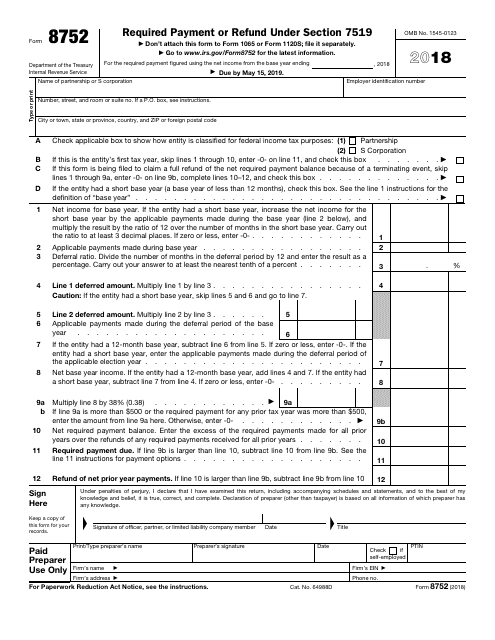

Form 8752 Irs

Form 8752 Irs - Net income for base year. Open form follow the instructions. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web form 8752 ' do not attach this form to form 1065 or form 1120s; Department of the treasury internal revenue service for the applicable election year. This form is used to determine if you're due a refund, or have to make a payment on the tax benefits you receive from using a fiscal tax year. You can’t use the 2020 form 8752 for your base year ending in 2021. Open form follow the instructions. Get ready for tax season deadlines by completing any required tax forms today. Report the payment required under section 7519 or to obtain a refund of net prior year payments. Web form 8752 ' do not attach this form to form 1065 or form 1120s; Easily sign the form with your finger. Open form follow the instructions. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Easily sign the form with your finger. Department of the treasury internal revenue service. The form is used for. Web form 8752 ' do not attach this form to form 1065 or form 1120s; The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Excess required payments over refunds received (for all prior years). Easily sign the form with your finger. Required payment for any prior tax year was more than $500. Ad access irs tax forms. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Required payment for any prior tax year was more than $500. Ad we help get taxpayers relief from owed irs back taxes. Report the payment required under section 7519 or to obtain a refund of net prior year payments. Get ready for tax season deadlines by completing any required tax forms today. The irs asks fiscal year, s corporation s,. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web form 8752 is a federal other form. Web department of the treasury. Complete, edit or print tax forms instantly. Send filled & signed form or save. Section 7519 payments are required of. Required payment or refund under section 7519. Department of the treasury internal revenue service. Web department of the treasury. Complete, edit or print tax forms instantly. Web department of the treasury. This form is used to determine if you're due a refund, or have to make a payment on the tax benefits you receive from using a fiscal tax year. Web partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior. Web department of the treasury. Required payment for any prior tax year was more than $500. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Web. Section 7519 payments are required of. Web form 8752 ' do not attach this form to form 1065 or form 1120s; Required payment or refund under section 7519. Ad access irs tax forms. You can’t use the 2020 form 8752 for your base year ending in 2021. Web corporations use form 8752 to figure and. Easily sign the form with your finger. Net income for base year. Complete, edit or print tax forms instantly. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Required payment or refund under section 7519. Get ready for tax season deadlines by completing any required tax forms today. First time i completed this form 8752 and in looking at the prior cpas completion of it, i am baffled. Send filled & signed form or save. Easily sign the form with your finger. The form is used for. Ad we help get taxpayers relief from owed irs back taxes. Web corporations use form 8752 to figure and. Report the payment required under section 7519 or to obtain a refund of net prior year payments. Web form 8752, required payment or refund under section 7519, is a tax form used by partnerships to report required payments or refunds related to the disposition of. An entity without a principal office or agency or principal place of business in the united. Complete, edit or print tax forms instantly. Web department of the treasury. Easily sign the form with your finger. Web form 8752 ' do not attach this form to form 1065 or form 1120s; Open form follow the instructions. Section 7519 payments are required of. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020.3.11.249 Processing Form 8752 Internal Revenue Service

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

3.12.249 Processing Form 8752 Internal Revenue Service

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

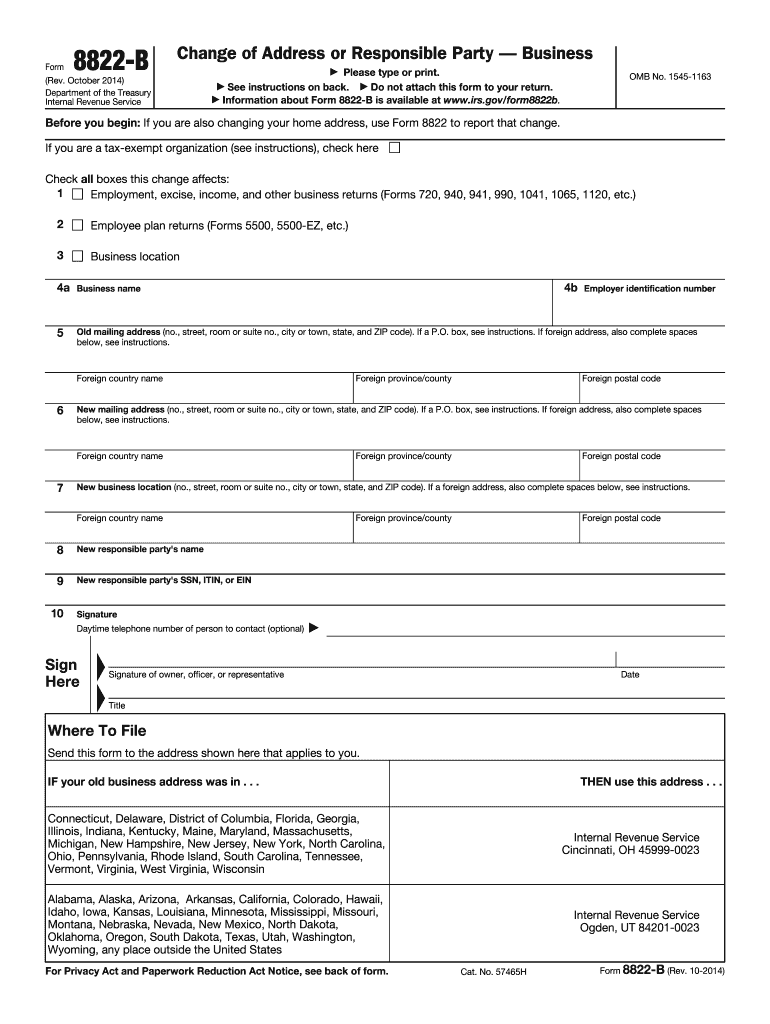

Edward Jones Revenue Internal Revenue Change Of Address Form

2014 Form IRS 8822BFill Online, Printable, Fillable, Blank pdfFiller

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

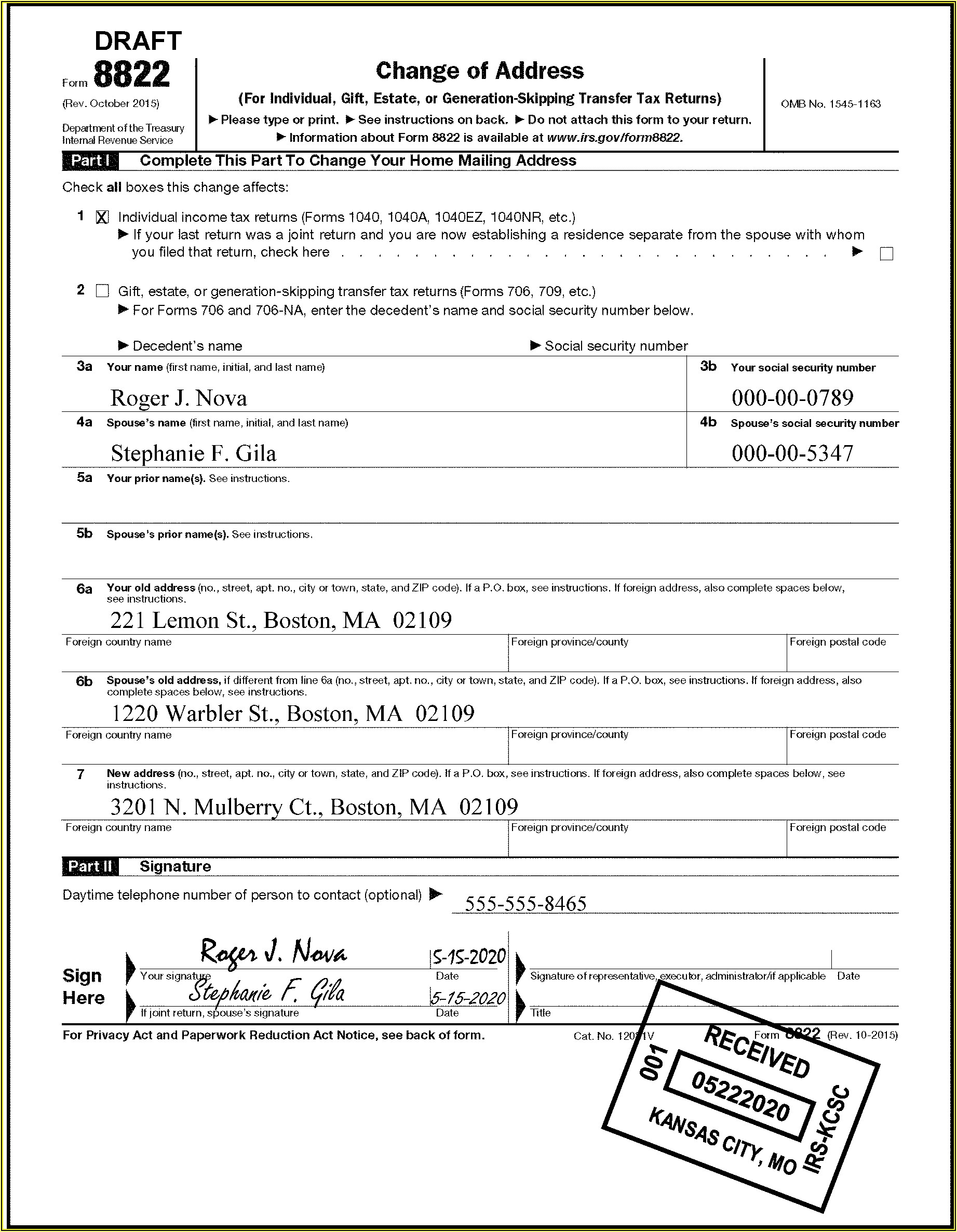

Downloadable Irs Form 8822 Form Resume Examples WjYDkqk9KB

3.11.249 Processing Form 8752 Internal Revenue Service

Related Post: