Form 8453 Pe

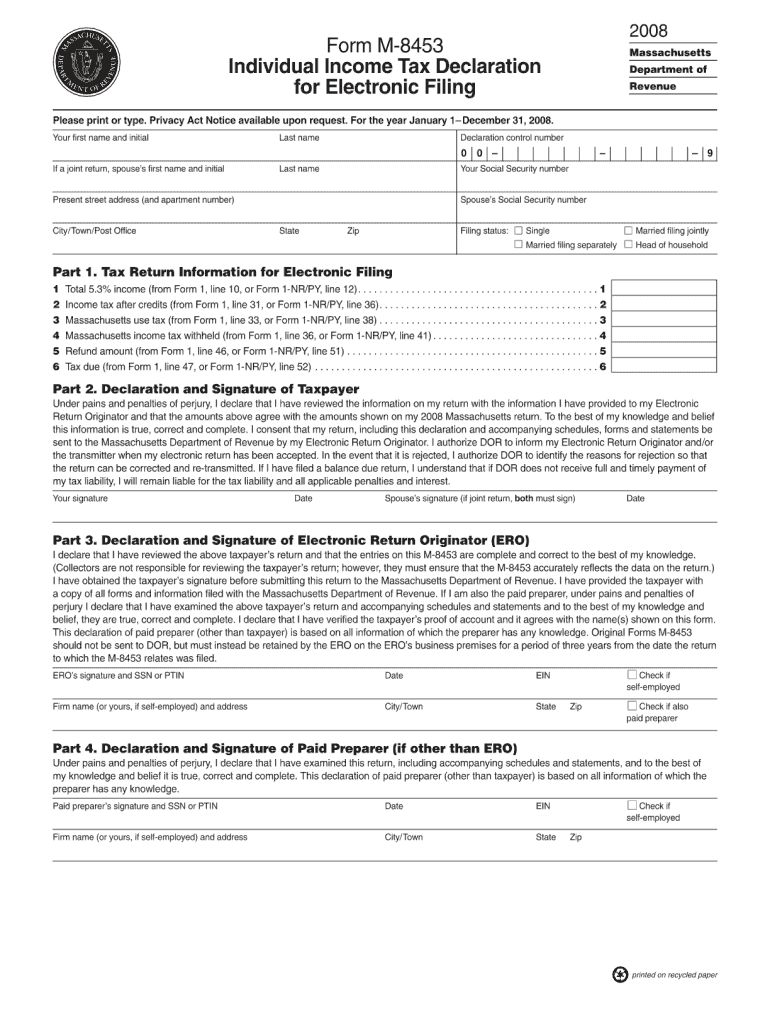

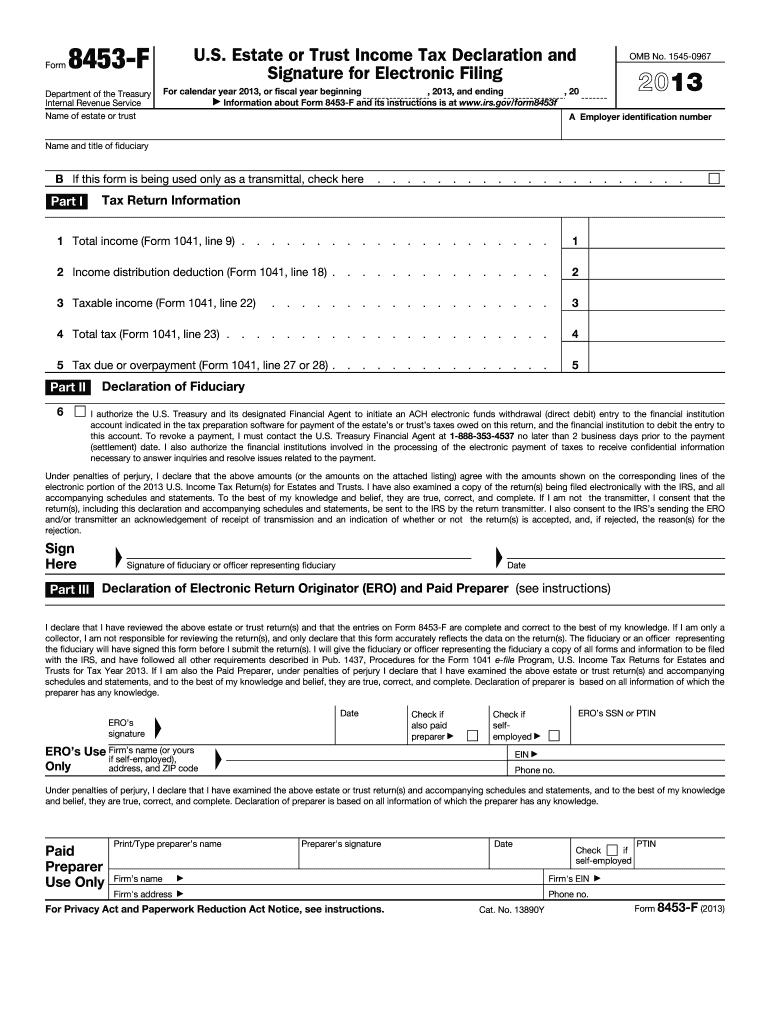

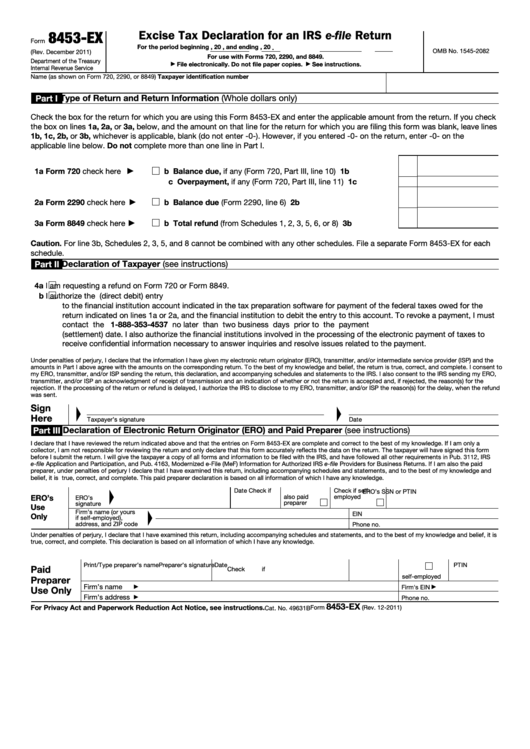

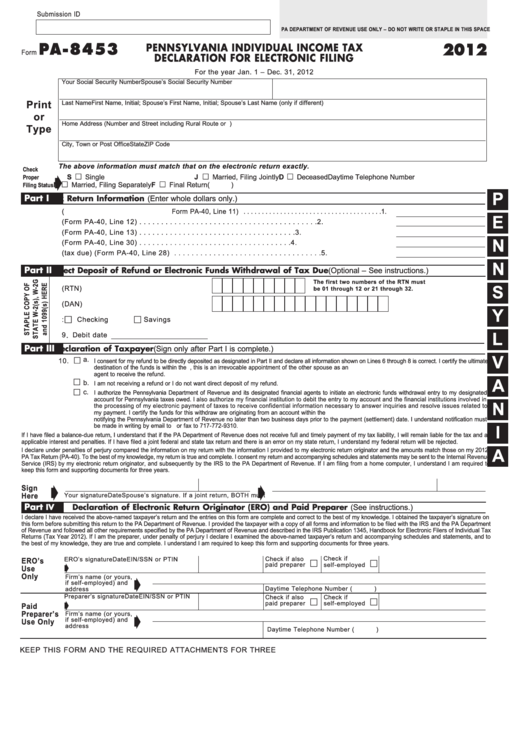

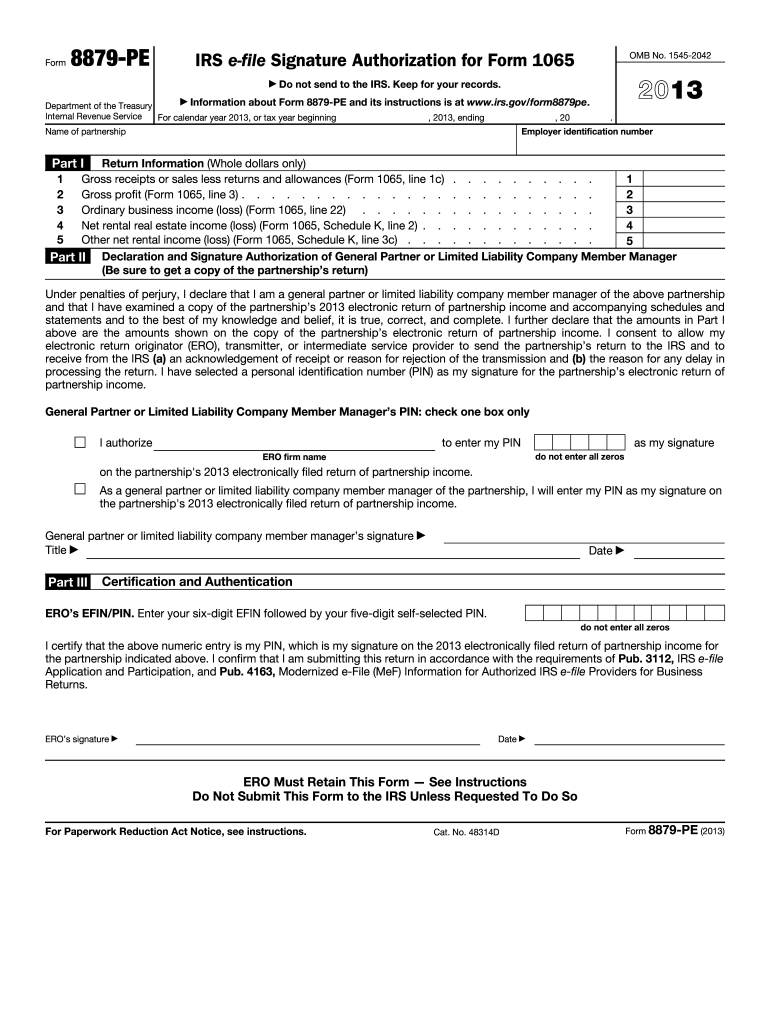

Form 8453 Pe - Meaning of 8453 pe form as a finance term. Return of partnership income, as part of return or aar; Choosing a authorized professional, creating an appointment and coming to the business office for a private meeting makes doing a. Authorize the electronic return originator (ero), if any,. Web to use the scanned form 8453 option, follow these steps. (for return of partnership income or administrative adjustment request) file. Web a signed form 8453, u.s. For calendar year 2022, or tax year beginning , 2022, and ending , 20. Complete, edit or print tax forms instantly. Authenticate an electronic form 1065, u.s. Meaning of 8453 pe form as a finance term. (for return of partnership income or administrative adjustment request) file. Return of partnership income, as part of return or aar; Go to www.irs.gov/form8453 for the. Return of partnership income, as part of return or aar; Authorize the electronic return originator. Department of the treasury internal revenue service. Web a signed form 8453, u.s. Return of partnership income, as part of return or aar; Web follow the simple instructions below: Meaning of 8453 pe form as a finance term. (for return of partnership income or administrative adjustment request) file. Web taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on. Authenticate an electronic form 1065, u.s. Get ready for tax season deadlines by completing any required. Get ready for tax season deadlines by completing any required tax forms today. Authorize the electronic return originator. Choosing a authorized professional, creating an appointment and coming to the business office for a private meeting makes doing a. Authorize the electronic return originator (ero), if any,. Department of the treasury internal revenue service. Web a signed form 8453, u.s. Meaning of 8453 pe form as a finance term. Go to www.irs.gov/form8453 for the. Web to use the scanned form 8453 option, follow these steps. Authenticate an electronic form 1065, u.s. Department of the treasury internal revenue service. Web tax exempt entity declaration and signature for electronic filing. Authorize the electronic return originator (ero), if any,. Authenticate an electronic form 1065, u.s. (for return of partnership income or administrative adjustment request) file. Ad access irs tax forms. Web tax exempt entity declaration and signature for electronic filing. Web to use the scanned form 8453 option, follow these steps. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/form8453 for the. Web taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on. Authorize the electronic return originator (ero), if any,. For calendar year 2022, or tax year beginning , 2022, and ending , 20. Ad access irs tax forms. Authenticate an electronic form 1065, u.s. What is 8453 pe form? Web to use the scanned form 8453 option, follow these steps. Go to www.irs.gov/form8453 for the. However, you will need to complete and mail in form. Return of partnership income, as part of return or aar; Authorize the electronic return originator. What is 8453 pe form? Web taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/form8453 for the. (for return of partnership income or administrative adjustment request) file. Return of partnership income, as part of return or aar; Authorize the electronic return originator. Web follow the simple instructions below: Authenticate an electronic form 1065, u.s. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. What is 8453 pe form? Ad access irs tax forms. Web to use the scanned form 8453 option, follow these steps. For calendar year 2022, or tax year beginning , 2022, and ending , 20. Authorize the electronic return originator (ero), if any,. Web taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on. Go to www.irs.gov/form8453 for the. Meaning of 8453 pe form as a finance term. Choosing a authorized professional, creating an appointment and coming to the business office for a private meeting makes doing a. However, you will need to complete and mail in form. Return of partnership income, as part of return or aar; Authenticate an electronic form 1065, u.s. Complete, edit or print tax forms instantly.Form 8453PE U.S. Partnership Declaration for an IRS Efile Return

Form 8453PE U.S. Partnership Declaration for an IRS Efile Return

Form 8453 Te Fill Out and Sign Printable PDF Template signNow

Form 8453EO Exempt Organization Declaration and Signature for

Form 8453PE U.S. Partnership Declaration for an IRS Efile Return

8453 form Fill out & sign online DocHub

Fillable Form 8453Ex Excise Tax Declaration For An Irs EFile Return

Form Pa8453 Pennsylvania Individual Tax Declaration For

Form 8453 PE IRS gov Fill Out and Sign Printable PDF Template signNow

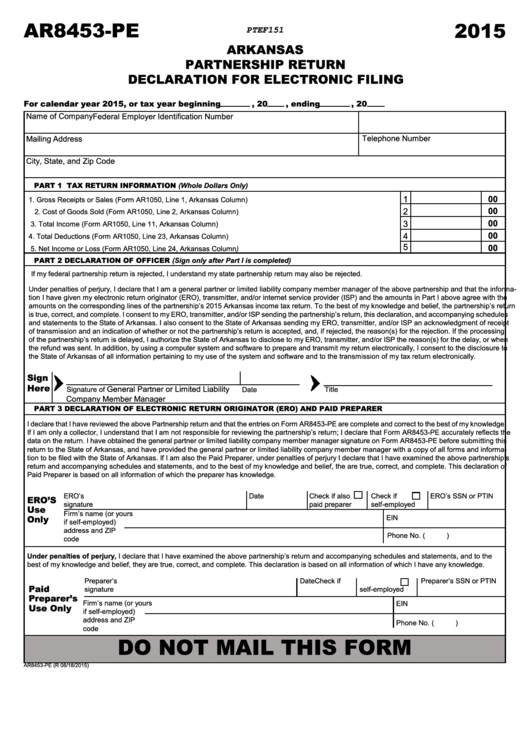

Form Ar8453Pe Arkansas Partnership Return Declaration For Electronic

Related Post: