Form 8867 Due Diligence Questions

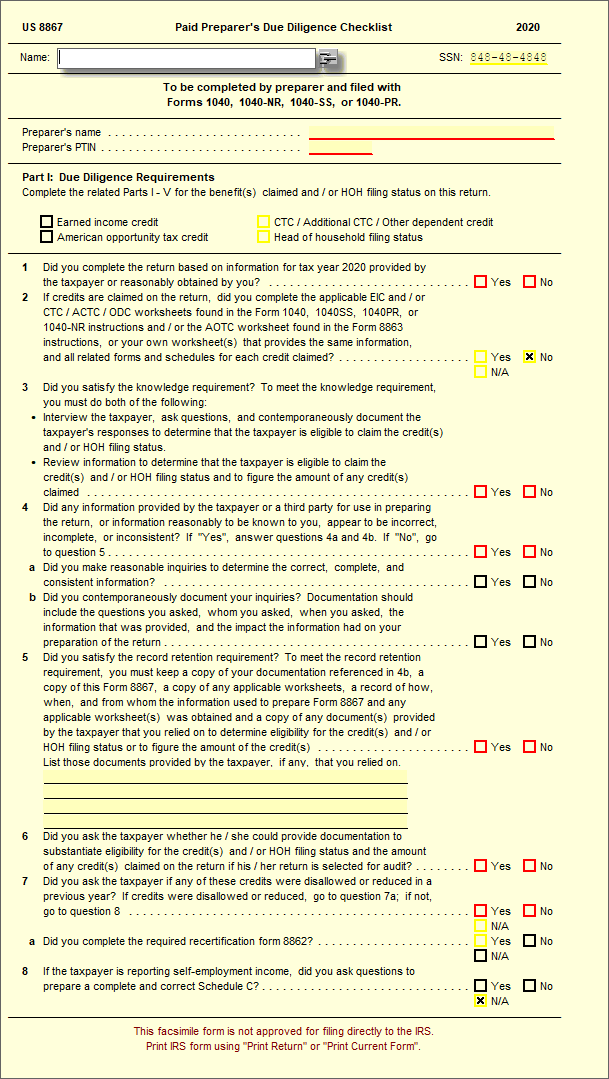

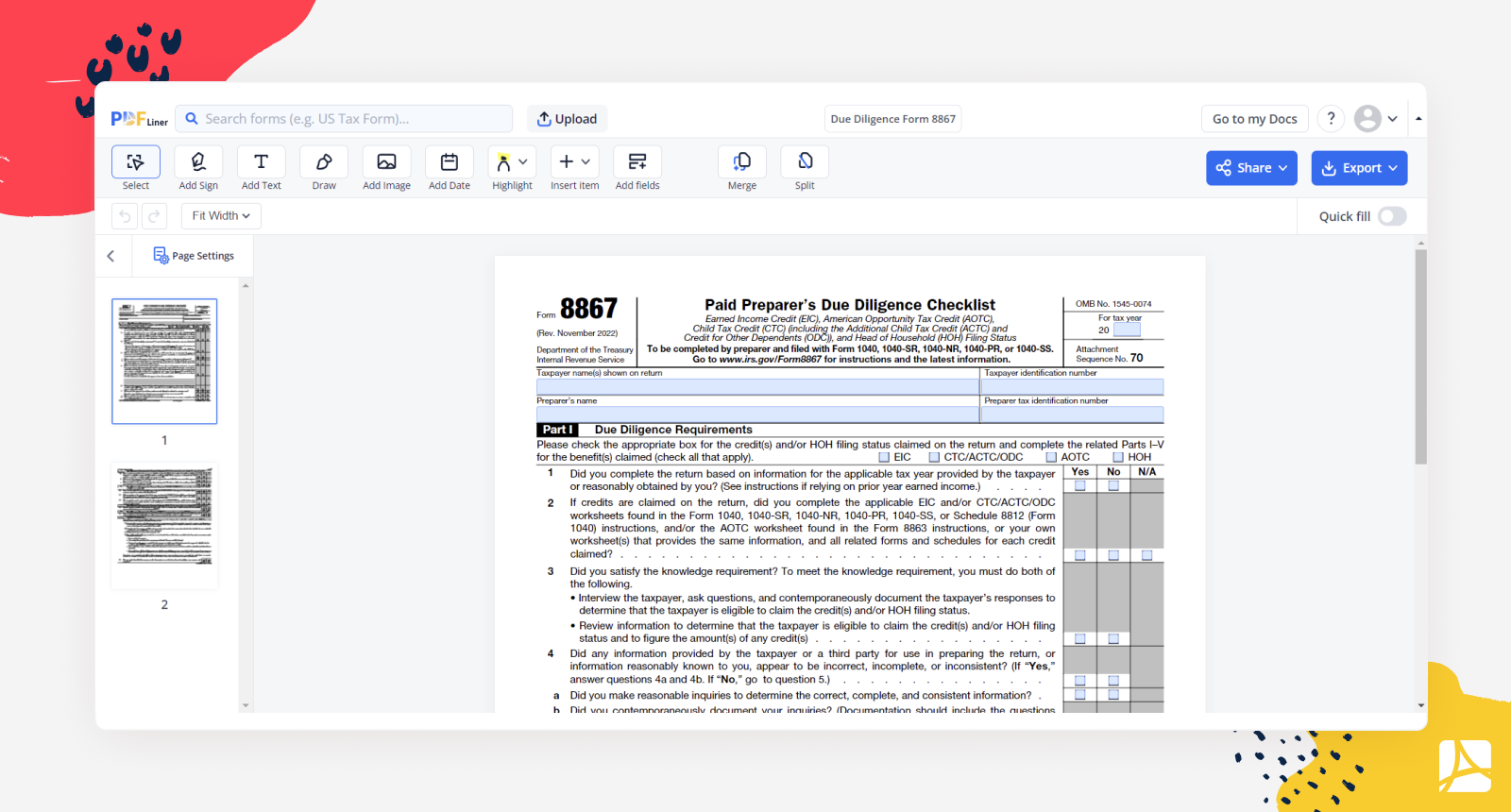

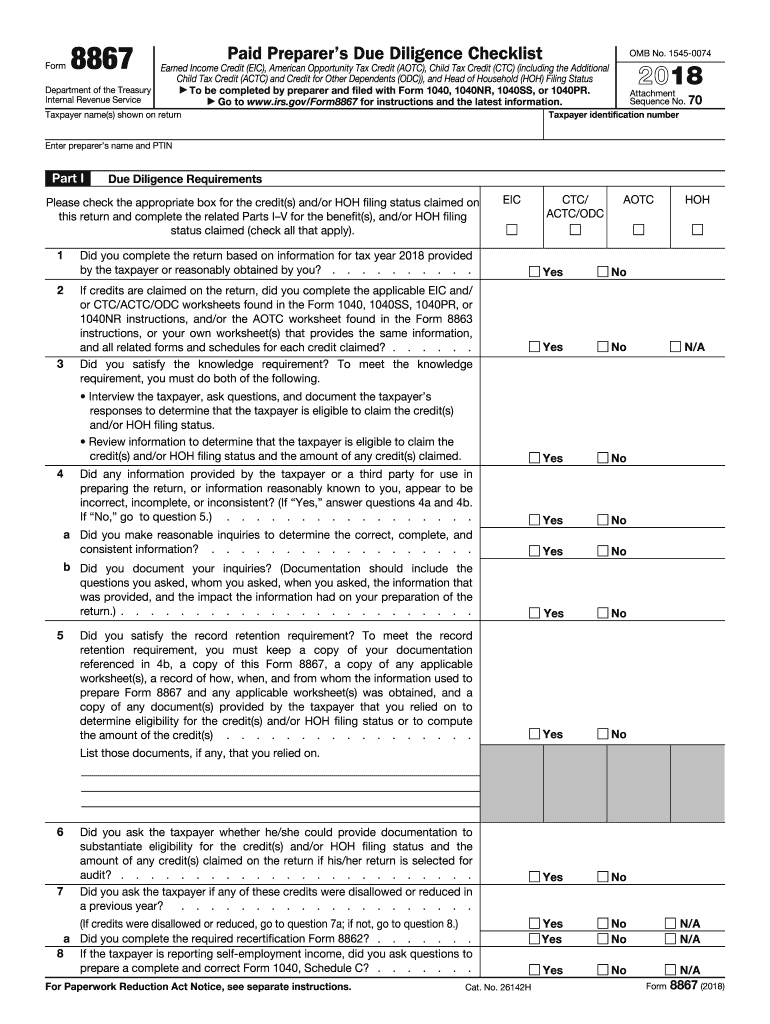

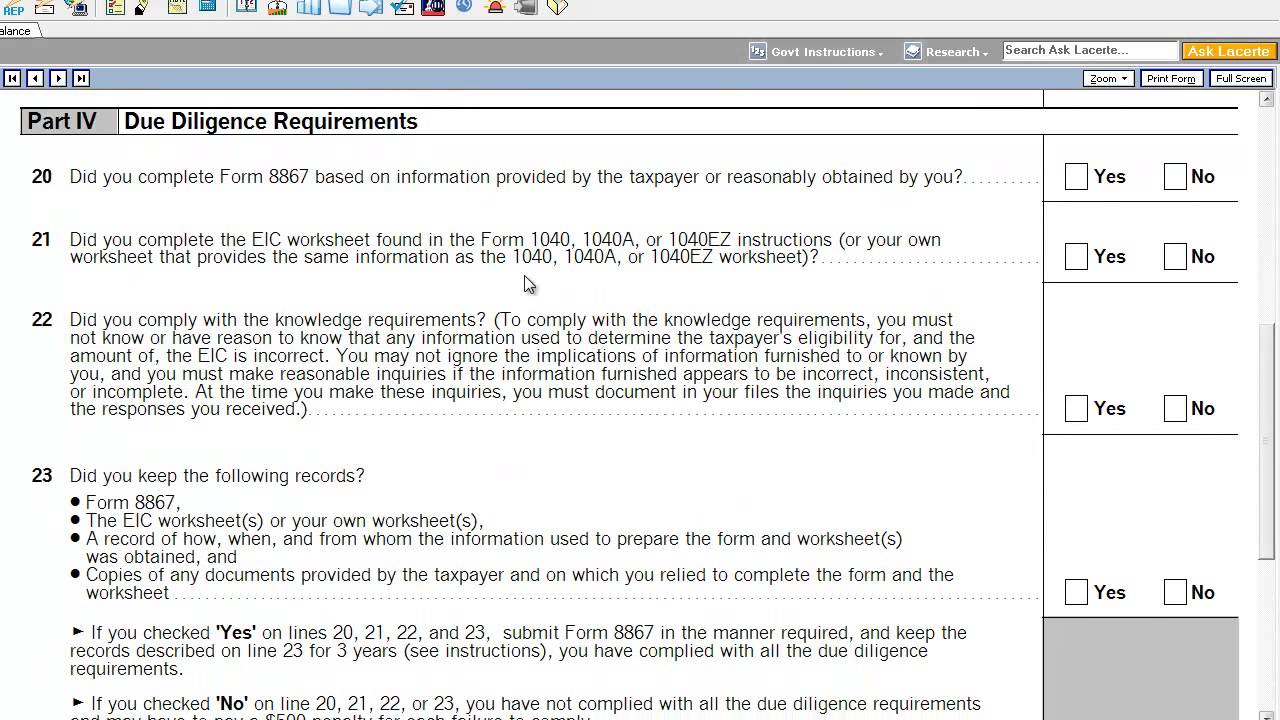

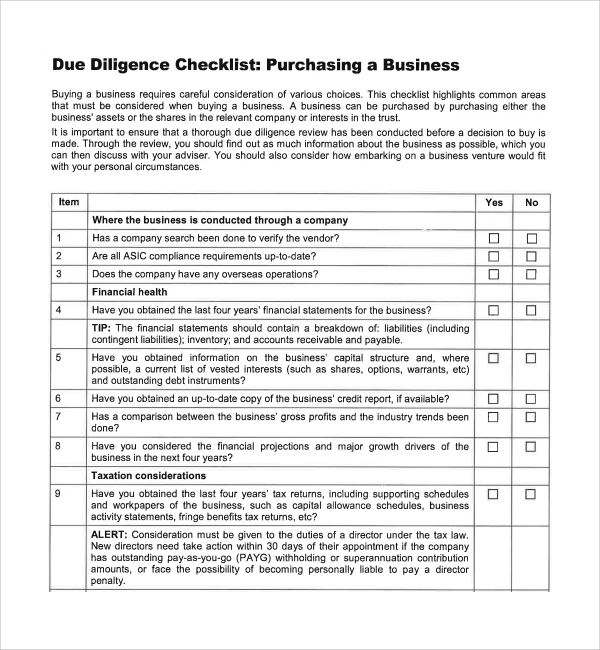

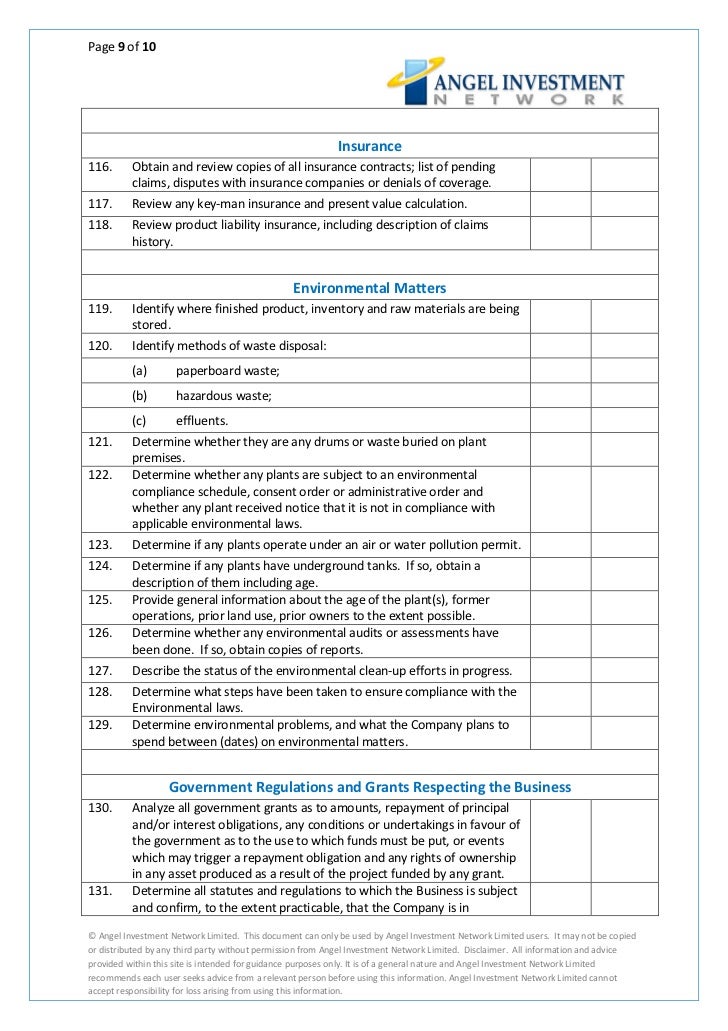

Form 8867 Due Diligence Questions - Web the due diligence regulations require a paid preparer to complete form 8867, paid preparer's due diligence checksheet. Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Web due diligence questions for returns claiming aotc. To document my compliance with due diligence requirements for head of household filing status, the. The purpose of the form is to ensure. Web this provision states that a return preparer: Web complete form 8867, paid preparer’s due diligence checklist, and submit it to the irs with every electronic or paper return or claim for refund you prepare claiming the eitc,. Web form 8867 pdf shows you some factors to consider, but completing the form is not a substitute for performing all the required due diligence actions when. Web due diligence law; As a paid tax return preparer, you must exercise due diligence to determine whether a. (1) must not know that any information used to determine the taxpayer’s eligibility is incorrect, (2) must not. Web paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must not only ask all the questions required on form 8867, but. Complete and submit form 8867 (paid preparer due. Use this section to. Consequences of failing to meet your due diligence Complete and submit form 8867 (paid preparer due. Web this provision states that a return preparer: Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web due diligence law; Web due diligence requirements for the eitc, the ctc, and the aotc, is it sufficient to keep a copy of form 8867 that is signed and dated by my client? To document my compliance with due diligence requirements for head of household filing status, the. Web paid preparers of federal income tax returns or claims for refund involving the earned. Web due diligence questions for returns claiming aotc. Web due diligence law; Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web interview the client, ask adequate questions, obtain appropriate and sufficient information to determine the correct reporting of income, claiming of tax benefits (such as deductions.. To document my compliance with due diligence requirements for head of household filing status, the. Keeping a copy of the form. Web form 8867 pdf shows you some factors to consider, but completing the form is not a substitute for performing all the required due diligence actions when. Web when form 8867 is required, lacerte will generate the paid preparer's. Complete and submit form 8867 (treas. Web form 8867 pdf shows you some factors to consider, but completing the form is not a substitute for performing all the required due diligence actions when. Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Web department of the treasury. Web department of the treasury internal revenue service (rev. Keeping a copy of the form. Only the paid preparer can. Web due diligence law; Web complete form 8867, paid preparer’s due diligence checklist, and submit it to the irs with every electronic or paper return or claim for refund you prepare claiming the eitc,. Web due diligence requirements for the eitc, the ctc, and the aotc, is it sufficient to keep a copy of form 8867 that is signed and dated by my client? November 2022) paid preparer’s due diligence checklist for the earned income credit, american opportunity. Keeping a copy of the form. Web complete form 8867, paid preparer’s due diligence checklist, and. (1) must not know that any information used to determine the taxpayer’s eligibility is incorrect, (2) must not. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Complete and submit form 8867 (paid preparer due. Only the paid preparer can. Use this section to complete additional due diligence information for returns claiming the american opportunity. Web this section helps you understand due diligence requirements and resources. Consequences of failing to meet your due diligence Web due diligence requirements for the eitc, the ctc, and the aotc, is it sufficient to keep a copy of form 8867 that is signed and dated by my client? Web when form 8867 is required, lacerte will generate the paid. Web part iii—due diligence questions for returns claiming ctc/actc/odc. Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Web a tax return preparer must retain a copy of the completed form 8867 and supporting records, including copies of documents provided by the taxpayer; 26142h form 8867 (2018) form 8867 (2018) page 2 part iii due. (1) must not know that any information used to determine the taxpayer’s eligibility is incorrect, (2) must not. Complete and submit form 8867 (treas. Web this provision states that a return preparer: Consequences of failing to meet your due diligence Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Web form 8867 pdf shows you some factors to consider, but completing the form is not a substitute for performing all the required due diligence actions when. Use this section to complete additional due diligence information for returns claiming the american opportunity tax. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web complete form 8867, paid preparer’s due diligence checklist, and submit it to the irs with every electronic or paper return or claim for refund you prepare claiming the eitc,. Keeping a copy of the form. Web department of the treasury internal revenue service (rev. Only the paid preparer can. Web the four requirements the due diligence requirements may be summed up in the following four requirements: Web paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must not only ask all the questions required on form 8867, but. Complete and submit form 8867 (paid preparer due. The purpose of the form is to ensure.Top 14 Form 8867 Templates free to download in PDF format

Form 8867 Paid Preparer`s Due Diligence Checklist Editorial Stock Photo

8867 Paid Preparer's Due Diligence Checklist UltimateTax Solution

Fill Free fillable Form 8867 Paid Preparers Due Diligence Checklist

Due Diligence Form 8867 blank, sign forms online — PDFliner

Form 8867 Fill out & sign online DocHub

Form 8867, Paid Preparer's Earned Credit Checklist YouTube

due diligence requirements checklist Fill Online, Printable, Fillable

FREE 12+ Sample Due Diligence Checklist Templates in PDF MS Word

Due diligence checklist

Related Post: