Form 8832 Instructions

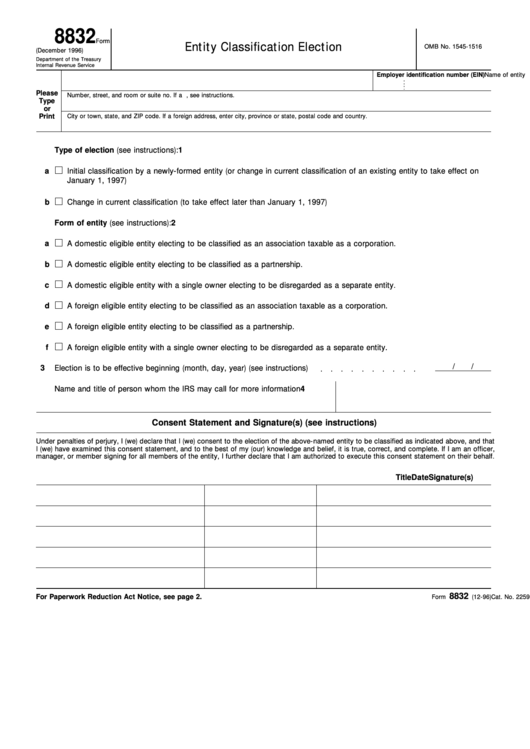

Form 8832 Instructions - Fill in your basic company information. Web information about form 8832 and its instructions at www.irs.gov/form8832. Web form 8832 allows businesses to request to be taxed as a corporation, partnership, or sole proprietorship when filing the relevant income tax return. If it opts to file for c corporation tax status by submitting. Web according to the form instructions, the following eligible entities should file form 8832: Web what is form 8832? The irs website has irs form 8832 as well as some other materials that. Web form 8832, known as the entity classification election form, is a specialized document furnished by the irs. Generally, llcs are not automatically included in this list, and are therefore not required. Its primary function is to grant eligible entities the. Your business information including name, employer. Allows you to change your tax classification, 3 while. Web irs form 8832 instructions: The entity intended to be. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web instructions for irs form 8832: Web form 8832, known as the entity classification election form, is a specialized document furnished by the irs. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Generally, llcs are not automatically included in this list, and are therefore not required. Web what is. Form 8832, entity classification election, is a tax form that allows certain businesses to select whether they want to be taxed as a: Essentially, form 2553 is an. Web instructions for irs form 8832: Fill in your basic company information. Get ready for tax season deadlines by completing any required tax forms today. Web the corrected form 8832, with the box checked entitled: Web form 8832, known as the entity classification election form, is a specialized document furnished by the irs. The irs website has irs form 8832 as well as some other materials that. Web irs form 8832 instructions: One copy of form 8832 is attached to form 1065 (if switching the. Form 8832, entity classification election, is a tax form that allows certain businesses to select whether they want to be taxed as a: Your business information including name, employer. One copy of form 8832 is attached to form 1065 (if switching the entity of the return to a partnership) and the second copy is. Get ready for tax season deadlines. Web page last reviewed or updated: The irs website has irs form 8832 as well as some other materials that. Its primary function is to grant eligible entities the. Web information about form 8832 and its instructions at www.irs.gov/form8832. Web form 8832 allows businesses to request to be taxed as a corporation, partnership, or sole proprietorship when filing the relevant. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. The irs website has irs form 8832 as well as some other materials that. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web up to $32 cash back form 8832 instructions. Complete, edit or print tax forms instantly. Web page last reviewed or updated: The entity intended to be. Generally, llcs are not automatically included in this list, and are therefore not required. Fill in your basic company information. Information about any future developments affecting form 8832 (such as legislation enacted after. Its primary function is to grant eligible entities the. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web up to $32 cash back form 8832 instructions and pdf. Fill in your basic company information. Its primary function is to grant eligible entities the. Allows you to change your tax classification, 3 while. Web instructions for irs form 8832: Your business information including name, employer. Complete, edit or print tax forms instantly. Generally, llcs are not automatically included in this list, and are therefore not required. Web instructions for irs form 8832: Web page last reviewed or updated: Web form 8832, known as the entity classification election form, is a specialized document furnished by the irs. December 2013) department of the treasury internal revenue service omb no. Web up to $32 cash back form 8832 instructions and pdf. Web information about form 8832 and its instructions at www.irs.gov/form8832. Web you are required to file two copies of form 8832. Web irs form 8832 instructions: Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Fill in your basic company information. Web at a glance. Web certain foreign entities (see form 8832 instructions). Information about any future developments affecting form 8832 (such as legislation enacted after. The irs website has irs form 8832 as well as some other materials that. Allows you to change your tax classification, 3 while. Its primary function is to grant eligible entities the. Web the corrected form 8832, with the box checked entitled: Complete, edit or print tax forms instantly. A domestic entity electing to be taxed as a corporation.Form 8832 (Rev. December 1996) printable pdf download

General Instructions For Form 8832 printable pdf download

Form 8832 Instruction 2023 2024

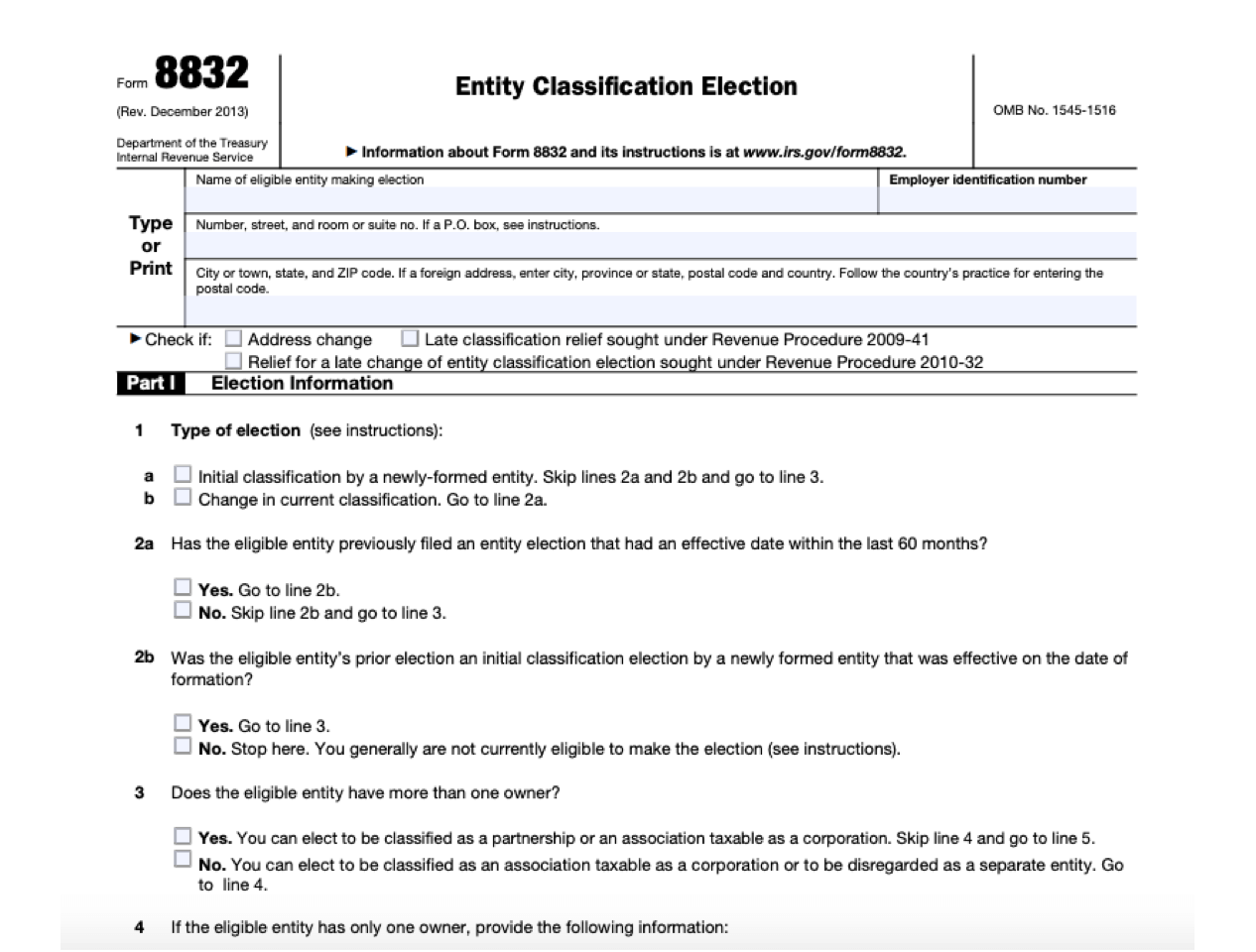

Form 8832 Entity Classification Election (2013) Free Download

Form 8832 All About It and How to File It?

Form 8832 Instructions and Frequently Asked Questions

Form 8832 Entity Classification Election (2013) Free Download

form 8832 late election relief reasonable cause examples Fill Online

Form 8832 Fillable Online Using eSignature eSign Genie

Filling out IRS Form 8832 An EasytoFollow Guide YouTube

Related Post: