Minnesota Form M1Pr Instructions

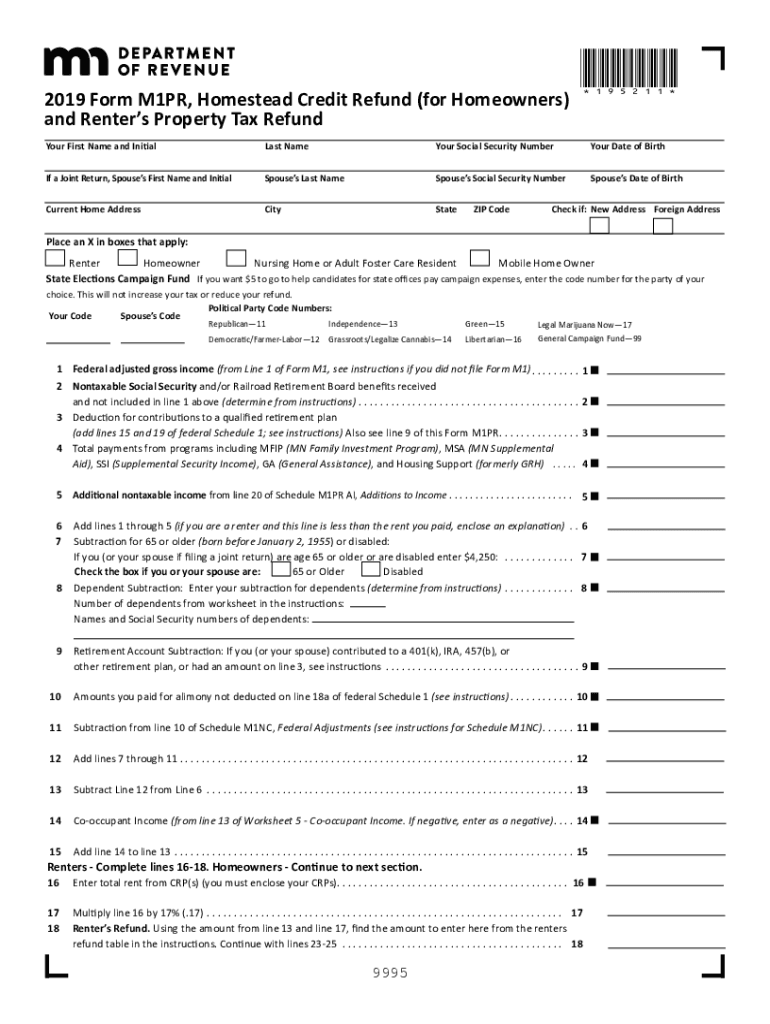

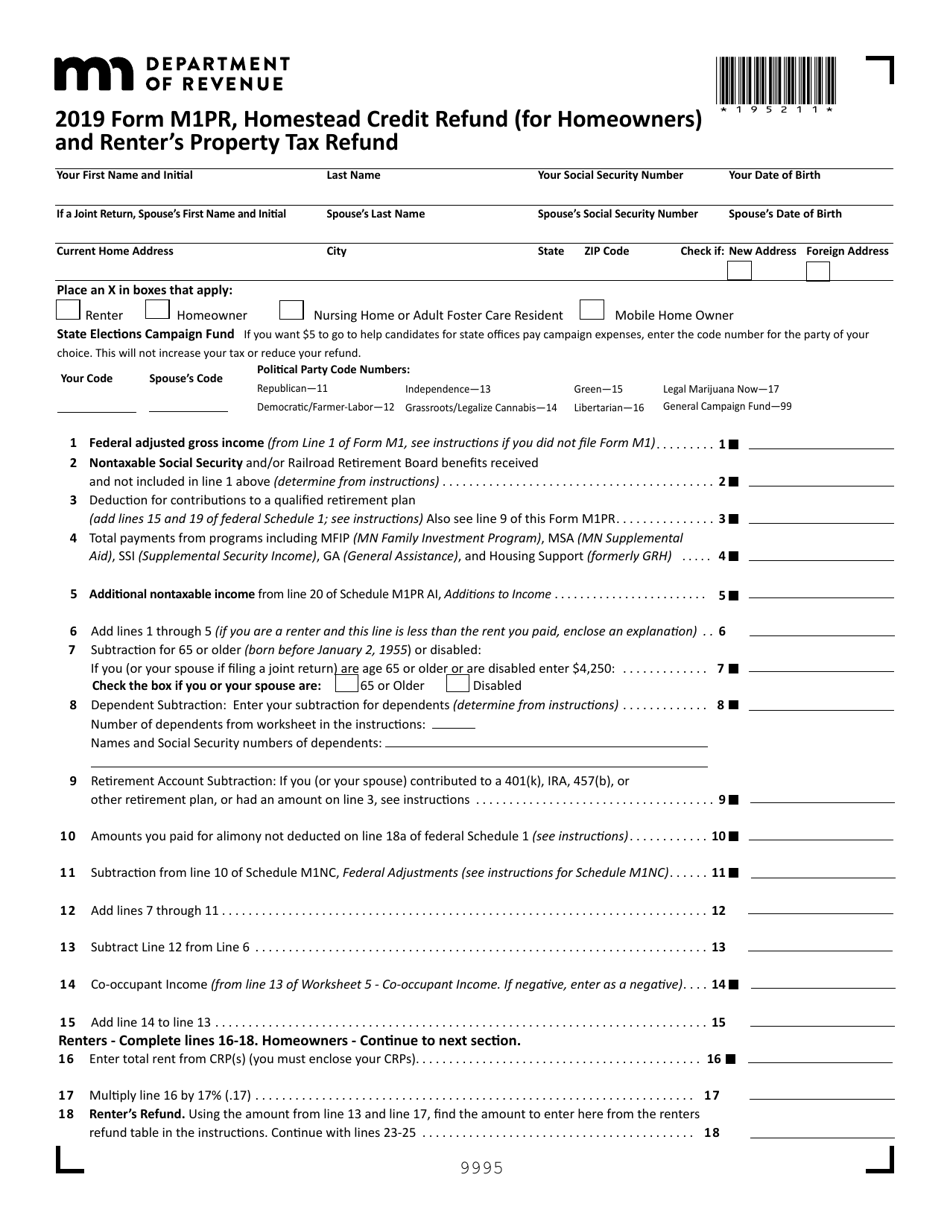

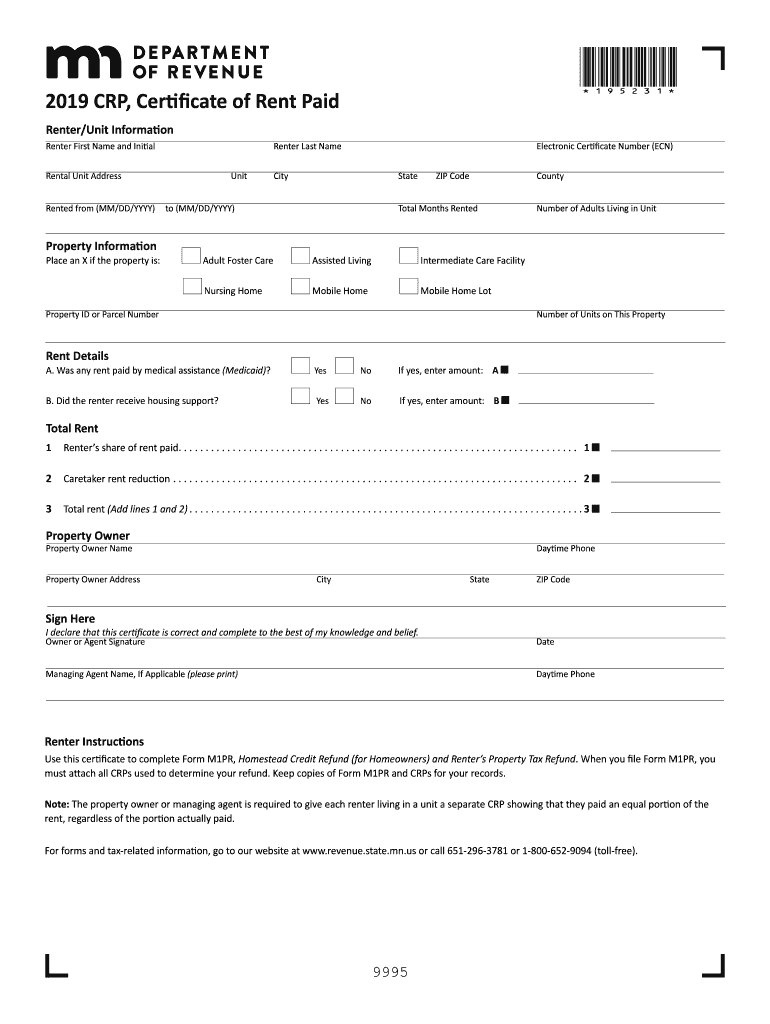

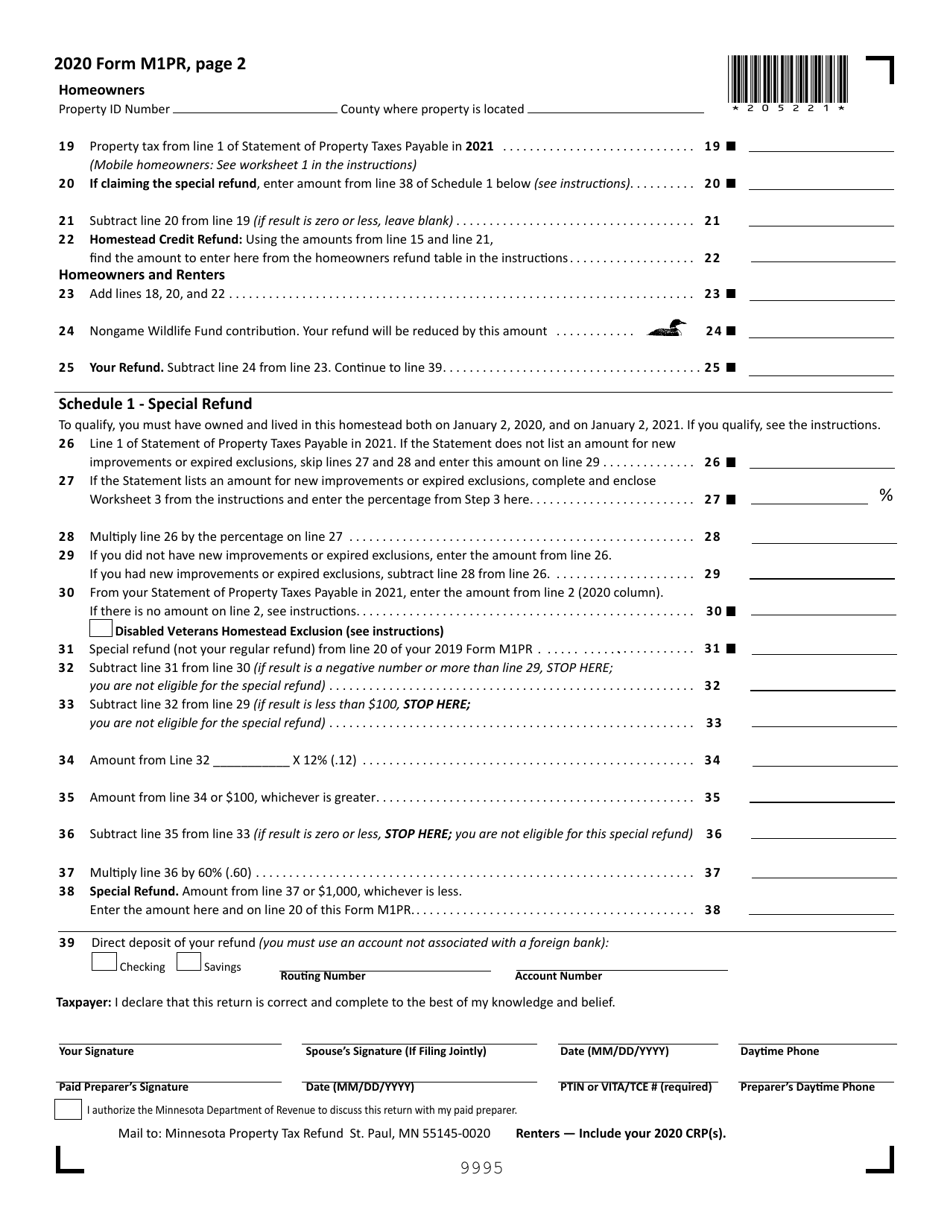

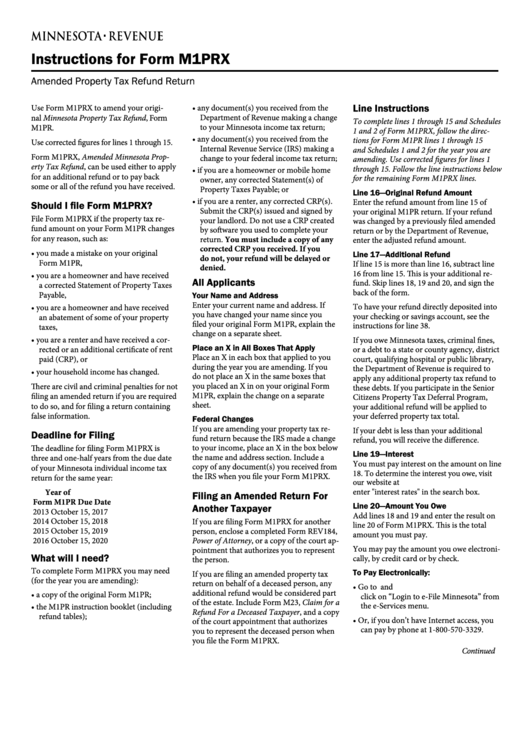

Minnesota Form M1Pr Instructions - Web refer to the instructions for lines 1 through 5 in the form m1pr instructions to complete these steps. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web line 17 of form m1pr. In prior years, a married couple would receive one crp with the. And/or railroad retirement board benefits received. Web your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. — you must have owned and occupied your home. Web mobile home owner to grant $5 to this fund, enter the code for the party of your choice. Web schedule m1pr is filed separately from the individual income tax form. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web 1 federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Claims filed before august 15, 2023, will be paid beginning in august 2023. Web the minnesota department of revenue june 2 published a draft. 2 nontaxable social security and/or railroad retirement board. You will not receive a refund if your return is filed or the. Web 1 federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). Web schedule m1pr is filed separately from the individual income tax form. If you are filing as a. The deadline for filing claims. Web mobile home owner to grant $5 to this fund, enter the code for the party of your choice. Ad download or email form m1pr & more fillable forms, register and subscribe now! Claims filed before august 15, 2023, will be paid beginning in august 2023. — you must have owned and occupied your home. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue. We'll make sure you qualify, calculate your minnesota property tax refund,. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. And/or railroad retirement board benefits received. 2 nontaxable social security and/or. Claims filed before august 15, 2023, will be paid beginning in august 2023. Ad download or email form m1pr & more fillable forms, register and subscribe now! And/or railroad retirement board benefits received. All adults in the rental unit will now receive a crp with an equal portion of the rent. Web mobile home owner to grant $5 to this. Web mobile home owner to grant $5 to this fund, enter the code for the party of your choice. And/or railroad retirement board benefits received. Web total payments from programs including mfip (mn family investment program), msa (mn supplemental aid) ssi (supplemental security income), ga (general assistance), and. Web you can access the minnesota website's where's my refund tool to. Ad download, fax, print or fill online form m1pr & more, subscribe now And/or railroad retirement board benefits received. Get ready for tax season deadlines by completing any required tax forms today. Web more about the minnesota form m1pr instructions tax credit. Web your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13,. We'll make sure you qualify, calculate your minnesota property tax refund,. In prior years, a married couple would receive one crp with the. Web add lines 1 through 5 (if you are a renter and this line is less than the rent you paid, enclose an explanation) 7 subtraction for 65 or older (born before january 2, 1956). All adults. In prior years, a married couple would receive one crp with the. Web add lines 1 through 5 (if you are a renter and this line is less than the rent you paid, enclose an explanation) 7 subtraction for 65 or older (born before january 2, 1956). Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web for details, see the instructions for form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web 2022 m1pr, homestead credit refund (for homeowners) and renter’s property tax refund instructions | minnesota department of revenue. This form is for income earned in tax year 2022,. You will not receive a refund if your return is filed or. Web schedule m1pr is filed separately from the individual income tax form. Get ready for tax season deadlines by completing any required tax forms today. Web total payments from programs including mfip (mn family investment program), msa (mn supplemental aid) ssi (supplemental security income), ga (general assistance), and. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web more about the minnesota form m1pr instructions tax credit. The deadline for filing claims. This form is for income earned in tax year 2022,. For more information, go to www.revenue.state.mn.us/residents. Web line 17 of form m1pr. — you must have owned and occupied your home. And/or railroad retirement board benefits received. If you are filing as a renter, include any certificates of. Web 1 federal adjusted gross income (from line 1 of form m1, see instructions if you did not file form m1). All adults in the rental unit will now receive a crp with an equal portion of the rent. Web refer to the instructions for lines 1 through 5 in the form m1pr instructions to complete these steps. You will not receive a refund if your return is filed or the. • if you are a homeowner or mobile home owner: Ad download or email form m1pr & more fillable forms, register and subscribe now! Web (from line 1 of form m1, see instructions if you did not file form m1) 1 2 nontaxable social security. 2 nontaxable social security and/or railroad retirement board.Mn Dept Of Revenue Form M1pr Instructions essentially.cyou 2022

20192021 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank

Form M1PR 2019 Fill Out, Sign Online and Download Fillable PDF

Crp forms for 2018 Fill out & sign online DocHub

Form M1pr Minnesota Property Tax Refund Return Instructions 2005

2011 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank PDFfiller

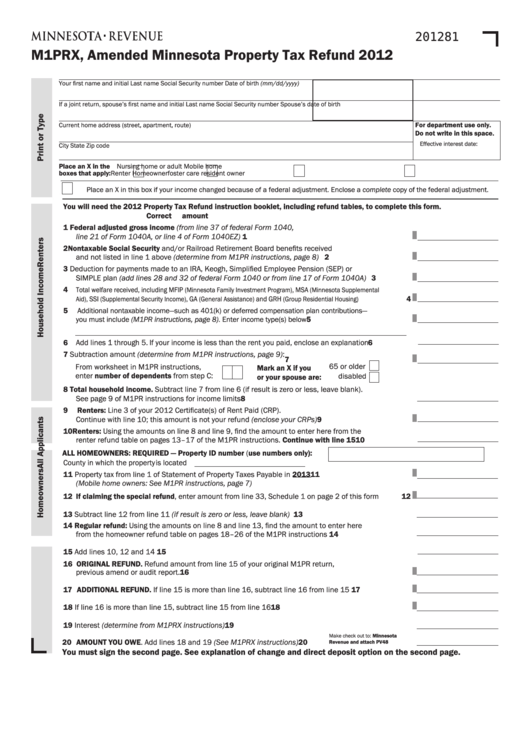

Fillable Form M1prx Amended Minnesota Property Tax Refund 2012

Form M1PR Download Fillable PDF or Fill Online Homestead Credit Refund

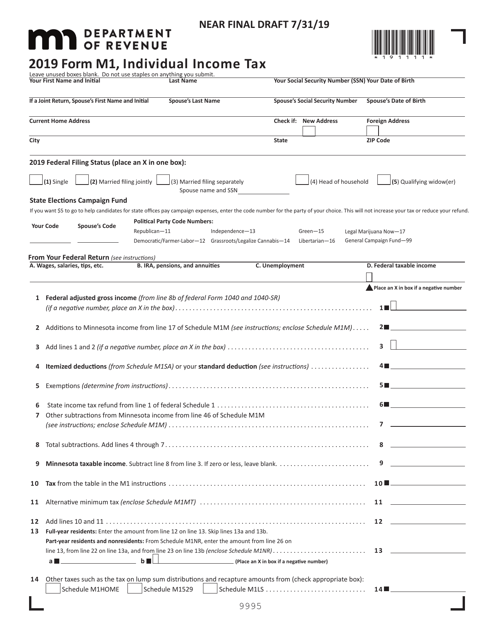

M1 Printable Tax Form Printable Forms Free Online

M1prx, Amended Property Tax Refund Return printable pdf download

Related Post: