Form 8283 Instructions

Form 8283 Instructions - Web general instructions purpose of form use form 8283 to report information about noncash charitable contributions. Dochub allows users to edit, sign, fill & share all type of documents online. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the noncash charitable contributions in december 2022, so this is the latest version of form 8283, fully updated for tax year 2022. November 2022) department of the treasury internal revenue service. Ad access irs tax forms. Web popular forms & instructions; Taxpayers who donate more than $500 of noncash charitable contributions in a tax year, except c. November 2019) department of the treasury internal revenue service. Web use form 8283 to report information about noncash charitable contributions. If the combined value of all property you donate is more than $500, you must prepare irs. All you have to do is enter all of your charitable. The donee must sign part iv. Web we last updated the noncash charitable contributions in december 2022, so this is the latest version of form 8283, fully updated for tax year 2022.. Form 8283 is used to claim a deduction. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. All you have to do is enter all of your charitable. This includes both single contributions and. Ad complete irs tax forms online or print government tax documents. December 2014) department of the treasury internal revenue service noncash charitable contributions attach to your tax return if you claimed a total. Web we last updated the noncash charitable contributions in december 2022, so this is the latest version of form 8283, fully updated for tax year 2022. Aattach. All you have to do is enter all of your charitable. This includes both single contributions and. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Form 8283 is used to claim a deduction. December 2014) department of the treasury internal revenue service noncash charitable contributions attach to your. Web the form 8283 is completed automatically by turbo tax if the combined value of all the property you donate is more than $500. All you have to do is enter all of your charitable. Attach one or more forms 8283 to your tax return if. Form 8283 is used to claim a deduction. November 2019) department of the treasury. For noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Web use form 8283 to report information about noncash charitable contributions. Web general instructions purpose of form use form 8283 to report information about noncash charitable contributions. Ad access irs tax forms. Attach one or more forms 8283 to your. All you have to do is enter all of your charitable. Dochub allows users to edit, sign, fill & share all type of documents online. 2 part v original statement of. Individual tax return form 1040 instructions; Web general instructions purpose of form use form 8283 to report information about noncash charitable contributions. All you have to do is enter all of your charitable. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. This includes both single contributions and. Aattach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. November 2022) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. The donee must sign part iv. Web general instructions purpose of form use form 8283 to report information about noncash charitable contributions. Form 8283 is used to claim a deduction. Ad access irs tax forms. Ad complete irs tax forms online or print government tax documents. Web we last updated the noncash charitable contributions in december 2022, so this is the latest version of form 8283,. Dochub allows users to edit, sign, fill & share all type of documents online. Get ready for tax season deadlines by completing any required tax forms today. Web popular forms & instructions; Web updated for tax year 2022 • december 1, 2022 9:21 am. Web for paperwork reduction act notice, see separate instructions. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Ad complete irs tax forms online or print government tax documents. This includes both single contributions and. If the combined value of all property you donate is more than $500, you must prepare irs. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web the rules that determine when to file form 8283 are simple. Web use form 8283 to report information about noncash charitable contributions. Web internal revenue service (irs) form 8283 describes deductions for noncash charitable contributions worth $500 or more. Aattach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. The donee must sign part iv. Web you can generate form 8283 for noncash contributions over $5,000 in the individual module of proconnect using the deductions screen. Attach one or more forms 8283 to your tax return if. Web department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today.Form 8283 YouTube

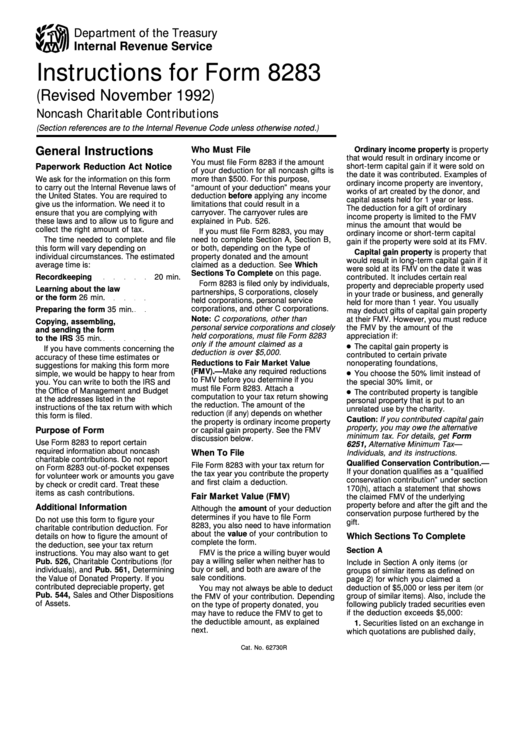

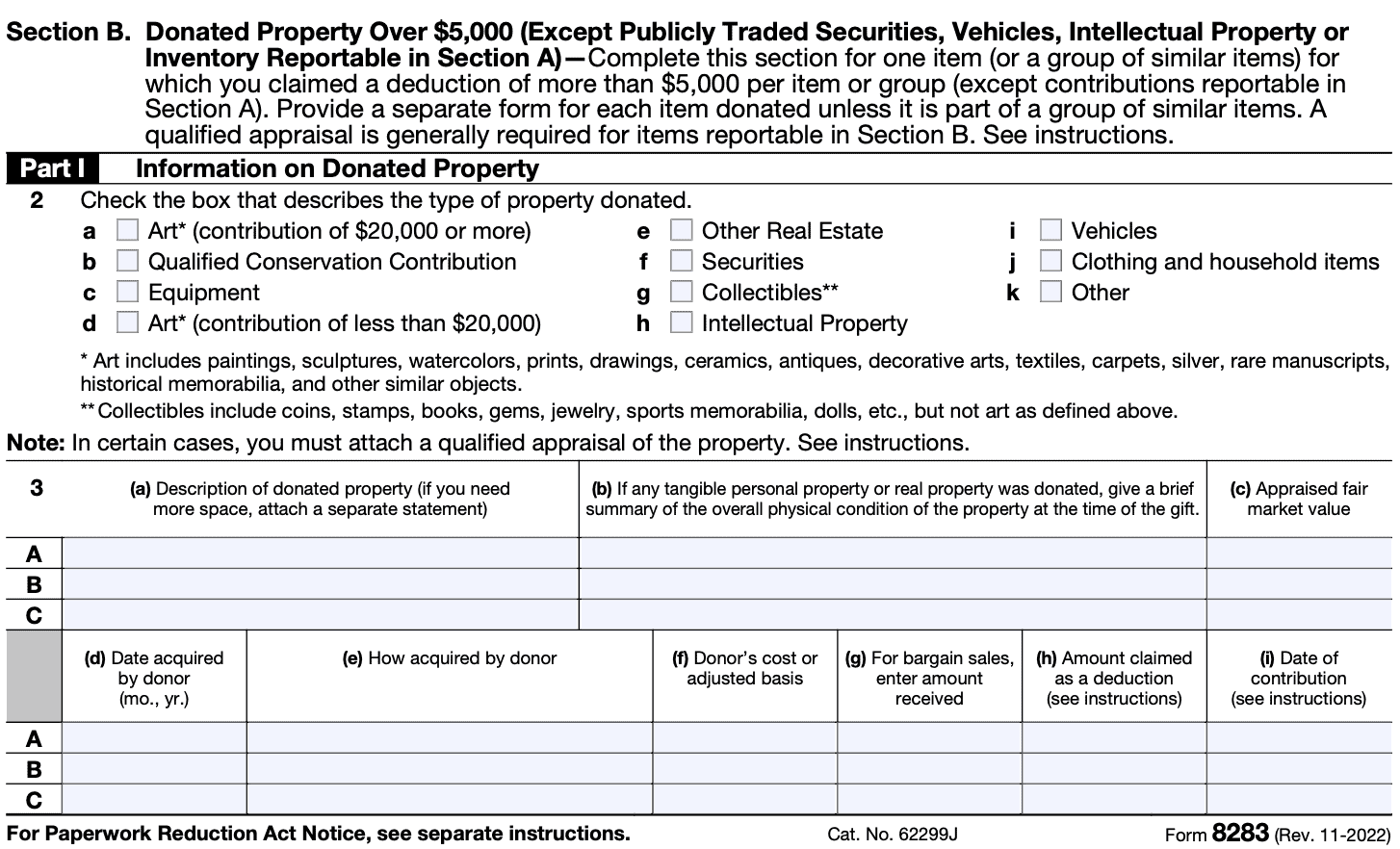

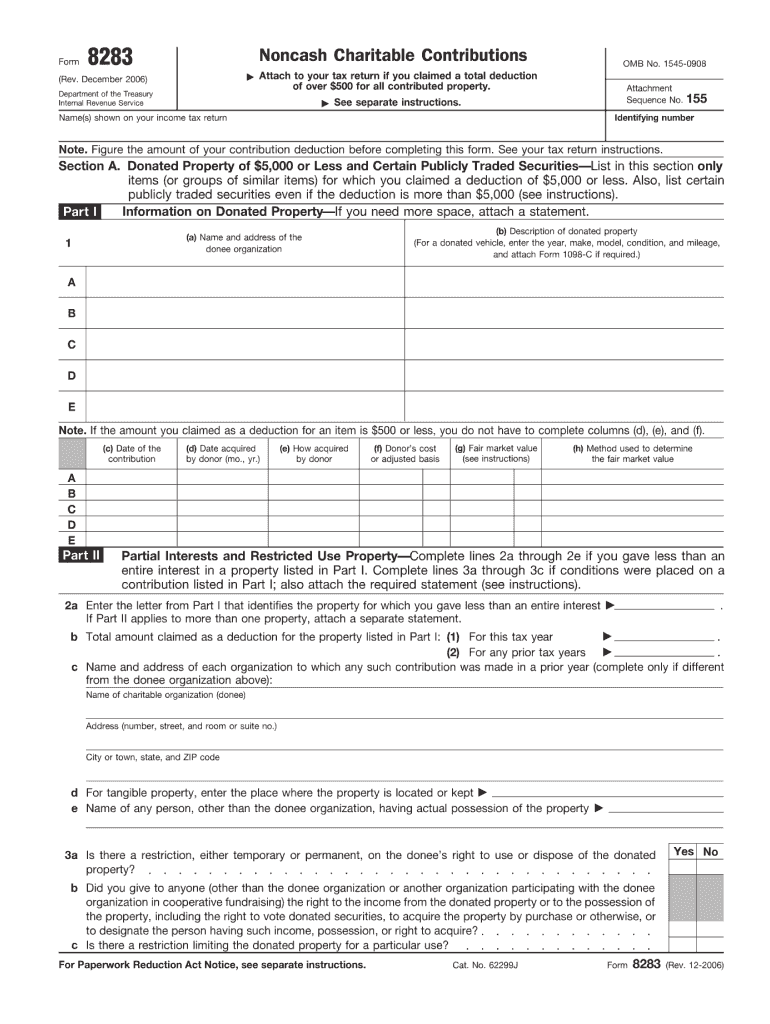

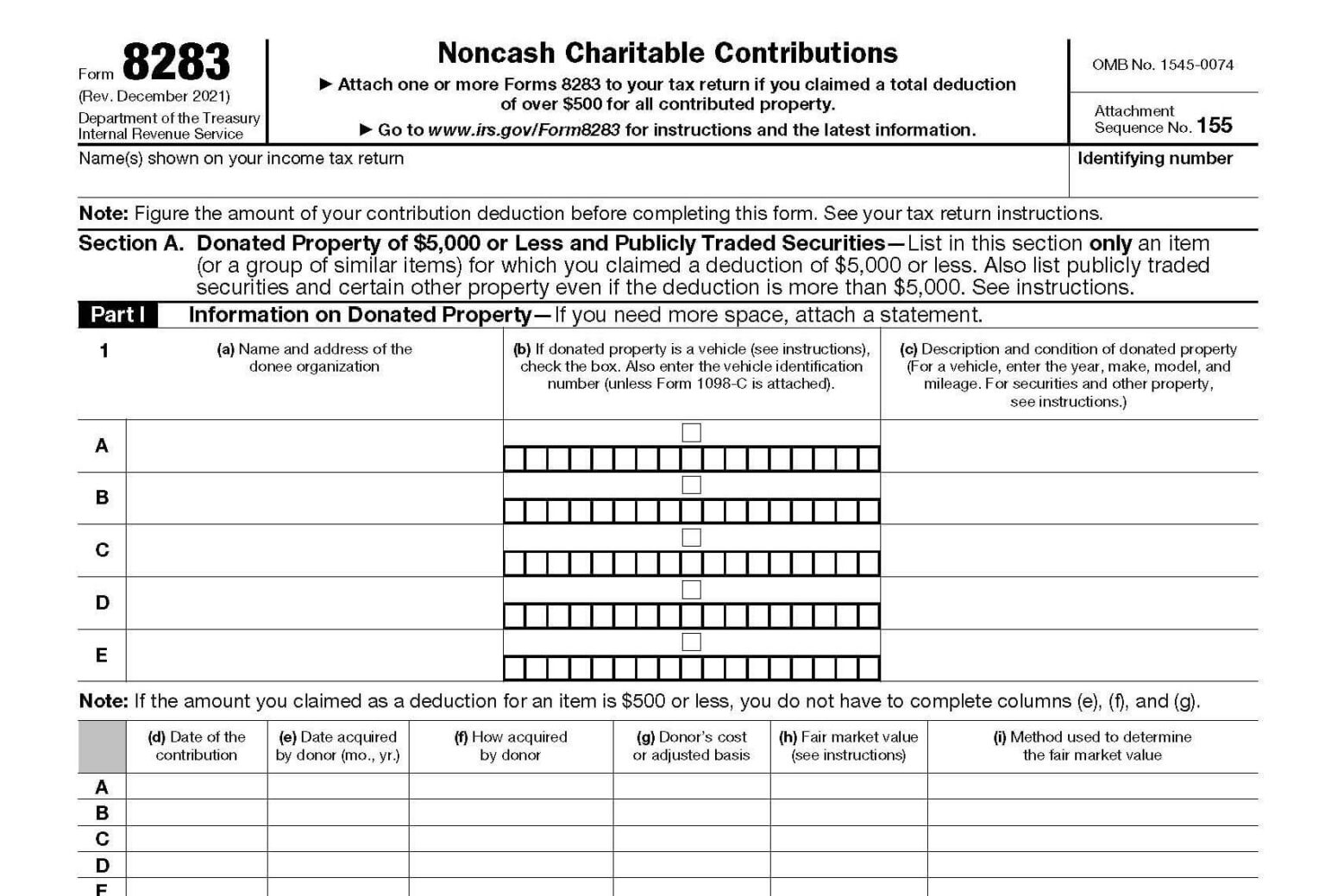

Instructions For Form 8283 printable pdf download

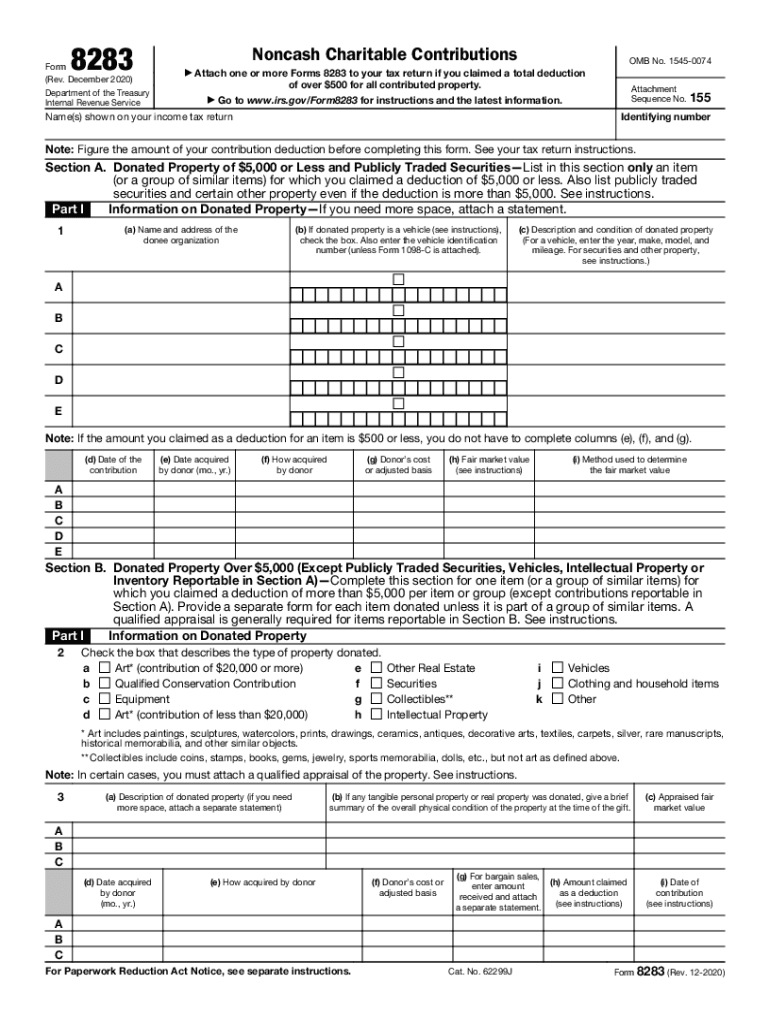

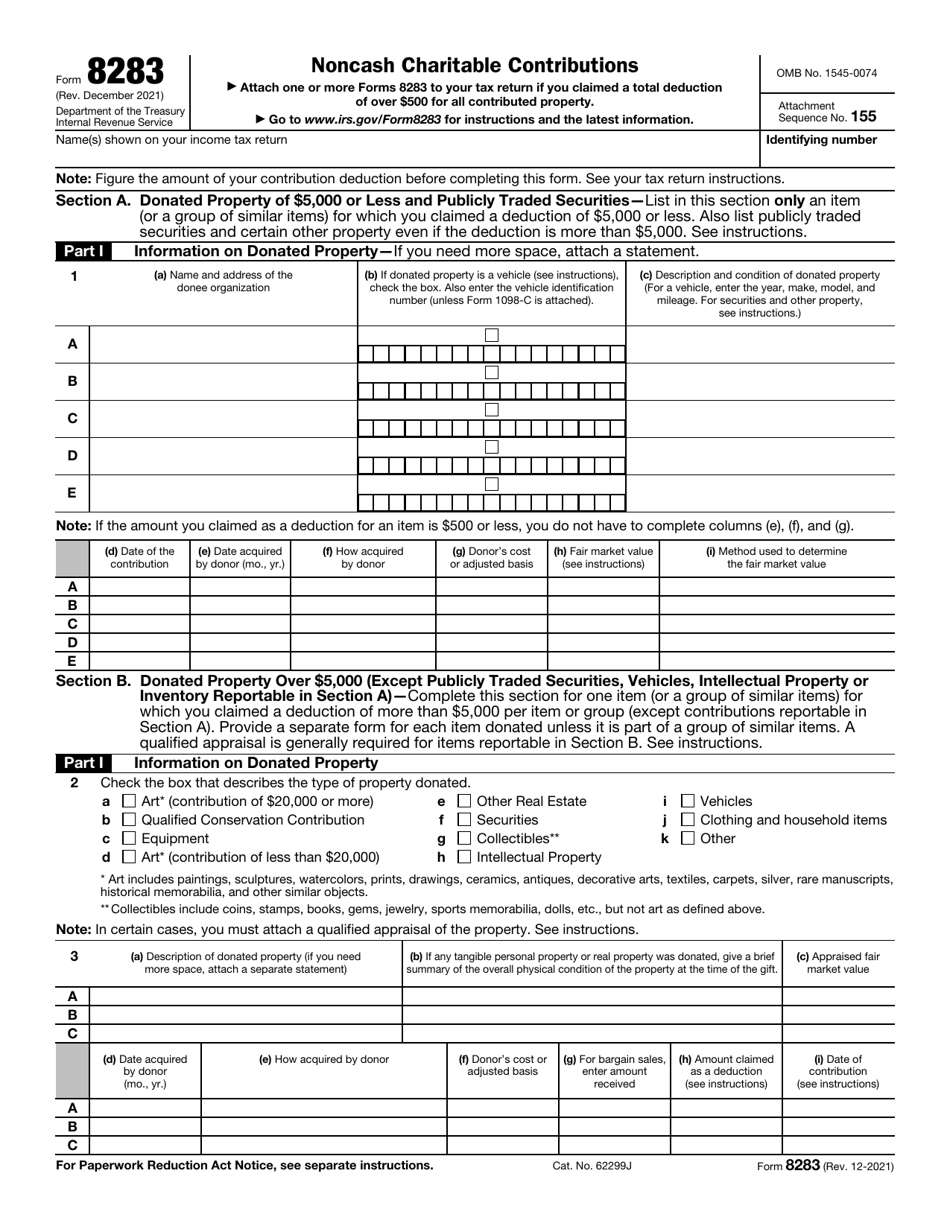

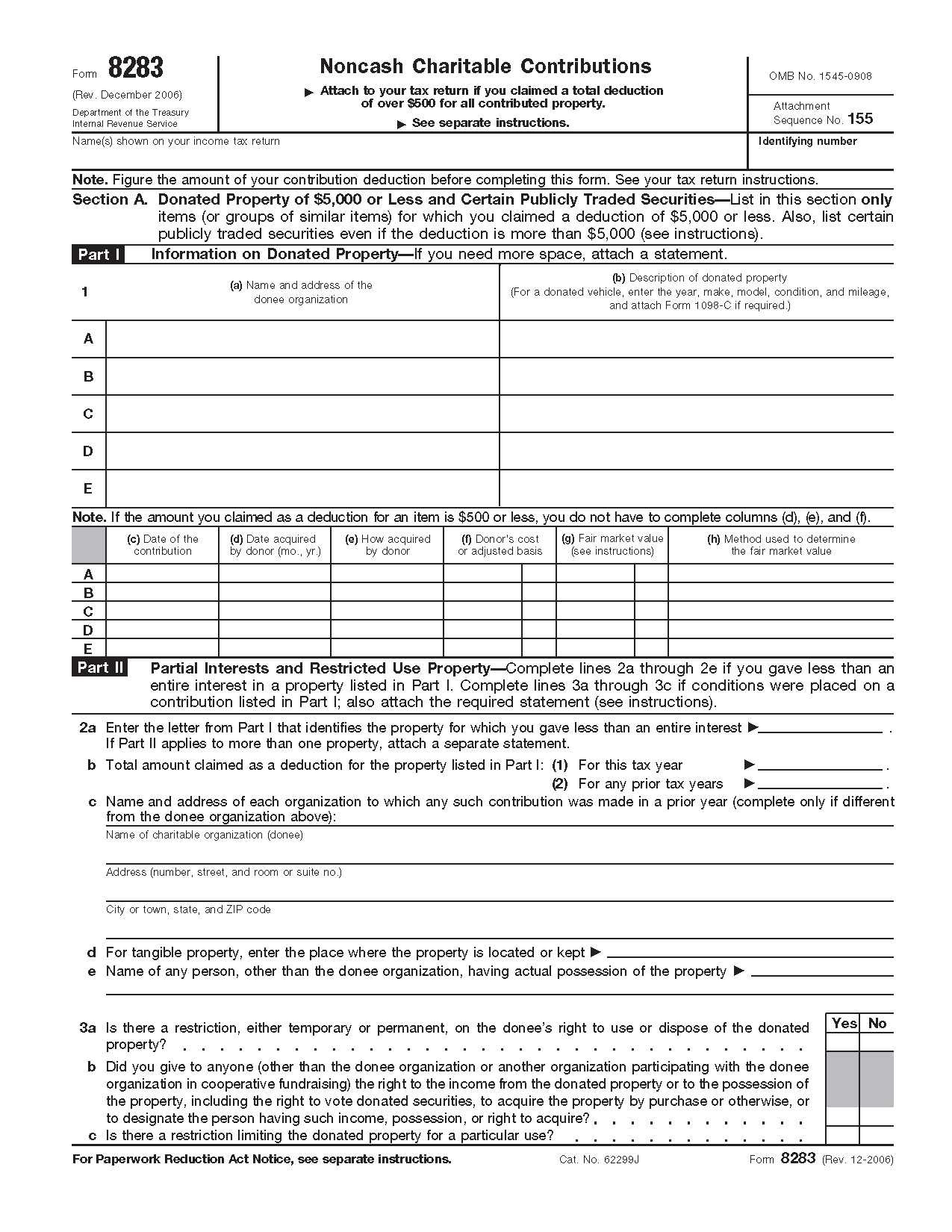

Federal Form 8283 Fill Out and Sign Printable PDF Template signNow

IRS Form 8283 Download Fillable PDF or Fill Online Noncash Charitable

Form 8283 Noncash Charitable Contributions 2021 Tax Forms 1040 Printable

IRS Form 8283 Instructions Noncash Charitable Contributions

Example of form 8283 filled out Fill out & sign online DocHub

How to Complete IRS Form 8283

Irs Form 8283 Printable Printable Forms Free Online

Download IRS Form 8283 for Free FormTemplate

Related Post: