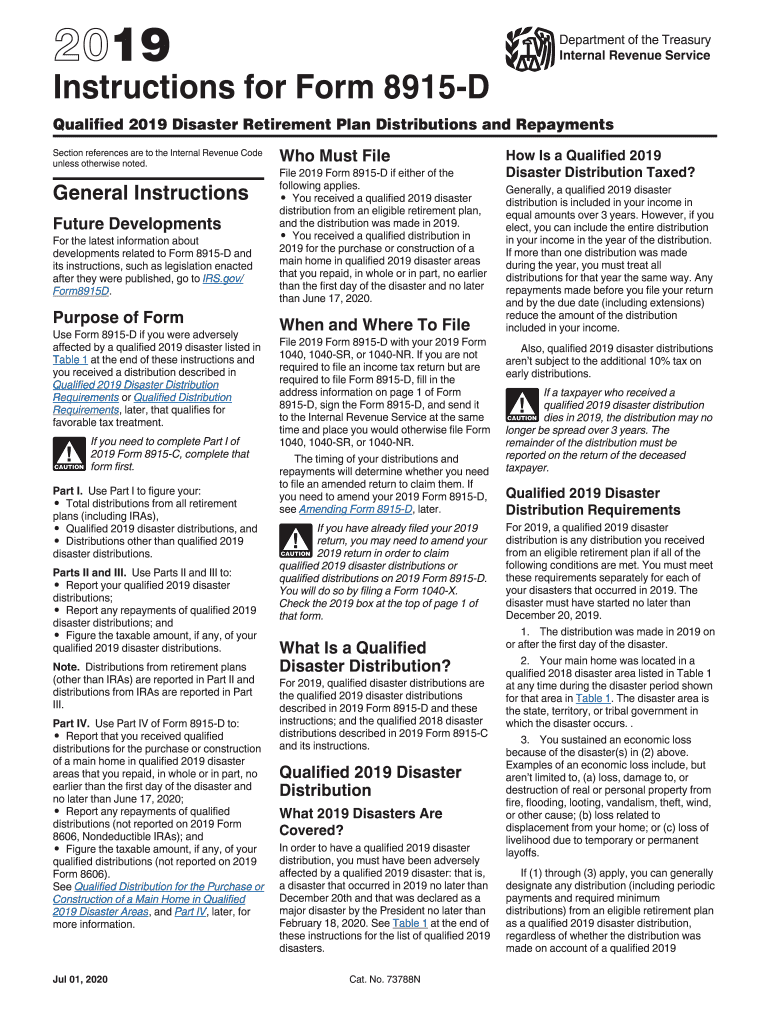

Form 8915-E Instructions

Form 8915-E Instructions - Choose the sample you want in the collection of templates. 13 14 enter the amount, if any, from 2020 form 8606, line 25b. Web if you took a distribution from a retirement plan (other than an ira), follow these instructions: Do not include on your 2020 form. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before december 31, you may have coronavirus. This is also where you would enter any repayment you made on the. First, it's a bit frustrating. We'll handle every form for you! Web tonyteshera level 3 i'm not an expert, but i'm the original poster of this thread, and i think i understand why we've all been confused. Web see the instructions for form 8606, line 15b. Web this article will help you generate form 8915e, qualified 2020 disaster retirement plan distributions and repayments (or form 8915f for 2021 and 2022), and. First, it's a bit frustrating. Web before you begin (see instructions for details): We'll handle every form for you! Web see the instructions for form 8606, line 15b. Web choose your type of plan and enter the distribution amount you received (limited to $100,000). Web if you took a distribution from a retirement plan (other than an ira), follow these instructions: This is also where you would enter any repayment you made on the. Open the template in our. First, it's a bit frustrating. This is also where you would enter any repayment you made on the. Web this article will help you generate form 8915e, qualified 2020 disaster retirement plan distributions and repayments (or form 8915f for 2021 and 2022), and. Choose the sample you want in the collection of templates. We'll handle every form for you! Web before you begin (see instructions for details): Ad we prepare your u.s. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before december 31, you may have coronavirus. Web this article will help you generate form 8915e, qualified 2020 disaster retirement plan distributions and repayments (or form 8915f for 2021 and. First, it's a bit frustrating. Choose the sample you want in the collection of templates. We'll handle every form for you! Do not include on your 2020 form. Sign in to your turbotax account open or download your2020 tax. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Open the template in our online editing tool. 13 14 enter the amount, if any, from 2020 form 8606, line 25b. We'll handle every form for you! Web choose your type of plan and enter the distribution amount you received (limited. Web this article will help you generate form 8915e, qualified 2020 disaster retirement plan distributions and repayments (or form 8915f for 2021 and 2022), and. Web go to www.irs.gov/form8915e for instructions and the latest information. Web choose your type of plan and enter the distribution amount you received (limited to $100,000). Web tonyteshera level 3 i'm not an expert, but. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Web tonyteshera level 3 i'm not an expert, but i'm the original poster of this thread, and i think i understand why we've all been confused. Web see the instructions for form 8606, line 15b. Web choose your type of plan. Open the template in our online editing tool. Web go to www.irs.gov/form8915e for instructions and the latest information. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Choose the sample you want in the collection of templates. Web this article will help you generate form 8915e, qualified 2020 disaster retirement. Web go to www.irs.gov/form8915e for instructions and the latest information. Web tonyteshera level 3 i'm not an expert, but i'm the original poster of this thread, and i think i understand why we've all been confused. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Open the template in our. Web see the instructions for form 8606, line 15b. Sign in to your turbotax account open or download your2020 tax. Web choose your type of plan and enter the distribution amount you received (limited to $100,000). We'll handle every form for you! Web go to www.irs.gov/form8915e for instructions and the latest information. First, it's a bit frustrating. Choose the sample you want in the collection of templates. Web tonyteshera level 3 i'm not an expert, but i'm the original poster of this thread, and i think i understand why we've all been confused. 13 14 enter the amount, if any, from 2020 form 8606, line 25b. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. This is also where you would enter any repayment you made on the. Web go to www.irs.gov/form8915e for instructions and the latest information. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before december 31, you may have coronavirus. Ad we prepare your u.s. Do not include on your 2020 form. Web before you begin (see instructions for details): Web if you took a distribution from a retirement plan (other than an ira), follow these instructions: Open the template in our online editing tool. Web this article will help you generate form 8915e, qualified 2020 disaster retirement plan distributions and repayments (or form 8915f for 2021 and 2022), and.Instructions 8915 Fill Out and Sign Printable PDF Template signNow

8915e tax form instructions Somer Langley

Instructions 8915 form Fill out & sign online DocHub

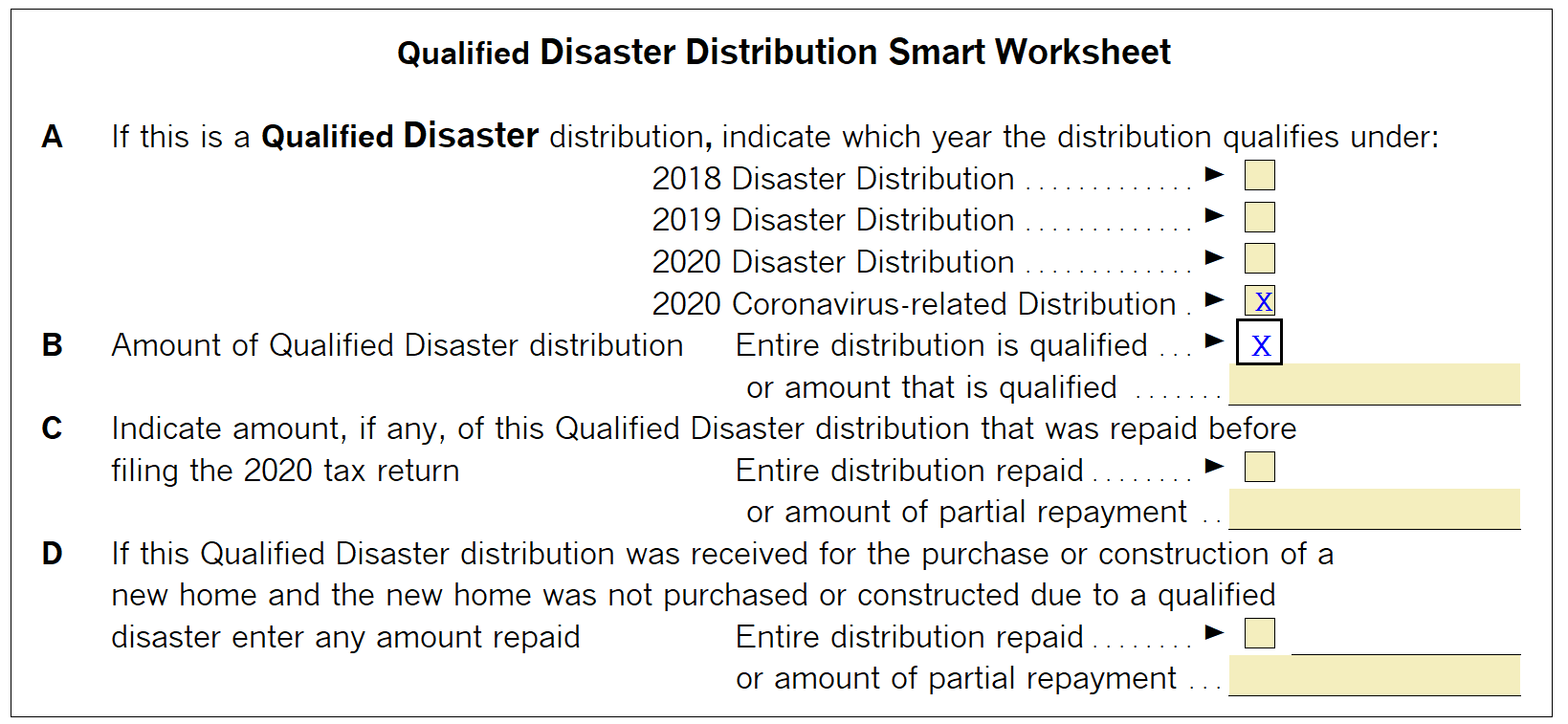

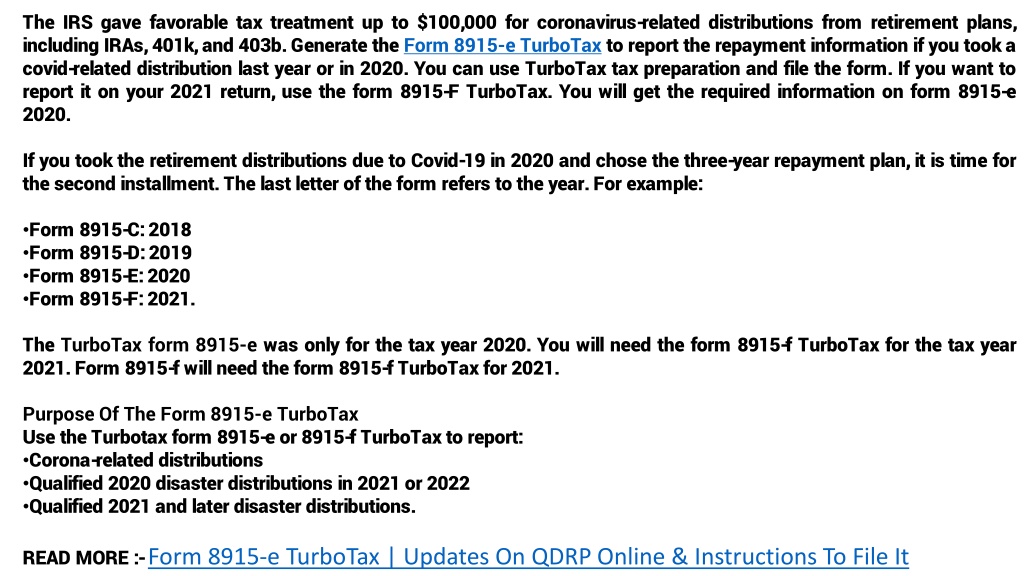

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

form 8915 e instructions turbotax Renita Wimberly

PPT Form 8915e TurboTax Updates On QDRP Online & Instructions To

8915e tax form instructions Somer Langley

form 8915 e instructions turbotax Renita Wimberly

PPT Form 8915e TurboTax Updates On QDRP Online & Instructions To

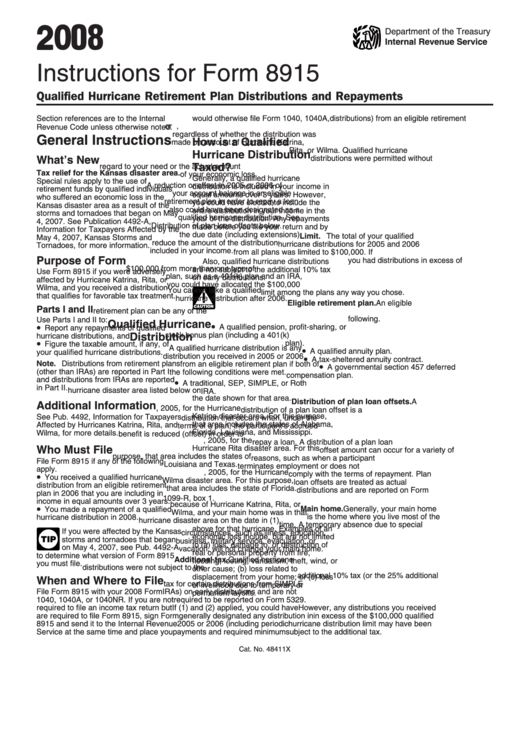

Instructions For Form 8915 2008 printable pdf download

Related Post: