Form 8834 Vs 8936

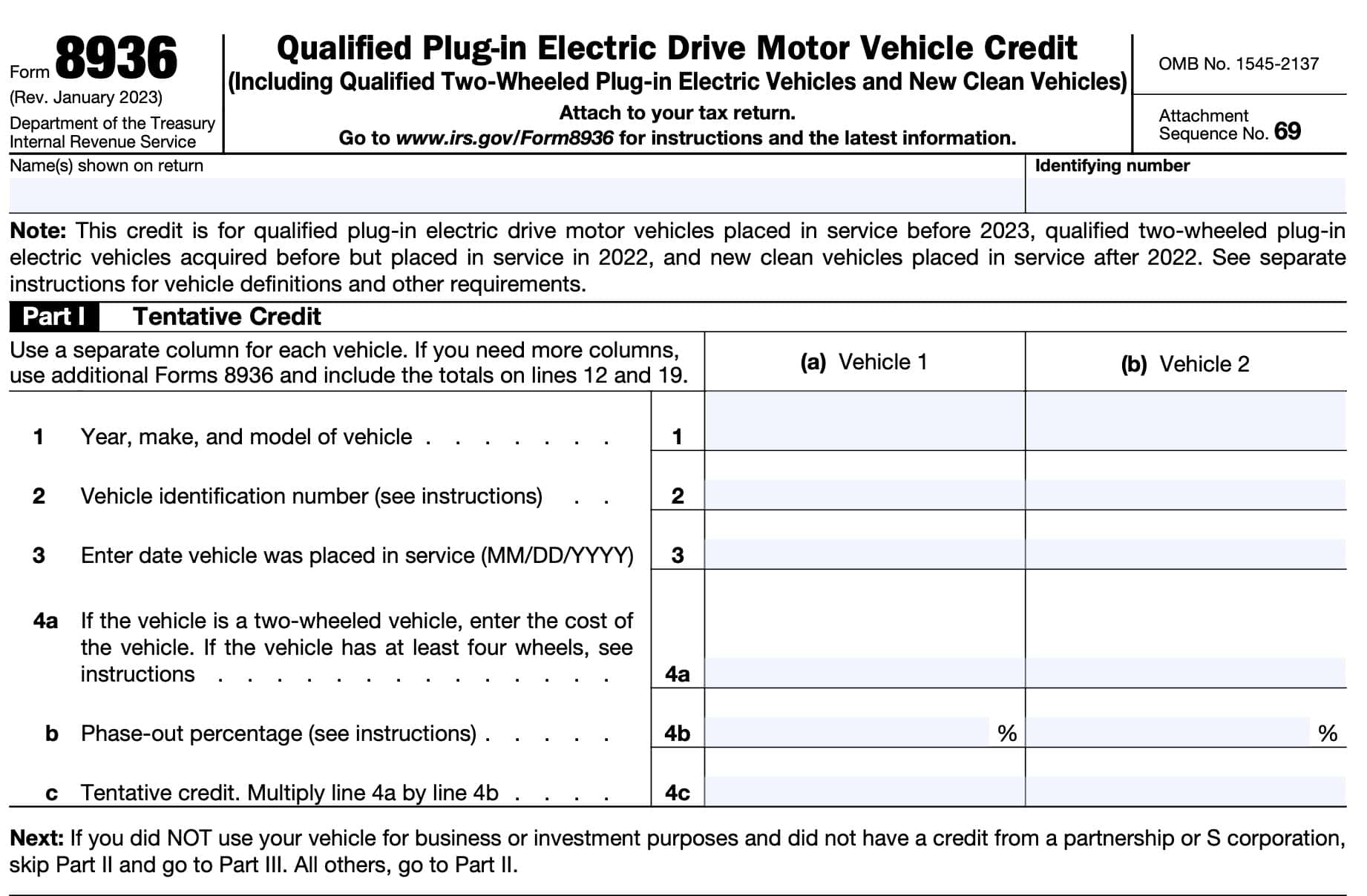

Form 8834 Vs 8936 - Qualified electric vehicle passive activity credits allowed. Here is how to find. Use prior revisions of this form for earlier tax years. The two forms have a similar name, but are used very differently. January 2023) department of the treasury internal revenue service. Web intuit help intuit. Information about form 8834, qualified electric vehicle credit, including recent updates, related forms and. Web use this november 2021 revision of form 8834 for tax years beginning in 2021 or later until a later revision is issued. • claim the credit for certain alternative motor vehicles on form 8910. Web be sure that the form you are looking for is form 8834 and not form 8936. January 2023) department of the treasury internal revenue service. Web be sure that the form you are looking for is form 8834 and not form 8936. 8834 is for an old tax credit available for cars that were purchased before 2007, as it says on top of the form. Information about form 8834, qualified electric vehicle credit, including recent updates,. Solved • by intuit • 211 • updated 1 year ago. 8834 is for an old tax credit available for cars that were purchased before 2007, as it says on top of the form. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Web solved•by intuit•87•updated february 10, 2023. Web page last. Web solved•by intuit•87•updated february 10, 2023. Here is how to find. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Qualified electric vehicle passive activity credits allowed. Use prior revisions of the form for earlier tax years. 8834 is for an old tax credit available for cars that were purchased before 2007, as it says on top of the form. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Also use form 8936 to figure your credit for. Web solved•by intuit•87•updated february 10, 2023. Information about form 8834, qualified. Web solved•by intuit•75•updated 1 year ago. Web intuit help intuit. 8834 is for an old tax credit available for cars that were purchased before 2007, as it says on top of the form. • claim the credit for certain alternative motor vehicles on form 8910. Have you been able to actually. Web solved•by intuit•75•updated 1 year ago. Qualified electric vehicle passive activity credits allowed. The two forms have a similar name, but are used very differently. Web be sure that the form you are looking for is form 8834 and not form 8936. Here is how to find. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Credits that reduce regular tax before the qualified. Here is how to find. Have you been able to actually. The two forms have a similar name, but are used very differently. Web intuit help intuit. The two forms have a similar name, but are used very differently. January 2023) department of the treasury internal revenue service. Information about form 8834, qualified electric vehicle credit, including recent updates, related forms and. Qualified electric vehicle passive activity credits allowed. Here is how to find. Web solved•by intuit•75•updated 1 year ago. Web use this november 2021 revision of form 8834 for tax years beginning in 2021 or later until a later revision is issued. Use prior revisions of the form for earlier tax years. Web use the january 2023 revision of form 8936 for tax years beginning in 2022 or. Credits that reduce regular tax before the qualified. Use prior revisions of this form for earlier tax years. Web page last reviewed or updated: Web use this november 2021 revision of form 8834 for tax years beginning in 2021 or later until a later revision is issued. Also use form 8936 to figure your credit for. Web use this november 2021 revision of form 8834 for tax years beginning in 2021 or later until a later revision is issued. Web solved•by intuit•87•updated february 10, 2023. Web use the january 2023 revision of form 8936 for tax years beginning in 2022 or later, until a later revision is issued. 8834 is for an old tax credit available for cars that were purchased before 2007, as it says on top of the form. Credits that reduce regular tax before the qualified. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle. Web solved•by intuit•75•updated 1 year ago. Also use form 8936 to figure your credit for. Have you been able to actually. Web be sure that the form you are looking for is form 8834 and not form 8936. The two forms have a similar name, but are used very differently. Here is how to find. • claim the credit for certain alternative motor vehicles on form 8910. Solved • by intuit • 211 • updated 1 year ago. January 2023) department of the treasury internal revenue service. Information about form 8834, qualified electric vehicle credit, including recent updates, related forms and. Use prior revisions of this form for earlier tax years. Web page last reviewed or updated: Qualified electric vehicle passive activity credits allowed. Web intuit help intuit.Top Va Form 218834 Templates free to download in PDF format

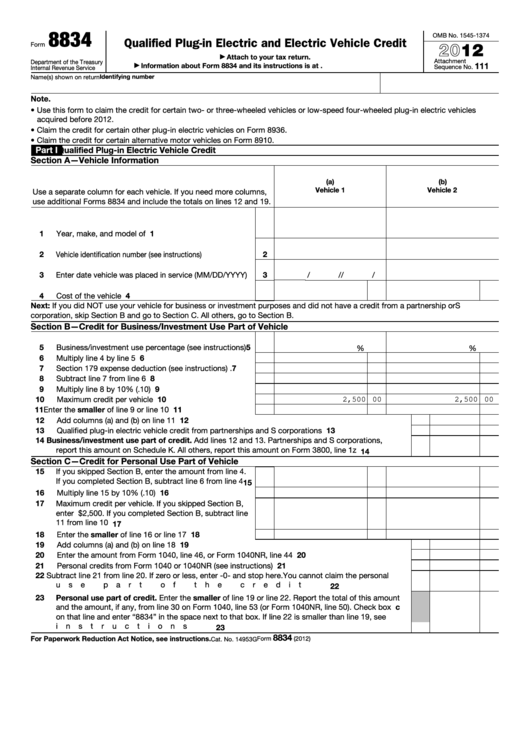

Fillable Form 8834 Qualified PlugIn Electric And Electric Vehicle

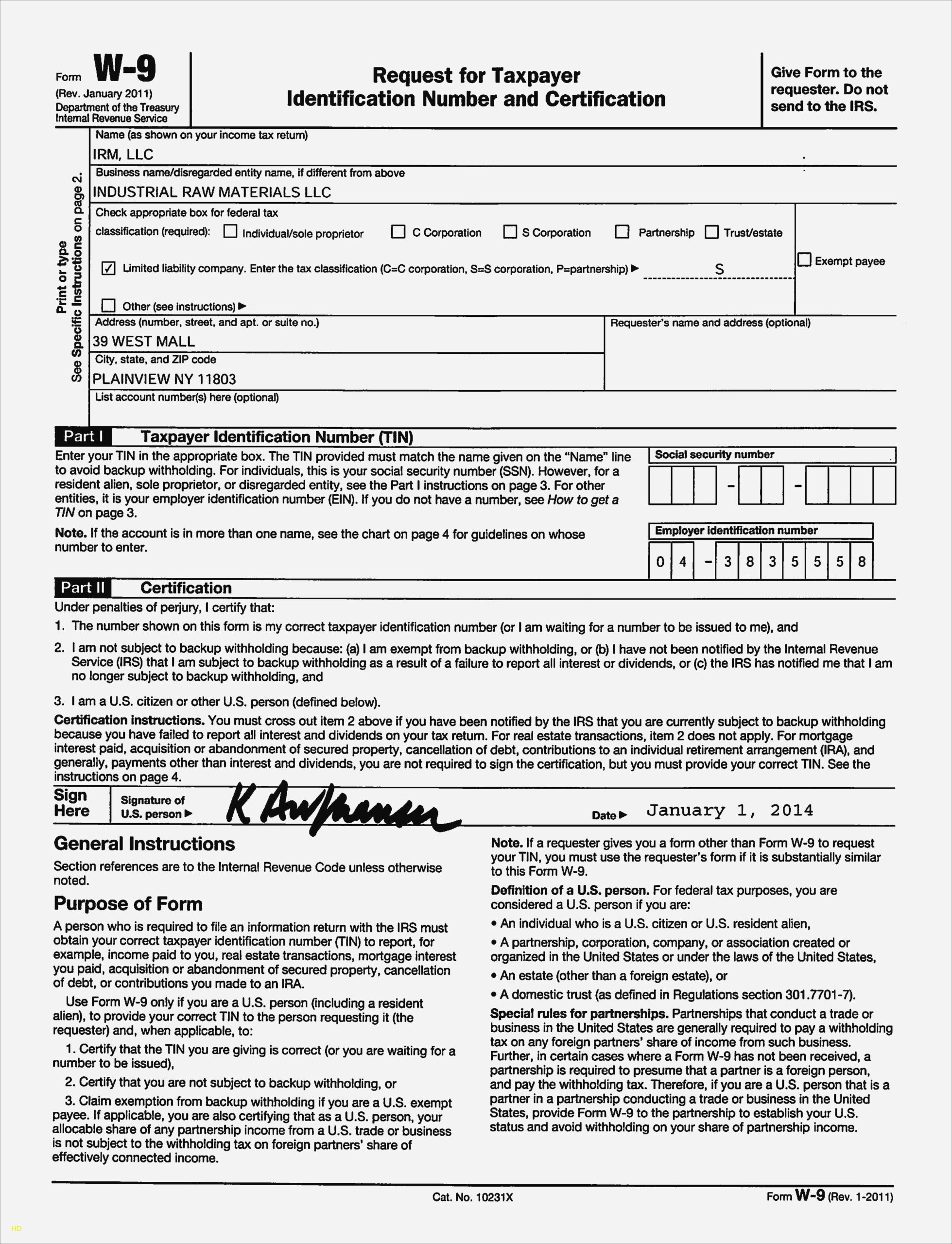

Free Fillable W 9 Forms Printable Forms Free Online

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

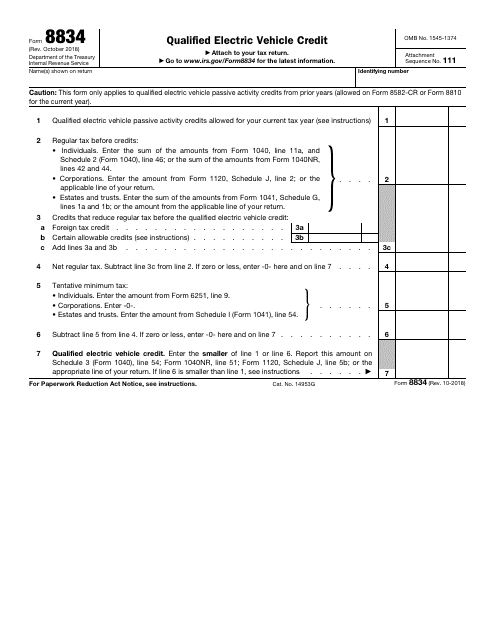

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric

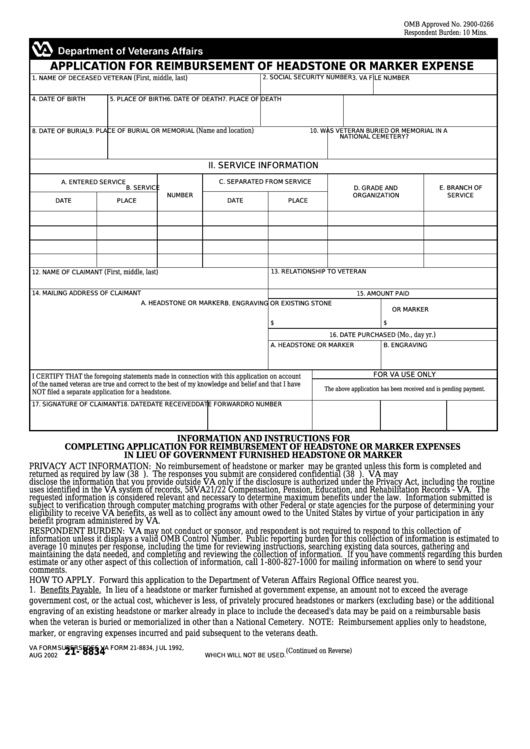

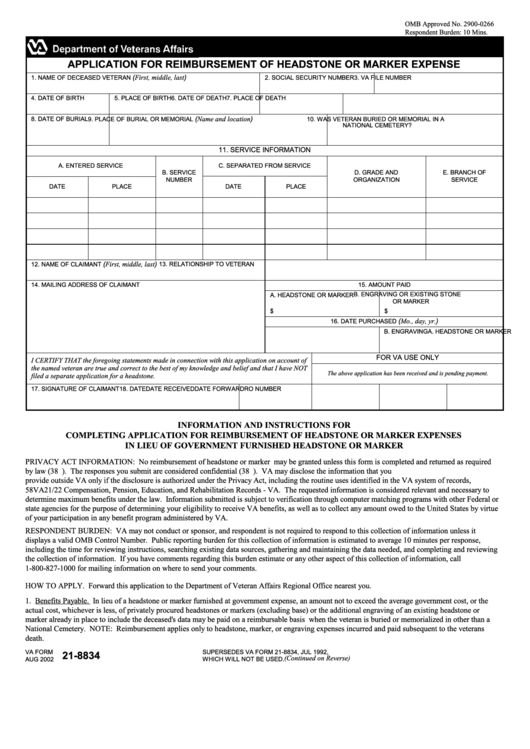

Fillable Va Form 218834 Application For Reimbursement Of Headstone

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

Filing Tax Returns & EV Credits Tesla Motors Club

IRS Form 8936 Instructions Qualifying Electric Vehicle Tax Credits

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

Related Post: