Form 50-114-A

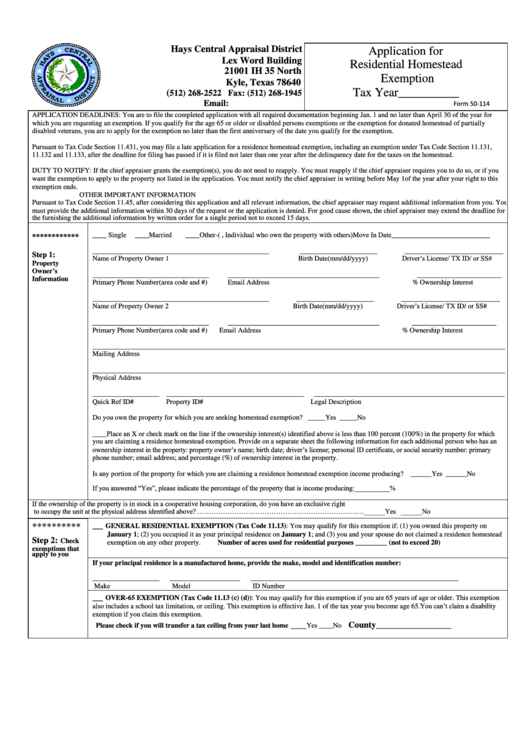

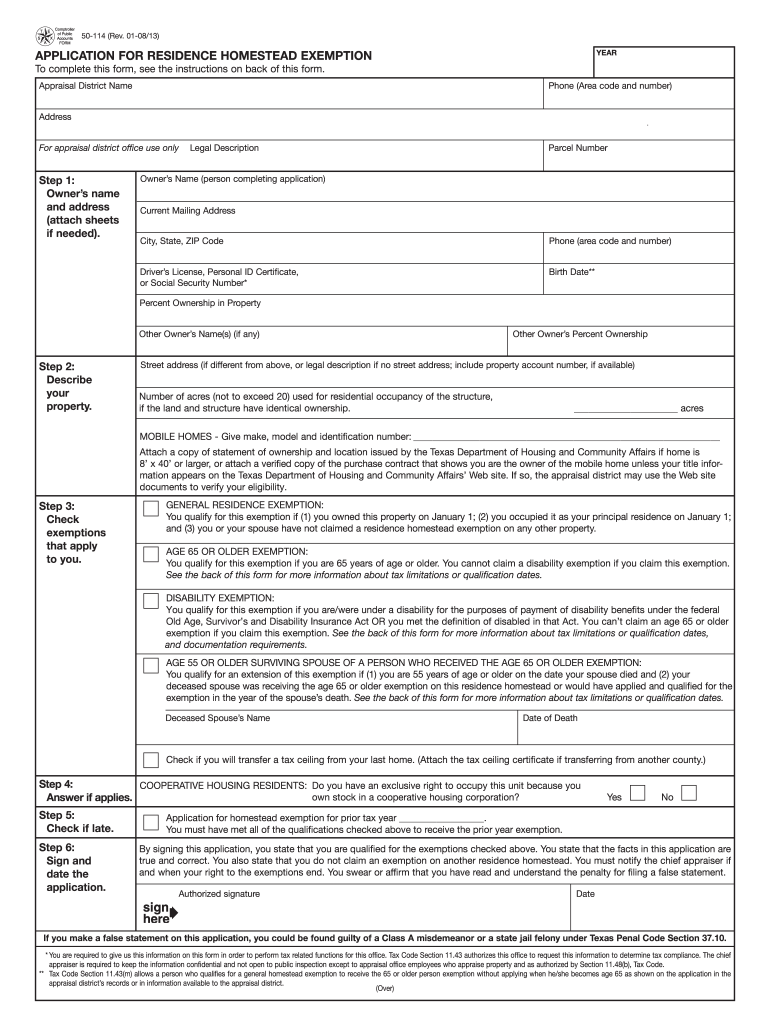

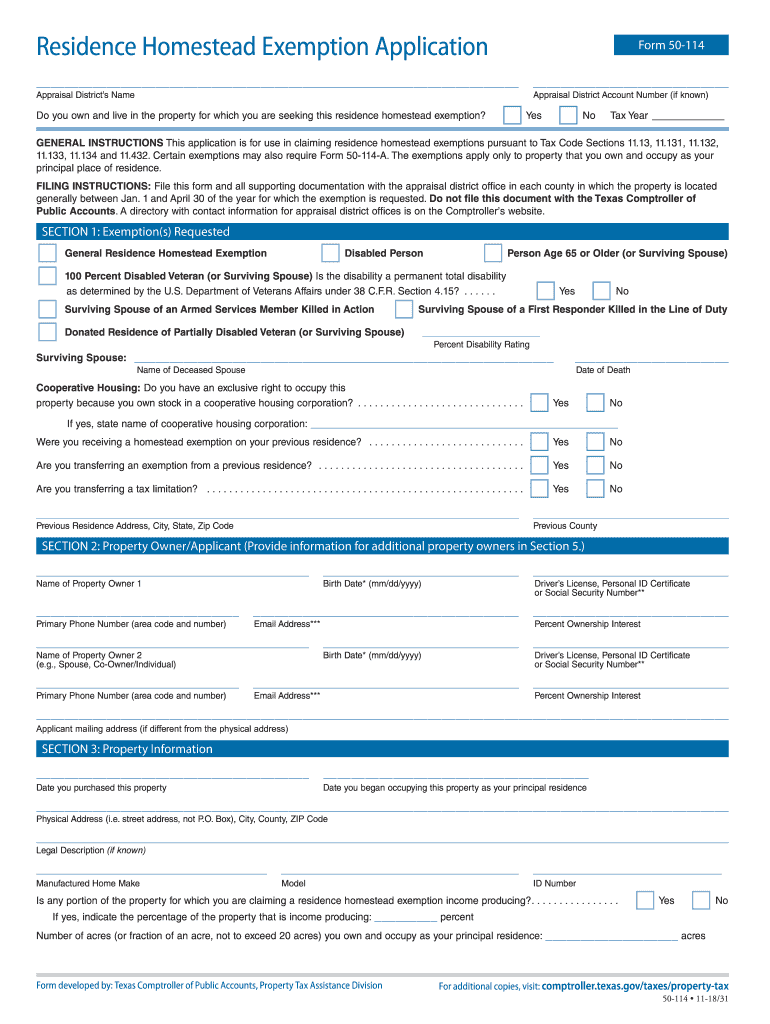

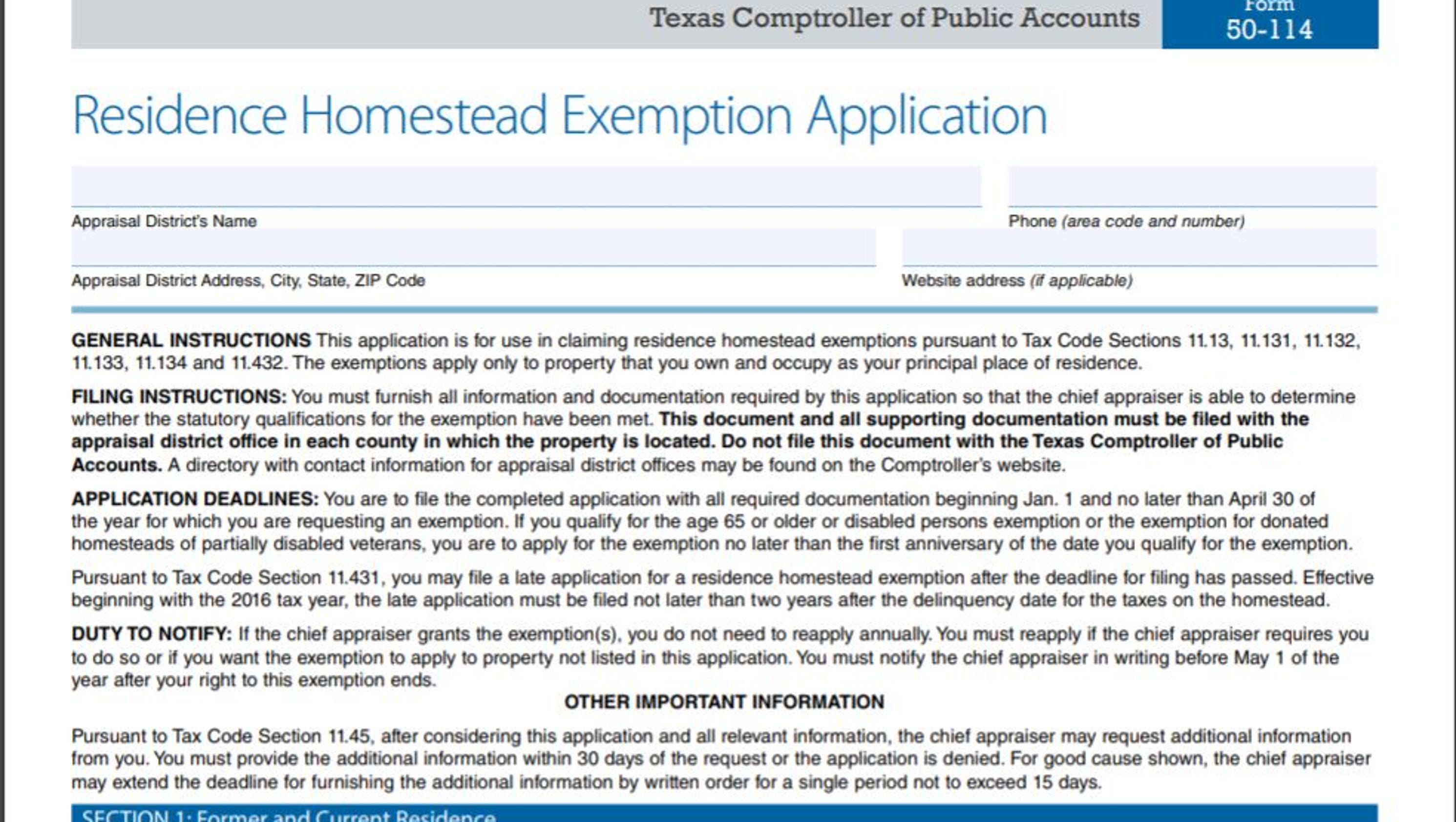

Form 50-114-A - Save or instantly send your ready documents. Web what is a homestead exemption in texas? Enter name, address, or ref id to pull up property. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Online with us legal forms. If you have inherited your home and your home is your primary residence, you can qualify for a. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Prepare for irs filing deadlines. If you turn 65 or become newly disabled, you need to submit. Order 1099 forms, envelopes, and software today. Online with us legal forms. 015777 (inactive) the arizona chamber of commerce and. Web affidavit for applicant claiming an ownership interest of property, including heir property. Web property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property. Save or instantly send your ready documents. Order 1099 forms, envelopes, and software today. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Easily fill out pdf blank, edit, and sign them. Prepare for irs filing deadlines. · on our website www.wcad.org within the property search. Easily fill out pdf blank, edit, and sign them. Web what is a homestead exemption in texas? Web affidavit for applicant claiming an ownership interest of property, including heir property. Save or instantly send your ready documents. If you have inherited your home and your home is your primary residence, you can qualify for a. · on our website www.wcad.org within the property search. Enter name, address, or ref id to pull up property. 015777 (inactive) the arizona chamber of commerce and. The exemptions apply only to property that you own and occupy as your principal place of residence. Web state form number: Easily fill out pdf blank, edit, and sign them. Prepare for irs filing deadlines. How much is the homestead exemption in texas? Web complete form 50 114 online with us legal forms. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. · on our website www.wcad.org within the property search. Texas comptroller of public accounts, property tax assistance division. If you turn 65 or become newly disabled, you need to submit. How much is the homestead exemption in texas? Superior court of arizona in maricopa county Prepare for irs filing deadlines. Easily fill out pdf blank, edit, and sign them. If you turn 65 or become newly disabled, you need to submit. Enter name, address, or ref id to pull up property. Texas comptroller of public accounts, property tax assistance division. How do i apply for a homestead exemption in texas? · on our website www.wcad.org within the property search. Web claims divisionabout the revised notice of claim status (form 104) ruby tate, claims manager. Prepare for irs filing deadlines. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Easily fill out pdf blank, edit, and sign them. If you turn 65 or become newly disabled, you need to submit. The exemptions apply only to property that you own and occupy as your principal place of residence. Web. Order 1099 forms, envelopes, and software today. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Enter name, address, or ref id to pull up property. Prepare for irs filing deadlines. 015777 (inactive) the arizona chamber of commerce and. How do i apply for a homestead exemption in texas? Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Enter name, address, or ref id to pull up property. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web complete form 50 114 online with us legal forms. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. For purpose of residence homestead exemption. Superior court of arizona in maricopa county This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132 versions 1 and 2, and. Prepare for irs filing deadlines. Online with us legal forms. This application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. How much is the homestead exemption in texas? Ad shop our selection of 1099 forms, envelopes, and software for tax reporting. Web affidavit for applicant claiming an ownership interest of property, including heir property. · on our website www.wcad.org within the property search. Texas comptroller of public accounts, property tax assistance division. Order 1099 forms, envelopes, and software today. If you turn 65 or become newly disabled, you need to submit.Form 50114 Application For Residential Homestead Exemption printable

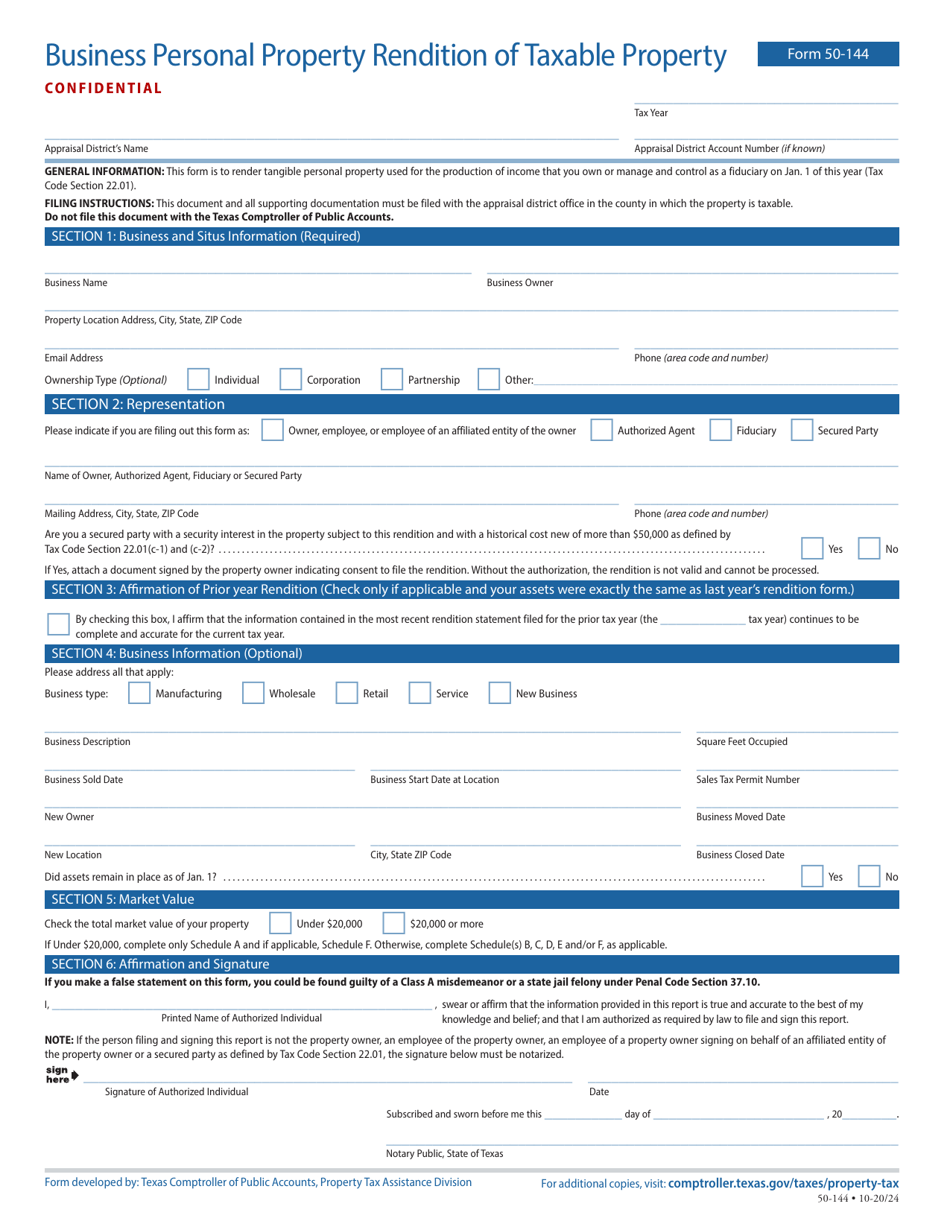

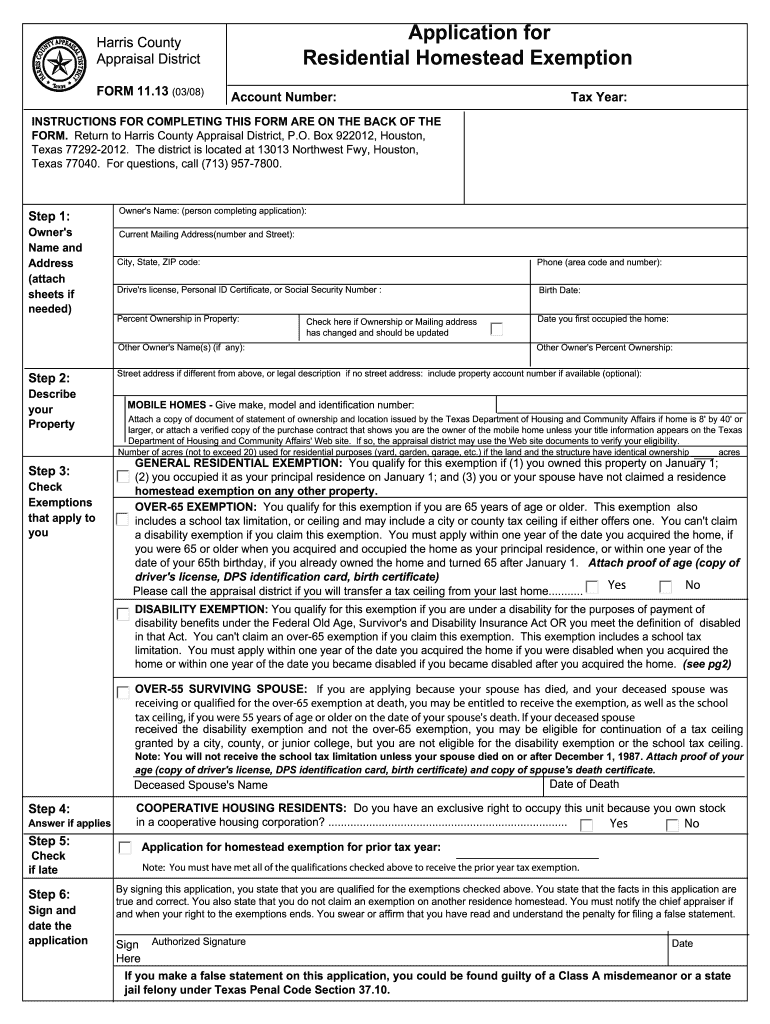

Form 50144 Fill Out, Sign Online and Download Fillable PDF, Texas

Fincen Form 114 Sample Fill and Sign Printable Template Online US

Form 50 114 Example Fill Out and Sign Printable PDF Template signNow

Form 50 114 Fill Out and Sign Printable PDF Template signNow

Deadline to file homestead exemption in Texas is April 30

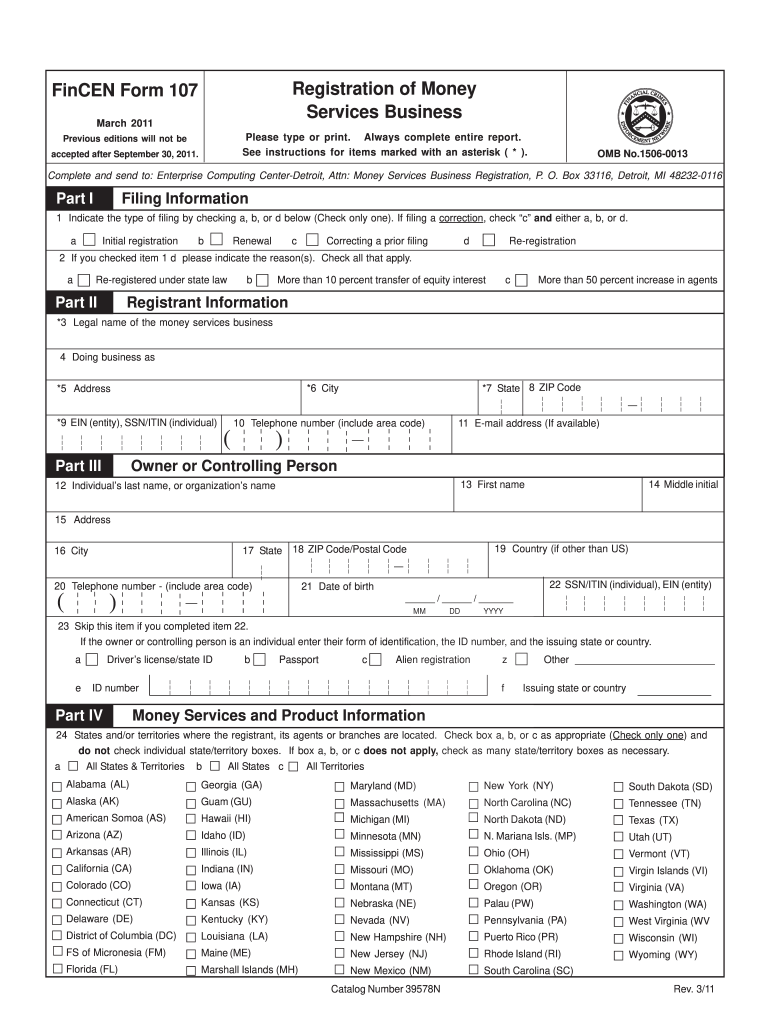

Fincen Form 107 Fill Out and Sign Printable PDF Template signNow

Fillable Online How to fill out Texas homestead exemption form 50114

Form 50 114 Fill Out and Sign Printable PDF Template signNow

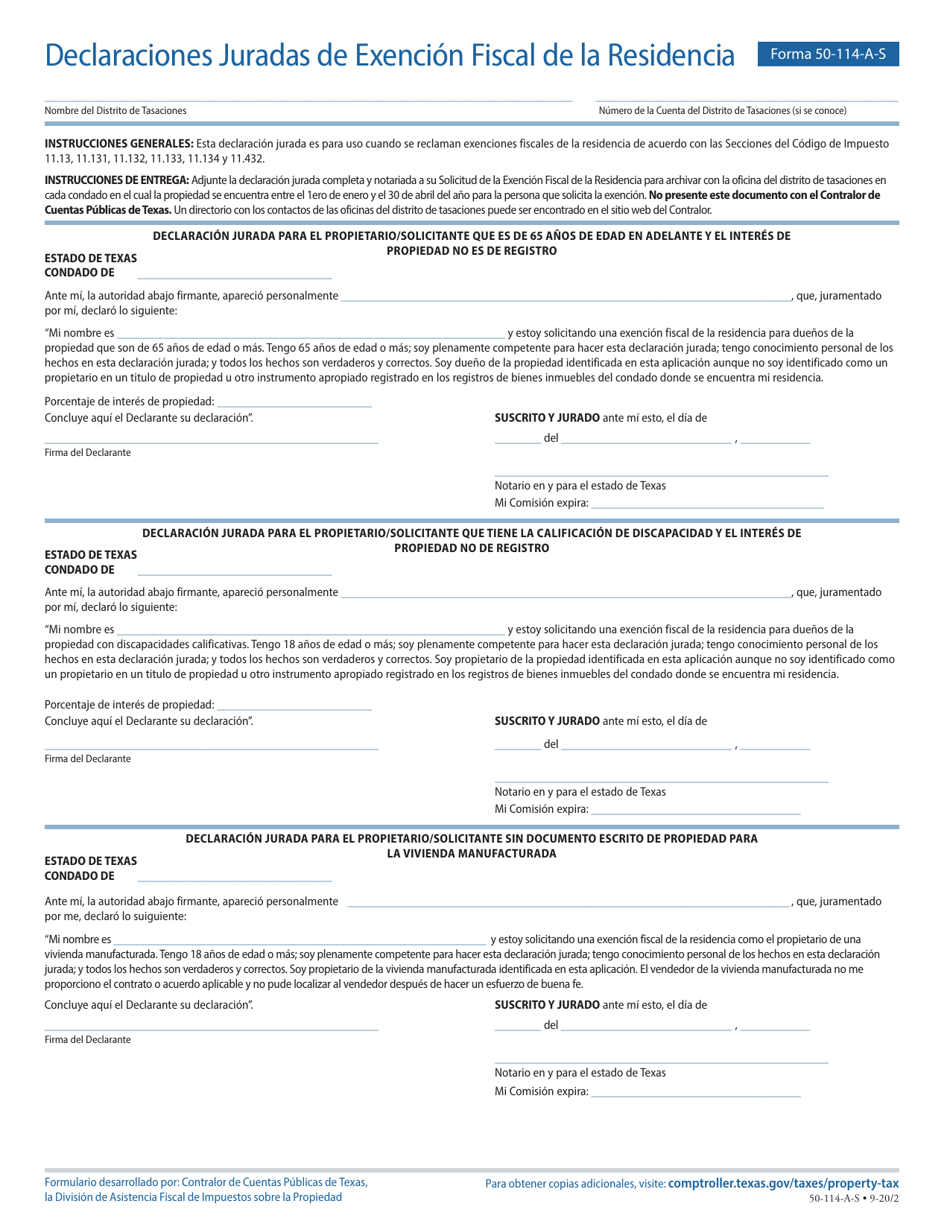

Formulario 50114A Download Fillable PDF or Fill Online Declaraciones

Related Post: