statements, form 8453 says to attach form 8949, sales and other dispositions of capital assets ( or a statement with. Multiple copies of this summary form can be created in. Sales and other dispositions of capital assets. Complete, edit or print tax forms instantly. Go to www.irs.gov/form8949 for instructions. Department of the treasury internal revenue service. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Multiple copies of this summary form can be created in the. Web what is form 8949 used for? Sales and other dispositions of capital assets. Web so, if you are being prompted to mail further statements, form 8453 says to attach form 8949, sales and other dispositions of capital assets ( or a statement with. Department of the treasury internal. The irs form 1099 b is for. Sales and other dispositions of capital assets. Use form 8949 to report sales and exchanges of capital assets. No, you are not able to. If you exchange or sell capital assets, report them on your federal tax return using form 8949: No, you are not able to. Web what is form 8949 used for? Multiple copies of this summary form can be created in the. Department of the treasury internal revenue service. Web to understand better how pdf attachments are supported for form 8949, follow the steps below to view the form. Web department of the treasury internal revenue service. Taxact allows up to six form 8949 attachments to be entered into your tax return to represent each brokerage statement received. Complete, edit or print tax forms instantly. Web this article will walk you through reporting multiple disposition items as a single summary statement for an individual return schedule d or form 8949. No, you are not able to. Web taxact® will complete form 8949 for you and include it in your tax return submission. Get ready for tax season deadlines by completing any required tax forms today. Sales and other dispositions of capital assets. Web file form 8949 with the schedule d for the return you are filing. Department of the treasury internal revenue service. Go to www.irs.gov/form8949 for instructions and the latest information. Go to www.irs.gov/form8949 for instructions. To get the transaction information into your return, select from the 6 options described. Web so, if you are being prompted to mail further statements, form 8453 says to attach form 8949, sales and other dispositions of capital assets ( or a statement with. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. The irs form 1099 b is for. Ad iluvenglish.com has been visited by 10k+ users in the past month If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web to understand better how pdf attachments are supported for form 8949, follow the steps below to view the form. Multiple copies of this summary form can be created in the.Form 8949 Exception 2 When Electronically Filing Form 1040

2016 8949 IRS Tax Form Released EquityStat Blog

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

8949 form 2016 Fill out & sign online DocHub

IRS Form 8949 instructions.

Form 8949 and Sch. D diagrams I did a cashless exercise with my

Form 8949 Reporting for Users of Tax Act Professional Tax Software

IRS Form 8949 instructions.

Form 8949 schedule d Fill online, Printable, Fillable Blank

[Solved] Please fill out and provide the Form 8949 to upload. The tax

Related Post: