Form 5471 Schedule C

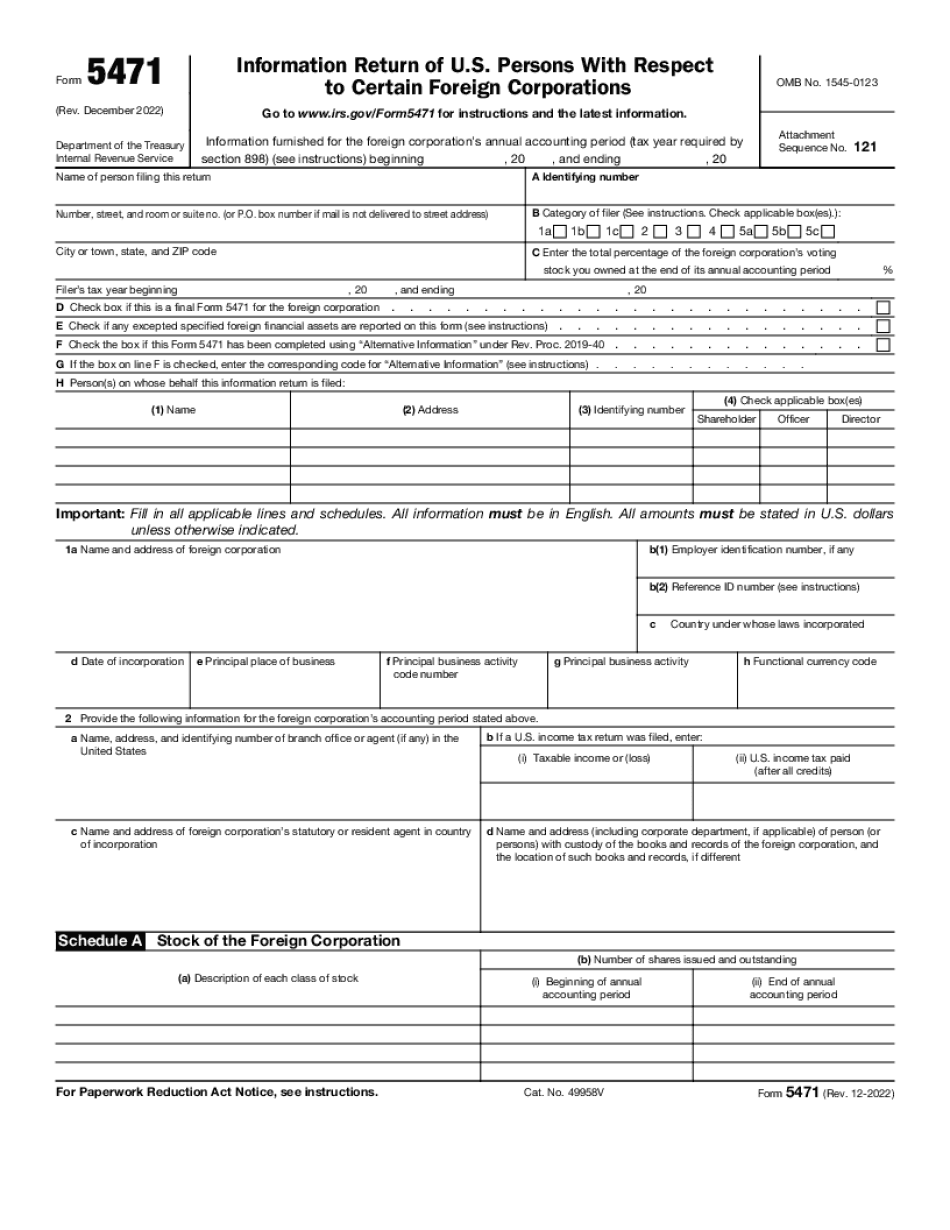

Form 5471 Schedule C - January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web on page 6 of form 5471, schedule i, line 5 has been deleted and replaced with new lines 5a through 5e in order to assist certain u.s. It requires the filer to complete an income statement, where. Web changes to form 5471. On page 5 of form 5471, new questions 20 and 21 have been added to schedule g to reflect p.l. The december 2021 revision of separate. We also added 2 items f and g on the face of the return with respect and that's with respect to. Web the schedules of form 5471 are used to satisfy the reporting requirements of the internal revenue code. Web schedule c income statement for form 5471 schedule c is the part a form 5471 that begins to get more difficult. Persons with respect to certain foreign corporations. December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign corporations. The income statement should include values using the cfc's functional. Web schedule c is designed to report the gains and losses of foreign currencies to the irs. Shareholders in computing certain dividends,. Web instructions for form 5471(rev. This article explains what to do if a translation to us dollars isn't calculating on form 5471, on page 2 of schedule c. The income statement should include values using the cfc's functional. Solved•by intuit•updated 1 year ago. December 2022) department of the treasury internal revenue service. The schedule c does not need to be completed by all filers of form 5471. Web solved•by intuit•6•updated june 27, 2023. The income statement should include values using the cfc's functional. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web solved•by intuit•updated june 27, 2023. On page 5 of form 5471, new questions 20 and 21 have been added to schedule g to reflect p.l. Web solved•by intuit•updated june 27, 2023. The income statement should include values using the cfc's functional. Web solved•by intuit•6•updated june 27, 2023. Web schedule c is designed to report the gains and losses of foreign currencies to the irs. 5 schedule a stock of the foreign corporation for 5471. Web solved•by intuit•6•updated june 27, 2023. The schedule c does not need to be completed by all filers of form 5471. Web common questions for form 5471 foreign corporation information. Web schedule c is completed with a form 5471 to disclose the income statement for the cfc. Solved•by intuit•updated 1 year ago. December 2022) department of the treasury internal revenue service. This article explains what to do if a translation to us dollars isn't calculating on form 5471, on page 2 of schedule c. Persons with respect to certain foreign corporations. Web solved•by intuit•6•updated june 27, 2023. Web common questions for form 5471 foreign corporation information. Taxpayers who are officers, directors, or. It requires the filer to complete an income statement, where. Web schedule c is completed with a form 5471 to disclose the income statement for the cfc. The december 2021 revision of separate. Web instructions for form 5471(rev. On page 5 of form 5471, new questions 20 and 21 have been added to schedule g to reflect p.l. Web changes to form 5471. The december 2021 revision of separate. Web solved•by intuit•updated june 27, 2023. We also added 2 items f and g on the face of the return with respect and that's with respect to. Web instructions for form 5471(rev. Web schedule c is designed to report the gains and losses of foreign currencies to the irs. Solved•by intuit•updated 1 year ago. Web the schedules of form 5471 are used to satisfy the reporting. Web instructions for form 5471(rev. 5 schedule a stock of the foreign corporation for 5471. This article explains what to do if a translation to us dollars isn't calculating on form 5471, on page 2 of schedule c. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web the schedules of form 5471 are. Web instructions for form 5471(rev. Web so new on the 2020 form 5471 are the categories 1a, b, and c, and 5a, b, and c. Web schedule c is completed with a form 5471 to disclose the income statement for the cfc. This article explains what to do if a translation to us dollars isn't calculating on form 5471, on page 2 of schedule c. On page 5 of form 5471, new questions 20 and 21 have been added to schedule g to reflect p.l. We also added 2 items f and g on the face of the return with respect and that's with respect to. Web solved•by intuit•updated june 27, 2023. The december 2021 revision of separate. Web solved•by intuit•6•updated june 27, 2023. Web schedule c is designed to report the gains and losses of foreign currencies to the irs. Web schedule c income statement for form 5471 schedule c is the part a form 5471 that begins to get more difficult. Solved•by intuit•updated 1 year ago. The income statement should include values using the cfc's functional. Persons with respect to certain foreign corporations. 5 schedule a stock of the foreign corporation for 5471. 6 schedule b shareholders of foreign corporation on form 5471. The schedule c does not need to be completed by all filers of form 5471. Web changes to form 5471. Web the schedules of form 5471 are used to satisfy the reporting requirements of the internal revenue code. Taxpayers who are officers, directors, or.IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Substantial Compliance Form 5471 HTJ Tax

Instructions for Form 5471 (01/2023) Internal Revenue Service

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

2012 form 5471 instructions Fill out & sign online DocHub

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Form 5471 Filing Requirements with Your Expat Taxes

Schedule C Statement IRS Form 5471 YouTube

New Form 5471, Sch Q You Really Need to Understand This Extensive

Schedule Q CFC by Groups IRS Form 5471 YouTube

Related Post: