Form 8880 Turbotax

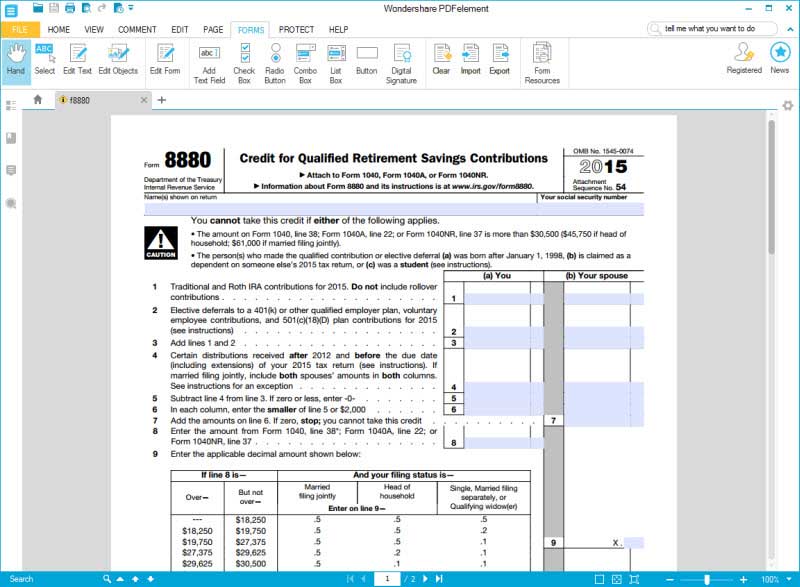

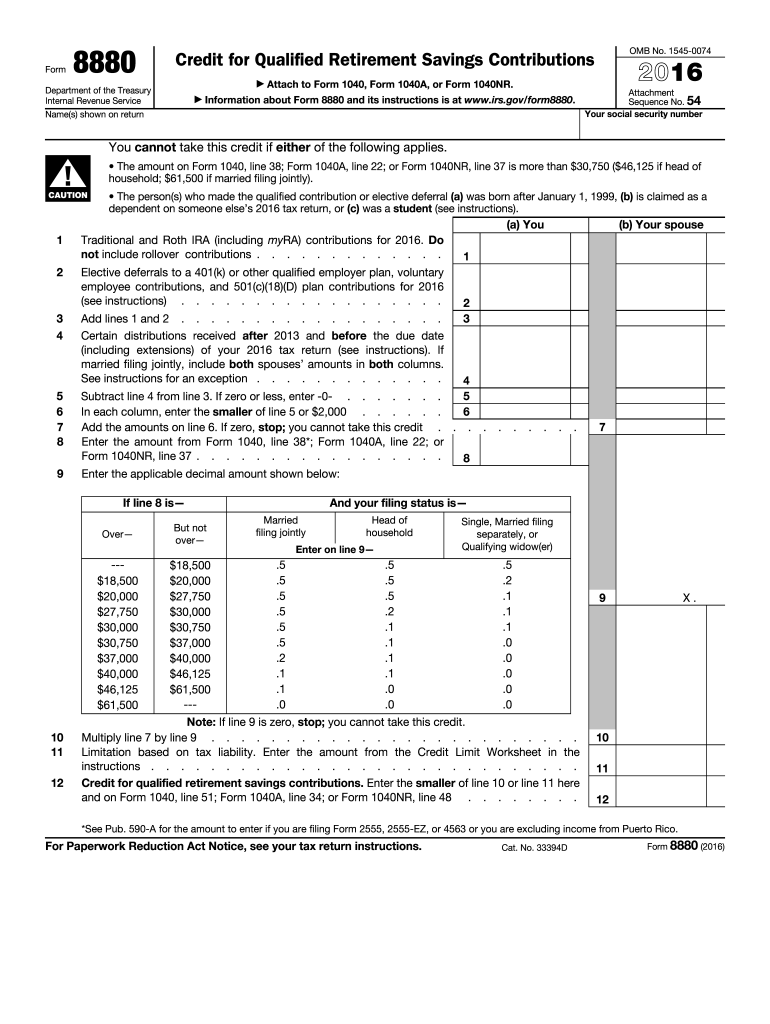

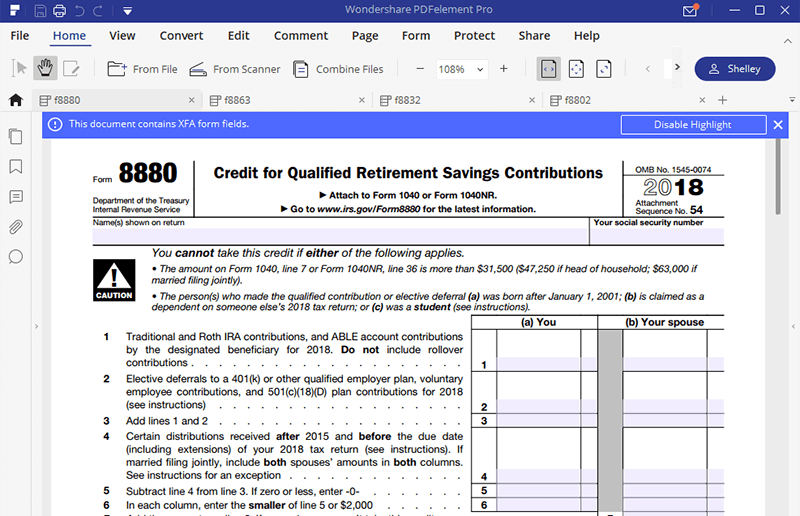

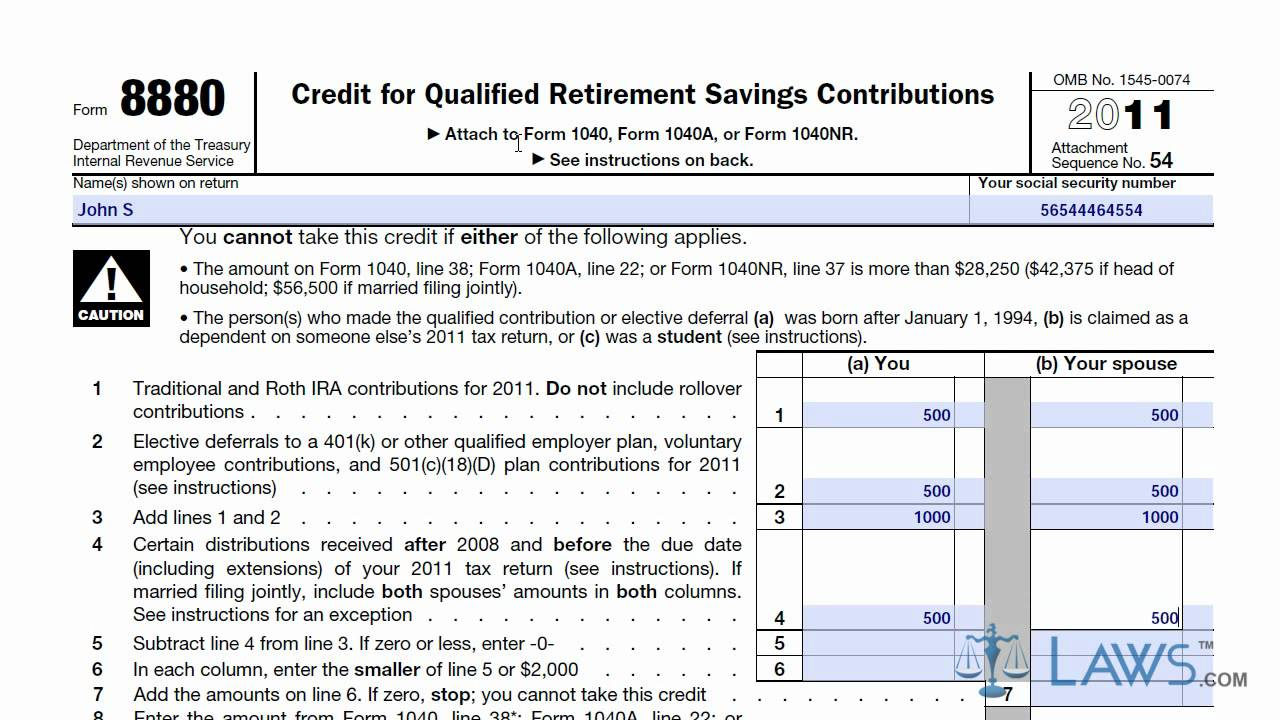

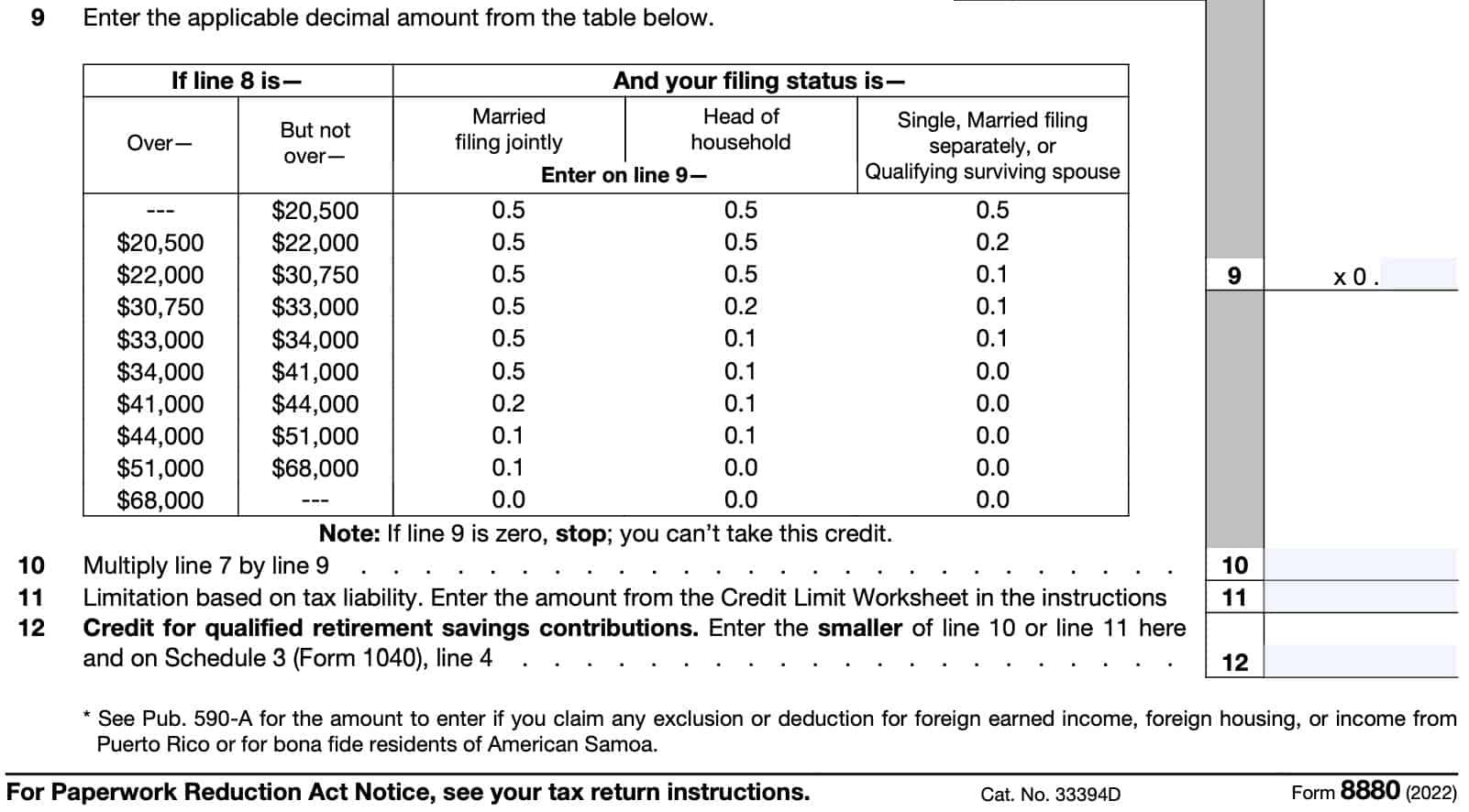

Form 8880 Turbotax - In this article, we’ll walk. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). In order to claim the retirement. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. A tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. You may be eligible to claim the retirement savings contributions credit, also known as the. Check box 12, code d , which displays amounts you. Web form 8880, credit for qualified retirement savings contributions pdf. Minimize potential audit risks and save time when filing taxes each year Ad signnow.com has been visited by 100k+ users in the past month Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Check box 12, code d , which displays amounts you. In this article, we’ll walk. You may be eligible to claim the retirement savings contributions credit,. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). The saver's credit is a tax credit for. Web what are the retirement savings contributions credit (form 8880) requirements? Page last reviewed or updated: Here's the rundown—follow it, and if you're eligible, you should get your tax. Here's the rundown—follow it, and if you're eligible, you should get your tax. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings. Form 8880 is not generating credit due to pension distributions; You may be eligible to claim the retirement savings contributions credit,. Form 8880 is not generating credit due to pension distributions; Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). In order to claim the retirement. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit. Ad save time and money with professional tax planning & preparation services. Minimize potential audit risks and save time when filing taxes each year In this article, we’ll walk. A tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. Web information about form 8880, credit for qualified retirement savings contributions,. Web turbotax will automatically generate form 8880 and file it with your tax return if you qualify for the saver's credit. Ad signnow.com has been visited by 100k+ users in the past month This credit can be claimed in addition to any ira. The saver's credit is a tax credit for. Here's the rundown—follow it, and if you're eligible, you. Web turbotax will automatically generate form 8880 and file it with your tax return if you qualify for the saver's credit. Web what are the retirement savings contributions credit (form 8880) requirements? Page last reviewed or updated: This credit can be claimed in addition to any ira. Web information about form 8880, credit for qualified retirement savings contributions, including recent. A tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web the irs is fairly explicit on how retirement savers can claim the saver's credit. $65,000 if. Web the irs is fairly explicit on how retirement savers can claim the saver's credit. Ad save time and money with professional tax planning & preparation services. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web what are the retirement savings contributions credit (form 8880) requirements?. Ad signnow.com has been visited by 100k+ users in the past month Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings. Web form 8880, credit for qualified retirement savings contributions pdf. A tax credit directly reduces the amount of tax you owe, unlike a deduction, which only decreases your taxable income. In this article, we’ll walk. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. $65,000 if married filing jointly). The person(s) who made the. Check box 12, code d , which displays amounts you. Web based on form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Page last reviewed or updated: Ad save time and money with professional tax planning & preparation services. To encourage people with lower incomes to contribute to their retirement savings accounts, the internal revenue service offers a tax credit for contributions to them. Web turbotax will automatically generate form 8880 and file it with your tax return if you qualify for the saver's credit. If you contribute to a retirement plan at work. You may be eligible to claim the retirement savings contributions credit, also known as the. Web eligible taxpayers may use irs form 8880 to claim a credit for qualified retirement savings contributions, known as the saver’s credit. Minimize potential audit risks and save time when filing taxes each year The saver's credit is a tax credit for. Web what are the retirement savings contributions credit (form 8880) requirements?Instructions for How to Fill in IRS Form 8880

IRS 8880 2016 Fill out Tax Template Online US Legal Forms

2016 Simple Tax Form 8880 YouTube

IRS Form 8880 Get it Filled the Right Way

Learn How To Fill The Form 8880 Credit For Qualified 2021 Tax Forms

Application Form Turbo Tax

Solved Form 8880 Line 4 Certain distributions Is TurboTax Doing It

TurboTax 2022 Form 1040 Credits for Retirement Savings Contributions

IRS Form 8880 Instructions Retirement Savings Tax Credit

Form 8880 Credit for Qualified Retirement Savings Contributions

Related Post:

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)