Form 8582 Cr

Form 8582 Cr - For more information on passive. Web if losses from passive activities are involved, form 8582 is produced when necessary to limit losses based on irs guidelines. This form also allows the taxpayer to report the. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Form 8582 is used by. Who must file form 8582 is filed by individuals, estates, and trusts who. Click forms in the header. Web open your turbotax return. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. This form also allows the taxpayer to report the. You can download or print. For more information on passive. Refer to the appropriate activity below. Type 8582 in the type a form name box, press. For example, if the taxpayer's magi is too high, the. Click forms in the header. This form also allows the taxpayer to report the. Web passive activity rules must use form 8810, corporate passive activity loss and credit limitations. Web information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how to file. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Click forms in the header. This article will help you: Form 8582 is used by. Web passive activity rules must use form 8810, corporate passive activity loss and credit limitations. Refer to the appropriate activity below. This form also allows the taxpayer to report the. Type 8582 in the type a form name box, press. This article will help you: Prior year unallowed commercial revitalization deduction. December 2019) department of the treasury internal revenue service. Refer to the appropriate activity below. Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. Web information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how to file. This article will help you: Prior year unallowed commercial revitalization deduction. This article will help you: Web irs form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. What is the form used for? Web if losses from passive activities are involved, form 8582 is produced when necessary to limit losses based on irs guidelines. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. December 2019) department of the treasury internal revenue service. Click forms in the header. For example, if the taxpayer's magi is too high, the. Web open your turbotax return. What is the form used for? For example, if the taxpayer's magi is too high, the. This form also allows the taxpayer to report the. 03 export or print immediately. Web 01 fill and edit template. Web information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how to file. This article will help you: What is the form used for? Web if losses from passive activities are involved, form 8582 is produced when necessary to limit losses based on irs guidelines. Ad download or email irs 8582 & more. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how to file. What is the form used for? Refer to the appropriate activity below. Department. Click forms in the header. Prior year unallowed commercial revitalization deduction. Who must file form 8582 is filed by individuals, estates, and trusts who. You can download or print. Refer to the appropriate activity below. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web 01 fill and edit template. This article will help you: Type 8582 in the type a form name box, press. This form also allows the taxpayer to report the. December 2019) department of the treasury internal revenue service. Click open form above the forms in my return section. What is the form used for? For more information on passive. Form 8582 is used by. Department of the treasury internal revenue service (99) passive activity loss limitations. Department of the treasury internal revenue service. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Figure the amount of any passive activity. 03 export or print immediately.Instructions for Form 8582CR (12/2019) Internal Revenue Service

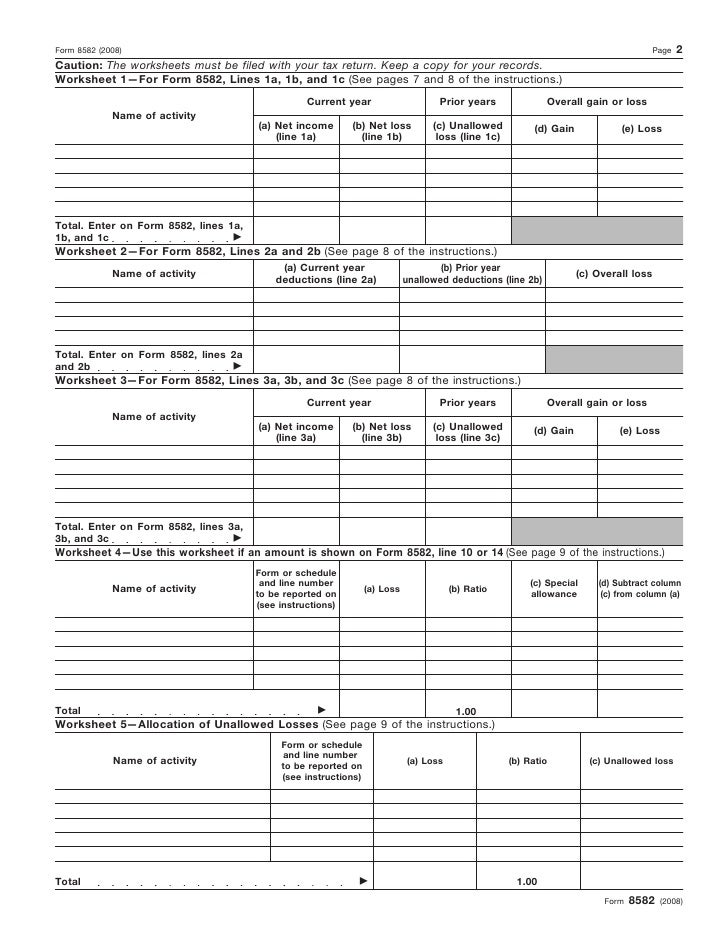

Form 8582 Passive Activity Loss Limitations (2014) Free Download

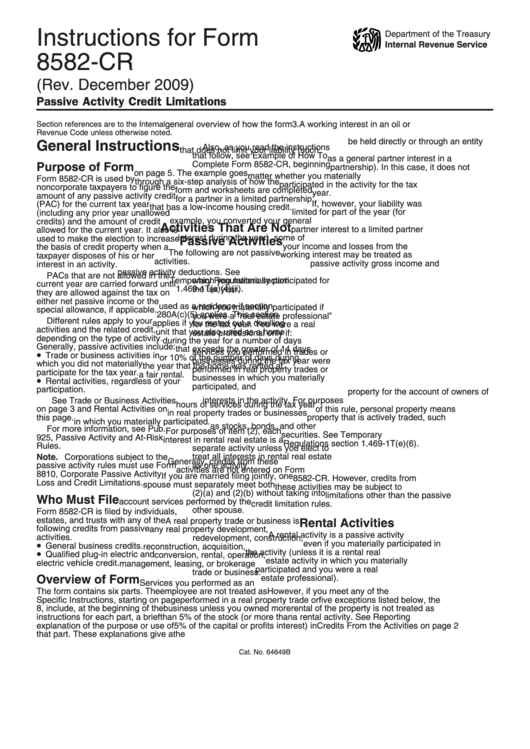

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Form 8582Passive Activity Loss Limitations

Instructions For Form 8582Cr (Rev. December 2009) printable pdf download

IRS Form 8582A Guide to Passive Activity Loss Limitations

Instructions for Form 8582CR, Passive Activity Credit Limitations

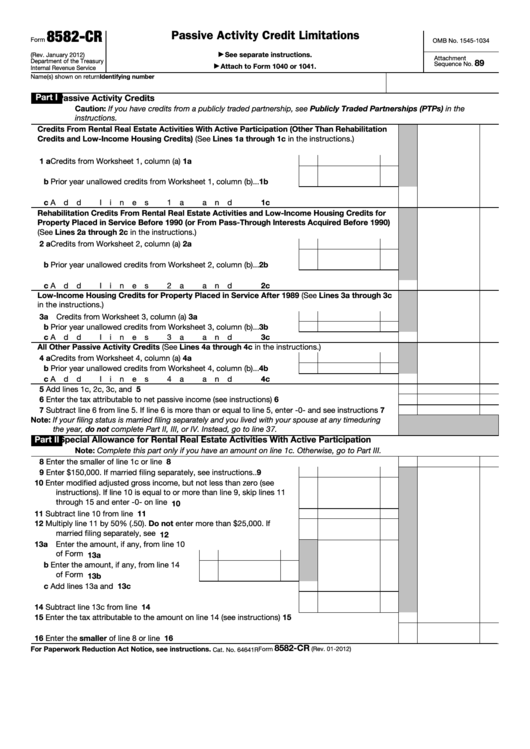

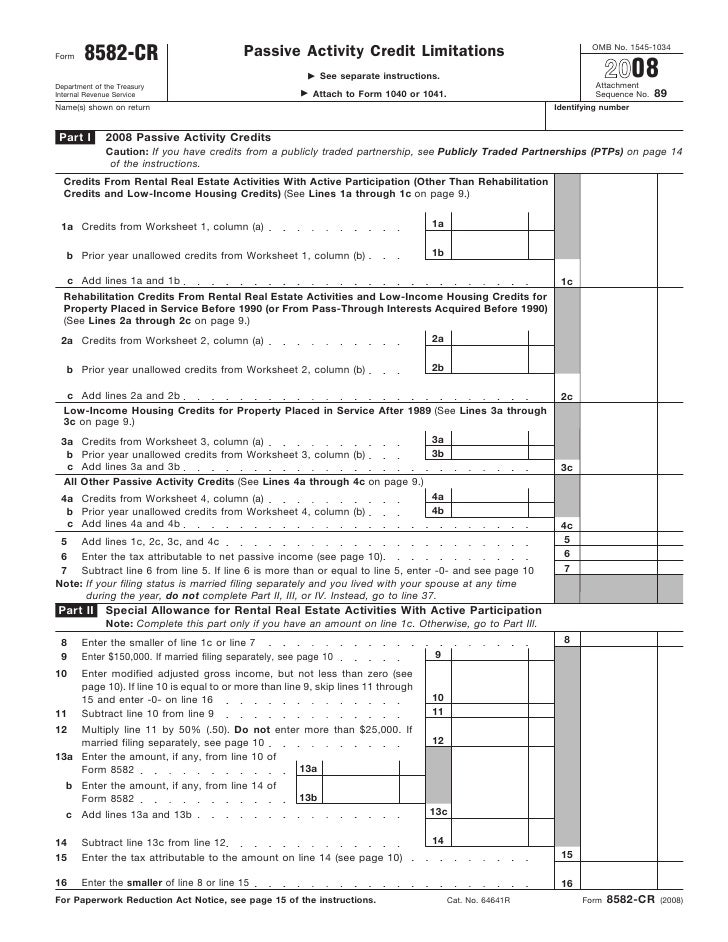

Fillable Form 8582Cr Passive Activity Credit Limitations printable

Form 8582CR Passive Activity Credit Limitations

Instructions for Form 8582CR, Passive Activity Credit Limitations

Related Post: