Nc 529 Withdrawal Form

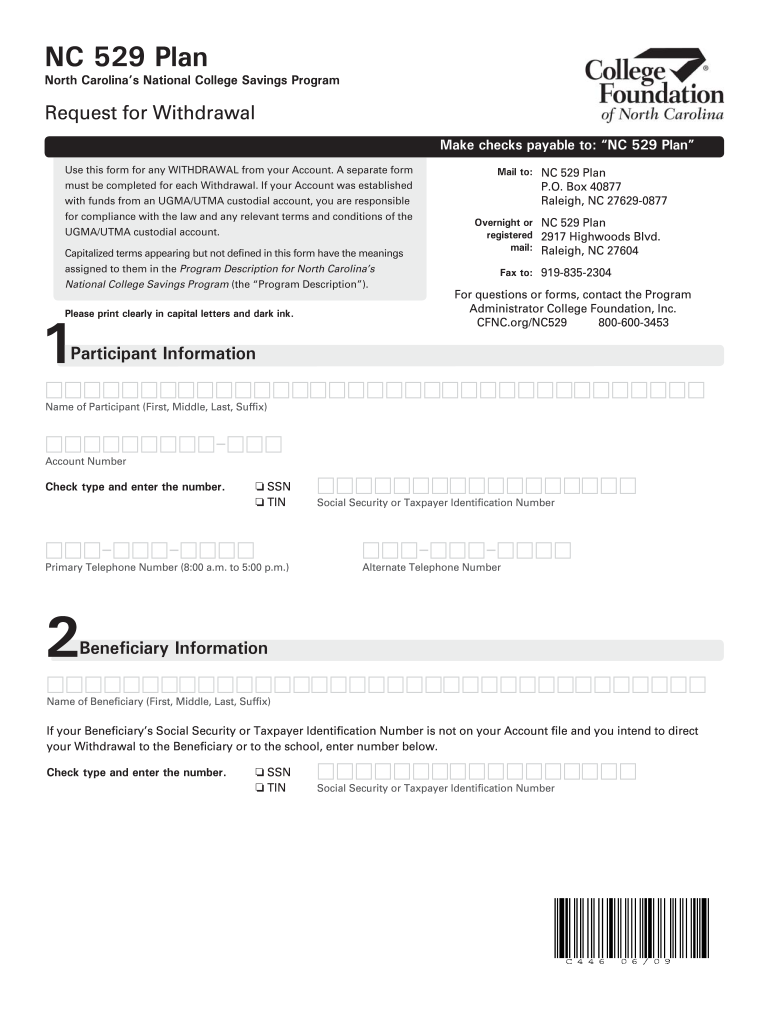

Nc 529 Withdrawal Form - Web in general, the earnings on nc 529 account funds withdrawn for payment of “qualified education expenses” are not subject to federal or north carolina state or local taxes. Web use this form for any withdrawal from your account. Give clients the power to achieve their savings goals with the scholars choice 529 plan. A separate form must be completed for each withdrawal. Use this form to request a full or partial withdrawal from your nc able account. Ad subscribe a plan for unlimited access to over 85k us legal forms for just $8/mo. All 529 plans have different forms and request different documents. If your account was established with funds from an. For withdrawals not used for qualified disability expenses the. I’ve entered an electronic funds transfer (eft) which has not been applied to my account. Ad open a ny 529 account today & invest in your child's future now. Ad subscribe a plan for unlimited access to over 85k us legal forms for just $8/mo. Web use this form for any withdrawal from your account. If your account was established with funds from an. Web consumer reports explains how to withdraw money from a 529. Web in general, the earnings on nc 529 account funds withdrawn for payment of “qualified education expenses” are not subject to federal or north carolina state or local taxes. How much will ego want? How long will it take to be applied? Ad open a ny 529 account today & invest in your child's future now. Web use this form. Nc 529 plan separate form must be completed for each withdrawal. Ad subscribe a plan for unlimited access to over 85k us legal forms for just $8/mo. Web use this form for any withdrawal from your account. Web please visit your 529 plan’s website to see what information is required to support a withdrawal request. See how our plan can. Ad open a ny 529 account today & invest in your child's future now. Web consumer reports explains how to withdraw money from a 529 college savings plan. How long will it take to be applied? Ad open a ny 529 account today & invest in your child's future now. If your account was established with funds from an. How long will it take to be applied? Give clients the power to achieve their savings goals with the scholars choice 529 plan. Web find and fill out the correct nc529 forms. Ad subscribe a plan for unlimited access to over 85k us legal forms for just $8/mo. Web please visit your 529 plan’s website to see what information is. If your account was established with funds from an. Web open an nc 529 account; If you contributed to the 529 plan, you will be able to claim a subtraction from income. Ad subscribe a plan for unlimited access to over 85k us legal forms for just $8/mo. These moves can save you money and avoid costly penalties. Use this form to request a full or partial withdrawal from your nc able account. Web nc 529 plan north carolina’s national college savings program rollover and transfer form make checks payable to: Web open an nc 529 account; Web find and fill out the correct nc529 forms. If you contributed to the 529 plan, you will be able to. Web nc 529 plan north carolina’s national college savings program rollover and transfer form make checks payable to: If you contributed to the 529 plan, you will be able to claim a subtraction from income. Web consumer reports explains how to withdraw money from a 529 college savings plan. How much will ego want? For withdrawals not used for qualified. Web consumer reports explains how to withdraw money from a 529 college savings plan. Ad why invest in a vanguard 529 plan? Web find and fill out the correct nc529 forms. How much will ego want? Ad open a ny 529 account today & invest in your child's future now. Choose the correct version of the editable pdf form from the list. See how our plan can help you save money for the future. If your account was established with funds from an. Web find and fill out the correct nc529 forms. Web how do i make a withdrawal? A separate form/request is required for each withdrawal. How long will it take to be applied? Manage my nc 529 account [lock] Web how do i make a withdrawal? Give clients the power to achieve their savings goals with the scholars choice 529 plan. Web your cfnc login will give you access to our full family of resources to plan, apply, save, and pay for college. Web please visit your 529 plan’s website to see what information is required to support a withdrawal request. If your account was established with funds from an. Learn how the official new york 529 plan with vanguard can help you start saving today Web in general, the earnings on nc 529 account funds withdrawn for payment of “qualified education expenses” are not subject to federal or north carolina state or local taxes. Setting up a vanguard 529 plan early can save you money on education costs. Web nc 529 plan north carolina’s national college savings program rollover and transfer form make checks payable to: See how our plan can help you save money for the future. All 529 plans have different forms and request different documents. These moves can save you money and avoid costly penalties. Ad why invest in a vanguard 529 plan? Choose the correct version of the editable pdf form from the list. Web a 529 account can help you pave the way for a loved one on the path to success, while both reducing the income taxes on your investments and the taxable value of your estate for. Real estate, family law, estate planning, business forms and power of attorney forms. Ad open a ny 529 account today & invest in your child's future now.Fill Free fillable Fidelity Investments PDF forms

Does A Withdrawal Look Bad Fill Out and Sign Printable PDF Template

how to report 529 distributions on tax return Fill Online, Printable

Withdrawal Request 401 K Form Fill Online, Printable, Fillable, Blank

Withdrawal Form Companies Credit Card

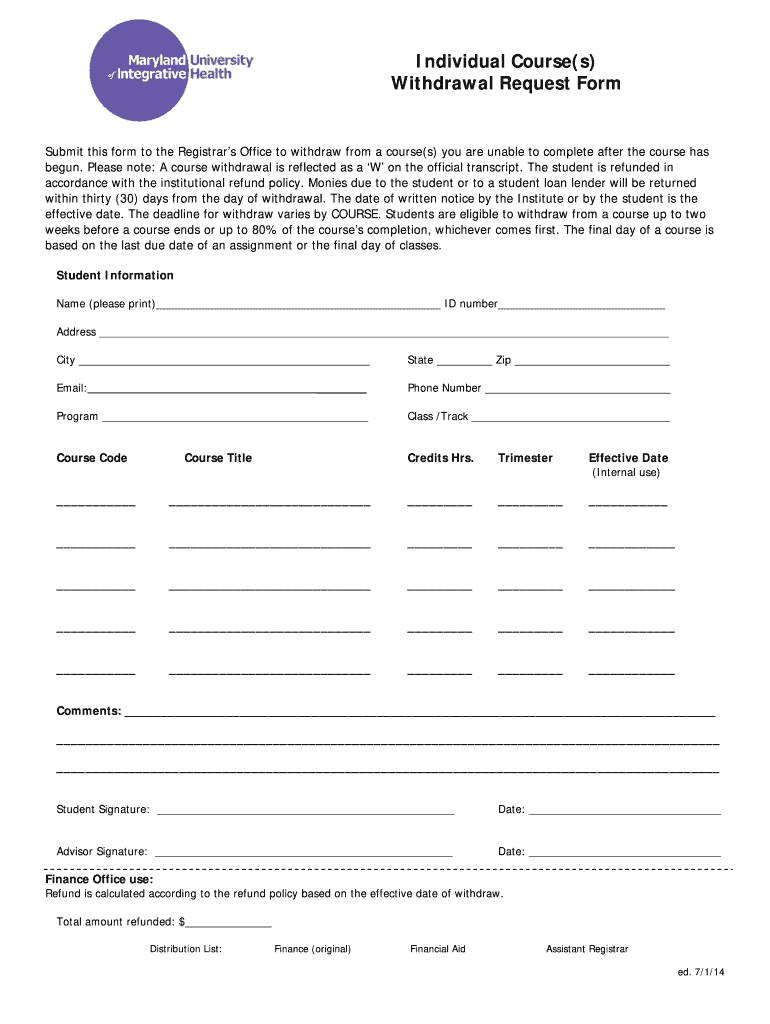

WITHDRAWAL FORM

Nc529 Forms Fill Out and Sign Printable PDF Template signNow

Blackrock 529 withdrawal Fill out & sign online DocHub

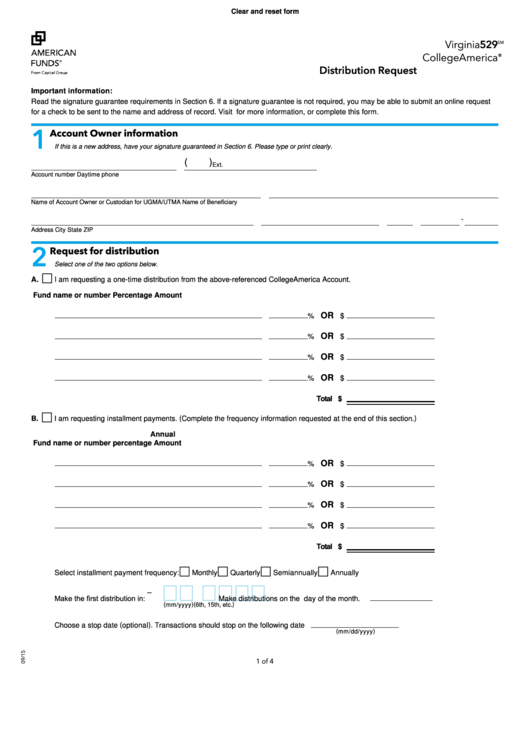

Fillable American Funds 529 Withdrawal Form Distribution Request

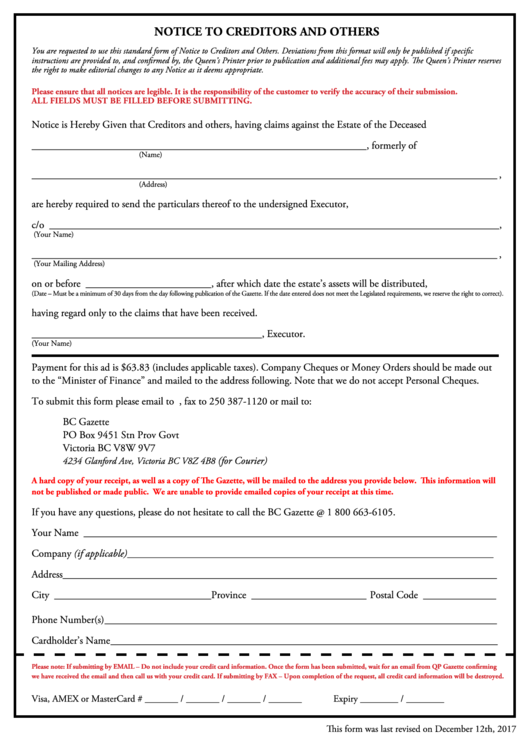

Fillable Notice To Creditors And Others Bc Gazette printable pdf download

Related Post: