Form 8825 Vs 1065

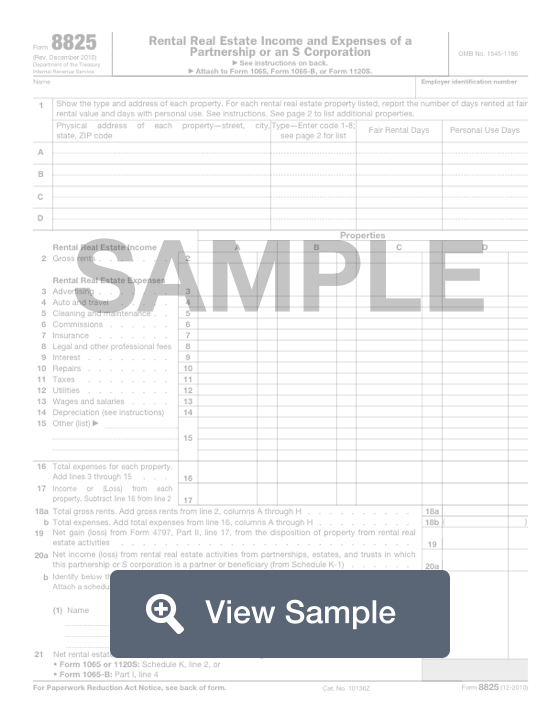

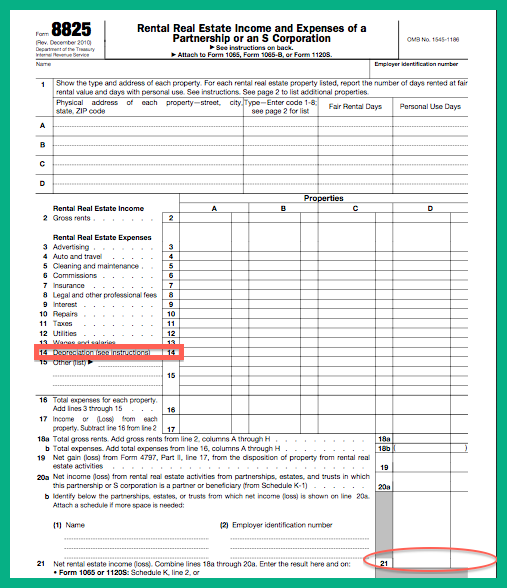

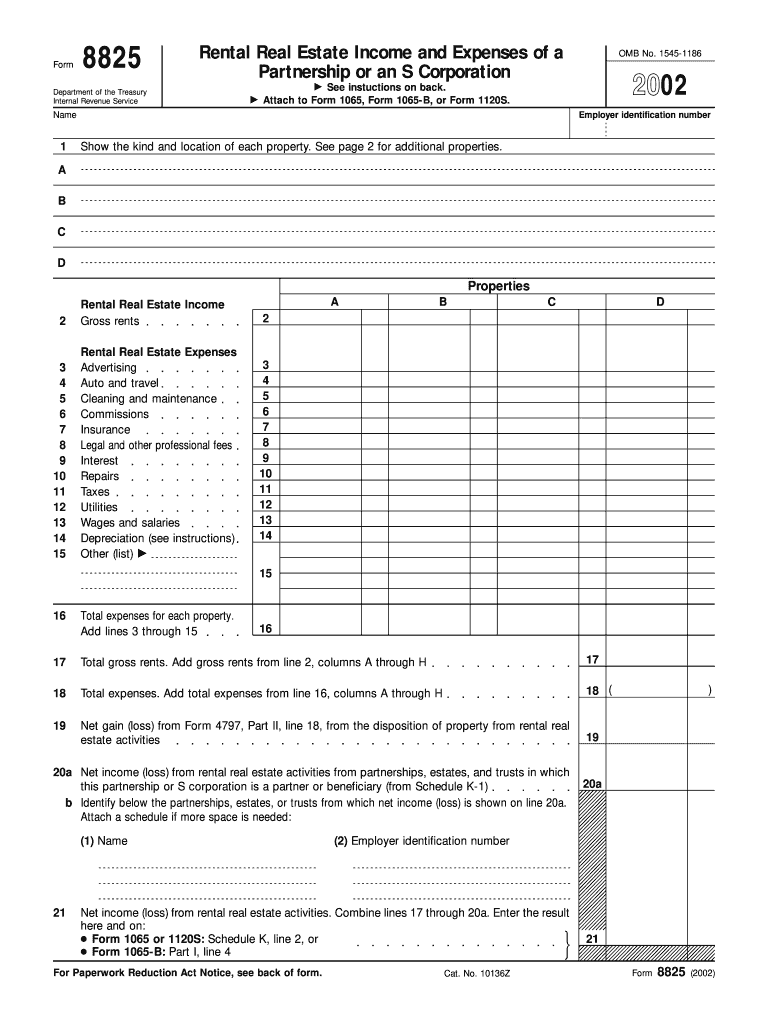

Form 8825 Vs 1065 - September 2017) department of the treasury internal revenue service. Top 1⁄ 2, center sides.prints: Web what are the documents that must accompany form 8825? If there are more than eight properties, attach additional. Schedule d (form 1065), capital gains and losses (if. There's a gain or loss from the sale of business rental real estate property, which should. 81⁄ 2 x 11 perforate:. Web form 8825, page 1 of 2 margins: This form has space to list up to 8 rental. If you have depreciable assets. September 2017) department of the treasury internal revenue service. If there are more than eight properties, attach additional. Web in addition to filling out the irs form 8825 rental real estate income and expenses of a partnership or an s corporation, these business entities would need to file their taxes. November 2018) department of the treasury internal revenue service name.. Web expenses reported on page 1 of 1065 is considered ordinary expense while reporting on form 8825 is considered as net rental real estate income/expense. Web form 8825 is used to report income and deductible expenses from rental real estate activities. • how to file form 1065 for. November 2018) department of the treasury internal revenue service name. Web 1065. For a full form 1065 example with form 8825, please see our video here: Web department of the treasury internal revenue service. Web if you want to associate rental activity with guaranteed payments, the rental real estate income must be reported on form 8825 rental real estate income and expenses of a. Web do i put all my depreciation (including. Return of partnership income, page 1, line 4 or form 8825, line 15 depending on how it is received. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web form 8825 is used to report income and deductible expenses from rental real estate activities. • form. Web in addition to filling out the irs form 8825 rental real estate income and expenses of a partnership or an s corporation, these business entities would need to file their taxes. For instructions and the latest information. Web form 8825, page 1 of 2 margins: Web form 8825, rental real estate income and expenses of a partnership or an. Rental real estate income and expenses of a partnership or an s corporation. Web combine lines 18a through 20a. Form 8825 provides space for up to eight properties. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (if required). Web if you want to associate rental activity with guaranteed payments, the rental real. Enter the result here and on: Rental real estate income and expenses of a partnership or an s corporation. Web what are the documents that must accompany form 8825? Web form 8825, page 1 of 2 margins: Web if you want to associate rental activity with guaranteed payments, the rental real estate income must be reported on form 8825 rental. 81⁄ 2 x 11 perforate:. Web do i put all my depreciation (including sec 179) on 8825 and not on 1065 line 12 ? Web combine lines 18a through 20a. Web what are the documents that must accompany form 8825? Web rental real estate income can be reported on form 1065 u.s. November 2018) department of the treasury internal revenue service name. September 2017) department of the treasury internal revenue service. This form has space to list up to 8 rental. Web do i put all my depreciation (including sec 179) on 8825 and not on 1065 line 12 ? Web department of the treasury internal revenue service. Web department of the treasury internal revenue service. Web what are the documents that must accompany form 8825? Web form 8825, page 1 of 2 margins: 81⁄ 2 x 11 perforate:. Web in addition to filling out the irs form 8825 rental real estate income and expenses of a partnership or an s corporation, these business entities would need to. Form 8825 provides space for up to eight properties. Web 1065 gain or loss from sale of business rental property doesn't flow to 8825: This form has space to list up to 8 rental. Web form 8825, rental real estate income and expenses of a partnership or an s corporation (if required). 81⁄ 2 x 11 perforate:. Web form 8825 is used to report income and deductible expenses from rental real estate activities. Top 1⁄ 2, center sides.prints: • how to file form 1065 for. Web in addition to filling out the irs form 8825 rental real estate income and expenses of a partnership or an s corporation, these business entities would need to file their taxes. Web do i put all my depreciation (including sec 179) on 8825 and not on 1065 line 12 ? Web expenses reported on page 1 of 1065 is considered ordinary expense while reporting on form 8825 is considered as net rental real estate income/expense. Schedule d (form 1065), capital gains and losses (if. Rental real estate income and expenses of a partnership or an s corporation. Enter the result here and on: Web if you want to associate rental activity with guaranteed payments, the rental real estate income must be reported on form 8825 rental real estate income and expenses of a. General questions unit property description. For a full form 1065 example with form 8825, please see our video here: Web rental real estate income and expenses of a partnership or an s corporation 8825 form (rev. Return of partnership income, page 1, line 4 or form 8825, line 15 depending on how it is received. Schedule k, line 2 for paperwork reduction act notice, see instructions.Form 1065 Line 20 Other Deductions Worksheet

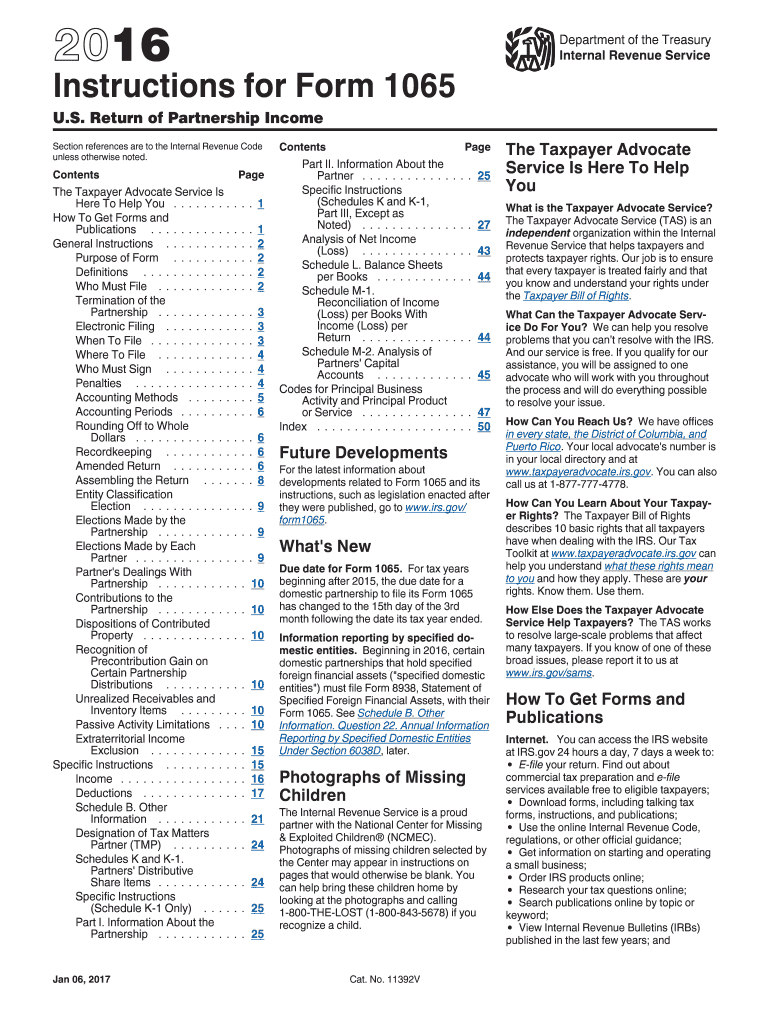

Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

Form 8825 Rental Real Estate and Expenses of a Partnership or

VS1065 VS1065 フロア総合カタログ 東リ 住まいとインテリア

Fillable IRS Form 8825 Printable PDF Sample FormSwift

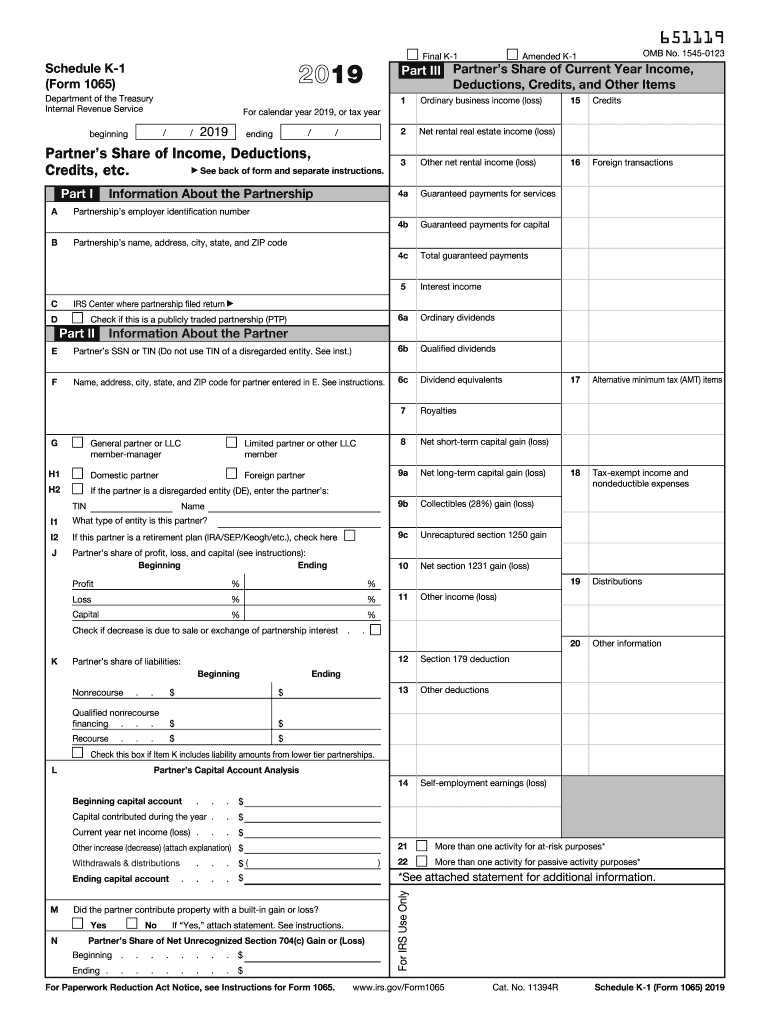

IRS 1065 Schedule K1 2019 Fill out Tax Template Online US Legal

IRS Form 8825 Rental Real Estate and Expenses of a Partnership

All about the 8825 Linda Keith CPA

IRS Form 8825 Fill Out and Sign Printable PDF Template signNow

Form 8825 2002 Fill out & sign online DocHub

Related Post: