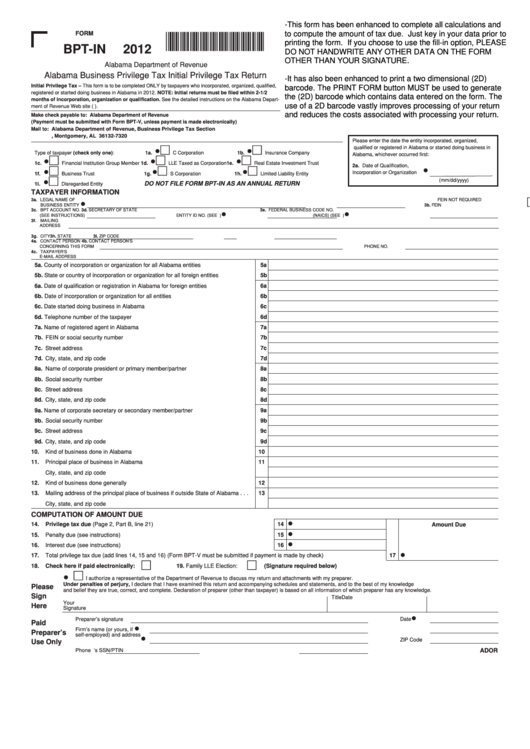

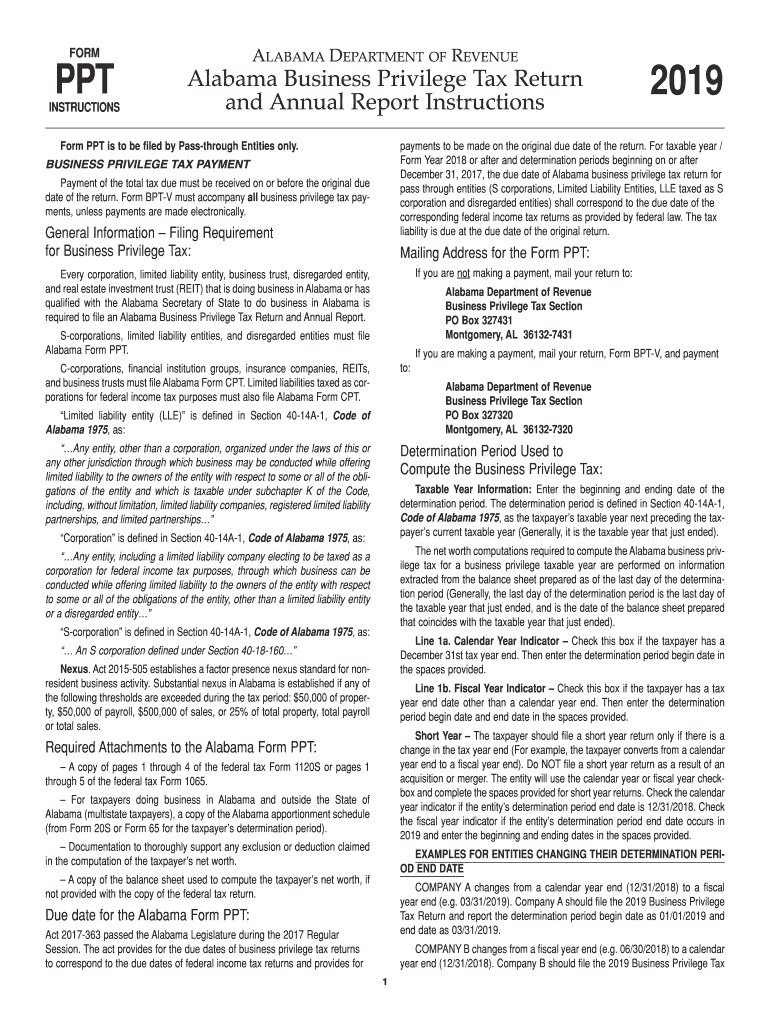

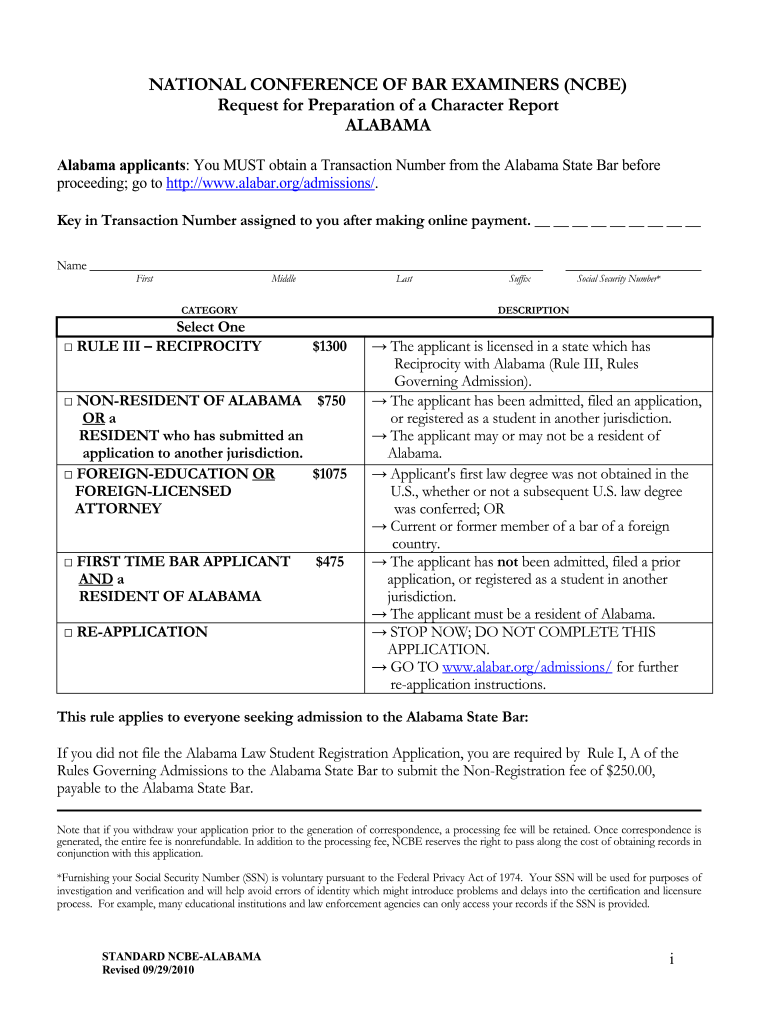

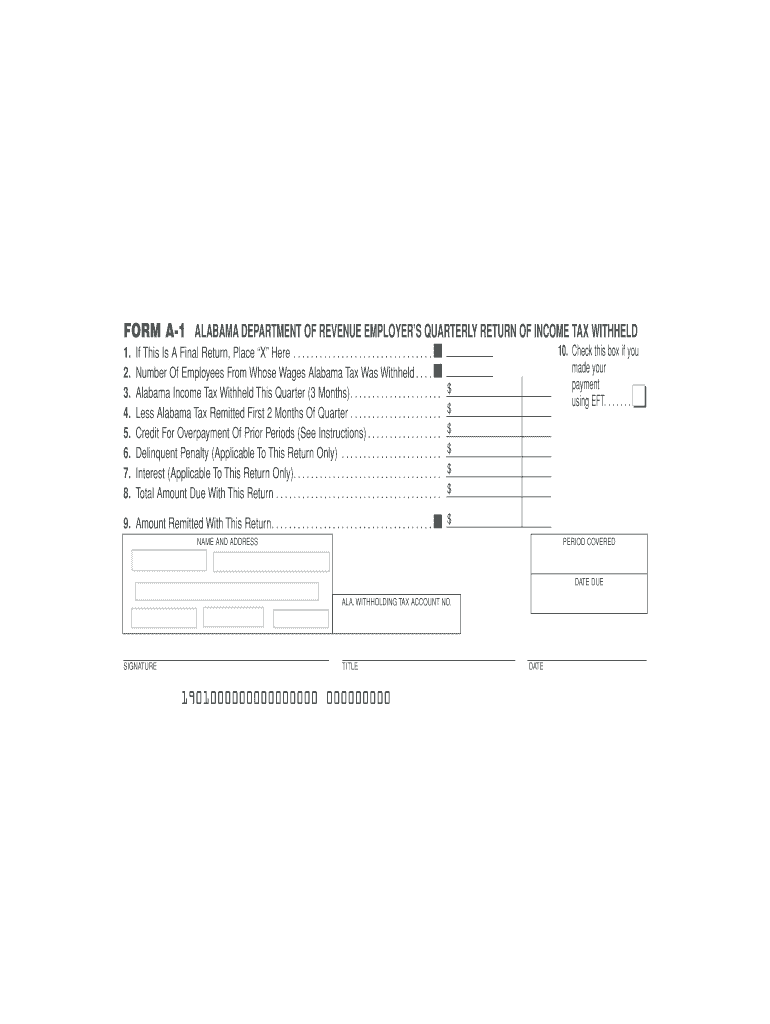

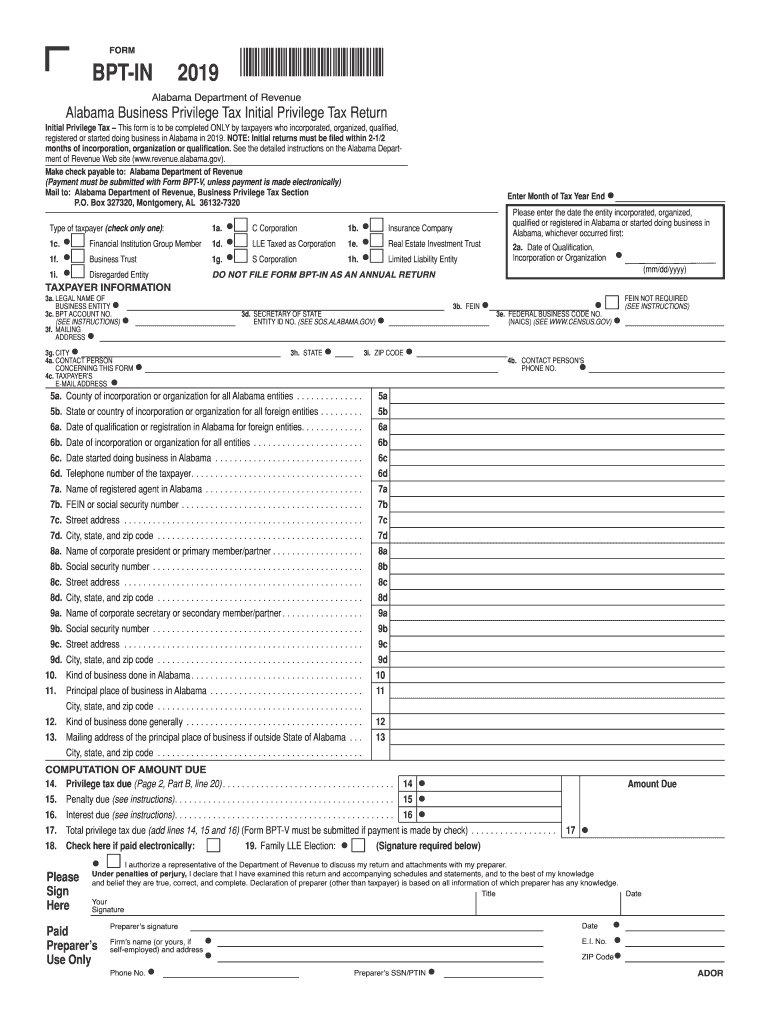

Alabama Form Bpt-In

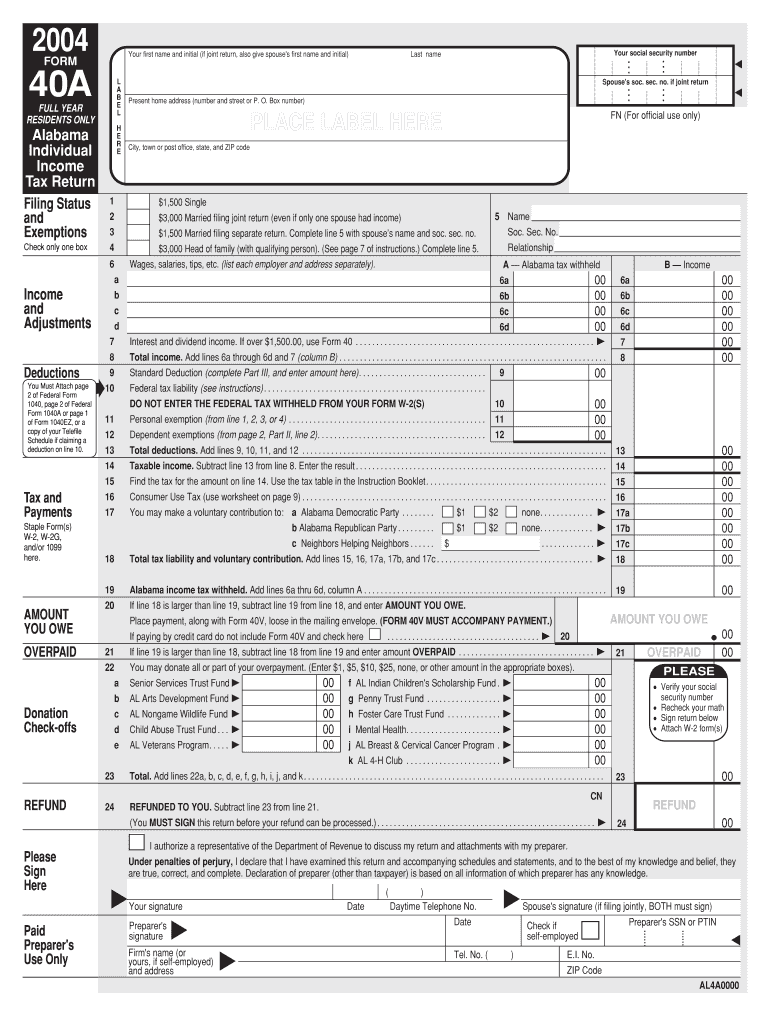

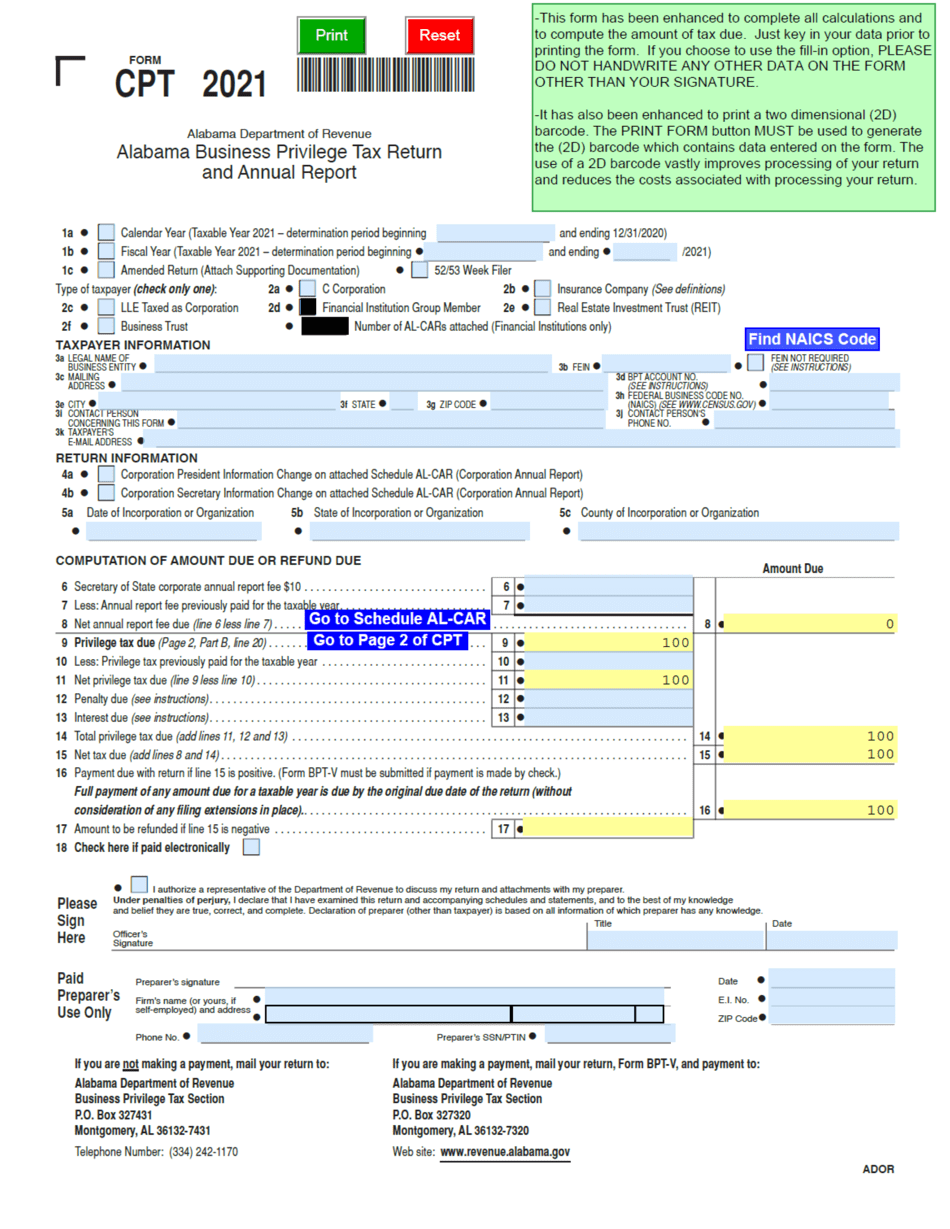

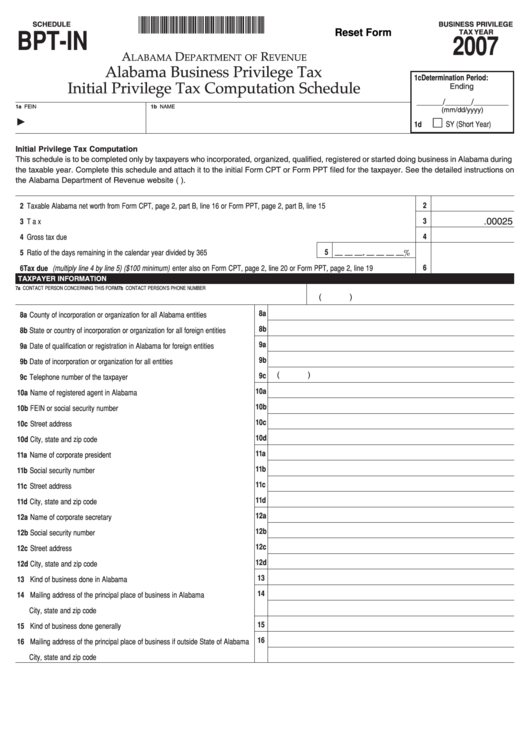

Alabama Form Bpt-In - Web bpt in alabama form. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another. How often is alabama business privilege tax due? Please contact the alabama department of. This form is for income earned in tax year 2022, with tax returns. For years prior to january 1, 2008, the alabama. Web alabama business privilege tax initial privilege tax return. Web at least $2,500,000, the tax rate shall be $1.75 per $1,000. Alabama business privilege tax initial privilege tax return. What is bpt in alabama? How often is alabama business privilege tax due? Show sources > about the individual income tax. Web up to $40 cash back get the free alabama form bpt in 2021. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of. Web the tax return and annual report are sent to the department of revenue. Send filled & signed form or save. Easily sign the form with your finger. This form is for income earned in tax year 2022, with tax returns. This form is for income earned in tax year 2022, with tax returns due in april. Formbptin2021×210001bn×alabama department of revenue alabama business. How often is alabama business privilege tax due? Web who files bpt in alabama? This form is for income earned in tax year 2022, with tax returns. Alabama business privilege tax initial privilege tax return. Web alabama form bpt v 2021. We are not affiliated with any brand or entity on this form. Web alabama business privilege tax initial privilege tax return. Web up to $40 cash back get the free alabama form bpt in 2021. If sending a return without a payment, send to: The irs and most states collect. Easily sign the bpt in alabama with. Get bpt in alabama form. Easily sign the form with your finger. Send filled & signed form or save. Complete, edit or print tax forms instantly. Web an extension of time for filing the alabama business privilege tax return and annual report will be given beginning and ending on. Open form follow the instructions. Minimum privilege tax is $100; Get alabama form bpt v 2021. Open form follow the instructions. Web at least $2,500,000, the tax rate shall be $1.75 per $1,000. How often is alabama business privilege tax due? Web alabama form bpt v 2021. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. Open form follow the instructions. Open form follow the instructions. What is bpt in alabama? Plus the $10 secretary of state annual report fee for corporations. Web at least $2,500,000, the tax rate shall be $1.75 per $1,000. Get alabama form bpt v 2021. If sending a return without a payment, send to: Web alabama business privilege tax initial privilege tax return. Show sources > about the individual income tax. How often is alabama business privilege tax due? Complete, edit or print tax forms instantly. Web the tax return and annual report are sent to the department of revenue. Open the alabama form bpt in and follow the instructions. Alabama business privilege tax initial privilege tax return. Web employees in alabama fill out form a4, employee's withholding tax exemption certificate, to be used when calculating withholdings. Web bpt in alabama form. What is bpt in alabama? Web the rates range from $0.25 to $1.75 for each $1,000 of net worth in alabama with a minimum business privilege tax set at $100 and the maximum amount. We are not affiliated with any brand or entity on this form. Web up to $40 cash back get the free alabama form bpt in 2021. This form is for income earned in tax year 2022, with tax returns due in april. Easily sign the form with your finger. Please contact the alabama department of. Web an extension of time for filing the alabama business privilege tax return and annual report will be given beginning and ending on. Easily sign the form with your finger. Plus the $10 secretary of state annual report fee for corporations. Open the alabama form bpt in and follow the instructions. This form is for income earned in tax year 2022, with tax returns. Complete, edit or print tax forms instantly. Open form follow the instructions. How often is alabama business privilege tax due? Each type of business entity in the state of alabama has a specific tax form to fill out each year. Web the alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another. The irs and most states collect.Alabama form 40 instructions Fill out & sign online DocHub

Form CPT 2018 Fill Out, Sign Online and Download Printable PDF

Form CPT Download Fillable PDF or Fill Online Alabama Business

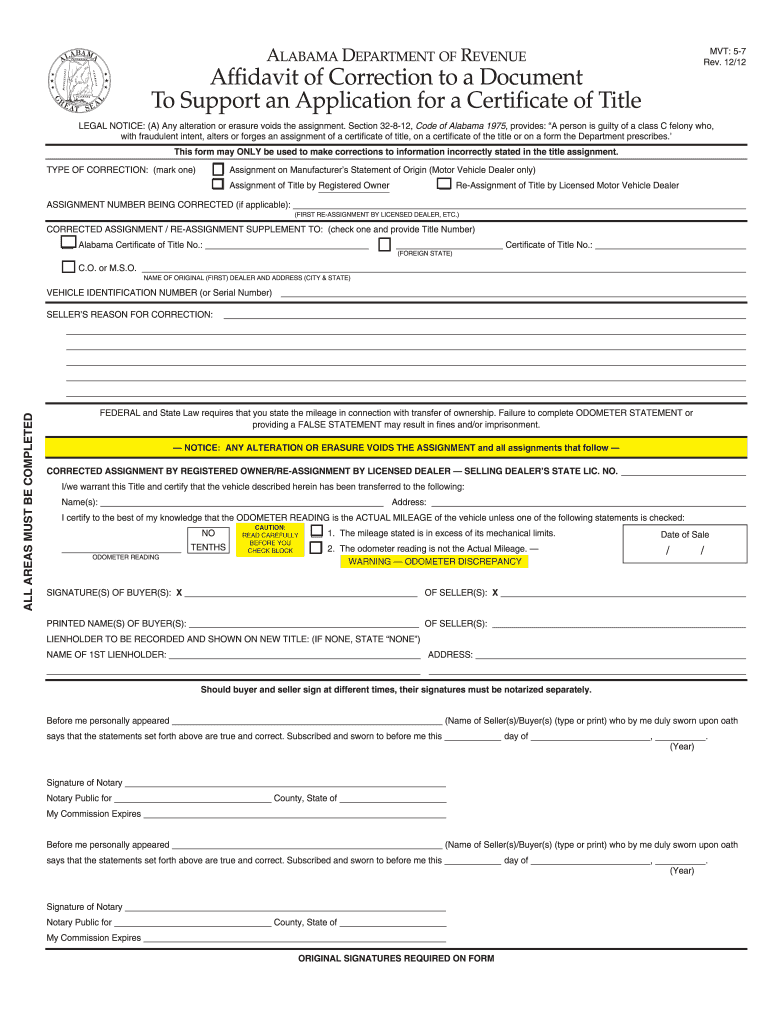

Alabama Title Application Pdf Fill Online, Printable, Fillable, Blank

Fillable Form BptIn Alabama Business Privilege Taxinitial Privilege

Fillable Form BptIn Alabama Business Privilege Tax Initial Privilege

2018 Alabama Instructions Fill Out and Sign Printable PDF Template

Fprm Bpt In State Of Alabama Fill Online, Printable, Fillable, Blank

Alabama Form a 1 Fill Out and Sign Printable PDF Template signNow

Alabama Business Privilege Tax Initial Return Form for Newly

Related Post: