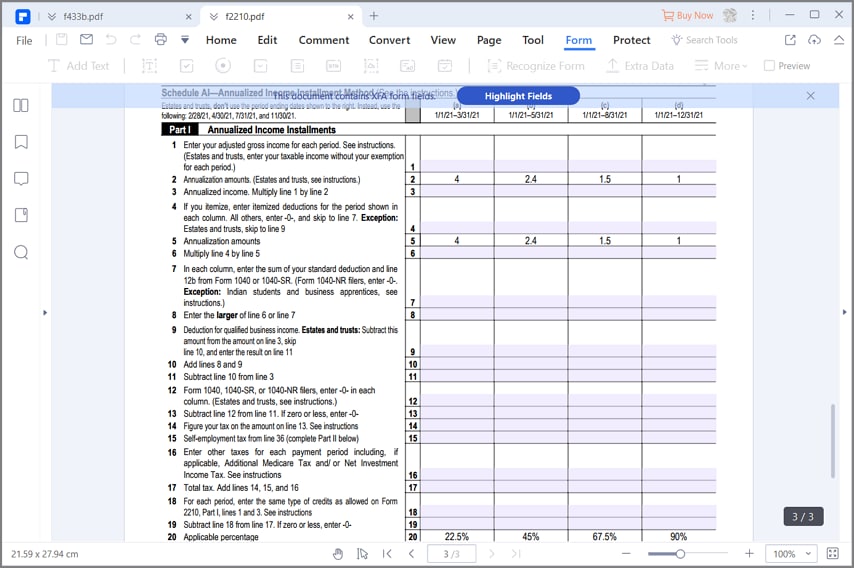

Form 2210 Schedule Ai

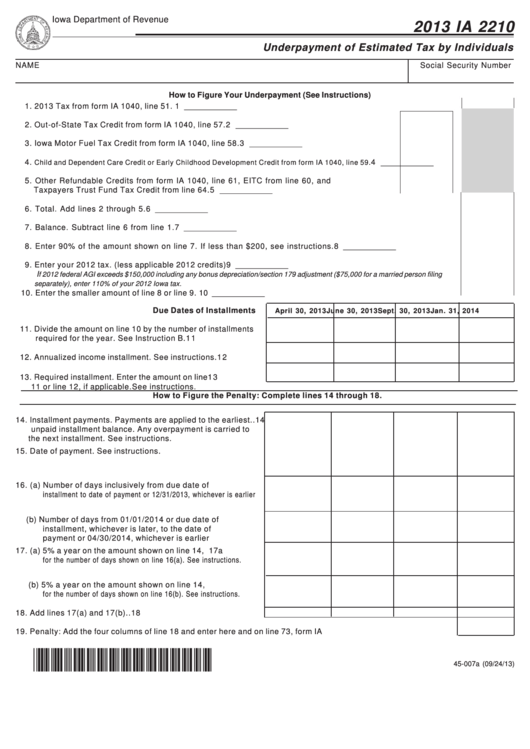

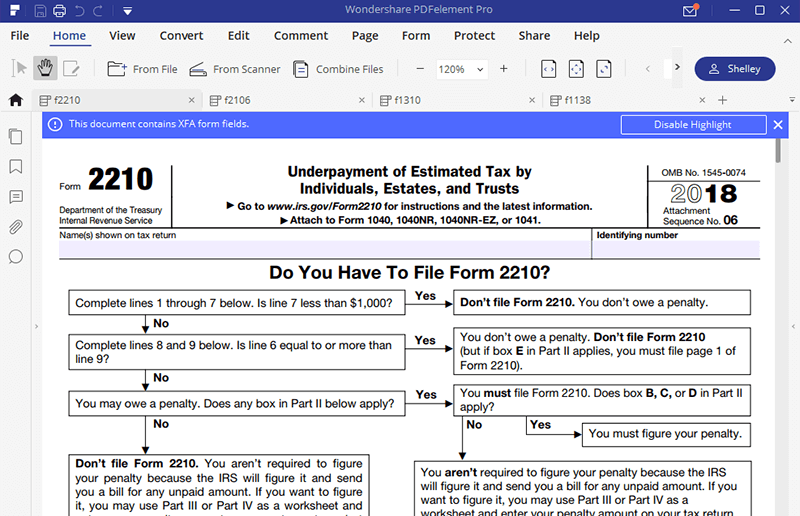

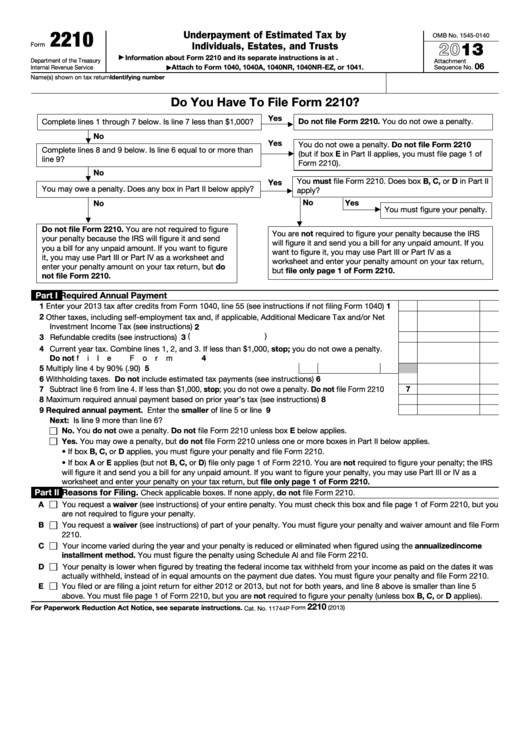

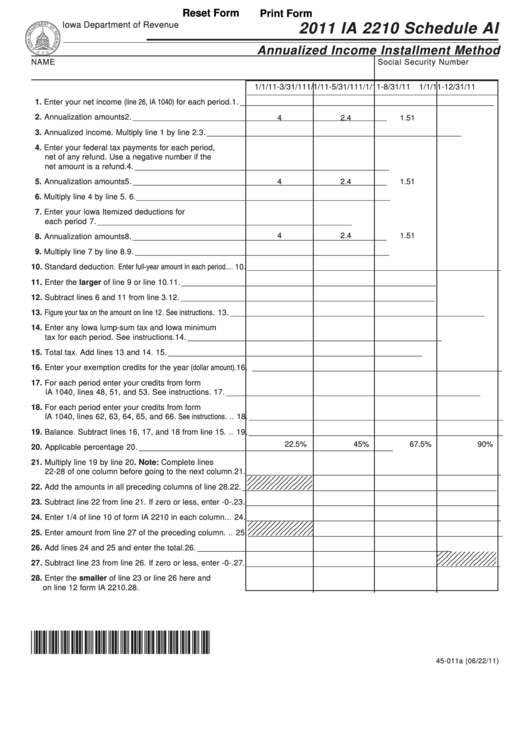

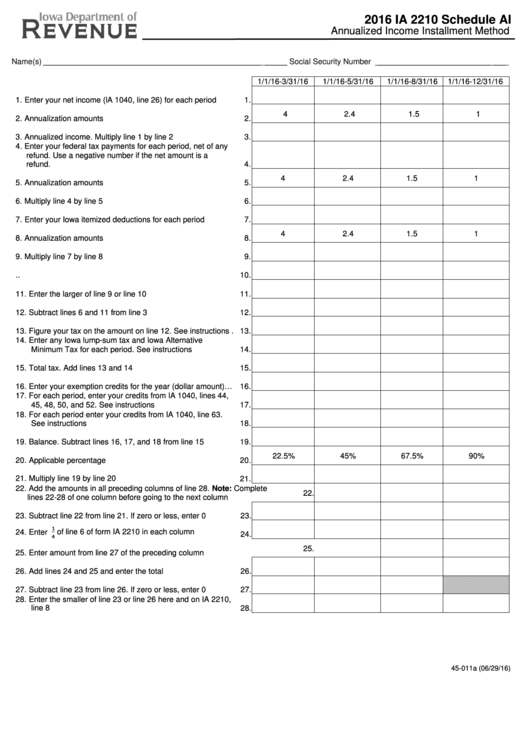

Form 2210 Schedule Ai - Upload, modify or create forms. Department of the treasury internal revenue service. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. And complete schedule ai and part iii, section a. This article is a guide to completing form 2210 in the taxslayer pro program. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Try it for free now! Complete, edit or print tax forms instantly. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Use form ftb 5805, underpayment of estimated tax by individuals and fiduciaries, to see if you owe a penalty for underpaying your estimated tax and, if you. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Upload, modify or create forms. Web there. Upload, modify or create forms. Ad access irs tax forms. This question is asking for the self employment income of the taxpayer. Upload, modify or create forms. Web payment due dates section a—figure your underpayment (a) (b) (c) 4/15/22 6/15/22 (d) 1/15/23 9/15/22 10 required installments. Upload, modify or create forms. If you use schedule ai for any payment due date, you must use it for all. This question is asking for the self employment income of the taxpayer. Complete, edit or print tax forms instantly. Underpayment of estimated tax by individuals, estates, and trusts. The form doesn't always have to be. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Enter the penalty. Check the applicable box(es) in part ii; Use form ftb 5805, underpayment of estimated tax by individuals and fiduciaries, to see if you owe a penalty for underpaying your estimated tax and, if you. Your income varies during the year. Section references are to the internal revenue code unless otherwise noted. Underpayment of estimated tax by individuals, estates, and trusts. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Ad register and subscribe now to work on your irs form 2210 & more fillable forms. Section references are to the internal revenue. Web use schedule ai to figure the required installments to enter on form 2210, part iii, line 10. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. This question is asking for the self employment income of the taxpayer. Use form 2210 to determine the amount of underpaid estimated tax and resulting. Complete, edit or print tax forms instantly. Let’s start with part i, below. In order to make schedule ai available, part ii of form 2210 must be entered. If box c in part ii applies, enter the amounts. Web there are 3 parts to this form (4, if you complete schedule ai, for computing your tax obligations using the annual. This article is a guide to completing form 2210 in the taxslayer pro program. This question is asking for the self employment income of the taxpayer. Department of the treasury internal revenue service. Ad access irs tax forms. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Enter the penalty on form 2210,. Underpayment of estimated tax by individuals, estates, and trusts. Web use schedule ai to figure the required. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web use schedule ai to figure the required installments to enter on form 2210, part iii, line 10. If you use schedule ai for any payment due date, you must use it for all. Underpayment of estimated tax by individuals, estates, and trusts. In order to complete schedule ai in the taxact program, you first need to complete the. Web complete schedule ai, part i (and part ii, if necessary). Department of the treasury internal revenue service. This article is a guide to completing form 2210 in the taxslayer pro program. Ad register and subscribe now to work on your irs form 2210 & more fillable forms. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web payment due dates section a—figure your underpayment (a) (b) (c) 4/15/22 6/15/22 (d) 1/15/23 9/15/22 10 required installments. Upload, modify or create forms. Complete, edit or print tax forms instantly. Ad access irs tax forms. Try it for free now! Use form ftb 5805, underpayment of estimated tax by individuals and fiduciaries, to see if you owe a penalty for underpaying your estimated tax and, if you. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure. Department of the treasury internal revenue service. Let’s start with part i, below.Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

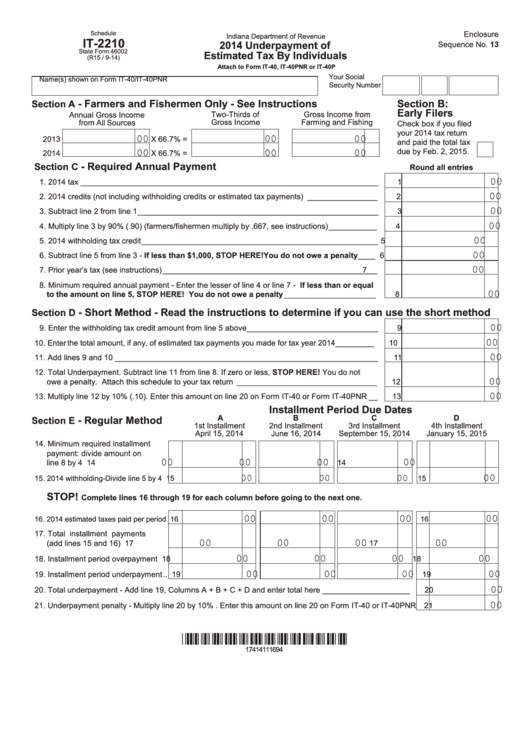

Fillable Schedule It2210 Underpayment Of Estimated Tax By

IRS Form 2210 Schedule AI walkthrough YouTube

IRS Form 2210Fill it with the Best Form Filler

Instructions For Form 2210 Underpayment Of Estimated Tax By

Remplir le formulaire 2210 de l'IRS avec le meilleur remplisseur

Instructions For Form 2210 Underpayment Of Estimated Tax By

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Fillable Schedule Ai (Form Ia 2210) Annualized Installment

Fillable Form Ia 2210 Schedule Ai Annualized Installment

Related Post: