Form 8843 유학생

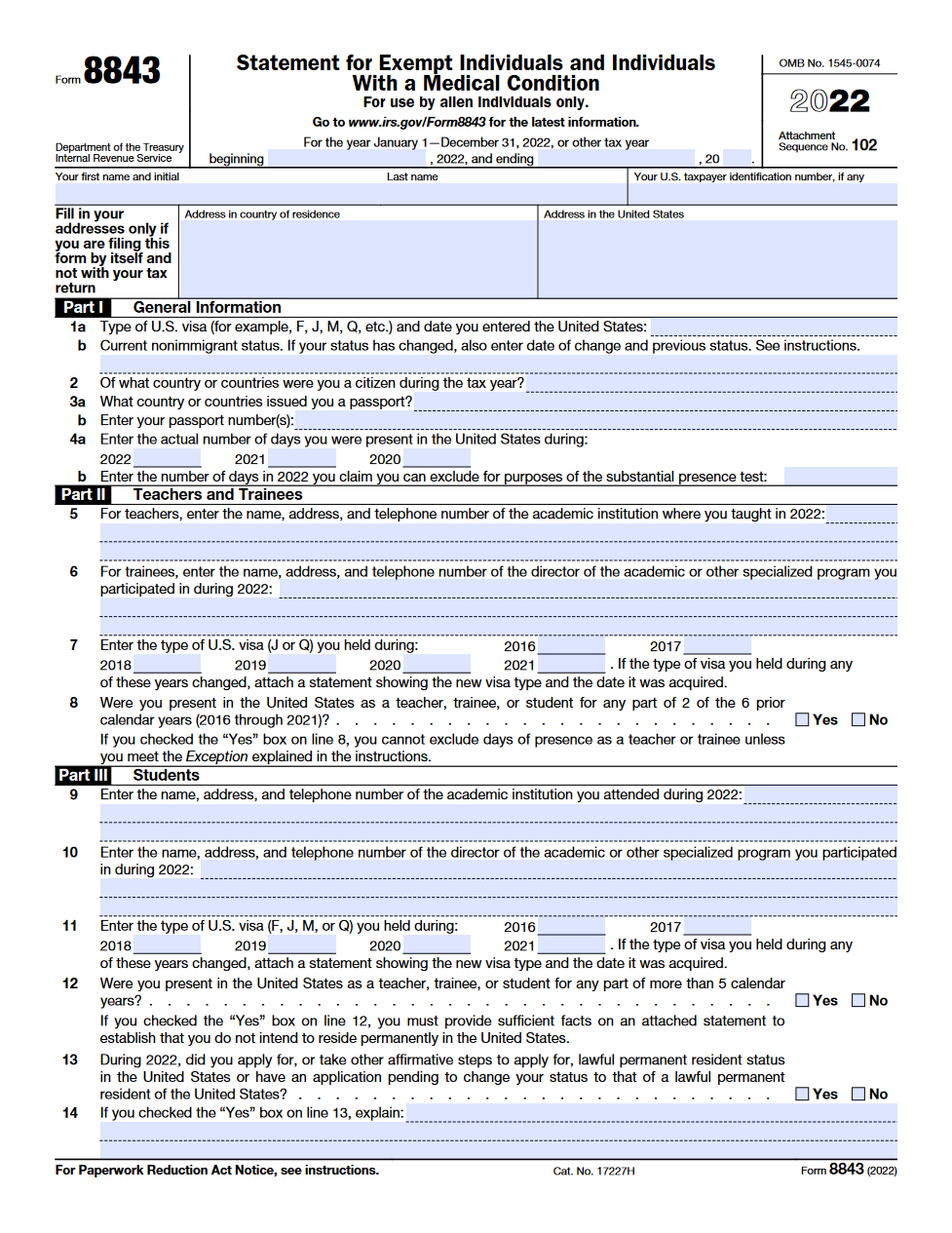

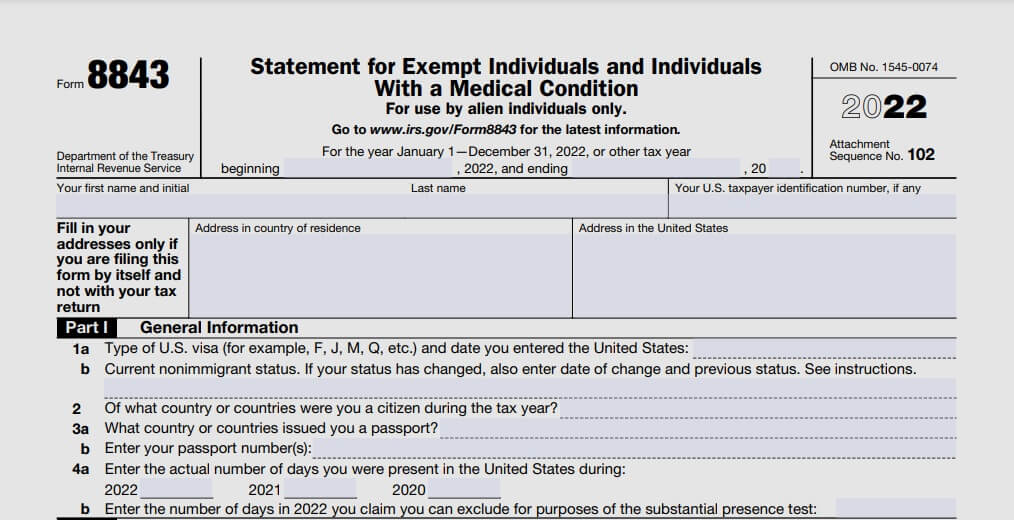

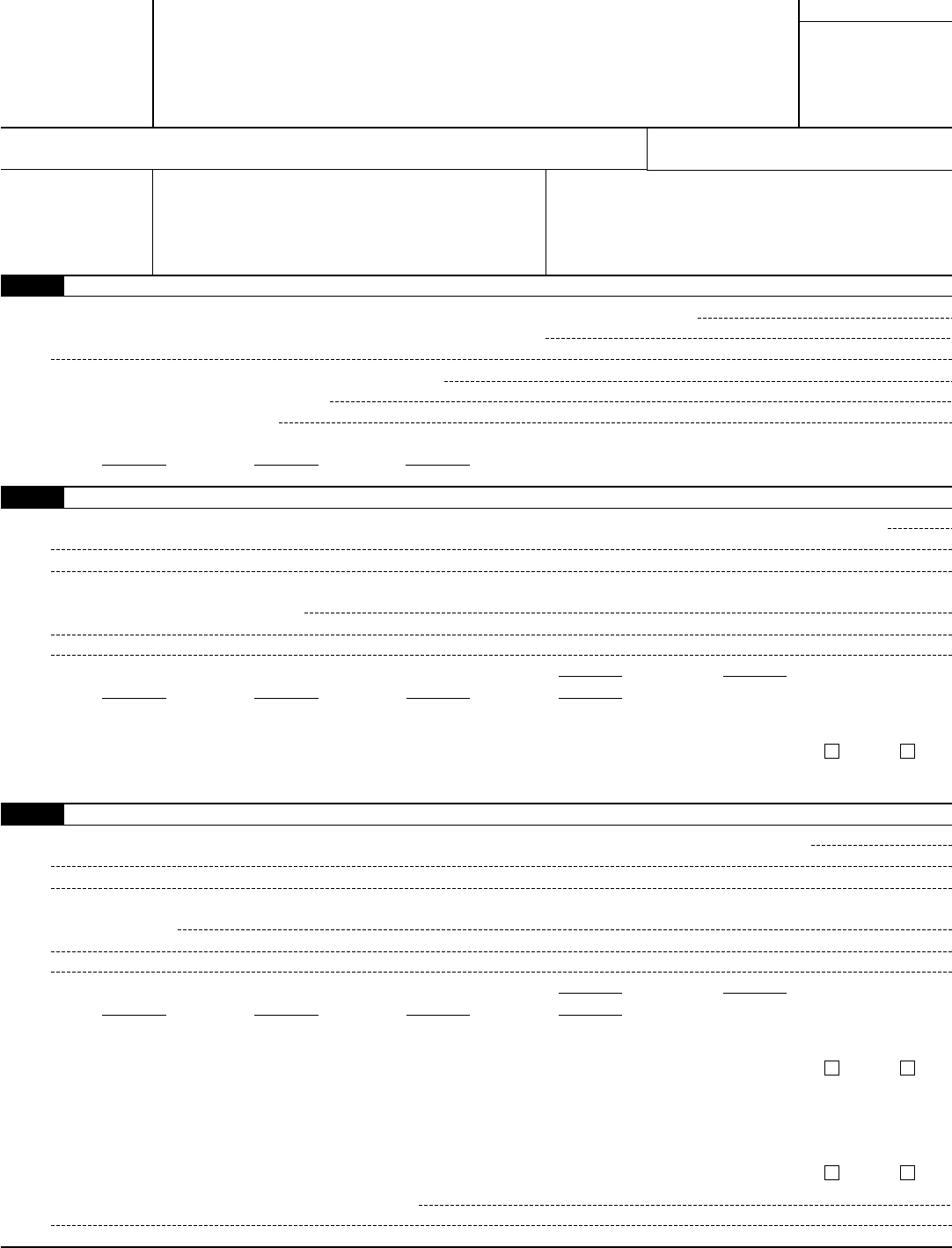

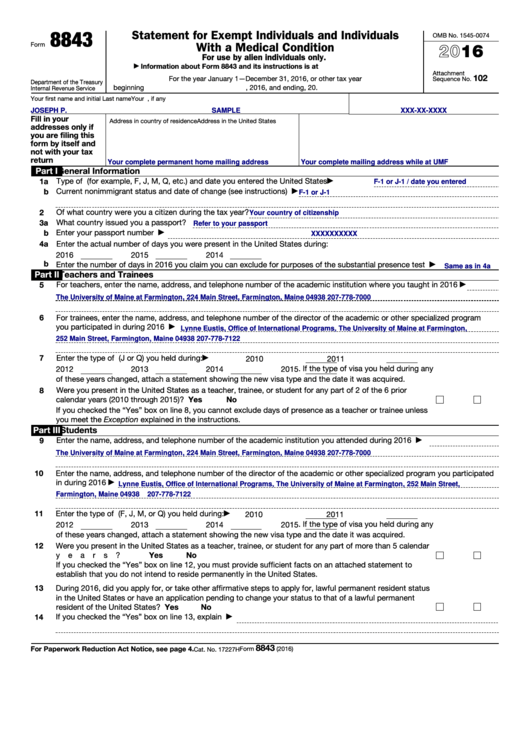

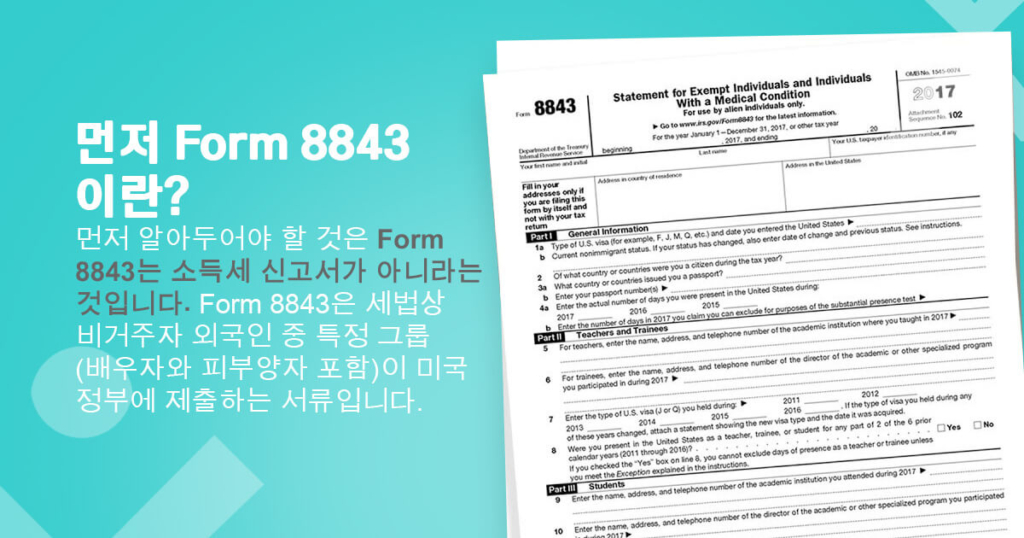

Form 8843 유학생 - For use by alien individuals only. Ad signnow.com has been visited by 100k+ users in the past month 먼저 알아두어야 할 것은 form 8843는 소득세 신고서가 아니라는 것입니다. It is an informational statement required by the irs for nonresidents for tax purposes. It should be filled out for every. Web 2019년에 미국에서 소득이 발생하였다면 form 1014 와 form 8843 두 가지를 모두 다 작성하여 2020년 4월 15일까지 텍스 신고 를 하여야 해요. Go to www.irs.gov/form8843 for the latest information. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Web form 8843 is not a u.s. Go to www.irs.gov/form8843 for the latest information. For use by alien individuals only. Go to www.irs.gov/form8843 for the latest information. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and. Get ready for tax season deadlines by completing any required tax forms today. Web form 8843 for 2022 must be completed and mailed to the irs. Ad download or email form 8843 & more fillable forms, register and subscribe now! Web statement for exempt individuals and individuals with a medical condition. For use by alien individuals only. Web 조회 수 1439 댓글 11. The guidance below has been created to help in completing form. Web form 8843 for 2022 must be completed and mailed to the irs by june 15, 2023. And help determine tax responsibility. Go to www.irs.gov/form8843 for the latest information. Web 반드시 마감일 전까지 irs에 form 8843을 제출해야 합니다. Ad download or email form 8843 & more fillable forms, register and subscribe now! Web 이번 포스팅에서는 form 8843 작성법에 대해서 알아보겠습니다. Statement for exempt individuals and individuals with a medical condition. And help determine tax responsibility. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. For use by alien individuals only. F/j의 유학생, 방문 교수, post doc, 연수생 등이 실제로 미국에 체류했지만, resident/nonresident를 결정할 때는 그 체류기간을 포함하지 않는다 (그래서,. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and. Web 2017년 텍스 리턴 포스팅 시리즈. Web 조회 수 1439 댓글 11. How do i complete form 8843? Statement for exempt individuals and individuals with a medical condition. For foreign nationals who had no u.s. 2019년도 무료 tax return을 위한 웹페이지 (f1/j1, f2/j2 대상) 를 통해 서류를 작성하거나 블로그 포스팅의 도움을 받아서 form 1040nr (. Form 8843은 입국 후 거주 기간 면제 여부 등을 체크 하기 위한 양식입니다. How do i complete form 8843? For foreign nationals who had no u.s. How do i complete form 8843? Web 2019년에 미국에서 소득이 발생하였다면 form 1014 와 form 8843 두 가지를 모두 다 작성하여 2020년 4월 15일까지 텍스 신고 를 하여야 해요. You must file this form to remain in compliance. Web 조회 수 1439 댓글 11. And help determine tax responsibility. Students, scholars, and dependents who are at indiana university in f or j status must file form 8843 every year. Ad download or email form 8843 & more fillable forms, register and subscribe now! You must file this form to remain in compliance. How do i complete form 8843? And help determine tax responsibility. It is an informational statement required by the irs for nonresidents for tax purposes. Web form 8843 is not a u.s. Web 네 form 8843는 세금 보고가 아니고 information statement 이고 매해 income 이 있건 없건 file 해야 하고 income 이 있을 경우 세금 보고는 1040nr 로 합니다. Ad signnow.com has been visited by 100k+. For use by alien individuals only. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Get ready for tax season deadlines by completing any required tax forms today. And help determine tax responsibility. Web form 8843은 제출하셔야 하는데, 이때 ssn 없으신 경우 itin이 필요합니다. Ad signnow.com has been visited by 100k+ users in the past month 먼저 알아두어야 할 것은 form 8843는 소득세 신고서가 아니라는 것입니다. Web form 8843 for 2022 must be completed and mailed to the irs by june 15, 2023. Go to www.irs.gov/form8843 for the latest information. Web statement for exempt individuals and individuals with a medical condition. It should be filled out for every. Web 반드시 마감일 전까지 irs에 form 8843을 제출해야 합니다. Go to www.irs.gov/form8843 for the latest information. Ad download or email form 8843 & more fillable forms, register and subscribe now! Web statement for exempt individuals and individuals with a medical condition. Web (2) form 8843 첨부. Form 8843은 세법상 비거주자 외국인 중 특정 그룹(배우자와 피부양자 포함)이 미국 정부에 제출하는 서류입니다. Web instructions for form 8843. It is an informational statement required by the irs for nonresidents for tax purposes. Web 2019년에 미국에서 소득이 발생하였다면 form 1014 와 form 8843 두 가지를 모두 다 작성하여 2020년 4월 15일까지 텍스 신고 를 하여야 해요. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. 2019년도 무료 tax return을 위한 웹페이지 (f1/j1, f2/j2 대상) 를 통해 서류를 작성하거나 블로그 포스팅의 도움을 받아서 form 1040nr (. And help determine tax responsibility. Form 8843은 입국 후 거주 기간 면제 여부 등을 체크 하기 위한 양식입니다. Web 네 form 8843는 세금 보고가 아니고 information statement 이고 매해 income 이 있건 없건 file 해야 하고 income 이 있을 경우 세금 보고는 1040nr 로 합니다.Form 8843 작성법 양식 8843 62 개의 새로운 답변이 업데이트되었습니다.

[2019 버전] F1/J1 미국 유학생 텍스 리턴 2편 Form 8843 (Federal Tax Return

IRS Form 8843. Statement for Exempt Individuals and Individuals with a

Form 8843 Instructions How to fill out 8843 form online & file it

Tax how to file form 8843 (1)

Form 8843 Edit, Fill, Sign Online Handypdf

Fillable Form 8843 Statement For Exempt Individuals And Individuals

Form 8843 정의와 제출 방법은? Sprintax

Form 8843留学生报税必填表格 Tax Panda 美国报税大熊猫

Fill Free fillable F8843 2019 Form 8843 PDF form

Related Post:

![[2019 버전] F1/J1 미국 유학생 텍스 리턴 2편 Form 8843 (Federal Tax Return](https://t1.daumcdn.net/cfile/tistory/99313F3D5E19343F0F)