Form 720 Fillable

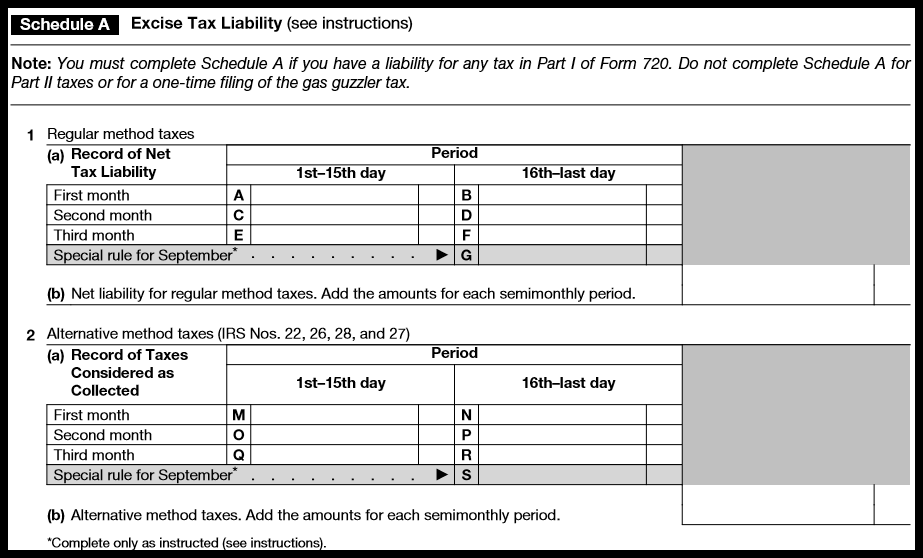

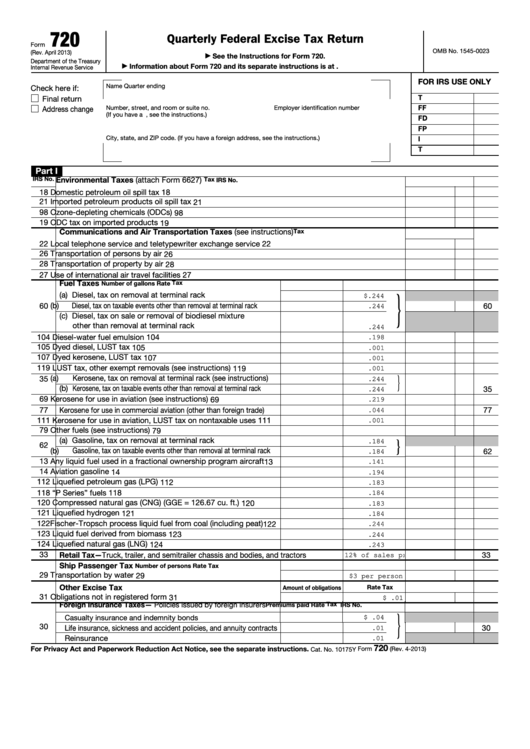

Form 720 Fillable - • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you. Check out the helpful instructions. In general, form 720 is for businesses. Open form follow the instructions. Web what information is needed to fill out irs form 720? Send filled & signed form or save. Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Complete, edit or print tax forms instantly. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or. Upload, modify or create forms. Download the irs form 720 to fill out and file quarterly federal excise tax return for u.s. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or. Easily sign the form with your finger.. Web 2023 irs form 720. Ensuring expeditious, unswerving transference of requisite excise payments, this document assuages the process of effectively remitting tax dues to the. In general, form 720 is for businesses. Web 2023 irs form 720 & pcori fee instructions. Quarterly federal excise tax return (irs). Beyond just fulfilling a legal obligation, timely and accurate filing of form 720 demonstrates a business's. Open form follow the instructions. Web what is form 720? Quarterly federal excise tax return. Web you must file form 720 if: Web what is form 720? What is the pcori deadline? Use form 720 (quarterly federal excise tax return) to report and pay excise tax. Quarterly federal excise tax return keywords \r\n\r\n created date: Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web 2023 irs form 720 & pcori fee instructions. Try it for free now! Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or. Ad get ready. Business in the 2023 year. Upload, modify or create forms. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you. Web irs form 720 fillable irs form 720, also known as the quarterly federal excise tax return, is a crucial document. Beyond just fulfilling a legal obligation, timely and accurate filing of form 720 demonstrates a business's. Send filled & signed form or save. Web you must file form 720 if: Web you must file form 720 if: Web 2023 irs form 720 & pcori fee instructions. If you own a business that deals in goods and services subject to excise tax, you must prepare a form 720 quarterly to report the tax to the irs. Try it for free now! Open form follow the instructions. Complete, edit or print tax forms instantly. Download the irs form 720 to fill out and file quarterly federal excise tax. Web benefits of filing form 720. Web you must file form 720 if: Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Easily sign the form with your finger. In general, form 720 is for businesses. Web you must file form 720 if: If you own a business that deals in goods and services subject to excise tax, you must prepare a form 720 quarterly to report the tax to the irs. Web 2021 form 720 author: Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one. Quarterly federal excise tax return keywords \r\n\r\n created date: If you own a business that deals in goods and services subject to excise tax, you must prepare a form 720 quarterly to report the tax to the irs. Web 2021 form 720 author: Fill online, printable, fillable, blank form 720: Try it for free now! Easily sign the form with your finger. Get the 720 tax form for the 2023 tax year. See the instructions for form 720. Web irs form 720 fillable irs form 720, also known as the quarterly federal excise tax return, is a crucial document for businesses that are required to pay excise taxes on. Quarterly federal excise tax return. Web 2023 irs form 720. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or. Web benefits of filing form 720. In general, form 720 is for businesses. Upload, modify or create forms. By understanding its features, addressing potential difficulties,. Beyond just fulfilling a legal obligation, timely and accurate filing of form 720 demonstrates a business's. Check out the helpful instructions. How to file form 720. Ad get ready for tax season deadlines by completing any required tax forms today.Fillable Form 720 (2nd Quarter 2019) Irs forms, Form, Fillable forms

Fillable Online Form 720 (Rev. June 2023) Fax Email Print pdfFiller

Fill Free fillable Form 720 Quarterly Federal Excise Tax Return (IRS

How to Complete Form 720 Quarterly Federal Excise Tax Return

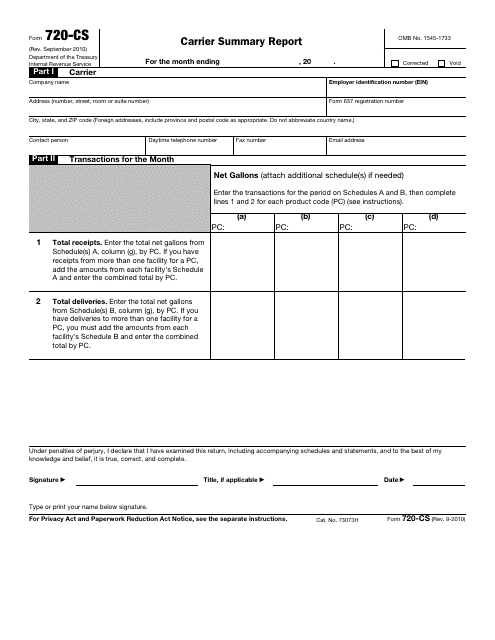

IRS Form 720CS Fill Out, Sign Online and Download Fillable PDF

How to complete IRS Form 720 for the PatientCentered Research

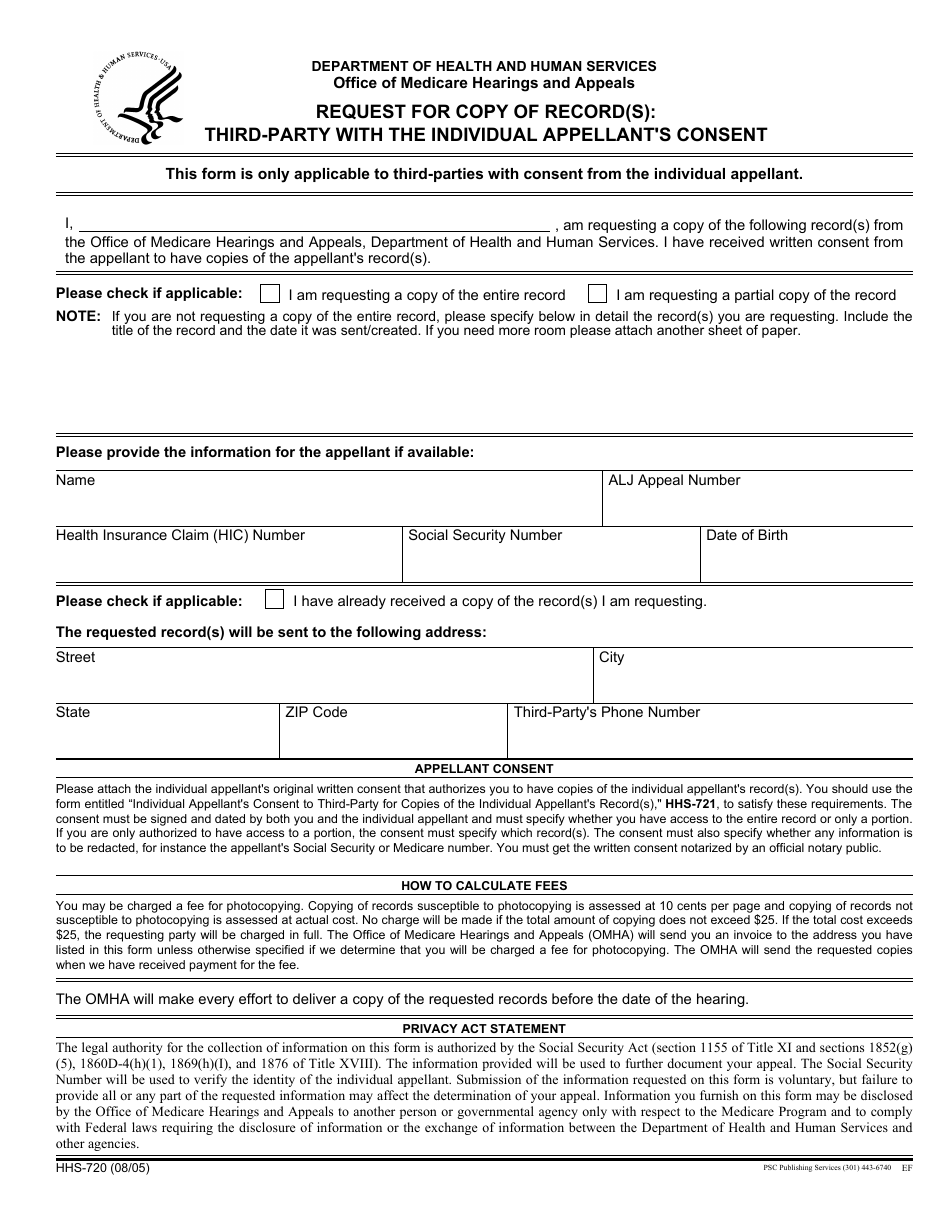

Form HHS720 Download Fillable PDF or Fill Online Request for Copy of

Fillable Form 720 Quarterly Federal Excise Tax Return printable pdf

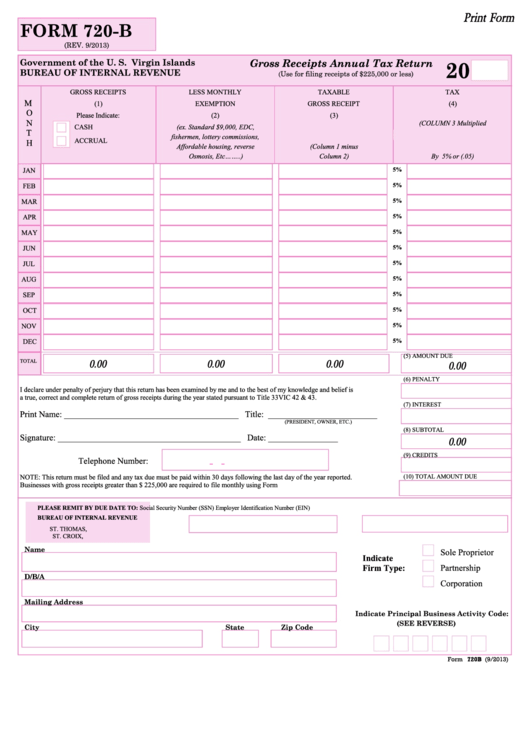

Fillable Form 720B Gross Receipts Annual Tax Return printable pdf download

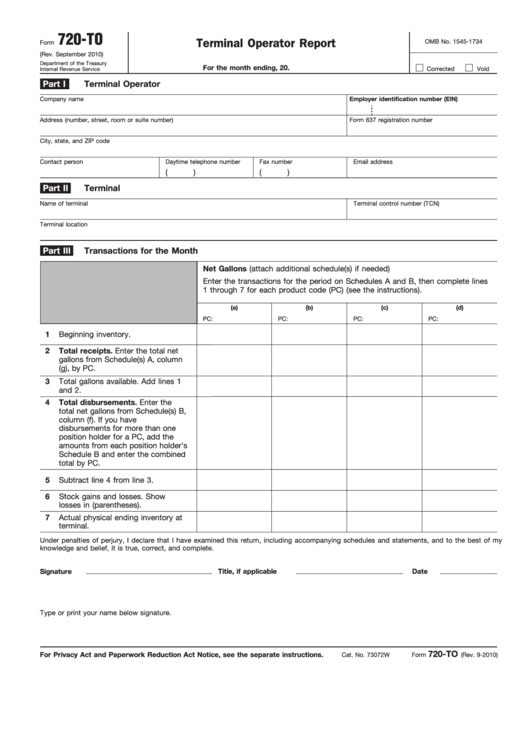

Fillable Form 720To Terminal Operator Report printable pdf download

Related Post: