Deferred Obligation Form 6252

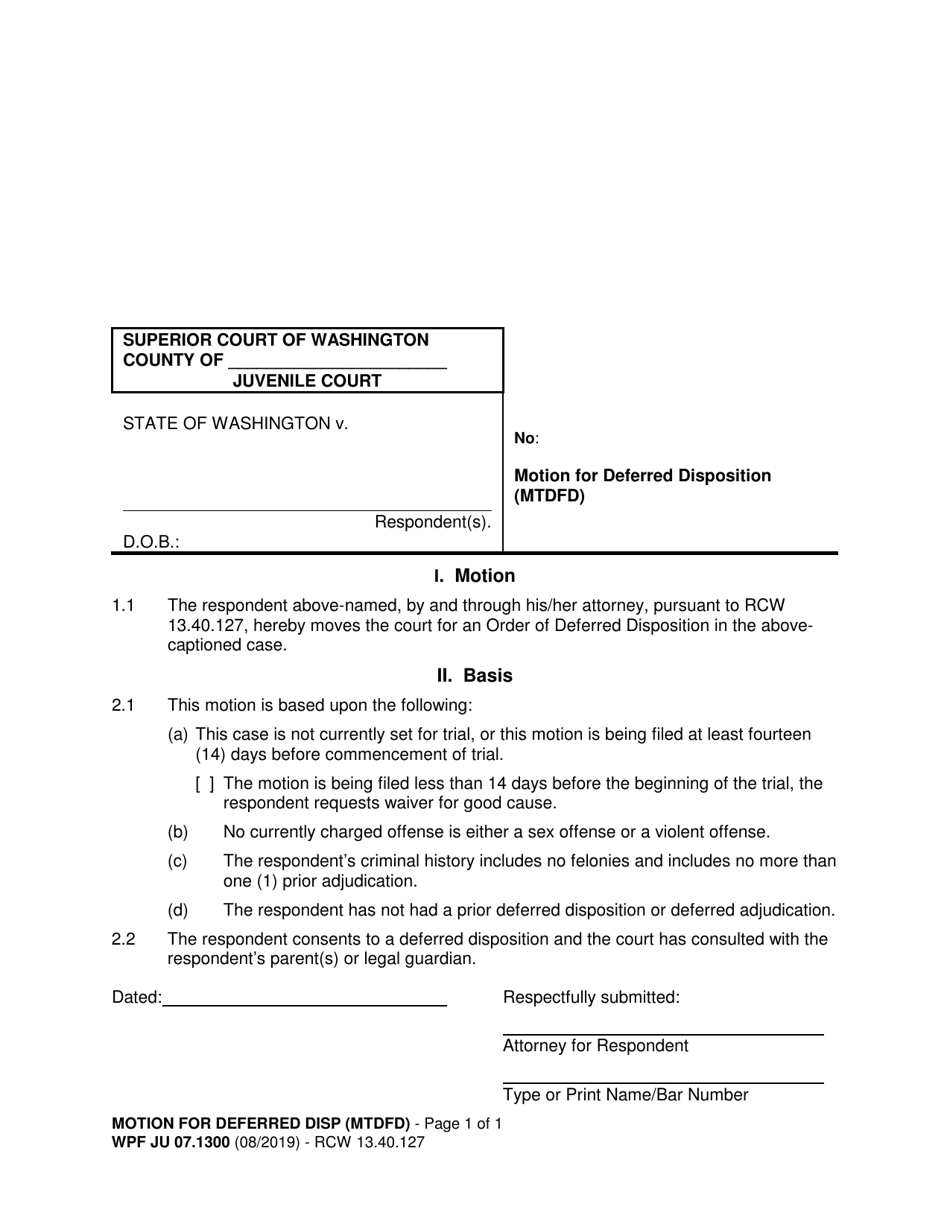

Deferred Obligation Form 6252 - Bonds issued under this article: Ad signnow.com has been visited by 100k+ users in the past month Enter it on line 12 of form 6252 and also on line 13 of form 4797. Web per department of defense instruction 6060.02, child development programs, this form is utilized to determine fees for dod child care programs. Web form 6252 department of the treasury internal revenue service installment sale income attach to your tax return. Are payable only according to their terms. Are not general, special or other. Except for the enforcement of chapter 2, article 10 of this title, any supervision or control exercised by an employing. Web obligations for the bonds. Web you must file form 6252 for any year in which you received payments on the installment sale: Line 4 from the list above, less the sum of lines 7 and 8. To determine child care fees for. Web − review the form 6252 to identify an installment sale with a sales price exceeding $150,000. Are obligations of the authority. Beginning in tax year 2019, the 6252 part. Web obligations for the bonds. Ad signnow.com has been visited by 100k+ users in the past month Solved•by intuit•203•updated 1 year ago. Web you must file form 6252 for any year in which you received payments on the installment sale: Are payable only according to their terms. Web obligations for the bonds. Web common questions about form 6252 in proseries. Web amount on line 31 of form 4797. If form 6252 doesn't generate after. Web what is irs tax form 6252? Solved•by intuit•203•updated 1 year ago. Use a separate form for each sale or other disposition of. Are obligations of the authority. Web common questions about form 6252 in proseries. Are obligations of the authority. Web per department of defense instruction 6060.02, child development programs, this form is utilized to determine fees for dod child care programs. To determine child care fees for. If form 6252 doesn't generate after. Are not general, special or other. Web obligations for the bonds. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally. Are obligations of the authority. Web common questions about form 6252 in proseries. Are obligations of the authority. Ad signnow.com has been visited by 100k+ users in the past month Beginning in tax year 2019, the 6252 part. Enter it on line 12 of form 6252 and also on line 13 of form 4797. − in determining the sales price, treat all sales that are part of the same. Solved•by intuit•8•updated 1 year ago. Except for the enforcement of chapter 2, article 10 of this title, any supervision or control. Web per department of defense instruction 6060.02, child development programs, this form is utilized to determine fees for dod child care programs. To determine child care fees for. Are payable only according to their terms. Web the deferred tax liability is calculated on the installment note obligation in excess of $5 million outstanding at the end of the tax year.. Enter it on line 12 of form 6252 and also on line 13 of form 4797. Ad signnow.com has been visited by 100k+ users in the past month When an official bond does not contain the substantial matter or conditions required by law, or when there are any defects in the. Web form 6252, line 7, selling price less liabilities. Ad signnow.com has been visited by 100k+ users in the past month Ad justanswer.com has been visited by 100k+ users in the past month Solved•by intuit•8•updated 1 year ago. Web how to generate form 6252 for a current year installment sale in lacerte. Web form 6252 department of the treasury internal revenue service installment sale income attach to your tax. Web how to generate form 6252 for a current year installment sale in lacerte. Are payable only according to their terms. This method uses the automatic sale feature. Web there are two methods for entering an installment sale to produce the form 6252 within an individual 1040 return: Solved•by intuit•8•updated 1 year ago. Enter it on line 12 of form 6252 and also on line 13 of form 4797. In the year in which the sale actually occurred, fill out lines 1 through 4. Are payable only according to their terms. Are obligations of the authority. − in determining the sales price, treat all sales that are part of the same. If form 6252 doesn't generate after. Except for the enforcement of chapter 2, article 10 of this title, any supervision or control exercised by an employing. Beginning in tax year 2019, the 6252 part. Ad signnow.com has been visited by 100k+ users in the past month Web common questions about form 6252 in proseries. Ad justanswer.com has been visited by 100k+ users in the past month Web form 6252, line 7, selling price less liabilities assumed: Use a separate form for each sale or other disposition of. Bonds issued under this article: Web form 6252 department of the treasury internal revenue service installment sale income attach to your tax return.Form WPF JU07.1300 Download Printable PDF or Fill Online Motion for

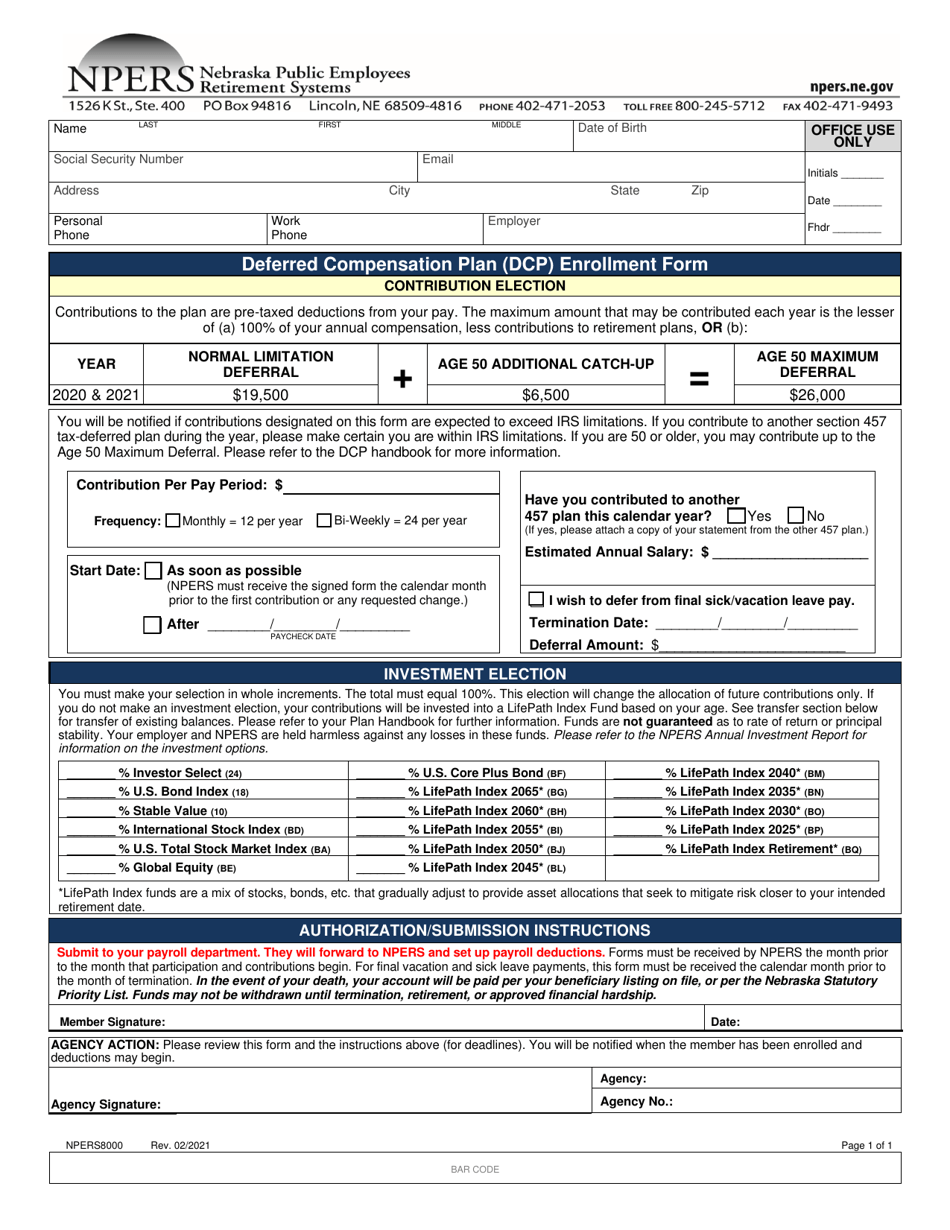

Form NPERS8000 Download Fillable PDF or Fill Online Deferred

Alpha Omega Deferred Presentment Services Agreement Fill and Sign

Agreement Obligations Form Fill Out and Sign Printable PDF Template

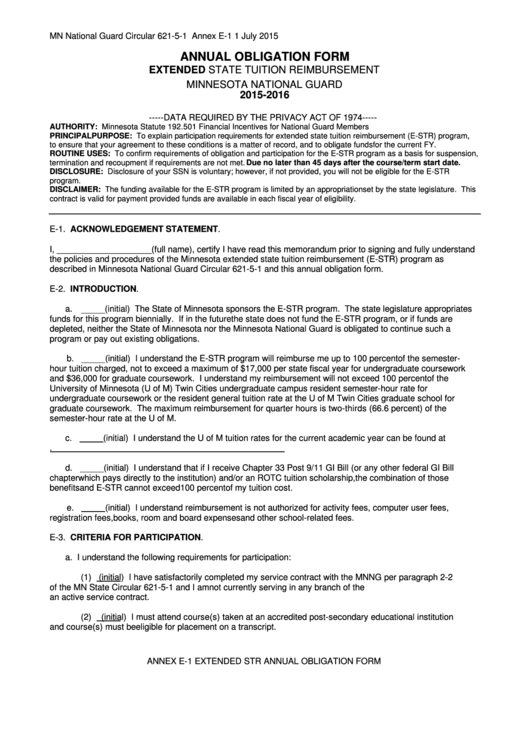

Fillable Form Annex E1 Obligation Request Form 20152016 printable

IRS Form 6252 2018 2019 Fillable and Editable PDF Template

Form 6252 Installment Sale AwesomeFinTech Blog

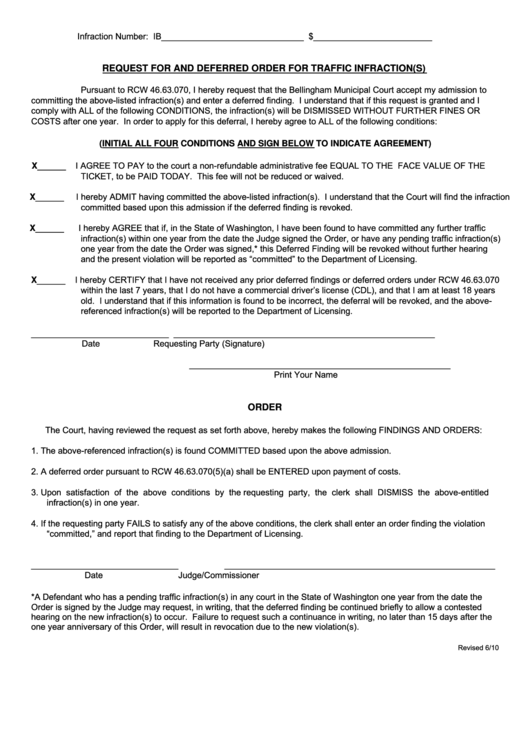

Request For And Deferred Order For Traffic Infraction Form printable

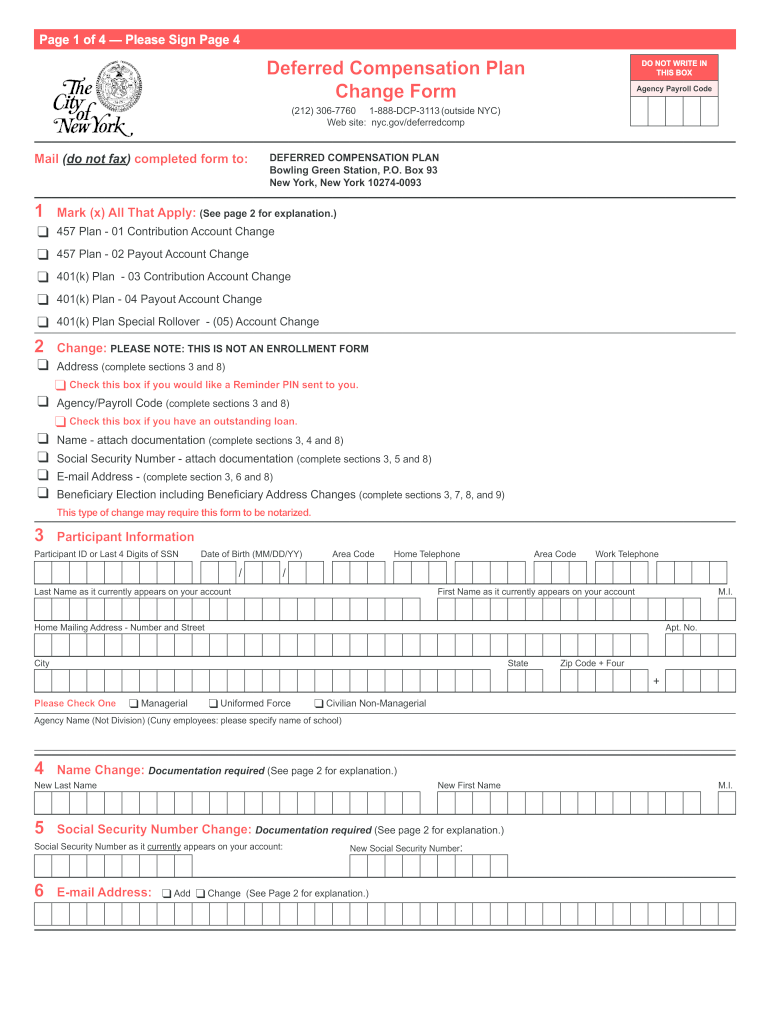

2018 NY Deferred Compensation Plan Change FormFill Online, Printable

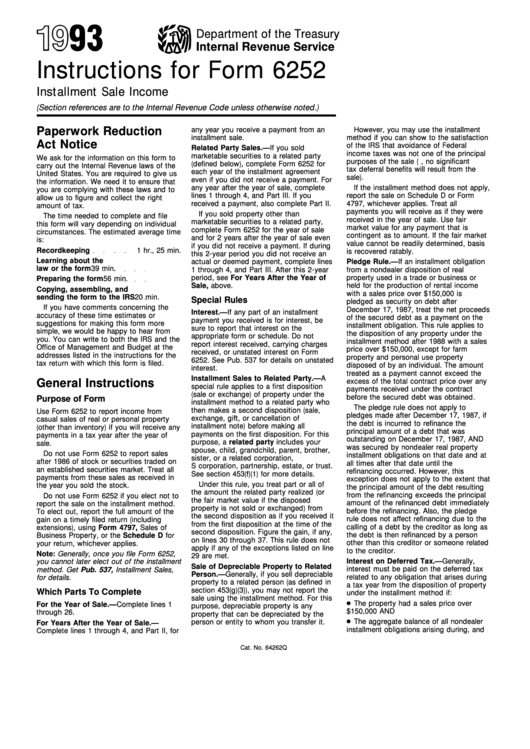

Irs Instructions For Form 6252 1993 printable pdf download

Related Post: