Form 8805 Instructions

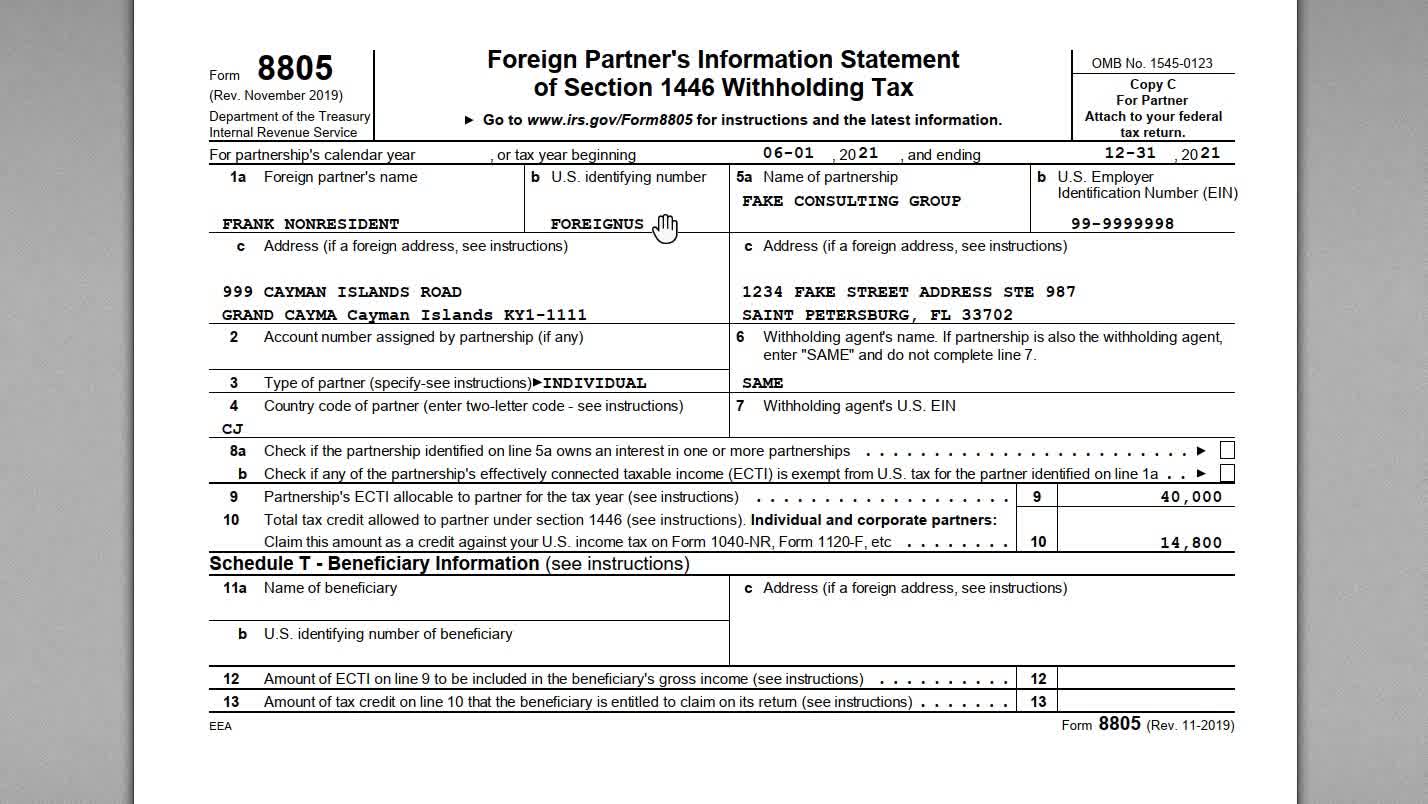

Form 8805 Instructions - This article will help you generate and file. Get ready for tax season deadlines by completing any required tax forms today. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web the form 8805 should be attached to the u.s. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Ad download or email irs 8805 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Dive into the specifics, withholding rates, compliance, and best. Web form 8805, foreign partner’s information statement of section 1446 withholding tax is a source document showing a foreign partner's effectively connected taxable income. About form 8805, foreign partner's information statement of section 1446. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit. Complete, edit or print tax forms instantly. Dive into the specifics, withholding rates, compliance, and best. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so. Web form 8805 is an internal revenue service (irs) tax form that is used to report income allocated to foreign partners. Web amount of ecti on line 9 to be included in the beneficiary’s gross income (see instructions). Web form 8805, foreign partner's information statement of section 1446 withholding tax. Get ready for tax season deadlines by completing any required. Person's income tax return to claim a withholding credit. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in. Web form 8805 is an internal revenue service (irs) tax form that is used to report income allocated to foreign partners. Web. This form must be completed by us. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax. A copy of this form must be. The foreign trust or estate must. Amount of tax credit on line 10 that the beneficiary. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit. Web up to $40 cash back form 8805 foreign partner's name foreign partner's information statement of section 1446 withholding tax omb no. Web the form 8805 should be attached to the u.s. Amount of. About form 8805, foreign partner's information statement of section 1446. File form 8804 by the 15th day of the 3rd month (4th month. Web this form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's tax year. Get ready for tax season deadlines by. Web generating forms 8804 and 8805 for a partnership return in lacerte. Solved•by intuit•30•updated may 23, 2023. The foreign trust or estate must. Person's income tax return to claim a withholding credit. Ad download or email irs 8805 & more fillable forms, register and subscribe now! Web generating forms 8804 and 8805 for a partnership return in lacerte. Amount of tax credit on line 10 that the beneficiary is entitled to. A copy of this form must be. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated. Web comprehensive guide on tax forms 8805 & 8804 for partnerships with foreign partners. The foreign trust or estate must. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income (ecti) allocable to foreign partners (as defined in. File form 8804 by the 15th day of the 3rd month. Dive into the specifics, withholding rates, compliance, and best. Form 8813, partnership withholding tax payment voucher (section. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax. November 2019) foreign partner’s information statement of section 1446 withholding tax department of. A copy of this form must be. File form 8804 by the 15th day of the 3rd month (4th month. Web this form is used to show the amount of effectively connected taxable income (ecti) and the total tax credit allocable to the foreign partner for the partnership's tax year. Web form 8805, foreign partner’s information statement of section 1446 withholding tax is a source document showing a foreign partner's effectively connected taxable income. Web a form 8805 for each foreign partner must be attached to form 8804, whether or not any withholding tax was paid. Web generating forms 8804 and 8805 for a partnership return in lacerte. Amount of tax credit on line 10 that the beneficiary is entitled to. About form 8805, foreign partner's information statement of section 1446. Web form 8805, a foreign partner’s information statement of section 1446 withholding tax is used to show the amount of ecti and the total tax credit. Form 8813, partnership withholding tax payment voucher (section. Solved•by intuit•30•updated may 23, 2023. Web we last updated the foreign partner's information statement of section 1446 withholding tax in february 2023, so this is the latest version of form 8805, fully updated for tax. Web form 8805 is an internal revenue service (irs) tax form that is used to report income allocated to foreign partners. Ad download or email irs 8805 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web use forms 8804, 8805, and 8813 to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. This form must be completed by us. Web amount of ecti on line 9 to be included in the beneficiary’s gross income (see instructions). Web the form 8805 should be attached to the u.s.Form 8805 Edit, Fill, Sign Online Handypdf

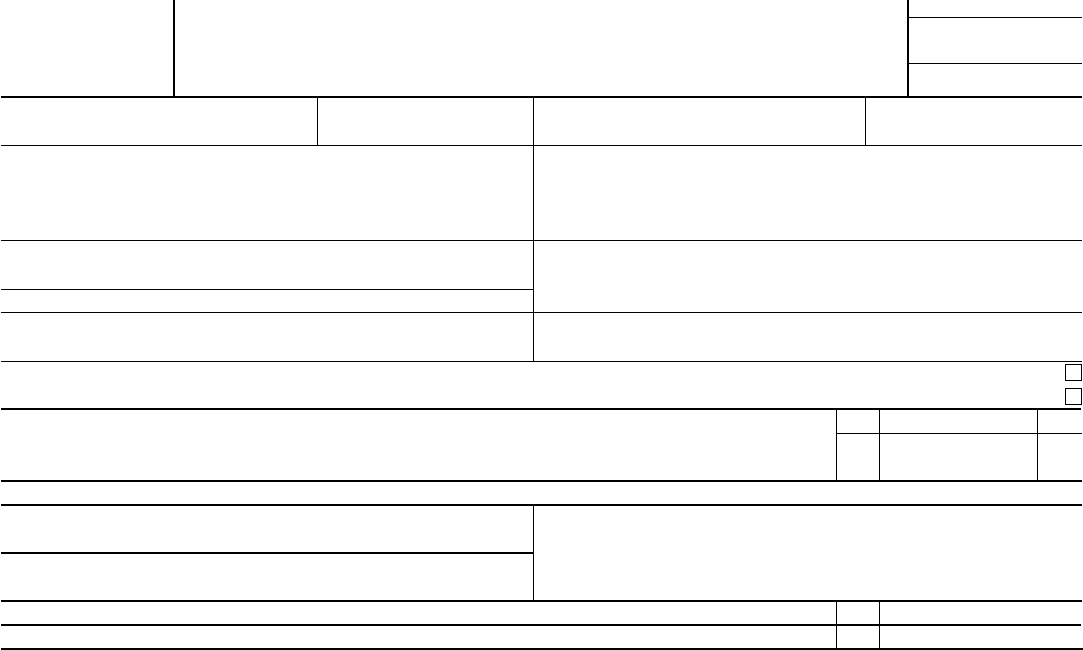

Fillable Form 8805 Foreign Partner'S Information Statement Of Section

Form 8805 Foreign Partner's Information Statement of Section 1446 Wi…

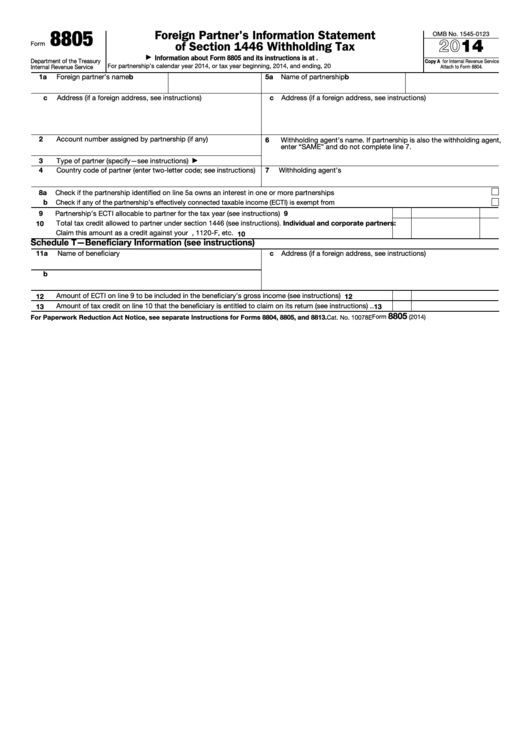

Instructions For Forms 8804, 8805, And 8813 2017 printable pdf download

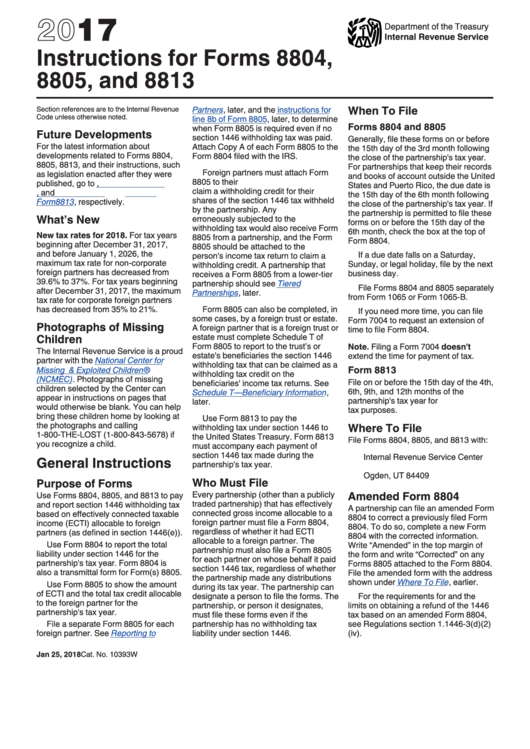

Form 8805 Foreign Partner'S Information Statement Of Section 1446

How to Fill Out IRS Form 8804 & 8805 for Foreign Partners

Understanding Key Tax Forms What investors need to know about Schedule

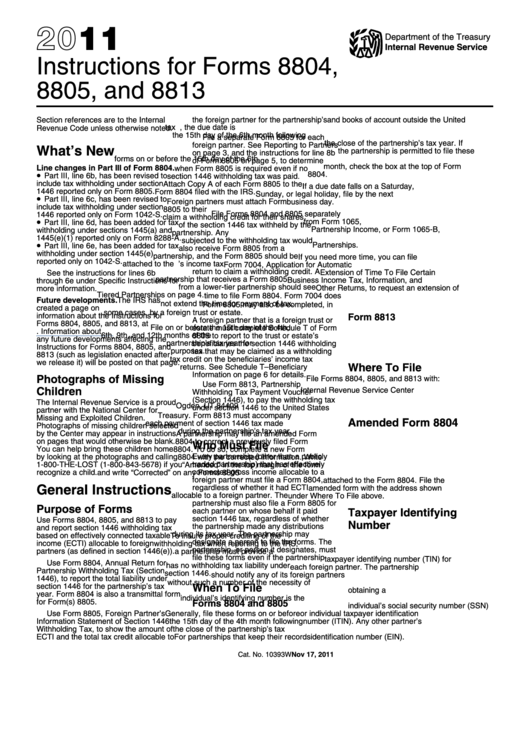

Instructions For Forms 8804, 8805, And 8813 2011 printable pdf download

Understanding Key Tax Forms What investors need to know about Schedule

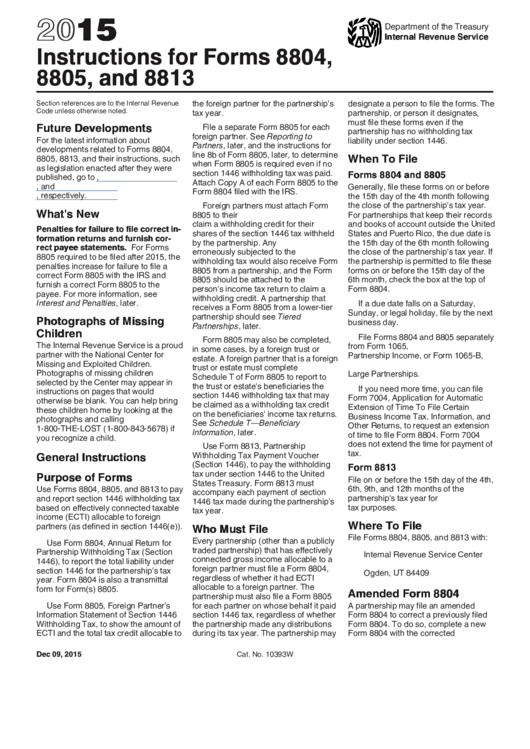

Instructions For Forms 8804, 8805, And 8813 (2015) printable pdf download

Related Post: