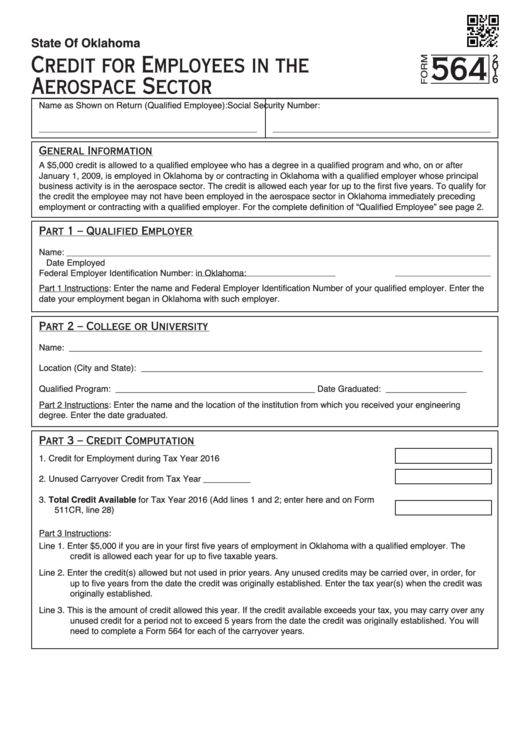

Oklahoma Form 564

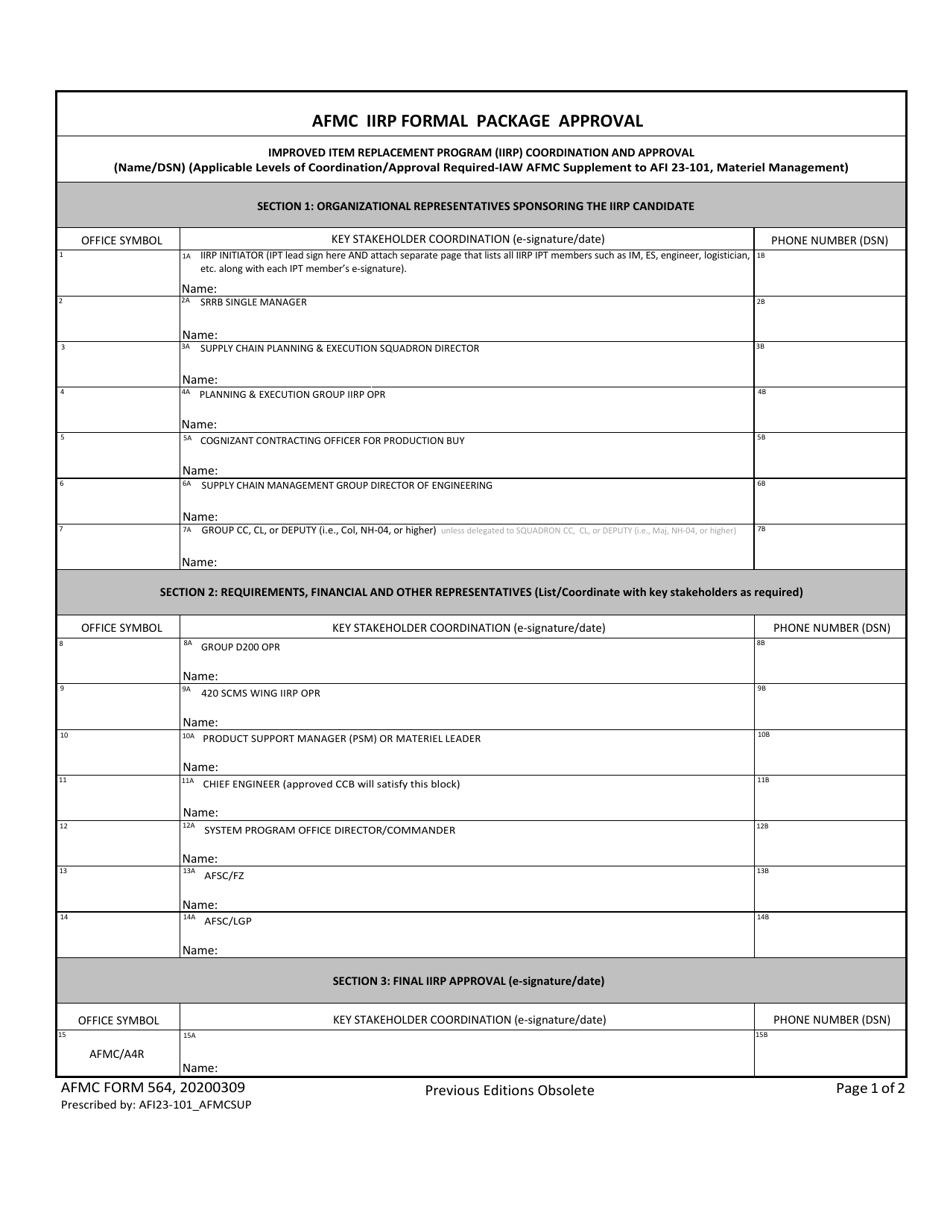

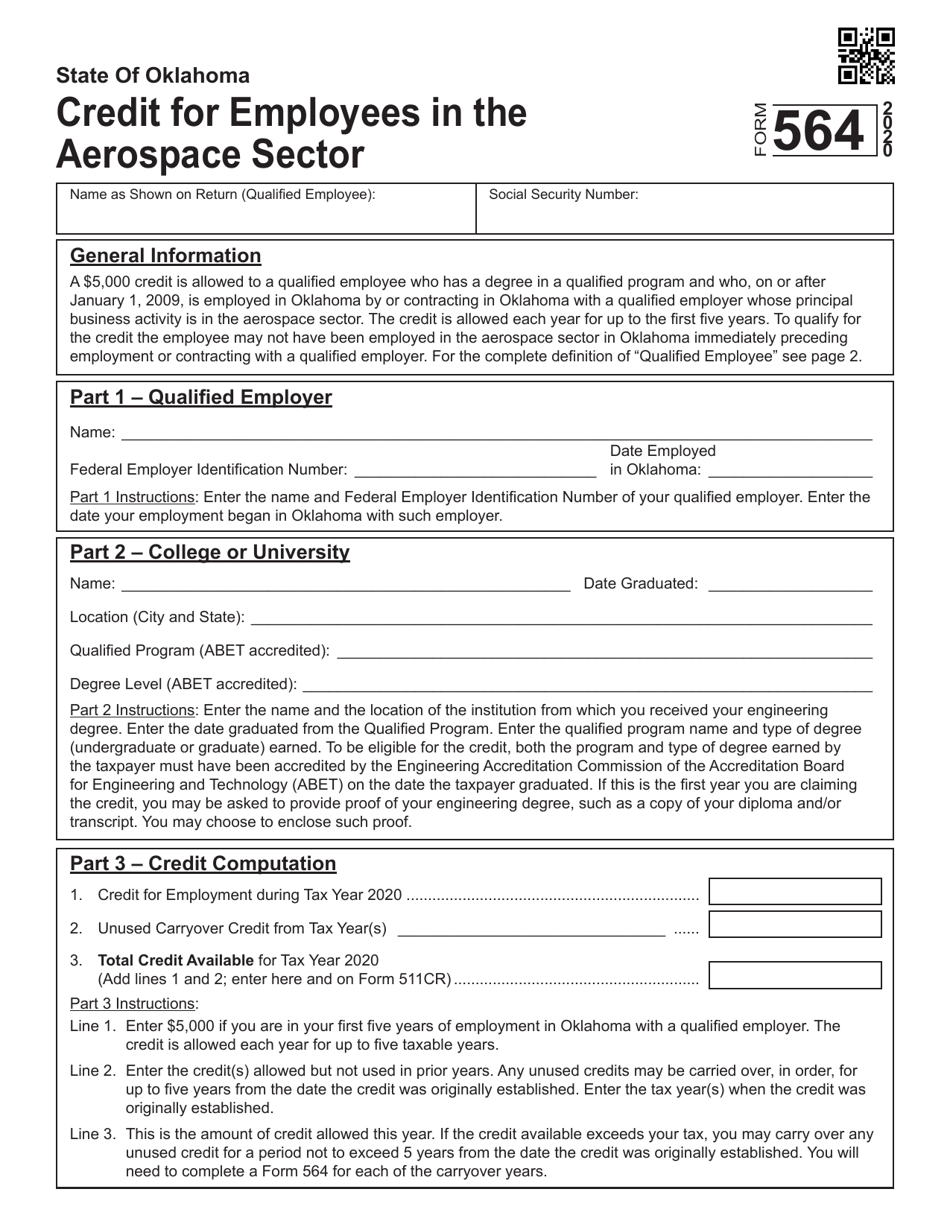

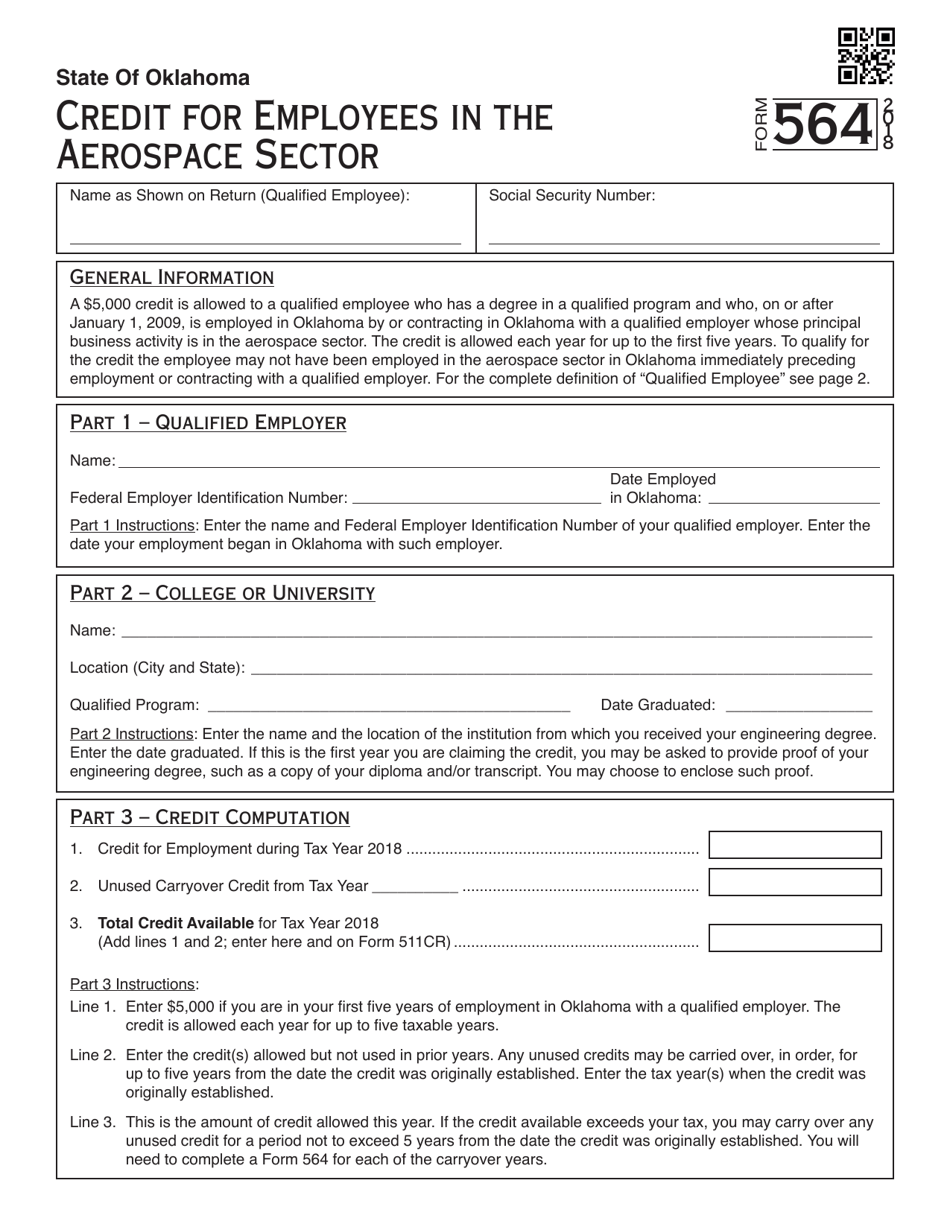

Oklahoma Form 564 - Qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. Web credit for employees in the aerospace sector (form 564) $5,000 credit for a qualified employee who has a degree in engineering and/or a qualified employer whose business. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. For the complete definition of “qualified. Enter the name and federal identification number of your qualified employer. Web need to complete a form 564 for each of the carryover years. Web form 504 is an oklahoma individual income tax form. Web state of oklahoma credit for employees in the form 564. Web we last updated the credits for employers in the aerospace sector in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web need to complete a form 564 for each of the carryover years. Web aerospace industry engineer workforce tax credits. Web form 504 is an oklahoma individual income tax form. Qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. Complete, edit or print tax forms instantly. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to. What makes the form 564 oklahoma. Browse for the form 564 oklahoma. Web form 504 is an oklahoma individual income tax form. Web need to complete a form 564 for each of the carryover years. Send out signed form 564 oklahoma 2018 or print it. Answer simple questions to make legal forms on any device in minutes. Browse for the form 564 oklahoma. Provide this form and supporting documents with your oklahoma tax return. Web we last updated the credits for employers in the aerospace sector in january 2023, so this is the latest version of form 565, fully updated for tax year 2022. Web. Web web 564 2 0 8 social security number: Web form 564 oklahoma rating. Web other credits form state of oklahoma name as shown on return: Web need to complete a form 564 for each of the carryover years. Web we last updated the credits for employers in the aerospace sector in january 2023, so this is the latest version. $5,000 credit is allowed to a qualified employee who, on or after january 1, 2009, is employed in oklahoma by or contracting in oklahoma with a. What makes the form 564 oklahoma. Get state of oklahoma credit for employees in the form 564. Qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. Web. Browse for the form 564 oklahoma. Enter the name and federal employer identification number of your qualified employer. Web in an effort to help oklahoma’s booming aerospace and aviation industry continue to grow, the state of oklahoma offers the aerospace industry engineer workforce tax credit. Provide this form and supporting documents with your oklahoma tax return. For the complete definition. Web aerospace industry engineer workforce tax credits. Web web 564 2 0 8 social security number: Qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. For the complete definition of “qualified. Web form 504 is an oklahoma individual income tax form. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Web form 504 is an oklahoma individual income tax form. Web fill out state of oklahoma credit for employees in the form 564 in just a few minutes following the guidelines listed below: Enter the. Get your online template and fill it in using progressive features. Web in an effort to help oklahoma’s booming aerospace and aviation industry continue to grow, the state of oklahoma offers the aerospace industry engineer workforce tax credit. ★ ★ ★ ★ ★. Web other credits form state of oklahoma name as shown on return: Web form 504 is an. Web other credits form state of oklahoma name as shown on return: A $5,000 credit is allowed to a qualified employee who has a degree in a qualified program and who, on or after. Answer simple questions to make legal forms on any device in minutes. ★ ★ ★ ★ ★. Ad pdffiller.com has been visited by 1m+ users in. Enter the name and federal employer identification number of your qualified employer. Web credit for employees in the aerospace sector (form 564) $5,000 credit for a qualified employee who has a degree in engineering and/or a qualified employer whose business. Answer simple questions to make legal forms on any device in minutes. Web need to complete a form 564 for each of the carryover years. Web fill out state of oklahoma credit for employees in the form 564 in just a few minutes following the guidelines listed below: Web other credits form state of oklahoma name as shown on return: Get state of oklahoma credit for employees in the form 564. Aerospace companies hiring engineers in a variety of fields will receive a tax credit equal to five (5) percent of the compensation. What makes the form 564 oklahoma. Get your online template and fill it in using progressive features. Web in an effort to help oklahoma’s booming aerospace and aviation industry continue to grow, the state of oklahoma offers the aerospace industry engineer workforce tax credit. Web you are a qualified employee who was hired by a qualified employer on or after january 1, 2009 and before july 1, 2010 and will continue employment for at least five years. Ad pdffiller.com has been visited by 1m+ users in the past month Web aerospace industry engineer workforce tax credits. Enter the name and federal identification number of your qualified employer. Qualified employer is allowed credits for tuition reimbursed and for compensation paid to a qualified employee. Web need to complete a form 564 for each of the carryover years. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Provide this form and supporting documents with your oklahoma tax return. Web web 564 2 0 8 social security number:AFMC Form 564 Download Fillable PDF or Fill Online Afmc Iirp Formal

Form 564 Download Fillable PDF or Fill Online Credit for Employees in

OTC Form 564 Download Fillable PDF or Fill Online Credit for Employees

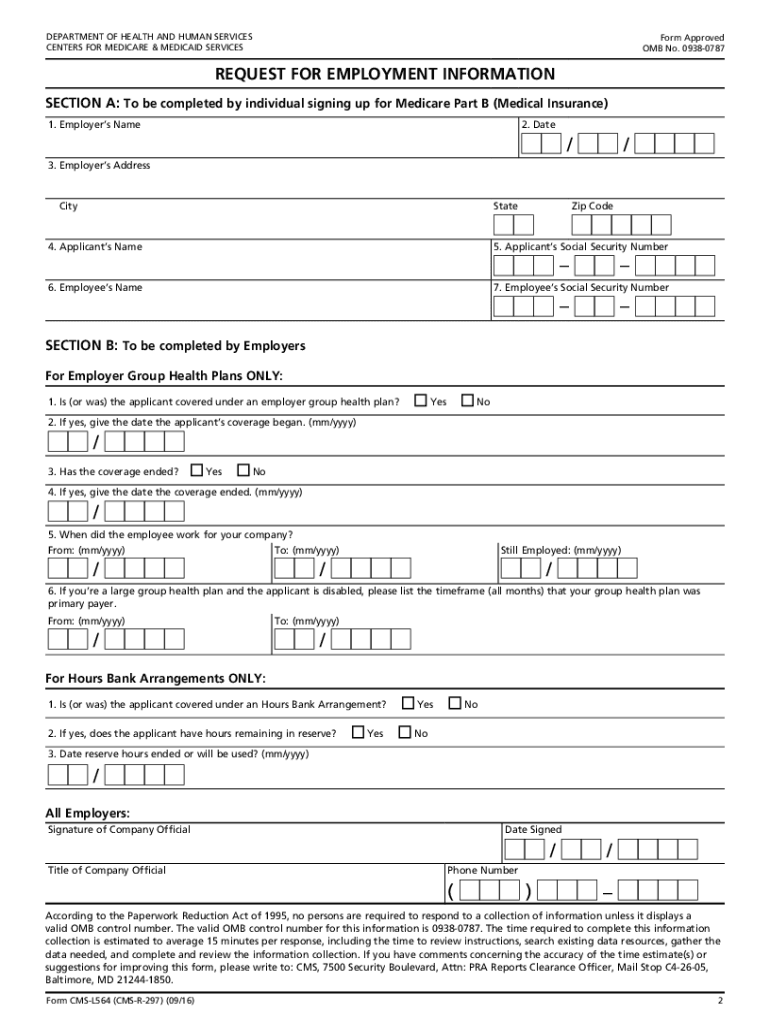

Form CMSL564 Request for Employment Information Medicare & Medicaid

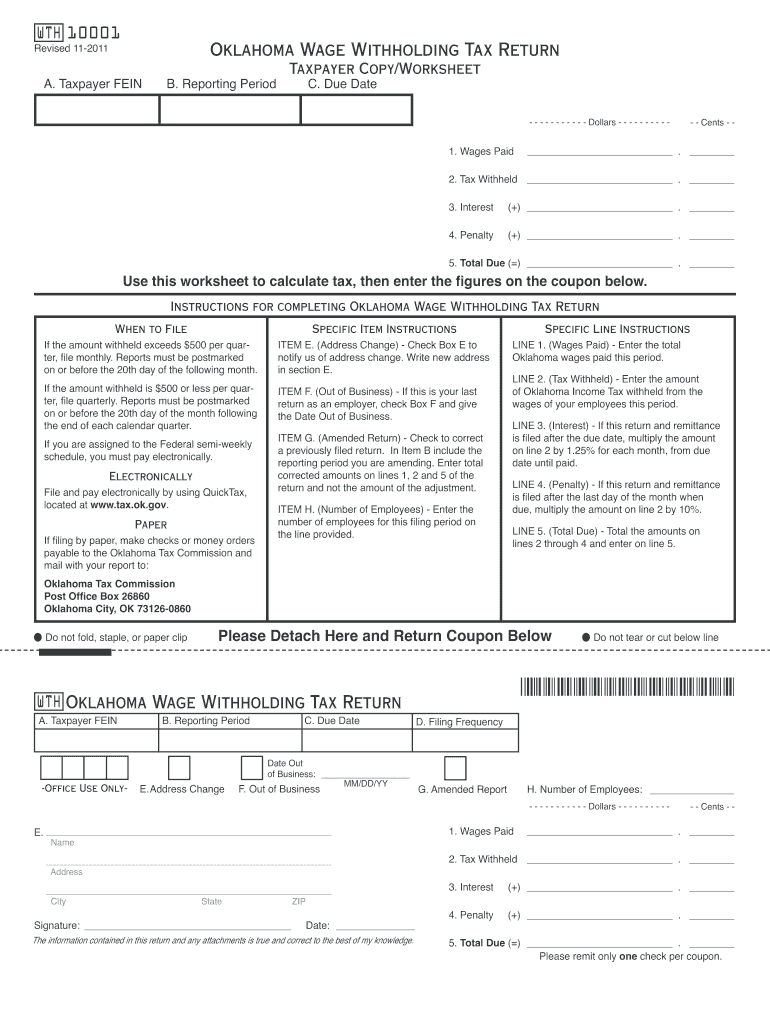

Oklahoma Withholding Tax for Form Fill Out and Sign Printable PDF

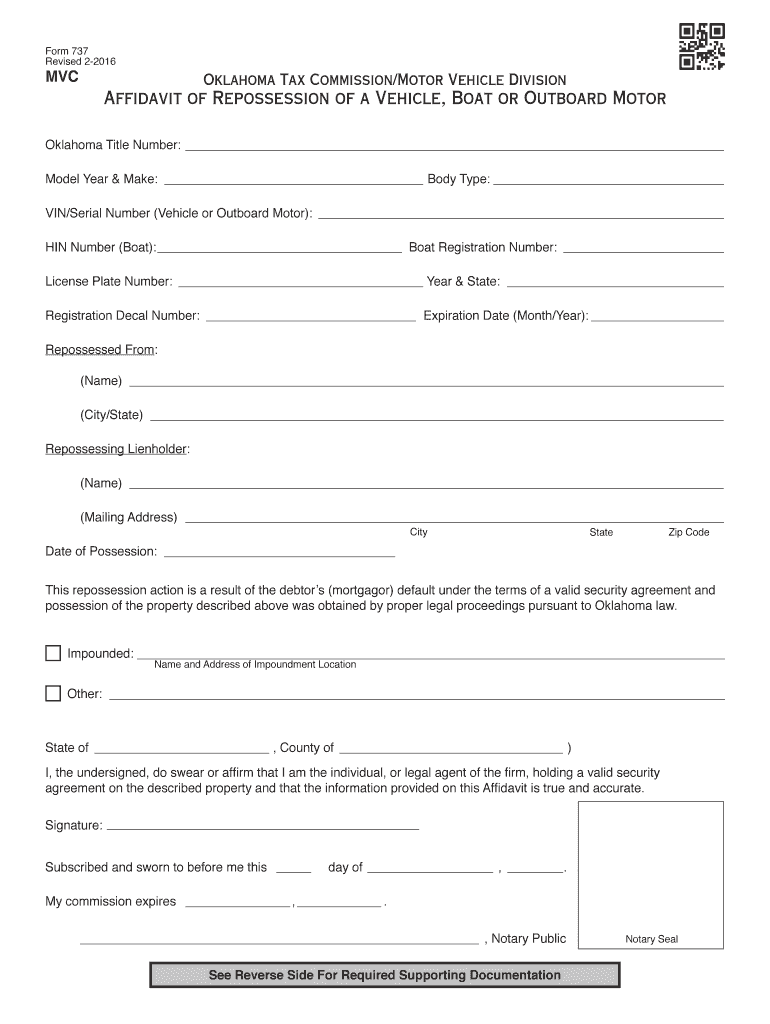

Oklahoma Tax Commission Family Affidavit Fill Out and Sign Printable

Download Oklahoma U.S. Armed Forces Affidavit Form for Free FormTemplate

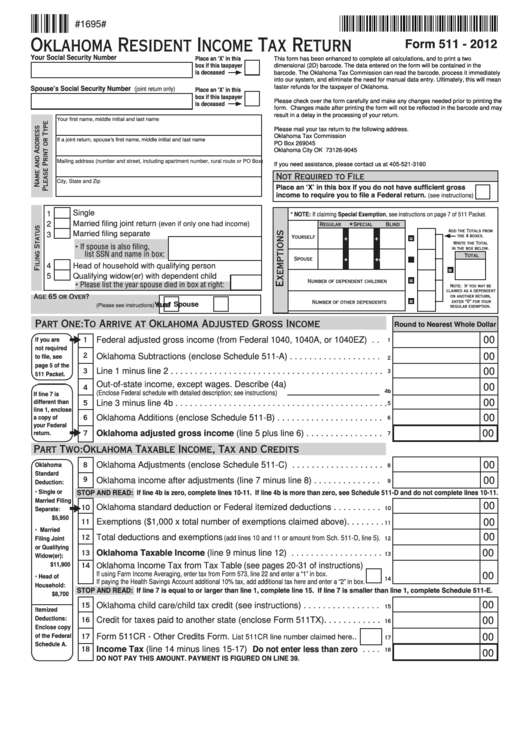

Printable Oklahoma Tax Form 511 Printable World Holiday

Fillable Form 564 Credit For Employees In The Aerospace Sector 2016

OK Form 139 2016 Fill out Tax Template Online US Legal Forms

Related Post: