Form 8949 Adjustment Codes

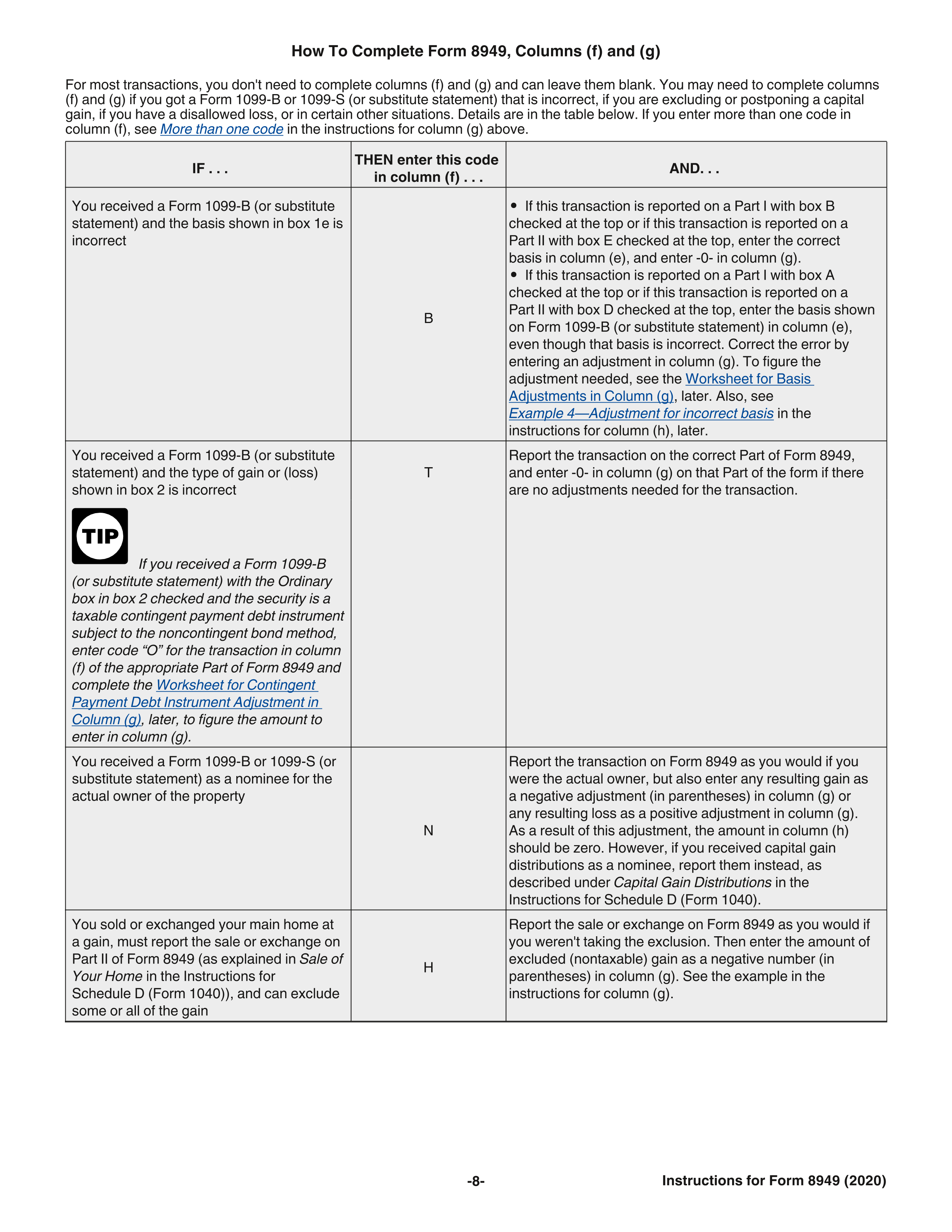

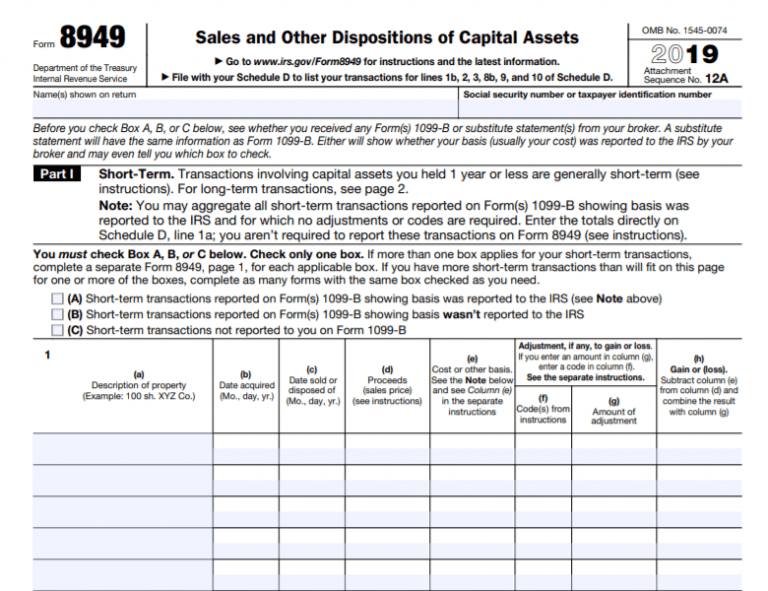

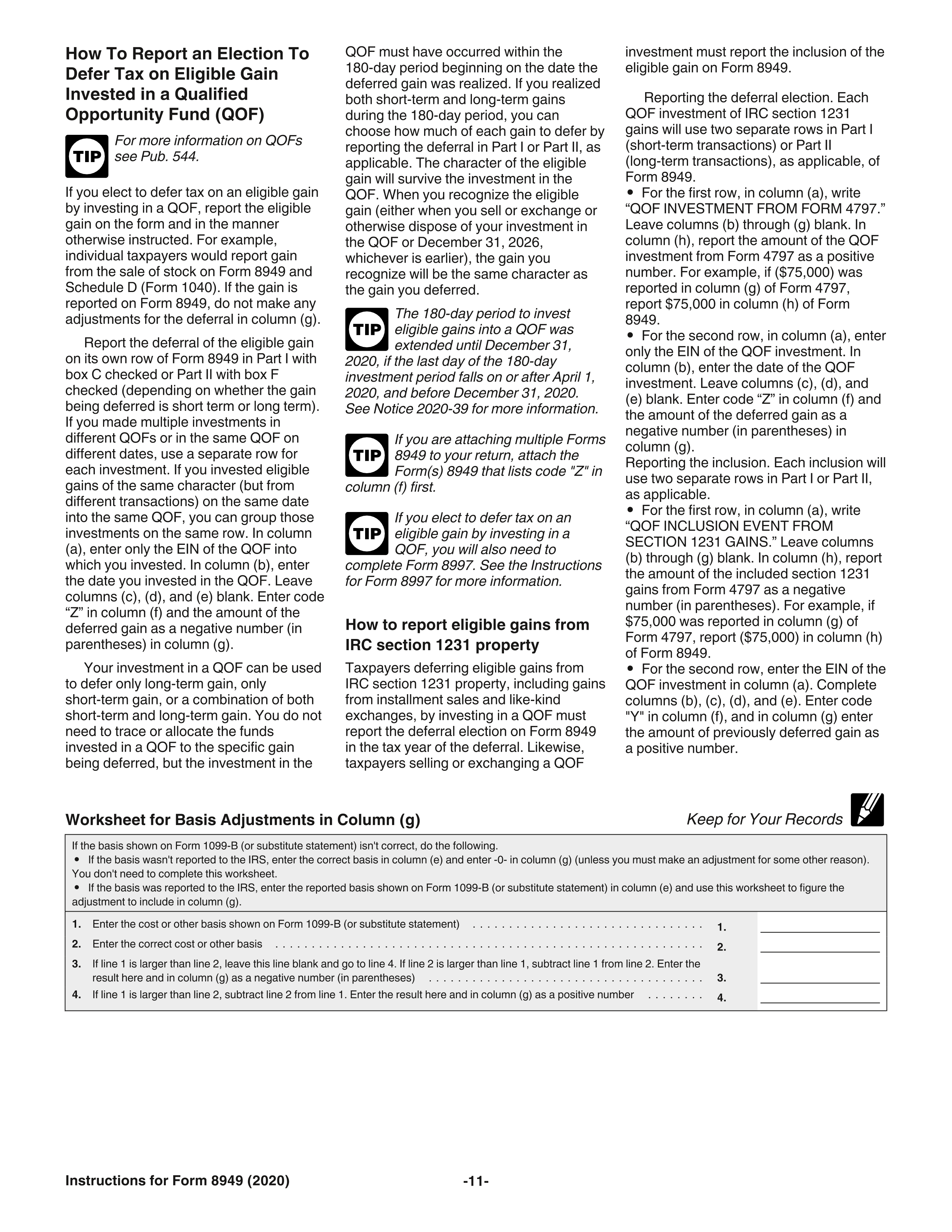

Form 8949 Adjustment Codes - Here is a summary of how to fill out tax form 8949. Web correct the error by entering an adjustment in column (g). Web 17 rows report the transaction on the correct part of form 8949, and enter 0 in column. Web file form 8949 with the schedule d for the return you are filing. For a complete list of. Web 8 rows form 8949 adjustment codes are reported in column (f). Web adjustment, if any, to gain or loss. Solved•by turbotax•6711•updated 6 days ago. Web file form 8949 with the schedule d for the return you are filing. See how to complete form 8949, columns (f). Web file form 8949 with the schedule d for the return you are filing. Web file form 8949 with the schedule d for the return you are filing. For a complete list of. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code. Web 8 rows form 8949 adjustment codes are reported in column (f). Get ready for tax season deadlines by completing any required tax forms today. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Web g8949 is a valid 2022 hcpcs code for documentation of patient reason (s) for patient not receiving counseling for diet and physical. (f) code(s) from instructions (g) amount of. Web g8949 is a valid 2022 hcpcs code for documentation of patient reason (s) for patient not receiving counseling for diet and physical activity (e.g., patient is not willing to discuss. Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in column. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. Follow the instructions for the code you. Get ready for tax season deadlines by completing any required tax forms today. If you enter an amount in column (g), enter a code in column (f). Here is a summary of how to fill out tax form 8949. Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in. For a complete list of. Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in column (f). Get ready for tax season deadlines by completing any required tax forms today. See how to complete form 8949, columns (f). If you go to sch d > form 8949 long. Web how to fill out tax form 8949. If you go to sch d > form 8949 long. Get ready for tax season deadlines by completing any required tax forms today. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web (see the form 8949 instructions here for an explanation of. Form 8949(sales and other dispositions of capital assets) records the details of. The adjustment amount will also be listed on. See how to complete form 8949, columns (f). Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web. Follow the instructions for the code you need to generate below. The adjustment amount will also be listed on. Form 8949(sales and other dispositions of capital assets) records the details of. See how to complete form 8949, columns (f). Solved•by turbotax•6711•updated 6 days ago. Web use form 8949 to report sales and exchanges of capital assets. Web file form 8949 with the schedule d for the return you are filing. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. If you go to sch d > form 8949 long. Web correct. For a complete list of. Web file form 8949 with the schedule d for the return you are filing. Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in column (f). Here is a summary of how to fill out tax form 8949. Get ready for tax season deadlines by completing any required tax forms today. Form 8949(sales and other dispositions of capital assets) records the details of. The adjustment amount will also be listed on. Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web adjustment, if any, to gain or loss. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. See how to complete form 8949, columns (f). Web report the gain or loss in the correct part of form 8949. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code that applies. Web 8 rows form 8949 adjustment codes are reported in column (f). (f) code(s) from instructions (g) amount of. Web file form 8949 with the schedule d for the return you are filing. Web use form 8949 to report sales and exchanges of capital assets. Web g8949 is a valid 2022 hcpcs code for documentation of patient reason (s) for patient not receiving counseling for diet and physical activity (e.g., patient is not willing to discuss.In the following Form 8949 example,the highlighted section below shows

Form 8949 and Sch. D diagrams I did a cashless exercise with my

IRS Form 8949 instructions.

Printable Form 8949 Printable Forms Free Online

Form 8949 Instructions & Information on Capital Gains/Losses Form

IRS Form 8949 instructions.

IRS Form 8949 Instructions 📝 Get 8949 Tax Form for 2022 Printable PDF

IRS Form 8949 instructions.

IRS Form 8949 instructions.

Form 8949 Fillable Printable Forms Free Online

Related Post: