Form 8910 Vs 8936

Form 8910 Vs 8936 - Follow these steps to generate the 8936 credit for a vehicle that isn't two or three. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Use the january 2023 revision of form 8936 for tax years beginning in 2022 or later, until a later revision is issued. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web which revision to use. Form 8834, qualified electric vehicle credit vs. Web • use this form to claim the credit for certain alternative motor vehicles. Currently, the only vehicle propulsion technology that meets the requirements of this credit is fuel cell technology. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Hosting for lacerte & proseries. Web • use this form to claim the credit for certain alternative motor vehicles. The credit attributable to depreciable property (vehicles used for business or. The alternative motor vehicle credit expired for vehicles purchased after 2021. Solved • by intuit • 5 • updated 1 year ago. Web form 8910 vs 8936 home; Web solved•by intuit•87•updated february 10, 2023. Web • use this form to claim the credit for certain alternative motor vehicles. The alternative motor vehicle credit is meant to lower the cost of purchasing a qualifying alternative motor vehicle. Hosting for lacerte & proseries. Use the january 2023 revision of form 8936 for tax years beginning in 2022 or later, until. Web page last reviewed or updated: Currently, the only vehicle propulsion technology that meets the requirements of this credit is fuel cell technology. Hosting for lacerte & proseries. Web which revision to use. The alternative motor vehicle credit expired for vehicles purchased after 2021. Information about form 8910, alternative motor vehicle credit, including recent updates, related forms and. Web alternative motor vehicle credit. The alternative motor vehicle credit is meant to lower the cost of purchasing a qualifying alternative motor vehicle. Web refer to the irs instructions for form 8936 for more information about this credit. Form 8834, qualified electric vehicle credit vs. Web alternative motor vehicle credit. The alternative motor vehicle credit is meant to lower the cost of purchasing a qualifying alternative motor vehicle. Assuming that this is the. Web page last reviewed or updated: Use prior revisions of the form. Hosting for lacerte & proseries. Web enter a 3 in, vehicle credit type: Solved • by intuit • 5 • updated 1 year ago. Web page last reviewed or updated: Web alternative motor vehicle credit. Use this form to claim the credit for certain alternative motor vehicles. Web which revision to use. Use prior revisions of the form. Assuming that this is the. Web solved•by intuit•85•updated 1 year ago. Web solved•by intuit•87•updated february 10, 2023. Web alternative motor vehicle credit. Web solved•by intuit•85•updated 1 year ago. Assuming that this is the. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Currently, the only vehicle propulsion technology that meets the requirements of this credit is fuel cell technology. Use this form to claim the credit for certain alternative motor vehicles. Web form 8910 vs 8936 home; Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Use the january 2023 revision of. The alternative motor vehicle credit is meant to lower the cost of purchasing a qualifying alternative motor vehicle. Use the january 2023 revision of form 8936 for tax years beginning in 2022 or later, until a later revision is issued. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web what vehicles qualify for the alternative motor vehicle. Information about form 8910, alternative motor vehicle credit, including recent updates, related forms and. Web page last reviewed or updated: Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? The alternative motor vehicle credit expired for vehicles purchased after 2021. Web which revision to use. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three. Web alternative motor vehicle credit. Form 8834, qualified electric vehicle credit vs. Assuming that this is the. Use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Use this form to claim the credit for certain alternative motor vehicles. Web form 8910 vs 8936 home; The credit attributable to depreciable property (vehicles used for business or. The alternative motor vehicle credit is meant to lower the cost of purchasing a qualifying alternative motor vehicle. Use the january 2023 revision of form 8936 for tax years beginning in 2022 or later, until a later revision is issued. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Web • use this form to claim the credit for certain alternative motor vehicles. Web solved•by intuit•85•updated 1 year ago. Solved • by intuit • 5 • updated 1 year ago.Electric Vehicle Tax Credits on IRS Form 8936 YouTube

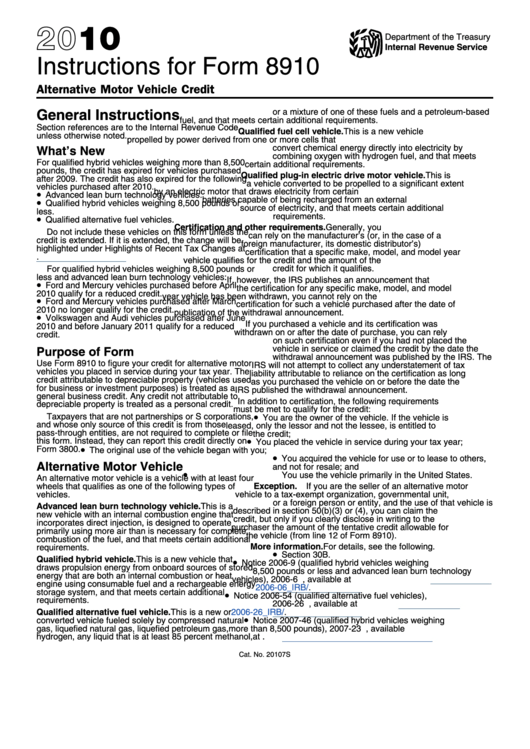

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

Audi, MINI & Toyota Prius models added to IRS electric vehicle tax

Form 8910 Edit, Fill, Sign Online Handypdf

Instructions For Form 8910 Alternative Motor Vehicle Credit 2010

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Free Fillable Form 1040 Missing Tuition Printable Forms Free Online

Fillable Form 8936 Qualified PlugIn Electric Drive Motor Vehicle

Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Related Post: