Form 8858 Sch M

Form 8858 Sch M - Ad access irs tax forms. 37387c schedule m (form 8858) (rev. Person filing form 8858, later. Persons with respect to foreign disregarded entities (fdes). Web schedule m (form 8858) (rev. Complete, edit or print tax forms instantly. Web fdes or fbs must file form 8858 and schedule m (form 8858). Form 8858 includes identifying information about the foreign entity, its activities, and transaction activity between the entity, the u.s. Download or email irs 8865 & more fillable forms, register and subscribe now! September 2021) department of the treasury internal revenue service. Web fdes or fbs must file form 8858 and schedule m (form 8858). Web form 8858 is used by certain u.s. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if. Web form 8858 (schedule m) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities 0921 09/30/2021. Persons that operate a foreign branch or own a foreign disregarded entity directly, indirectly, or constructively. What's new the filing of form 8858, including the separate schedule m (form 8858), has been expanded to include the. A foreign disregarded entity is an. Web schedule m (form 8858) (rev. What's new the filing of form 8858, including the separate schedule m (form 8858), has been expanded to include the reporting of foreign branch activity of. Web form 8858 (schedule m) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities. Persons that operate a foreign branch or own a foreign disregarded entity directly, indirectly, or constructively. Web schedule m (form 8858) (rev. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Person filing form 8858, later. Web form 8858 is used by certain u.s. Persons that operate a foreign branch or own a foreign disregarded entity directly, indirectly, or constructively. Persons with respect to foreign disregarded entities (fdes). Web form 8858 is used by certain u.s. Transactions between foreign disregarded entity of a foreign. Form 8858 includes identifying information about the foreign entity, its activities, and transaction activity between the entity, the u.s. Web form 8858 is used by certain u.s. Form 8858 (schedule m) (rev. Person filing form 8858, later. Web fdes or fbs must file form 8858 and schedule m (form 8858). September 2021) department of the treasury internal revenue service. Web when and where to file form 8858? September 2021) department of the treasury internal revenue service. Web what is irs form 8858 who must file this tax form how to file irs form 8858, and when to submit it let’s begin by walking through this irs form step by step. Form 8858 (schedule m) (rev. Web in the schedule. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the. Person filing form 8858, later. Persons that own an fde directly or, in certain circumstances, indirectly or constructively. Download or email irs 8865 & more fillable forms, register and subscribe now! What's new the filing of form 8858, including the separate. Web what is irs form 8858 who must file this tax form how to file irs form 8858, and when to submit it let’s begin by walking through this irs form step by step. Web schedule m (form 8858) (rev. Web in the schedule m transactions between fde of a foreign tax owner and the filer or other related entities. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the. Persons that own an fde directly or, in certain circumstances, indirectly or constructively. Ad access irs tax forms. Persons with respect to foreign disregarded entities (fdes). September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer. Web schedule m (form 8858) attach to form 8858. Web form 8858 is used by certain u.s. Transactions between foreign disregarded entity of a foreign. Persons with respect to foreign disregarded entities (fdes). Persons that own an fde directly or, in certain circumstances, indirectly or constructively. Web form 8858 (schedule m) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities 0921 09/30/2021. Ad access irs tax forms. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Persons that operate a foreign branch or own a foreign disregarded entity directly, indirectly, or constructively. Person filing form 8858, later. December 2018) department of the treasury internal revenue service transactions between foreign disregarded entity (fde) or foreign. A foreign disregarded entity is an. Download or email irs 8865 & more fillable forms, register and subscribe now! Web schedule m (form 8858) (rev. September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities. Person that is a tax owner of an fde or operates an fb at any time during the u.s. Form 8858 includes identifying information about the foreign entity, its activities, and transaction activity between the entity, the u.s. Web schedule m (form 8858) (rev. What's new the filing of form 8858, including the separate schedule m (form 8858), has been expanded to include the reporting of foreign branch activity of. September 2021) department of the treasury internal revenue service.IRS Form 8858 Used With Respect to Foreign Disregarded Entities SF

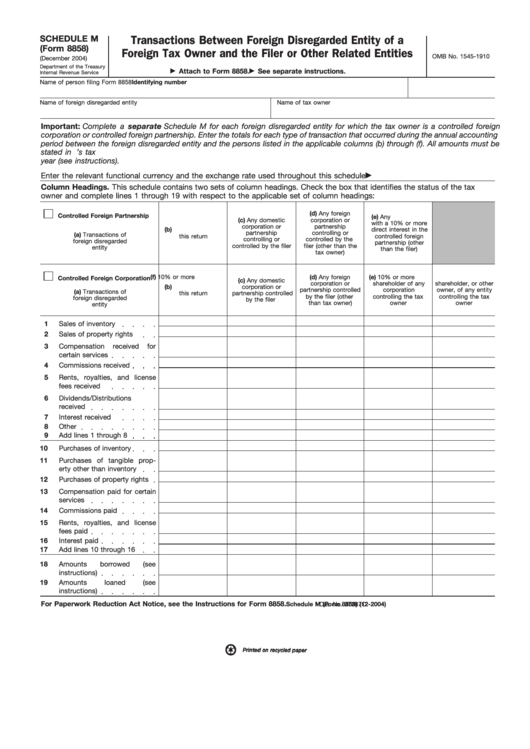

Fillable Schedule M (Form 8858) Transactions Between Foreign

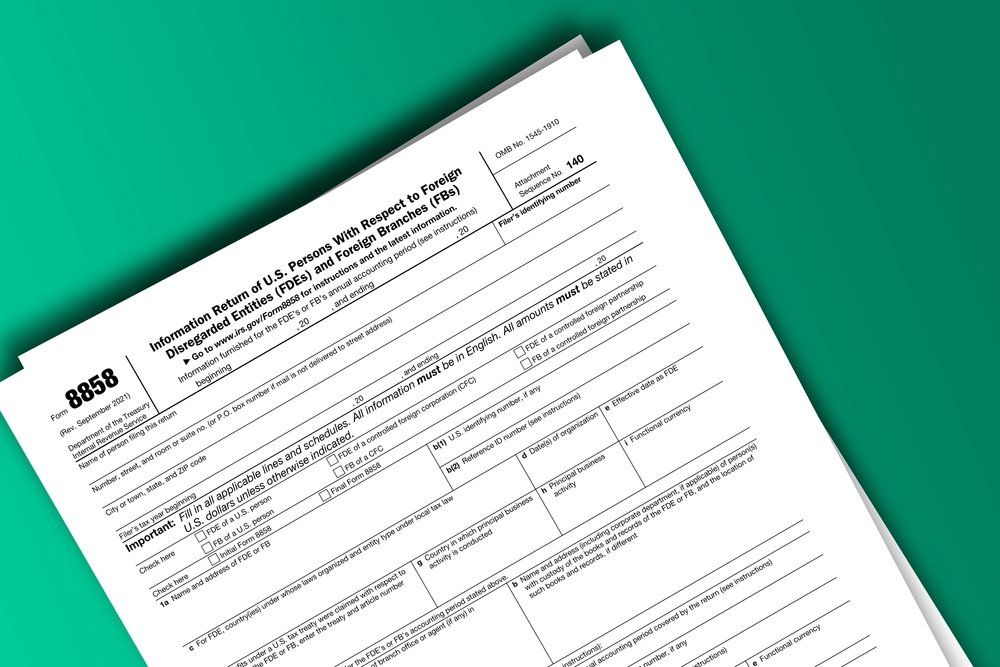

Form 8858 Information Return of U.S. Persons With Respect to Foreign

Form 8858 Edit, Fill, Sign Online Handypdf

Form 8858 (Schedule M) Transactions between Foreign Disregarded

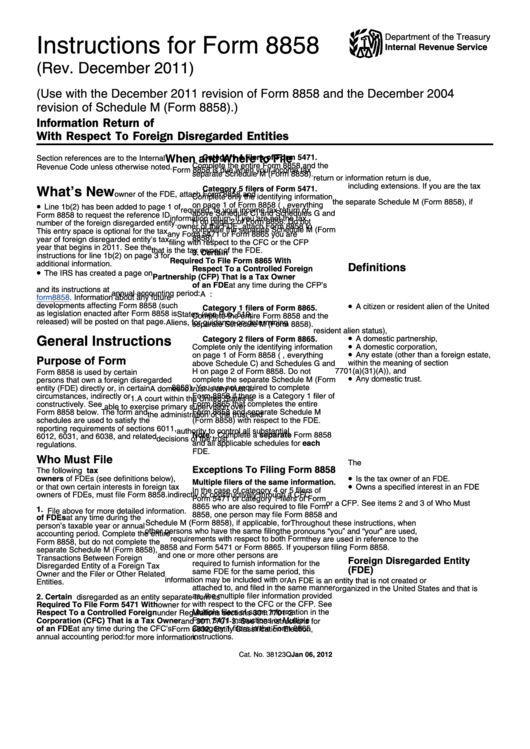

Instructions For Form 8858 2011 printable pdf download

Instructions For Form 8858 (Rev. 2013) printable pdf download

Form 8858 (Schedule M) Transactions between Foreign Disregarded

IRS Form 8858 Instructions Information Return for FDEs & FBs

How to Fill Out IRS Form 8858 Foreign Disregarded Entity YouTube

Related Post: