Form 8821 Vs 2848

Form 8821 Vs 2848 - The designee may not substitute. January 2021) department of the treasury internal revenue service. Web solved•by intuit•33•updated october 26, 2022. Signing form 2848, power of attorney and declaration of. Other items you may find. Web the key difference is this: Unlike form 8821, form 2848 allows a licensed representative to engage with the irs on behalf of a taxpayer. Irs launches new option to submit forms 2848 and 8821 online. Web the difference between forms 2848 and 8821 is pretty obvious as 2848 authorizes an individual to represent you before the irs while 8821 doesn’t. In addition to tax attorneys and cpas,. Web form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. Unlike form 8821, form 2848 allows a licensed representative to engage with the irs on behalf of a taxpayer. Instructions for form 8821 ( print version pdf) recent developments. Here are some of the things that. The taxpayer and the tax. Irs form 8821 allows you to share specific tax information with a tax professional of your choice. Instructions for form 8821 ( print version pdf) recent developments. Web the key difference is this: Here are some of the things that. Below are solutions to frequently asked questions about entering form 2848, power of attorney and. Web you can securely submit online for your clients form 2848, power of attorney and declaration of representative and form 8821, tax information authorization. Web whereas form 2848 establishes representation, form 8821 is a request for authorization to review tax information. In addition to tax attorneys and cpas,. Go to www.irs.gov/form8821 for instructions and the. Web next, you can complete. Web next, you can complete form 8821, which allows the third party to receive tax information on your behalf. Here are some of the things that. The designee may not substitute. Web the key difference is this: Web the difference between forms 2848 and 8821 is pretty obvious as 2848 authorizes an individual to represent you before the irs while. Web form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The form 8821 does not permit representation of. Web the difference between forms 2848 and 8821 is pretty obvious as 2848 authorizes an individual to represent you before the irs while 8821 doesn’t. January 2021) department of the treasury internal revenue. In addition to tax attorneys and cpas,. January 2021) department of the treasury internal revenue service. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. Web the key difference is this: Irs form 8821 allows you to share specific tax information with a tax professional. Web whereas form 2848 establishes representation, form 8821 is a request for authorization to review tax information. Here are some of the things that. Other items you may find. The taxpayer and the tax professional must. Web form 8821 allows you to secure the same information from the irs that you typically obtain with a form 2848, power of attorney. Web the biggest difference between form 2848 and form 8821 is that the latter does not allow you to represent your client to the irs. Irs form 8821 allows you to share specific tax information with a tax professional of your choice. Here are some of the things that. Web the two forms — form 2848, “power of attorney and. Go to www.irs.gov/form8821 for instructions and the. The designee may not substitute. Web whereas form 2848 establishes representation, form 8821 is a request for authorization to review tax information. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. 25, 2021, the irs launched a new. Web while both form 8821 (tax information authorization) and form 2848 (power of attorney and declaration of representative) allow for the sharing of tax. The form 8821 does not permit representation of. Web use form 2848, power of attorney and declaration of representative, to authorize an individual to represent you before the irs. Below are solutions to frequently asked questions. Web form 2848 vs. Other items you may find. Here are some of the things that. The designee may not substitute. Web form 8821 allows you to secure the same information from the irs that you typically obtain with a form 2848, power of attorney. Web next, you can complete form 8821, which allows the third party to receive tax information on your behalf. Go to www.irs.gov/form8821 for instructions and the. Web while both form 8821 (tax information authorization) and form 2848 (power of attorney and declaration of representative) allow for the sharing of tax. Web the biggest difference between form 2848 and form 8821 is that the latter does not allow you to represent your client to the irs. The form 8821 does not permit representation of. Web you can securely submit online for your clients form 2848, power of attorney and declaration of representative and form 8821, tax information authorization. Web form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must. Web solved•by intuit•33•updated october 26, 2022. Web the key difference is this: Irs launches new option to submit forms 2848 and 8821 online. Signing form 2848, power of attorney and declaration of. Instructions for form 8821 ( print version pdf) recent developments. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. 25, 2021, the irs launched a new option to electronically submit third.Form 2848 Definition

Form 8821 IRS Mind

How to Fill Out and Submit Form 2848 & Form 8821 IRS Power of Attorney

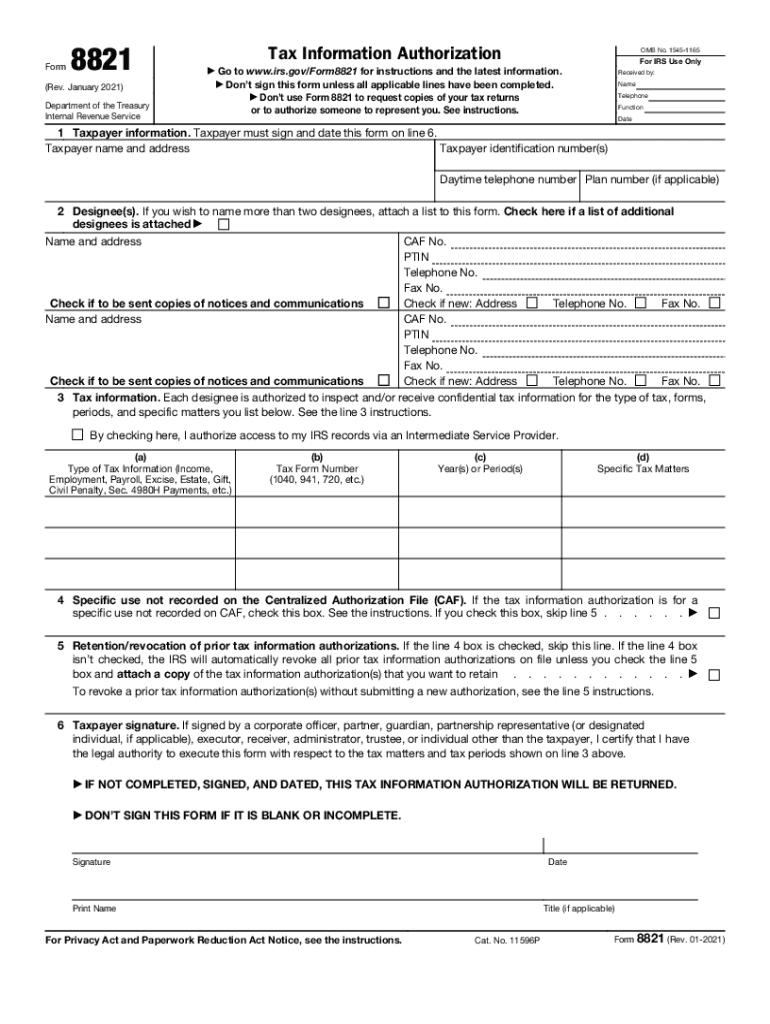

IRS Form 8821 Tax Information Authorization

New Draft Instructions For Form 2848 & 8821 Emphasize The Use of the

irs form 8821 Fill out & sign online DocHub

New IRS "Submit Forms 2848 and 8821 Online" offers contactfree

What is the Form 2848? Why Do I Need a Form 2848?

Form 2848 Instructions for IRS Power of Attorney Community Tax

Publication 947, Practice Before the IRS and Power of Attorney

Related Post:

:max_bytes(150000):strip_icc()/2848POAandDeclarationofRepresentative-1-dc7262d52b53477e9bd16828e7429381.png)