Form 8814 Vs 8615

Form 8814 Vs 8615 - Web for the child's return (form 8615), click tax on child's unearned income. If the qualified dividends and capital gain tax. Web if your child's interest, dividends, and other unearned income total more than $2,300, it may be subject to a specific tax on the unearned income of certain children. 1 if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have. Web this article will assist you with figuring out whether to use 8615 or form 8814 to report a child's income in the individual module of lacerte.form 8615, tax fo you. Web common questions about form 8615 and form 8814 below are answers to frequently asked questions about using form 8615 and 8814 in proseries basic and. If the parent files form 2555, see the instructions. Per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. However, the federal income tax on the child’s income, including qualified dividends and capital gain distributions, may be higher if this. Web form 4972, 8814, or. Web form 8615 must be filed for any child who meets all of the following conditions. Web for the child's return (form 8615), click tax on child's unearned income. Or any tax from recapture of an education credit. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. The child had more than $1,100 in. Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and dividends. Or any tax from recapture of an education credit. Web to make the election, complete and attach form(s) 8814 to your tax. For the parents' return (form 8814), click child's interest and dividend income on your return. Web for the child's return (form 8615), click tax on child's unearned income. Web continue with the interview process to enter your information. Web if your child's interest, dividends, and other unearned income total more than $2,300, it may be subject to a specific tax. If the qualified dividends and capital gain tax. Web form 8615 must be filed for any child who meets all of the following conditions. Web this article will assist you with figuring out whether to use 8615 or form 8814 to report a child's income in the individual module of lacerte.form 8615, tax fo you. If the child doesn't qualify. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and dividends. Web unearned income who's required. Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and dividends. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Web common questions about form 8615 and form 8814 below are. For the parents' return (form 8814), click child's interest and dividend income on your return. Treatment of unearned income click to expand unearned income unearned income is income gained from a. Web for the child's return (form 8615), click tax on child's unearned income. Web the choice to file form 8814 with the parents' return or form 8615 with the. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web this article will assist you with figuring out whether to use 8615 or form 8814 to report a child's income in the individual module of lacerte.form 8615, tax fo you. The form will help you. Web unearned income who's required to file form 8615? Web won’t have to file a return or form 8615. More details, see form 8814, parents’. The child had more than $2,200 of unearned income. Web form 8615 must be filed for any child who meets all of the following conditions. Per irs publication 929 tax rules for. The child had more than $2,200 of unearned income. Web continue with the interview process to enter your information. Web earning interest and dividends can result in your child needing to file a tax return for their investment income, however, and those amounts must be reported on. Web for the child's return (form. The form will help you calculate the correct tax rate based on the parent's income and tax liability. Per the irs instructions, the following notes will appear at the top of printed versions of these forms: For the parents' return (form 8814), click child's interest and dividend income on your return. Web unearned income who's required to file form 8615? More details, see form 8814, parents’. The child had more than $1,100 in. However, the federal income tax on the child’s income, including qualified dividends and capital gain distributions, may be higher if this. Form 8615 must be filed if the child meets all of the following conditions: Treatment of unearned income click to expand unearned income unearned income is income gained from a. If the parent files form 2555, see the instructions. Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and dividends. Web for the child's return (form 8615), click tax on child's unearned income. Web this article will assist you with figuring out whether to use 8615 or form 8814 to report a child's income in the individual module of lacerte.form 8615, tax fo you. Or any tax from recapture of an education credit. If the qualified dividends and capital gain tax. Web form 8615 must be filed for any child who meets all of the following conditions. Web for the child's return (form 8615), click tax on child's unearned income. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. The child had more than $2,200 of unearned income.Form 8615 Tax for Certain Children Who Have Unearned (2015

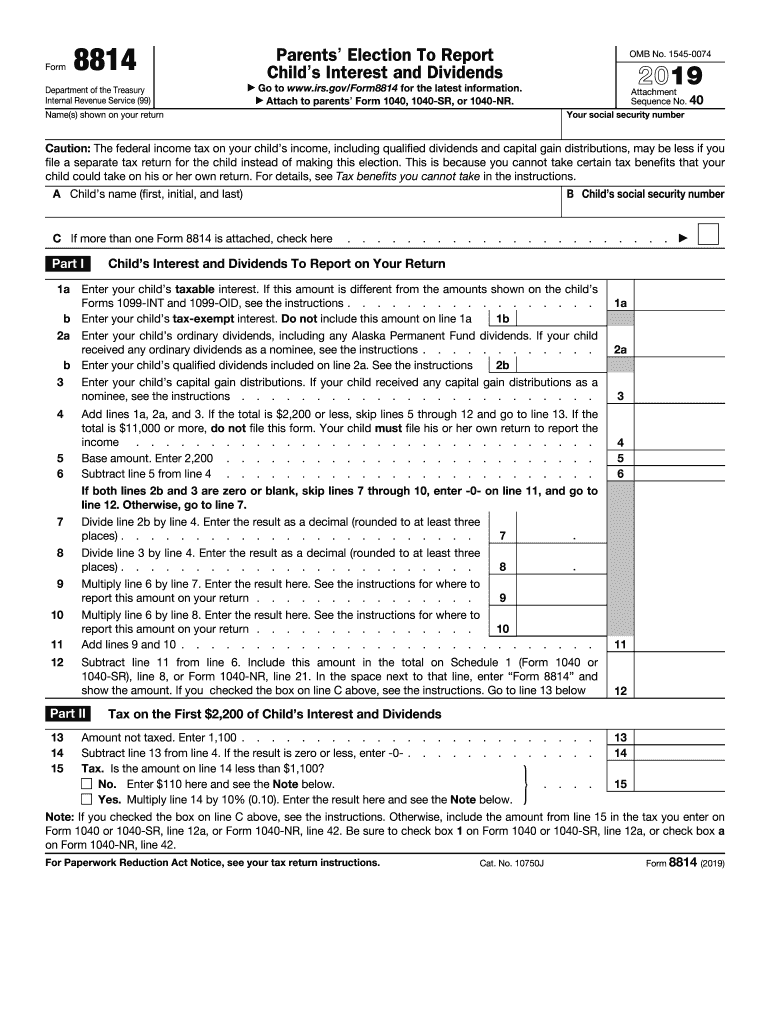

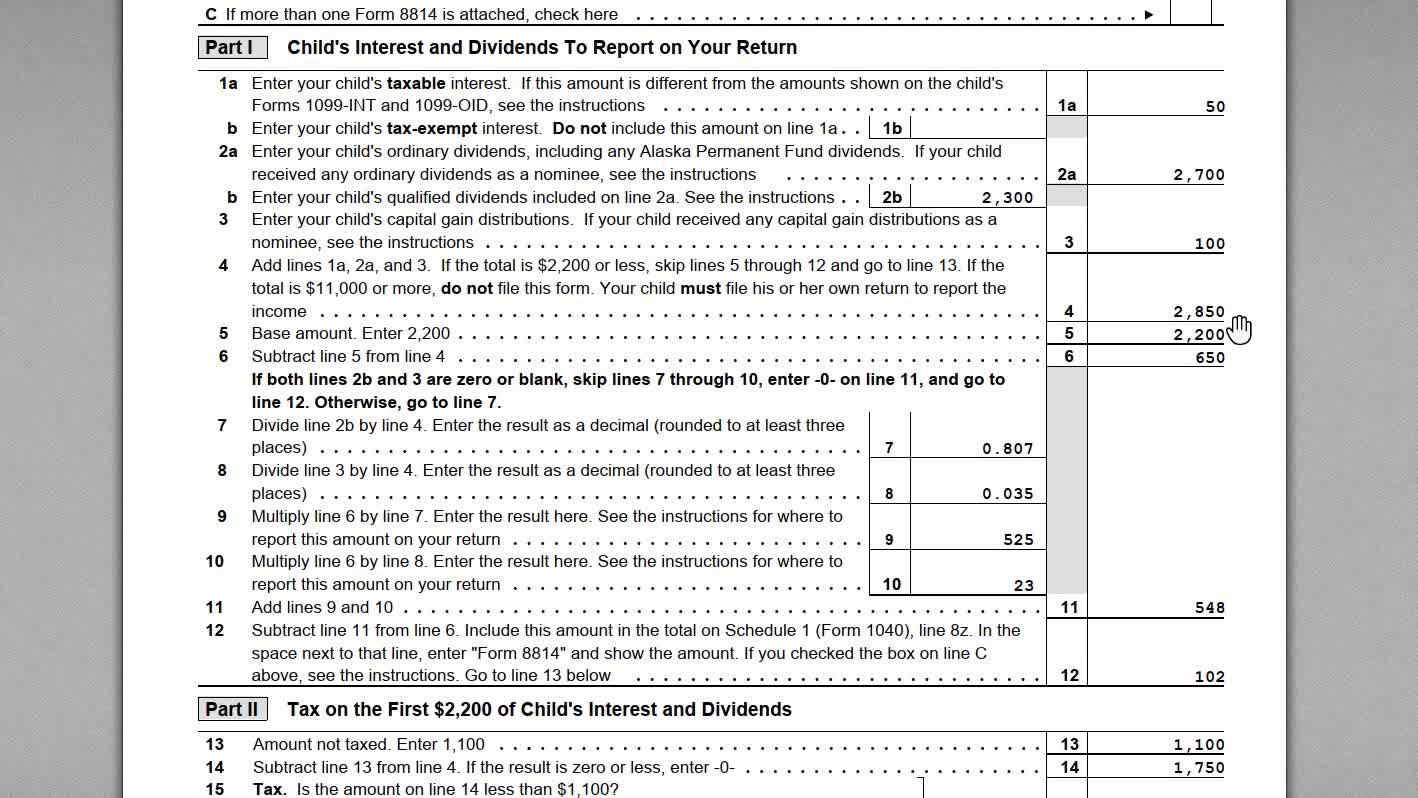

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

How to Fill Out IRS Form 8814 (Election to Report Child's Interest

Las instrucciones para el formulario 8615 del IRS Los Basicos 2023

Printable Pub 915 Worksheet 1 Free Printable Worksheets HD

8814 Form 2023

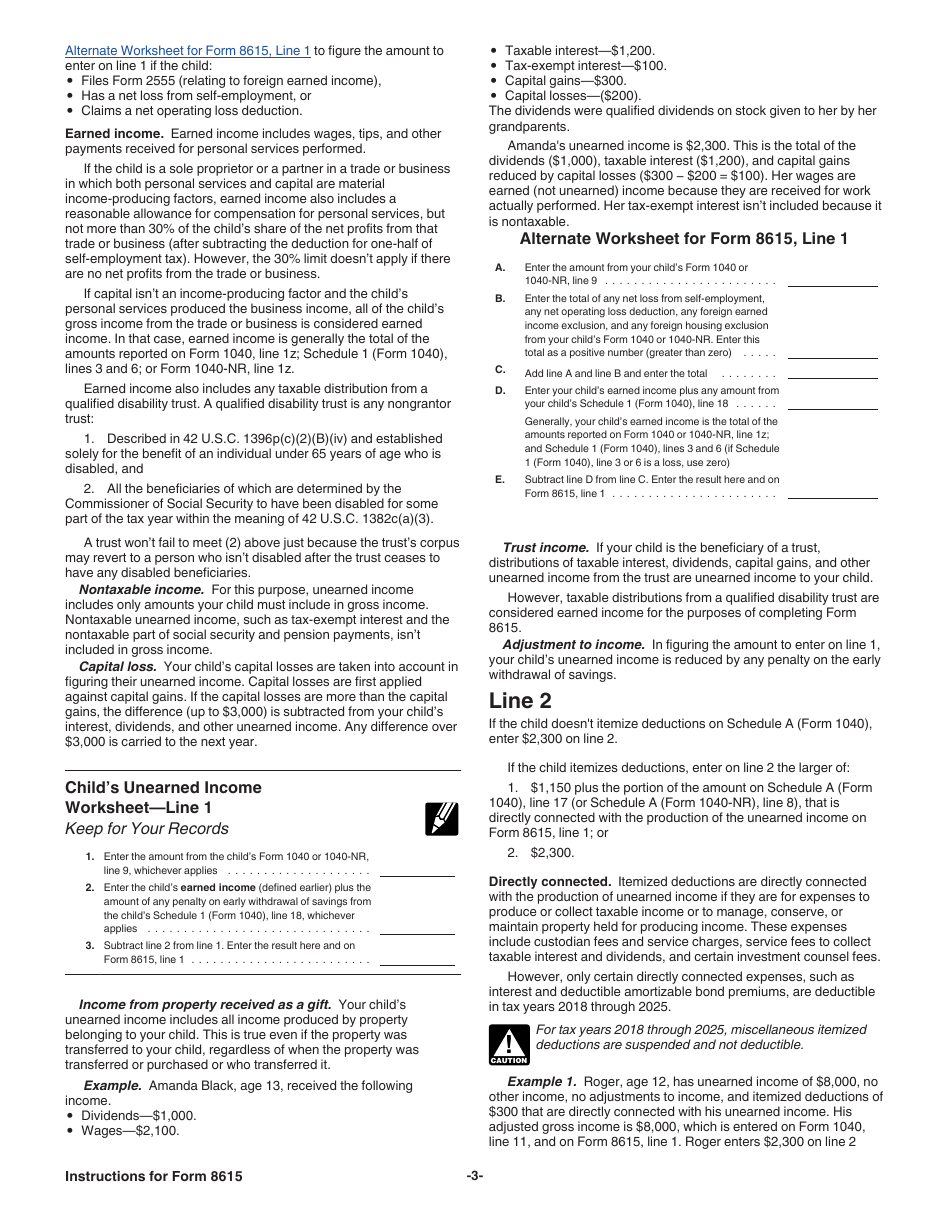

Instructions for IRS Form 8615 Tax For Certain Children Who Have

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Form 8615 Worksheet Math Worksheets 4 Kids

Related Post: