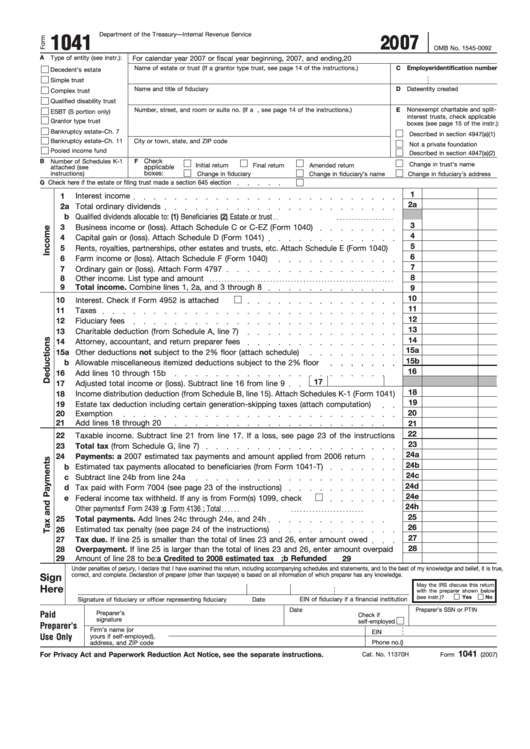

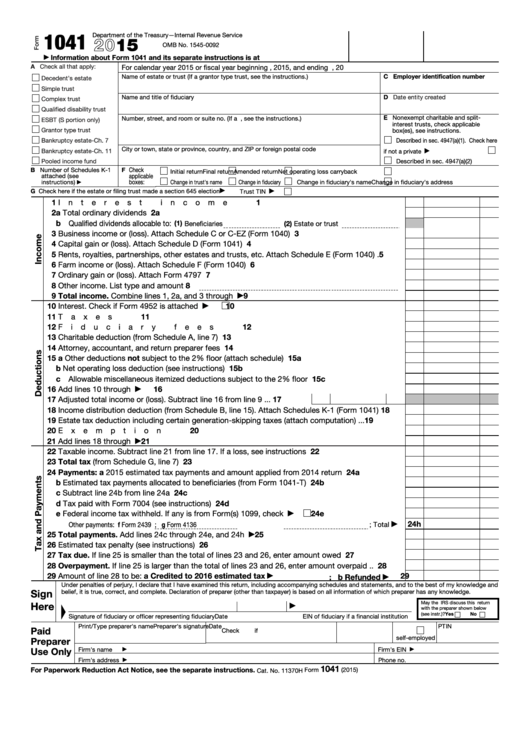

Form 1041 Schedule E

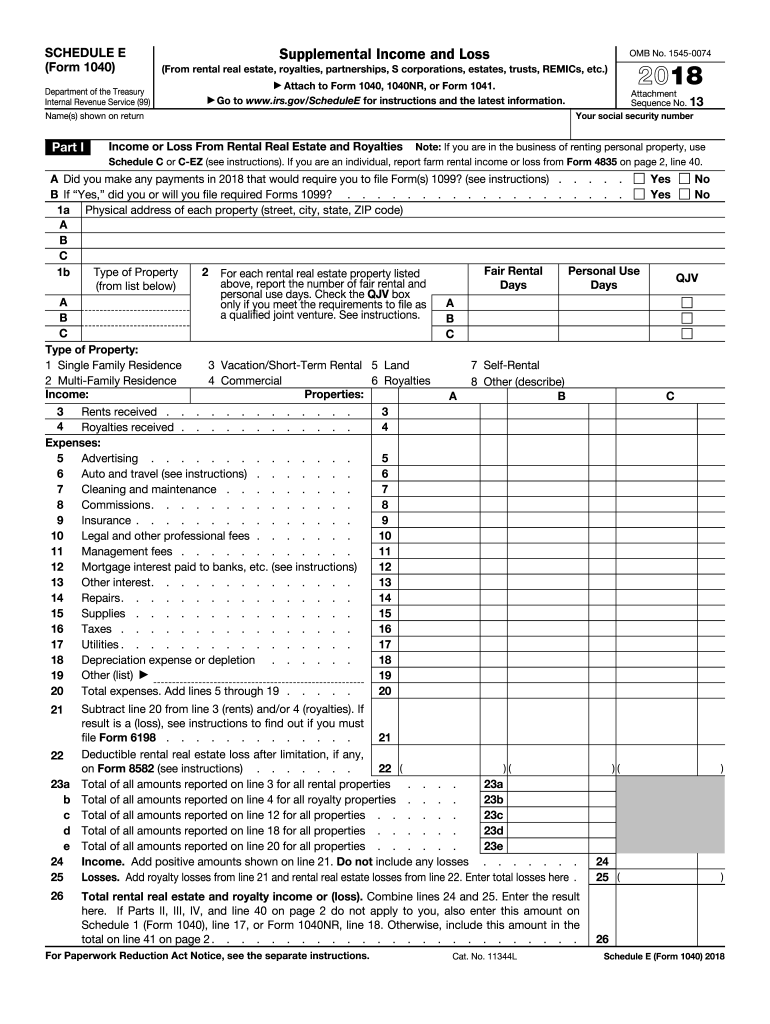

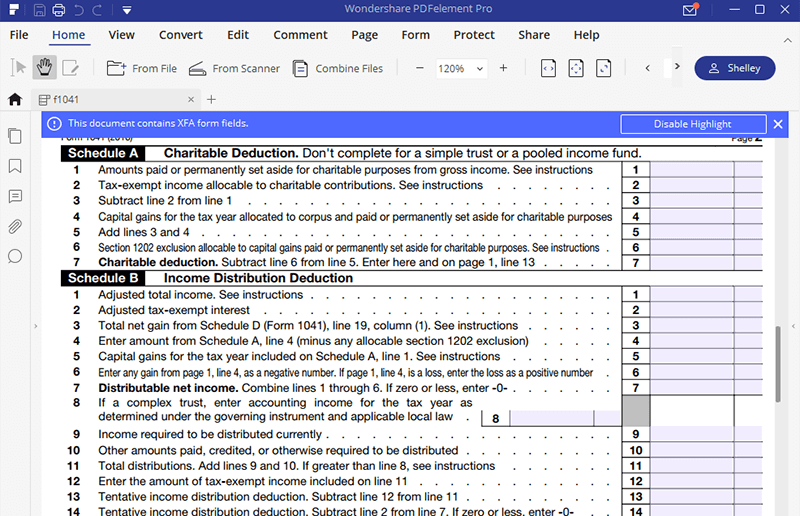

Form 1041 Schedule E - Web 2 schedule a charitable deduction. Department of the treasury—internal revenue service. 4 days ago @ 2:20 pm. Web select the asset you want to link to the schedule e from the left navigation panel. Web updated for tax year 2022 • june 2, 2023 8:40 am. Scroll down the asset information section and locate the general subsection. Web enter the amount from line 27 of schedule d (form 1041), line 14 of the schedule d tax worksheet, or line 5 of the qualified dividends tax worksheet in the instructions for. Ohio department of taxation p.o. Don’t complete for a simple trust or a pooled income fund. Web instructions for this form are on our website at tax.ohio.gov. For instructions and the latest information. You will use part i of schedule e to report rental and royalty income and part ii of. A trust or decedent's estate is allowed a. Don’t complete for a simple trust or a pooled income fund. Web instructions for this form are on our website at tax.ohio.gov. Web enter the amount from line 27 of schedule d (form 1041), line 14 of the schedule d tax worksheet, or line 5 of the qualified dividends tax worksheet in the instructions for. You will use part i of schedule e to report rental and royalty income and part ii of. Connect with our cpas or other tax experts who. Scroll down the asset information section and locate the general subsection. For instructions and the latest information. Ad file form 1041 with confidence with taxact's tax planning & form checklists. Instructions for form 1041 ( print version pdf) recent developments. Web 2 schedule a charitable deduction. Is schedule e only for passive income? just the form 1041 and the grantor letter or the 1041, grantor letter, and the schedule e? just the form 1041 and grantor letter. Web what is schedule e tax form for? Web 2 schedule a charitable deduction. Entering prior year unallowed losses. Web updated for tax year 2022 • june 2, 2023 8:40 am. Entering prior year unallowed losses. Ohio department of taxation p.o. Web what is schedule e tax form for? Web rental real estate income and expenses. Entering prior year unallowed losses. Complete, edit or print tax forms instantly. You will use part i of schedule e to report rental and royalty income and part ii of. A trust or decedent's estate is allowed a. Web select the asset you want to link to the schedule e from the left navigation panel. Web rental real estate income and expenses. Get ready for tax season deadlines by completing any required tax forms today. Ohio department of taxation p.o. Web 1 best answer. A trust or decedent's estate is allowed a. Web schedule e is a tax form that you will complete and attach to form 1040. You will use part i of schedule e to report rental and royalty income and part ii of. For instructions and the latest information. Connect with our cpas or other tax experts who can help you navigate your tax situation. If you earn rental. Ohio department of taxation p.o. Introduction to estate and gift taxes. Income tax return for estates and trusts. Web select the asset you want to link to the schedule e from the left navigation panel. Web department of the treasury—internal revenue service. Don’t complete for a simple trust or a pooled income fund. Ad file form 1041 with confidence with taxact's tax planning & form checklists. The depreciation in a trust is. Department of the treasury—internal revenue service. For instructions and the latest. Income tax return for estates and trusts. Instructions for form 1041 ( print version pdf) recent developments. Web 2 schedule a charitable deduction. 4 days ago @ 2:20 pm. just the form 1041 and the grantor letter or the 1041, grantor letter, and the schedule e? just the form 1041 and grantor letter. Web 1 best answer. Listed below are the irs form instructions. Schedule g—tax computation and payments. Web rental real estate income and expenses. Department of the treasury—internal revenue service. Web updated for tax year 2022 • june 2, 2023 8:40 am. Scroll down the asset information section and locate the general subsection. You will use part i of schedule e to report rental and royalty income and part ii of. Don’t complete for a simple trust or a pooled income fund. A trust or decedent's estate is allowed a. Entering prior year unallowed losses. Get ready for tax season deadlines by completing any required tax forms today. Who has to file schedule e? Ad file form 1041 with confidence with taxact's tax planning & form checklists. For instructions and the latest.Fillable Tax Form 1041 Printable Forms Free Online

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

Schedule E Fill Out and Sign Printable PDF Template signNow

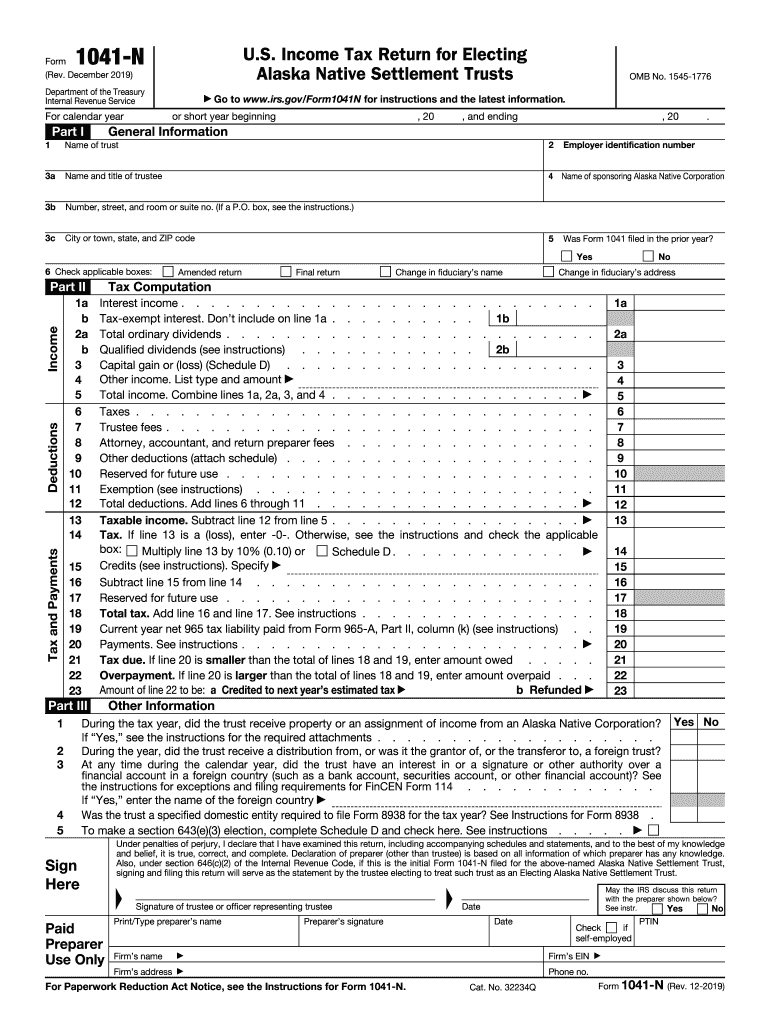

Guide for How to Fill in IRS Form 1041

2017 Form IRS Instruction 1041Fill Online, Printable, Fillable, Blank

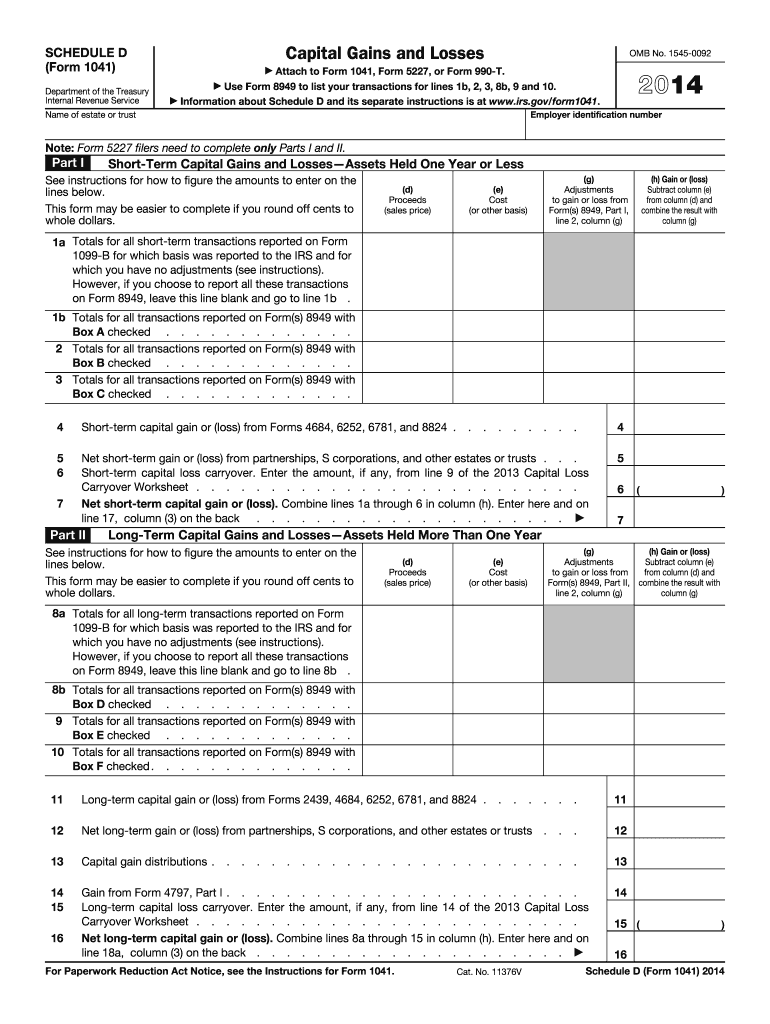

Instructions for Schedule D (Form 1041) (2018)Internal Revenue

2020 Form IRS 1041T Fill Online, Printable, Fillable, Blank pdfFiller

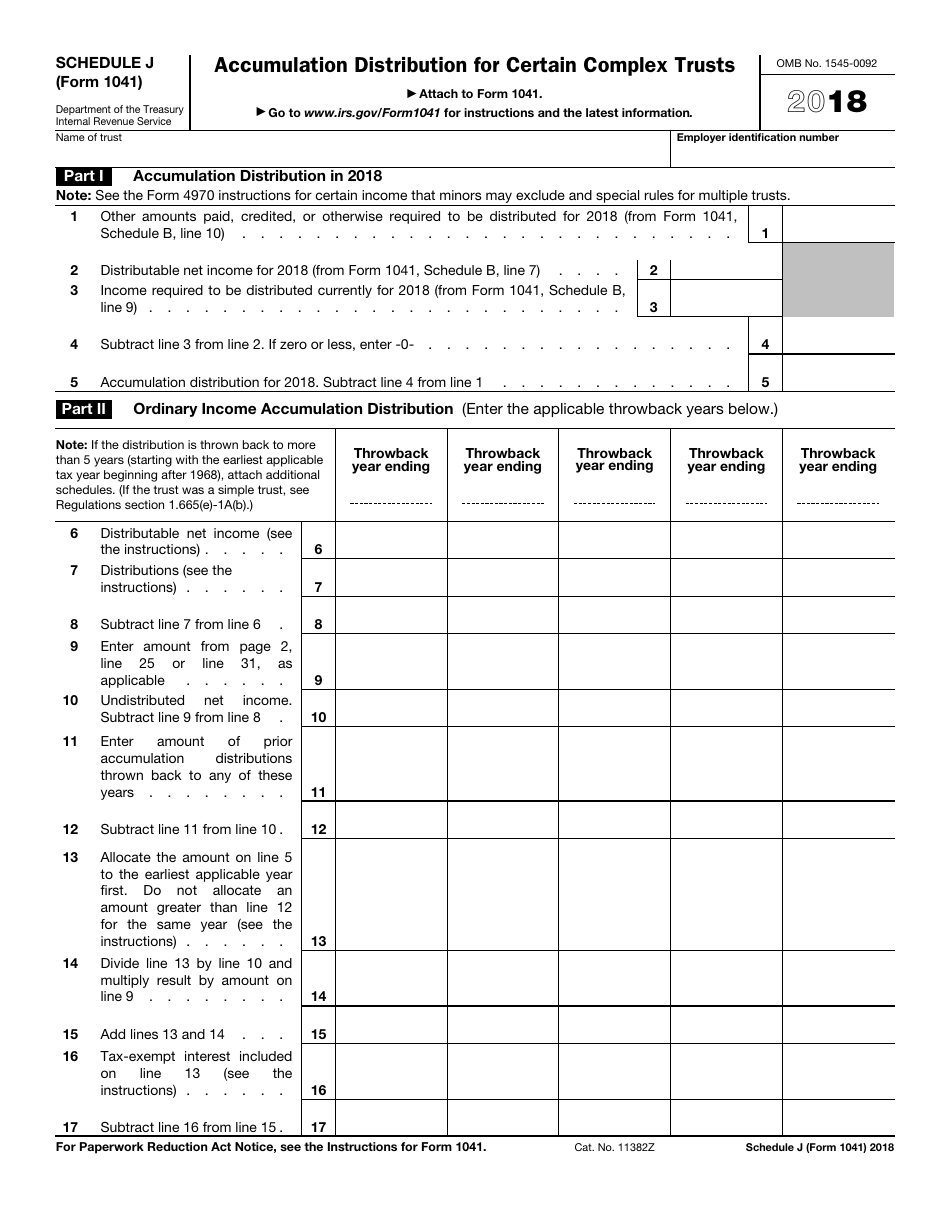

IRS Form 1041 Schedule J 2018 Fill Out, Sign Online and Download

1041 Schedule D Tax Worksheet

Form 1041 Fill Out and Sign Printable PDF Template signNow

Related Post: