Form 8621 Turbotax

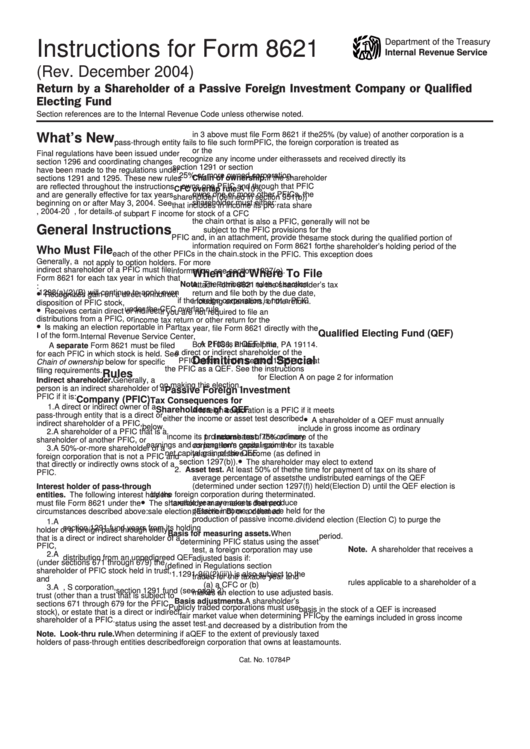

Form 8621 Turbotax - Web attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including extensions, of the return at. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms,. However for 2019 taxes, turbotax is not. Shareholder to make the election by attaching the. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web common questions on form 8621 in proconnect. You can own pfics directly, or you can own them indirectly. Web when you print the return, do not send the form(s) 8621 with the combined amounts to the irs. Web you are correct that no version of turbotax supports irs form 8621, information return by a shareholder of a passive foreign investment company or. Ad webshopadvisors.com has been visited by 100k+ users in the past month Unlike the fbar for example, the form 8621 is very complex —. Learn the basics of pfic reporting to the irs on form 8621 tax returns for pfic. Web form 8621 is used to report information about pfics (passive foreign investment companies) to the irs. Web common questions on form 8621 in proconnect. And (4) allow a u.s. The form 8621 (pfic)tax filing & reporting requirements 2022. The regulations clarify that such individual should file form 8621 as. Web when you print the return, do not send the form(s) 8621 with the combined amounts to the irs. Web how do i know if i need to file form 8621? Person that is a direct or indirect shareholder of. Information return by a shareholder of a passive foreign investment company or. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing. Ad import tax data online in no time with our easy to use simple tax software. The regulations clarify that such individual should file form 8621 as. Learn the basics. Over 90 million taxes filed with taxact. And (4) allow a u.s. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing. Web income from foreign mutual funds, also known as passive foreign investment firms (pfics), is reported on tax form 8621, information return by a shareholder of a passive foreign. Web. This article will give instructions for generating form 8621 information return by a shareholder of a passive. You can own pfics directly, or you can own them indirectly. Ad import tax data online in no time with our easy to use simple tax software. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing. The regulations clarify that such individual should file form 8621 as. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. My 2018 taxes were done by cpa and he has filed this form. Ad import tax data online in no time with our easy to use simple tax software. Unlike the fbar for example, the form 8621 is very complex —. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. And (4) allow a u.s. (new) passive investment reporting rules 2021. You can own pfics directly, or you can own them indirectly. Over 90 million taxes filed with taxact. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing. Web common questions on form 8621 in proconnect. Information return by a shareholder of a passive foreign investment company or. Over 90 million taxes filed with taxact. Web form 8621 can still be required even if the individual is not required to file a us income tax return for the year. Web when you print the return, do not send the form(s) 8621 with the combined amounts to the irs. Person that is a direct or indirect shareholder of a. Golding & golding, international tax lawyers. Web when you print the return, do not send the form(s) 8621 with the combined amounts to the irs. Instead, replace the form(s) with the printed copies of each individual form. Web attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Instead, replace the form(s) with the printed copies of each individual form. (new) passive investment reporting rules 2021. Web you are correct that no version of turbotax supports irs form 8621, information return by a shareholder of a passive foreign investment company or. Web form 8621 is used to report information about pfics (passive foreign investment companies) to the irs. Ad import tax data online in no time with our easy to use simple tax software. Web attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due date, including extensions, of the return at. Over 90 million taxes filed with taxact. Web common questions on form 8621 in proconnect. Start basic federal filing for free. Ad webshopadvisors.com has been visited by 100k+ users in the past month Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms,. Shareholder to make the election by attaching the. Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year under the following five circumstances if the u.s. Learn the basics of pfic reporting to the irs on form 8621 tax returns for pfic. Web form 8621 can still be required even if the individual is not required to file a us income tax return for the year. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing. However for 2019 taxes, turbotax is not. Web how do i know if i need to file form 8621? Golding & golding, international tax lawyers. Web turbotax does not include form 8621 return by a shareholder of a passive foreign investment company or qualified electing fund so you're not able to attach it to.Instructions For Form 8621 (Rev.december 2004) printable pdf download

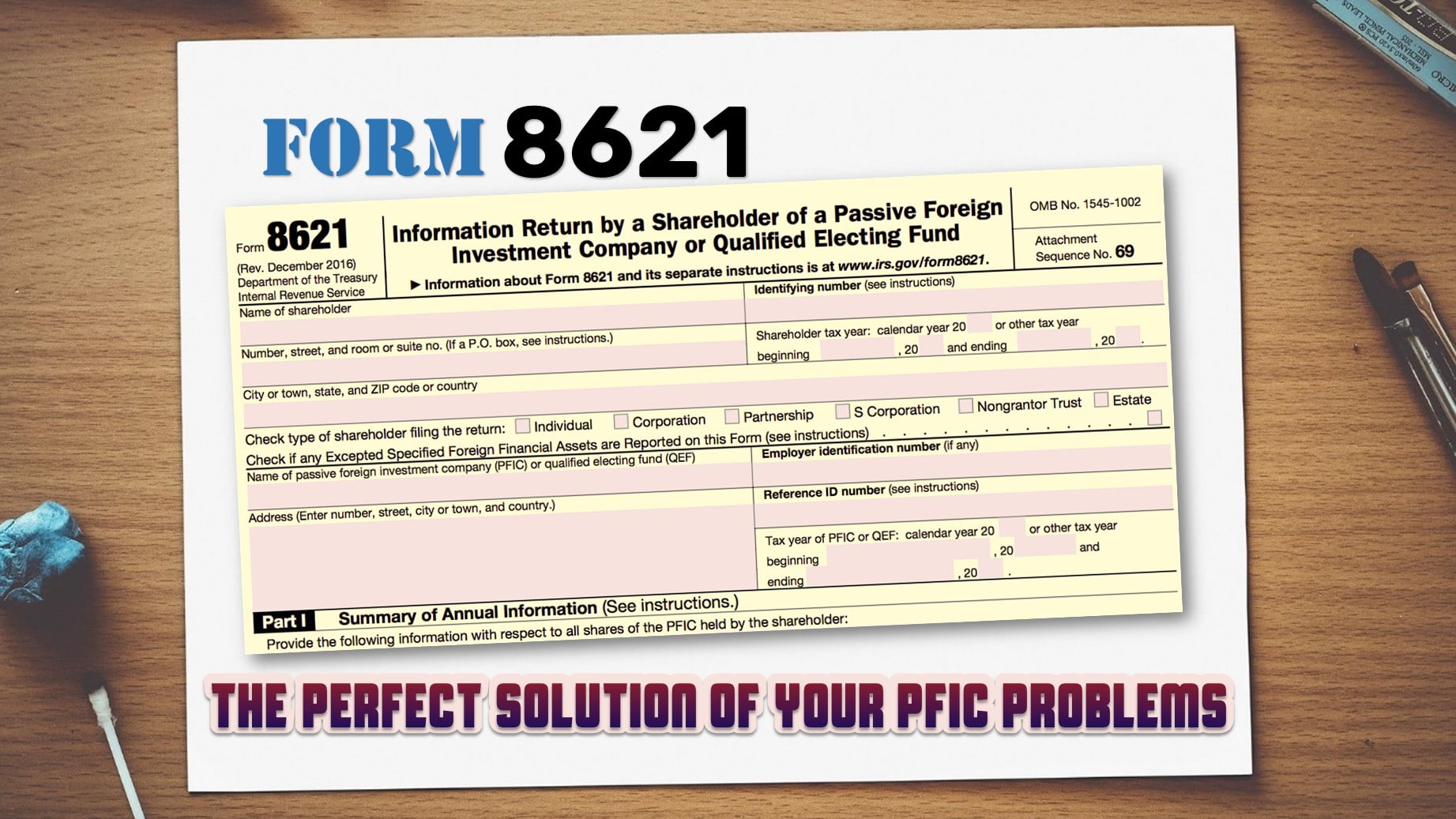

Need to prepare Form 8621 for your PFICs? Expat Tax Tools' Form 8621

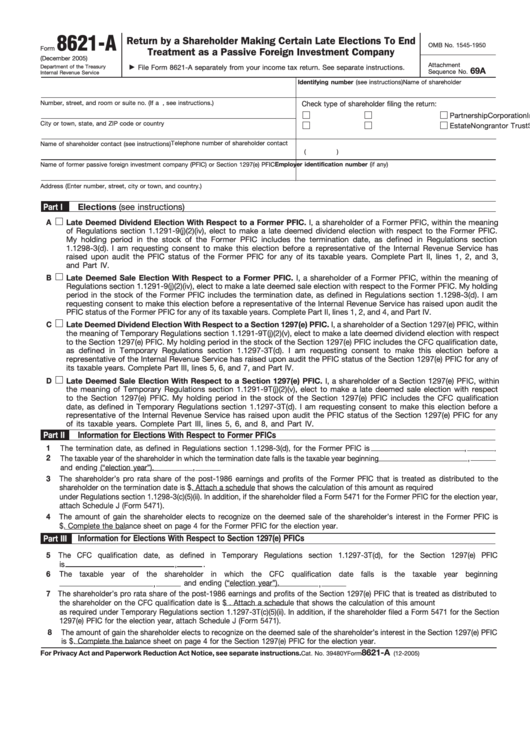

Fillable Form 8621A Return By A Shareholder Making Certain Late

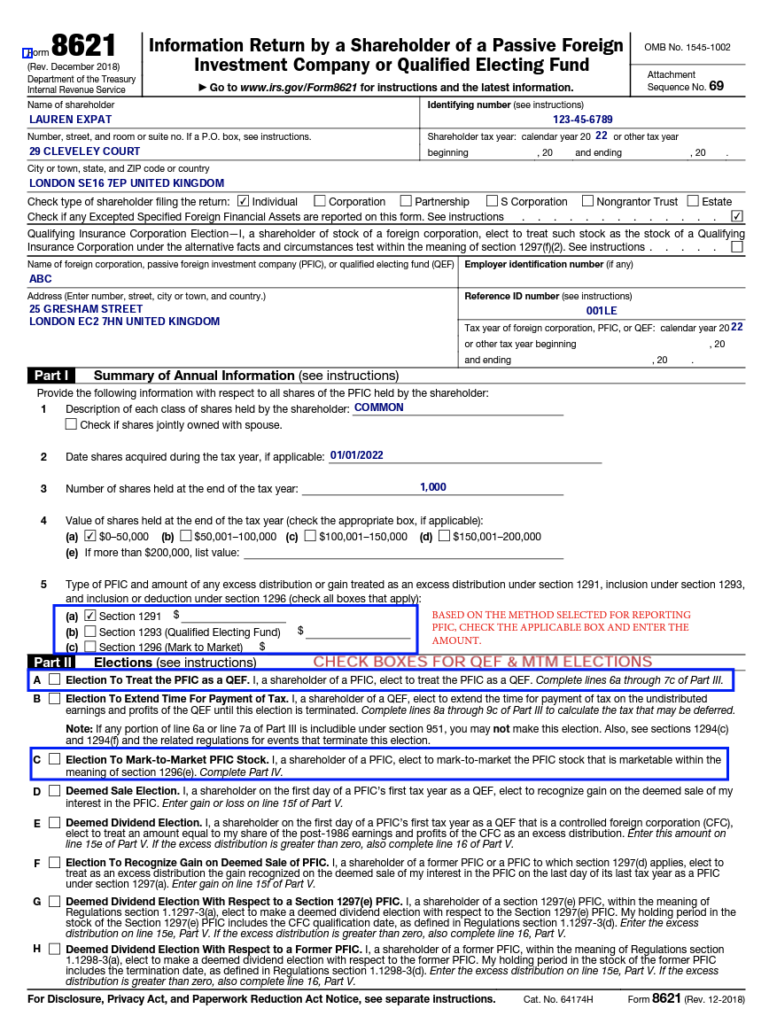

Form 8621 for American Expatriates and Passive Foreign Investment Companies

Form 8621A Return by a Shareholder Making Certain Late Elections to

Top 16 Form 8621 Templates free to download in PDF format

Form 8621 Instructions 2020 2021 IRS Forms

5 [FREE] REFERENCE ID NUMBER FORM 8621 PDF PRINTABLE DOCX DOWNLOAD ZIP

Form 8621 pdf Fill out & sign online DocHub

All about Form 8621 SDG Accountant

Related Post:

![5 [FREE] REFERENCE ID NUMBER FORM 8621 PDF PRINTABLE DOCX DOWNLOAD ZIP](https://www.formsbirds.com/formimg/tax-support-document/8326/form-8621-information-return-by-a-shareholder-of-a-passive-foreign-investment-company-2014-l2.png)