Oklahoma Form 200F

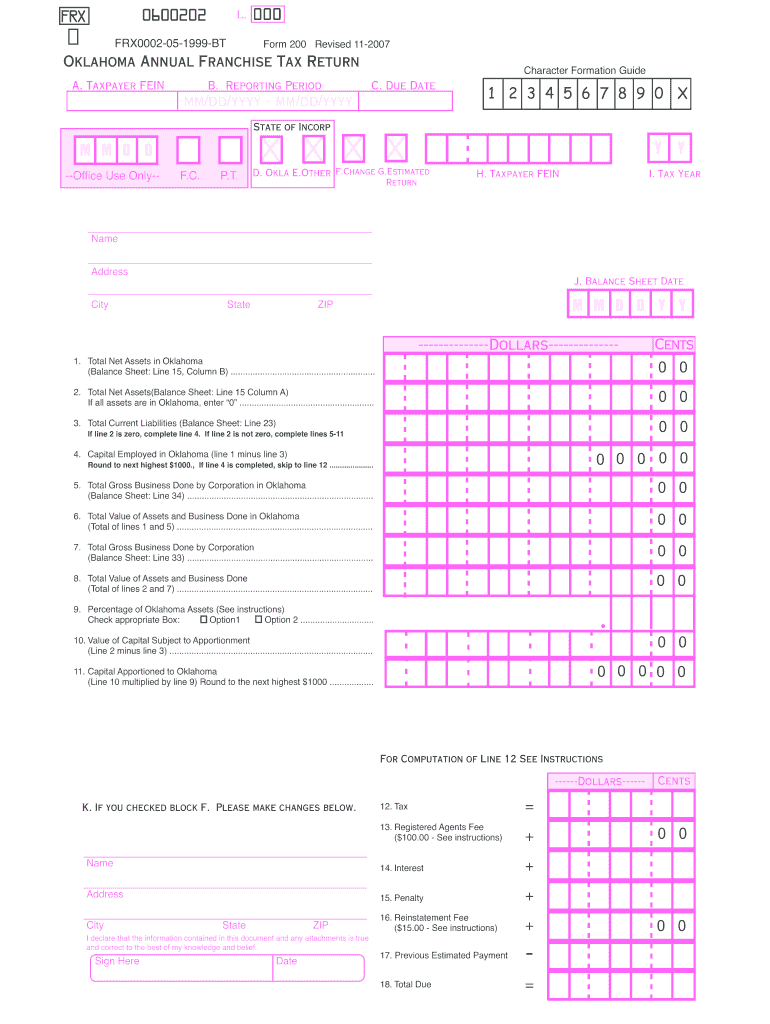

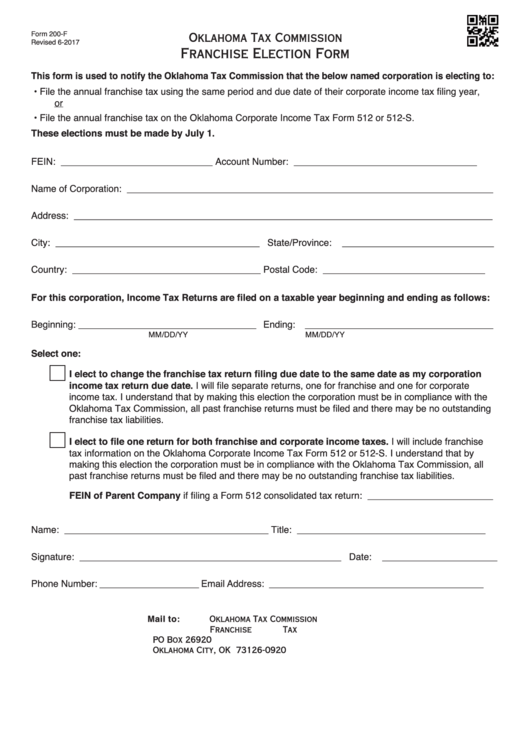

Oklahoma Form 200F - The corporation must make this election no later than july 1. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. The report and tax will be delinquent if not. This form is used to notify the oklahoma tax commission that the below named corporation. For a corporation that has elected to change its filing. Form 200, oklahoma annual franchise tax return. I will include franchise tax information on the oklahoma. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Get ready for tax season deadlines by completing any required tax forms today. Submit all applications to a local tag office or service oklahoma at the address shown on page 2 of this form. License plates are issued for a. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. The report and tax will be delinquent if not. Web any corporation. Submit all applications to a local tag office or service oklahoma at the address shown on page 2 of this form. When the oklahoma business activity tax was. Ad fill, sign, email ok form 200 & more fillable forms, register and subscribe now! I elect to file one return for both franchise and corporate income taxes. Who must pay the. For a corporation that has elected to change its filing. Web corporations required to le a franchise tax return, may elect to le a combined corporate income and franchise tax return. Web oklahoma franchise tax is due and payable each year on july 1. I elect to file one return for both franchise and corporate income taxes. Total net assets. (line 16 of form 200.) if you. Open it up with online editor and begin adjusting. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Fill in the blank areas; Who must pay the franchise tax? Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation. Submit all applications to a local tag office or service oklahoma at the address shown on page 2. Corporations that remitted the maximum amount of franchise tax for. Open it up with online editor and begin adjusting. This page contains schedules b, c, and d for the completion of form 200: Web the form 200: The corporation must make this election no later than july 1. Form 200, oklahoma annual franchise tax return. Get ready for tax season deadlines by completing any required tax forms today. Fill in the blank areas; Involved parties names, addresses and phone numbers etc. Ad fill, sign, email ok form 200 & more fillable forms, register and subscribe now! I elect to file one return for both franchise and corporate income taxes. Fill in the blank areas; I will include franchise tax information on the oklahoma. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. The report and tax will be delinquent if not. Web get the form 200 f you need. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Involved parties names, addresses and phone numbers etc. Get ready for tax season deadlines by completing any required tax forms today. This form is used to notify the oklahoma tax commission that the below named corporation. For a corporation that has elected to change its filing. License plates are issued for a. (line 16 of form 200.) if you. Web corporations required to le a franchise tax return, may elect to le a combined corporate income and franchise tax return. When the oklahoma business activity tax was. The corporation must make this election no later than july 1. Web get the form 200 f you need. Who must pay the franchise tax? I elect to file one return for both franchise and corporate income taxes. Open it up with online editor and begin adjusting. Web corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Web any corporation doing business within or deriving income from sources within oklahoma is required to file an oklahoma corporation income tax return, whether or not a tax is due. Ad download or email ok form 200 & more fillable forms, register and subscribe now! Submit all applications to a local tag office or service oklahoma at the address shown on page 2 of this form. The report and tax will be delinquent if not. Corporations that remitted the maximum amount of franchise tax for. This page contains schedules b, c, and d for the completion of form 200: Involved parties names, addresses and phone numbers etc. Web the form 200: It was an acquired habit, the result of a. Oklahoma annual franchise tax return (state of oklahoma) form is 4 pages long and contains: If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Ad fill, sign, email ok form 200 & more fillable forms, register and subscribe now! When the oklahoma business activity tax was.Ok Form 200 F Fill Out and Sign Printable PDF Template signNow

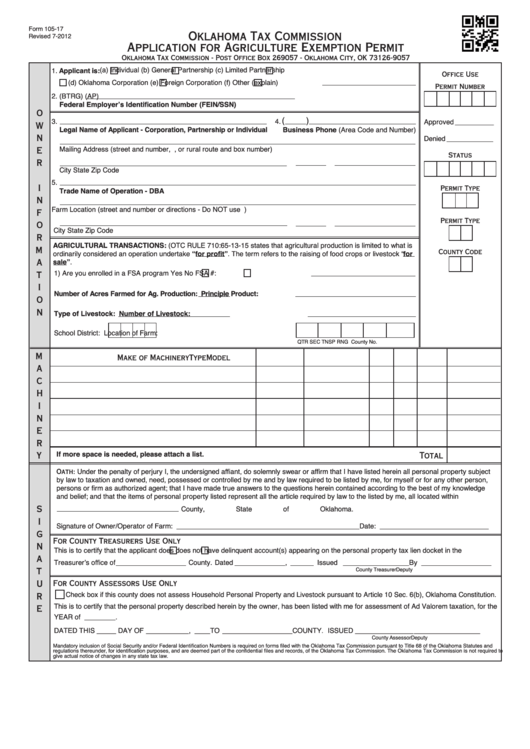

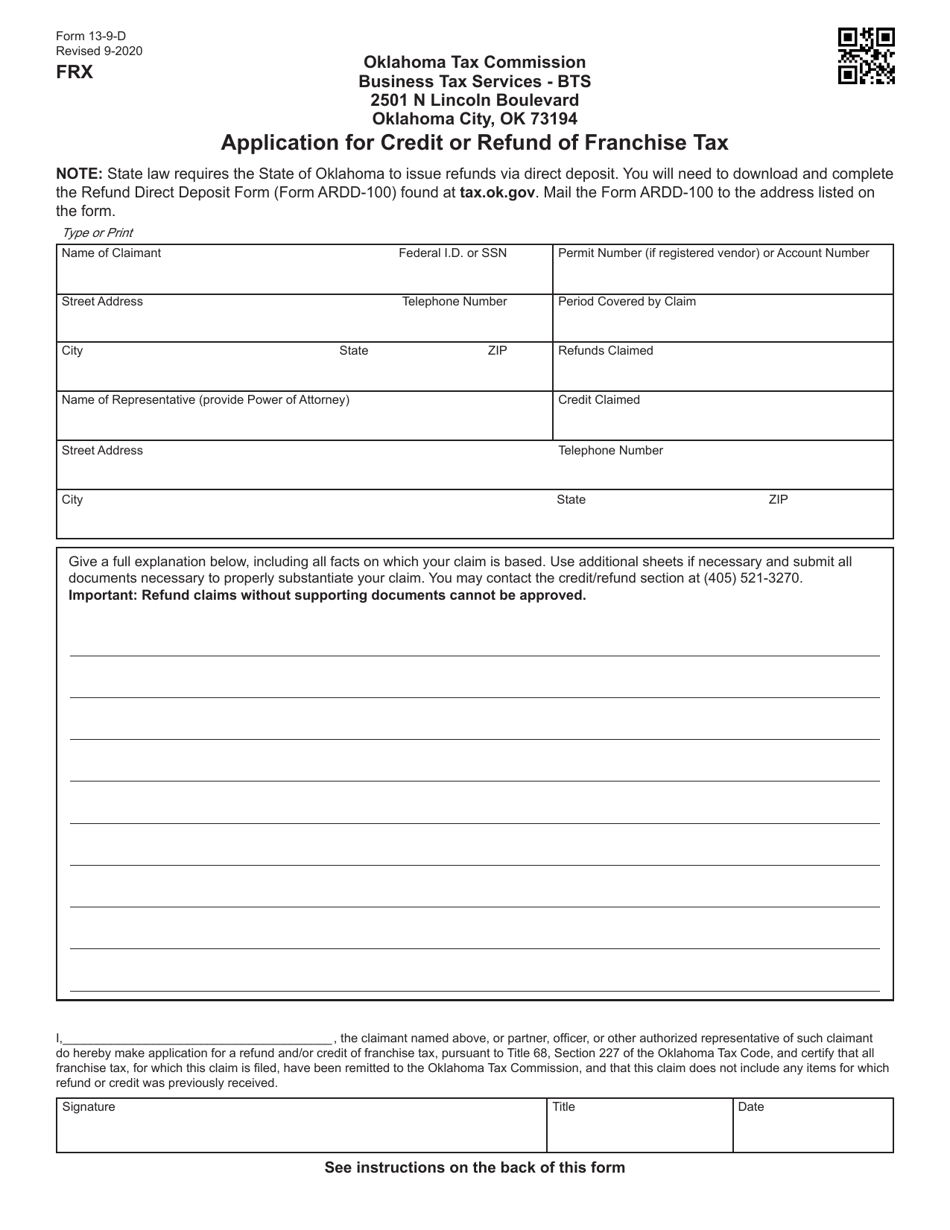

Fillable Oklahoma Tax Commission Application For Agriculture Exemption

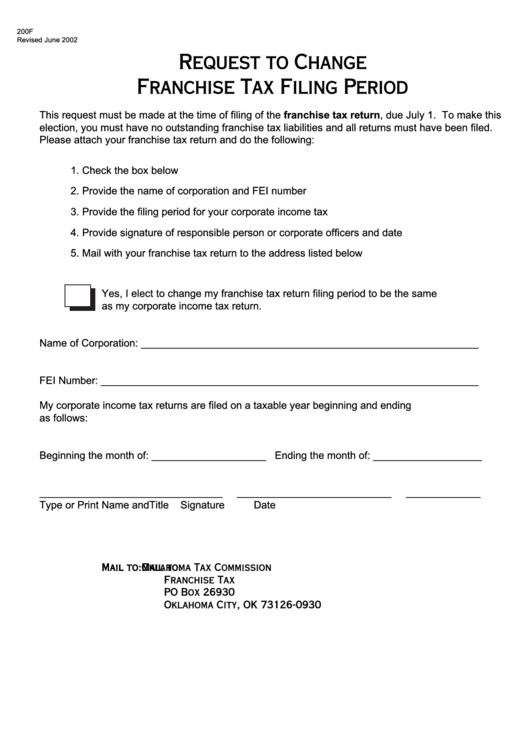

Fillable Form 200F Franchise Election Oklahoma Tax Commission

Fill Free fillable forms State of Oklahoma

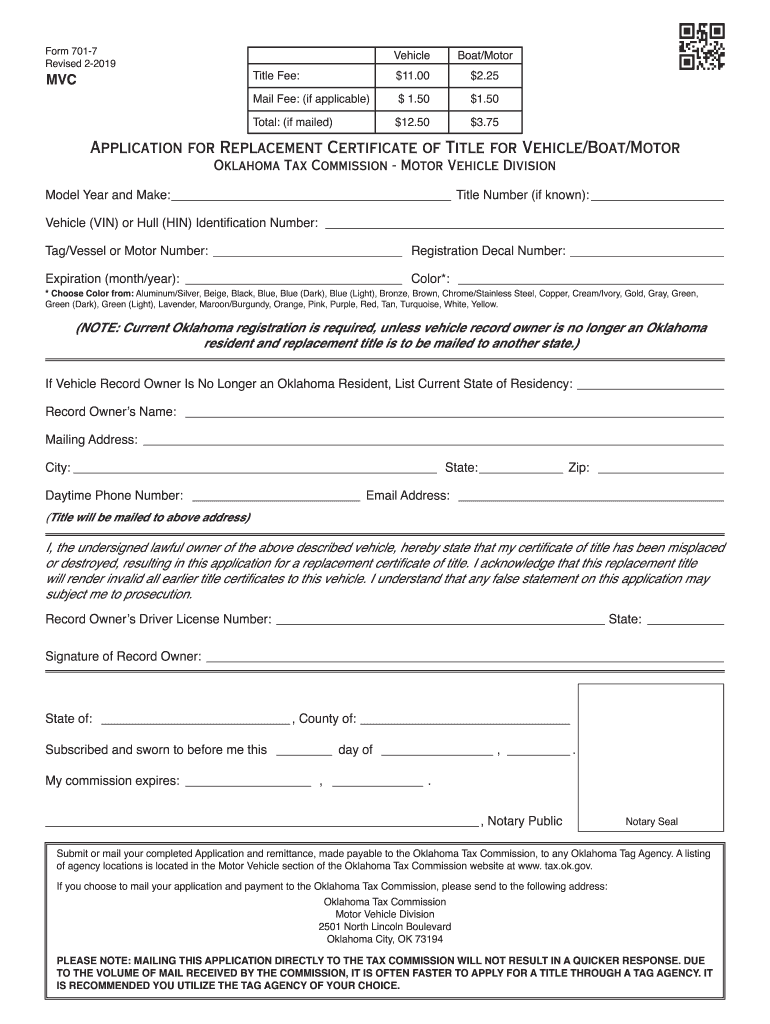

Oklahoma form 701 7 Fill out & sign online DocHub

oklahoma franchise tax instructions Hugeness Webzine Photo Exhibition

oklahoma franchise tax instructions Hugeness Webzine Photo Exhibition

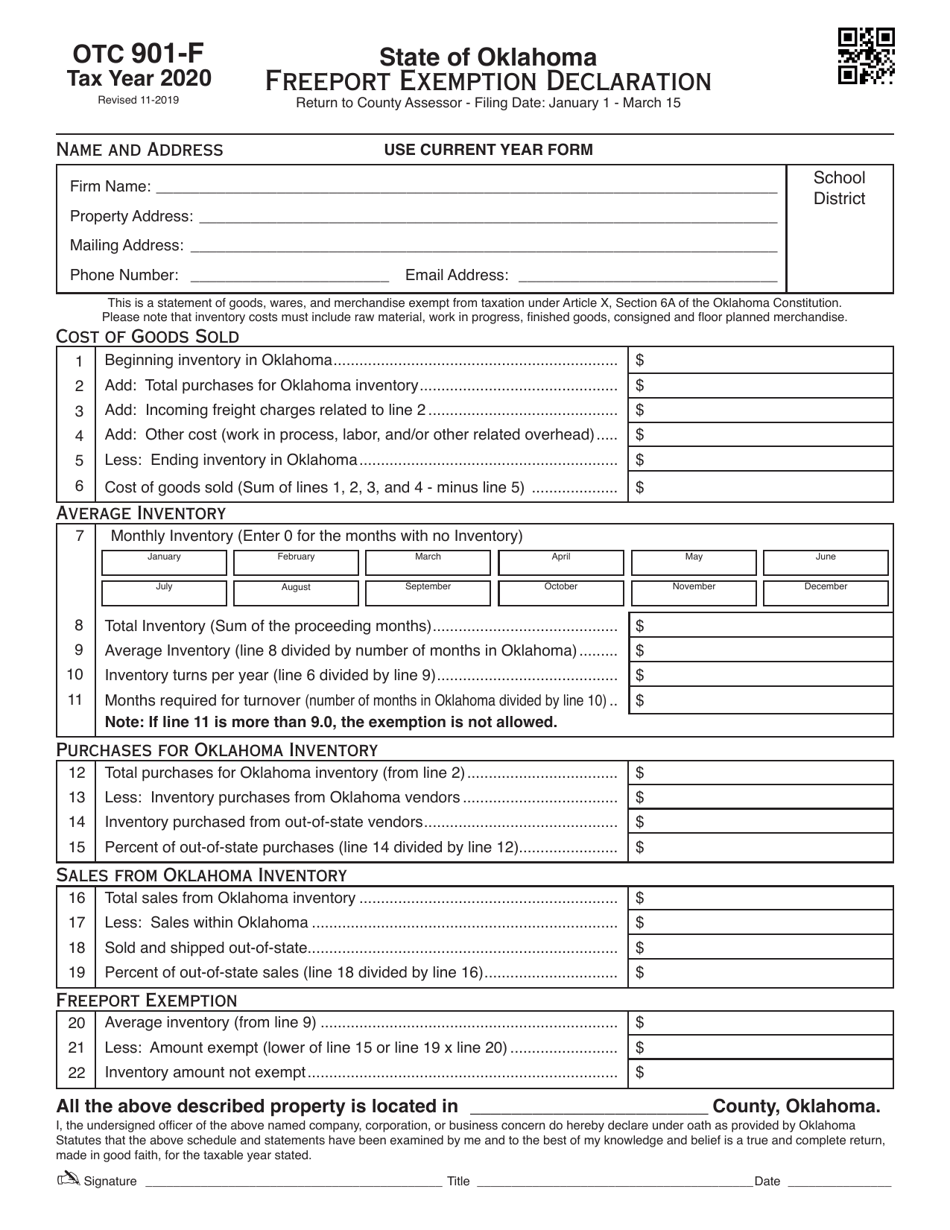

OTC Form 901F Download Fillable PDF or Fill Online Freeport Exemption

Form 200f Request To Change Franchise Tax Filing Period printable pdf

oklahoma franchise tax form Dannie Crabtree

Related Post: