Form 4562 Instructions

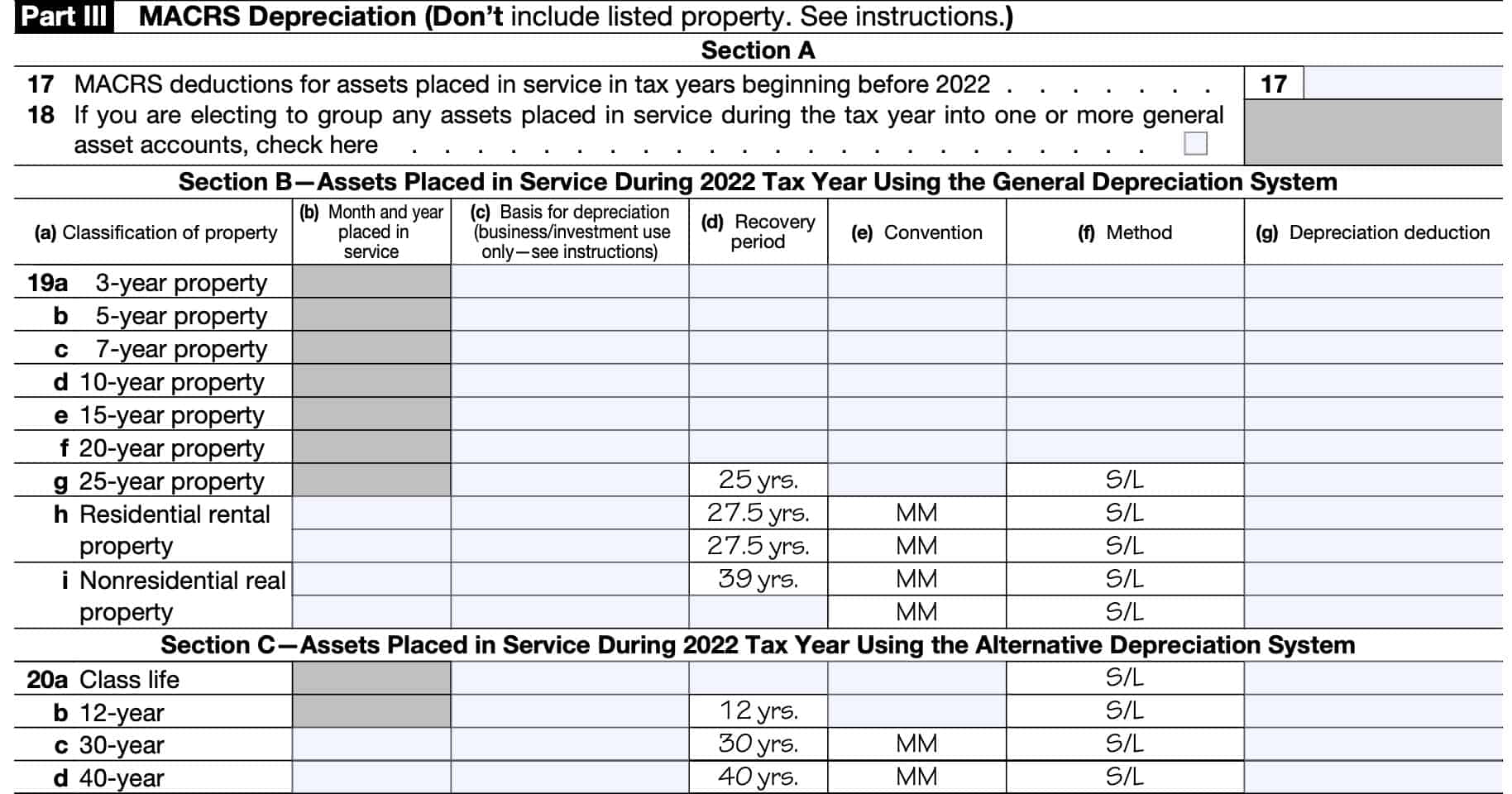

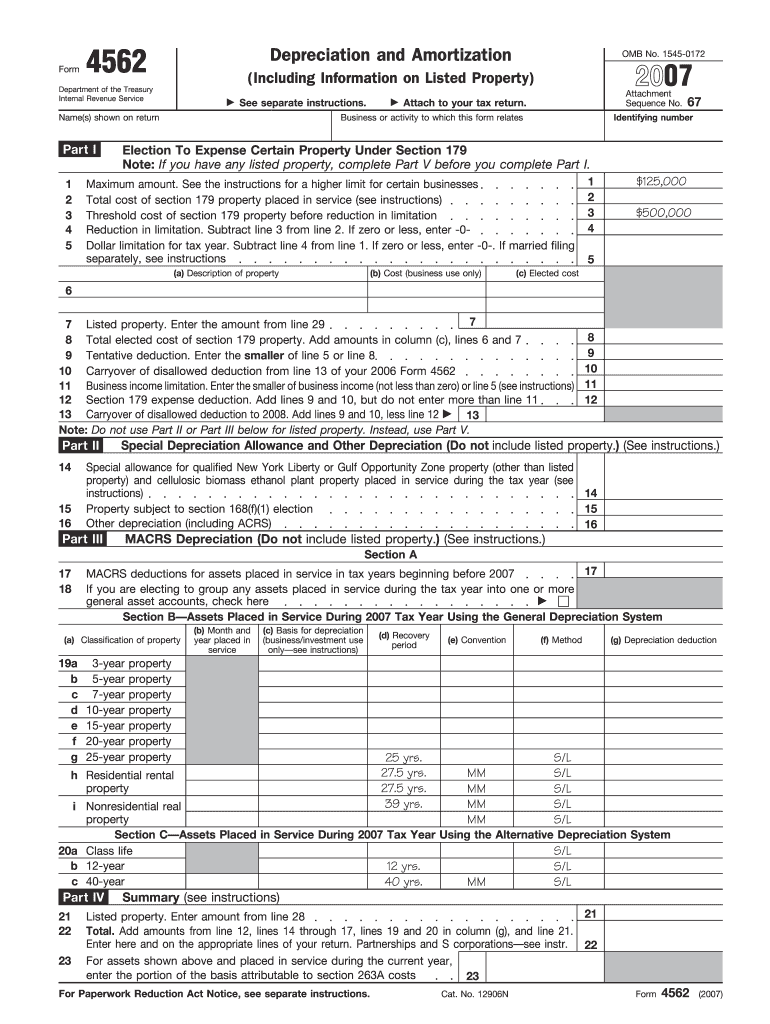

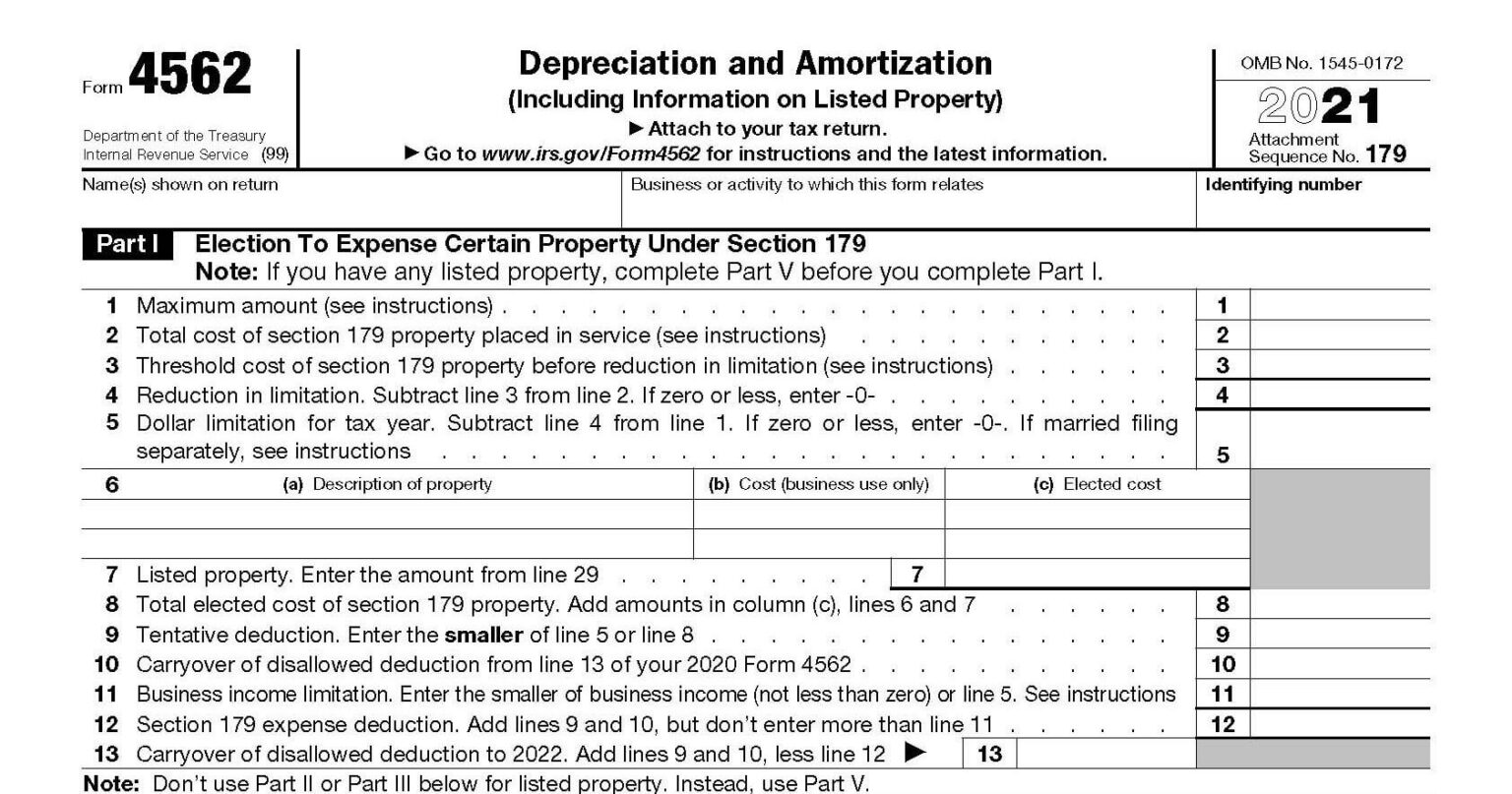

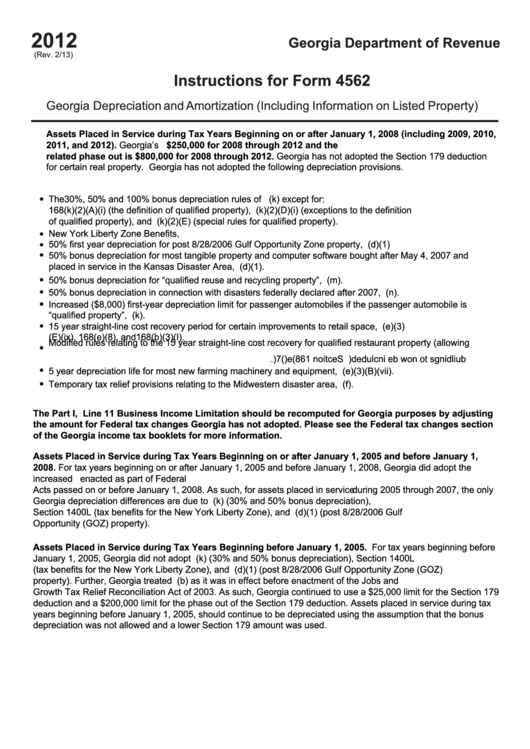

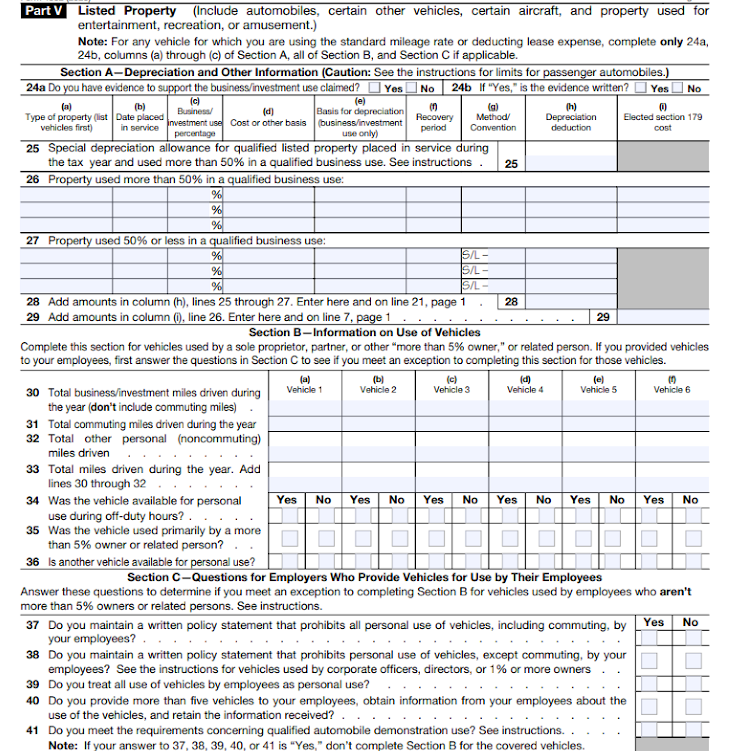

Form 4562 Instructions - Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Web irs form 4562: Depreciation for property placed in service during the current. Web according to form 4562 instructions, the form is required if the taxpayer claims any of the following: Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Web irs form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. Ad access irs tax forms. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web who must file form 4562? Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Ad access irs tax forms. Web who must file form 4562? Complete, edit or print tax forms instantly. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Depreciation applies to assets that have a useful life of. Ad access irs tax forms. Web irs form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. To complete form 4562, you'll need to know the. Form 4562 is used to. Depreciation for property placed in service during the current. Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. If you are claiming any of the following,. Depreciation applies to assets that have a useful life of. Web common questions for form 4562 in proseries. • claim your deduction for depreciation and. To complete form 4562, you'll need to know the. Web instructions for form 4562 (rev. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to. • claim your deduction for depreciation and. Each year, you can use the form to. Depreciation applies to assets that have a useful life of. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Complete, edit or print tax forms instantly. General instructions purpose of form use form 4562 to: • claim your deduction for depreciation and. Web the first part of irs form 4562 deals with the section 179 deduction. See the instructions for lines 20a through 20d, later. Complete, edit or print tax forms instantly. To complete form 4562, you'll need to know the. • claim your deduction for depreciation and. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Depreciation for property placed in service during the current. Ad access irs tax forms. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web common questions for form 4562 in proseries. Solved • by intuit • 3 • updated 1 year. Depreciation applies to assets that have a useful life of. Web irs form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Web the new rules allow for 100% bonus expensing. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web common questions for form 4562 in proseries. Web general instructions purpose of form use form 4562 to: Web form 4562, depreciation and amortization. General instructions purpose of form use form 4562 to: Depreciation for property placed in service during the current. Web instructions for form 4562 (rev. Get answers to frequently asked questions about form 4562 and. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Web irs form 4562 is used to properly claim a deduction for assets used in your business or freelancing activities. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to. If you are claiming any of the following,. 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years. Web according to form 4562 instructions, the form is required if the taxpayer claims any of the following: Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Complete, edit or print tax forms instantly. Irs suggests submitting one form 4562 per business or activity included on your tax return. To complete form 4562, you'll need to know the. Depreciation applies to assets that have a useful life of. Ad get ready for tax season deadlines by completing any required tax forms today.IRS Form 4562 Instructions Depreciation & Amortization

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

How to Complete IRS Form 4562

Irs Form 4562 Instructions 2014 prosecution2012

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Instructions For Form 4562 Depreciation And Amortization

IRS Form 4562 Explained A StepbyStep Guide The Blueprint

Tutorial pour remplir le formulaire 4562 de l'IRS

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

2017 instructions 4562 form Fill out & sign online DocHub

Related Post: