Form 6251 Instructions

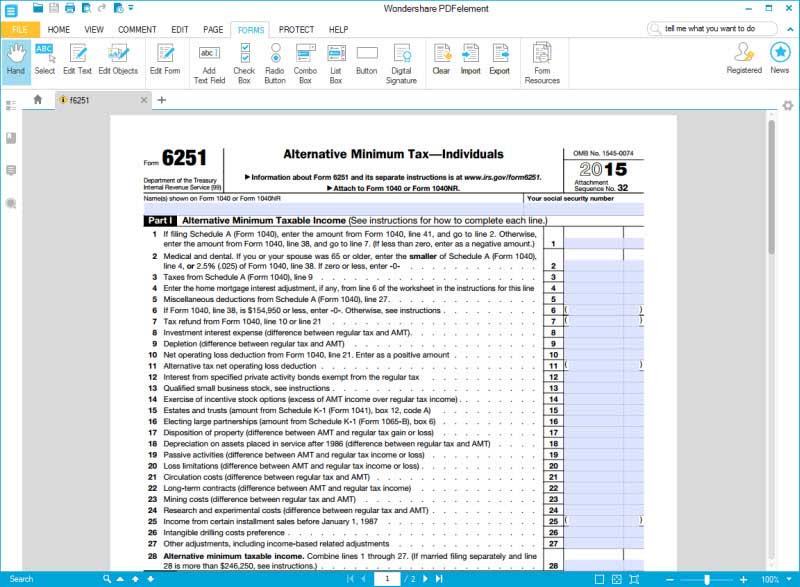

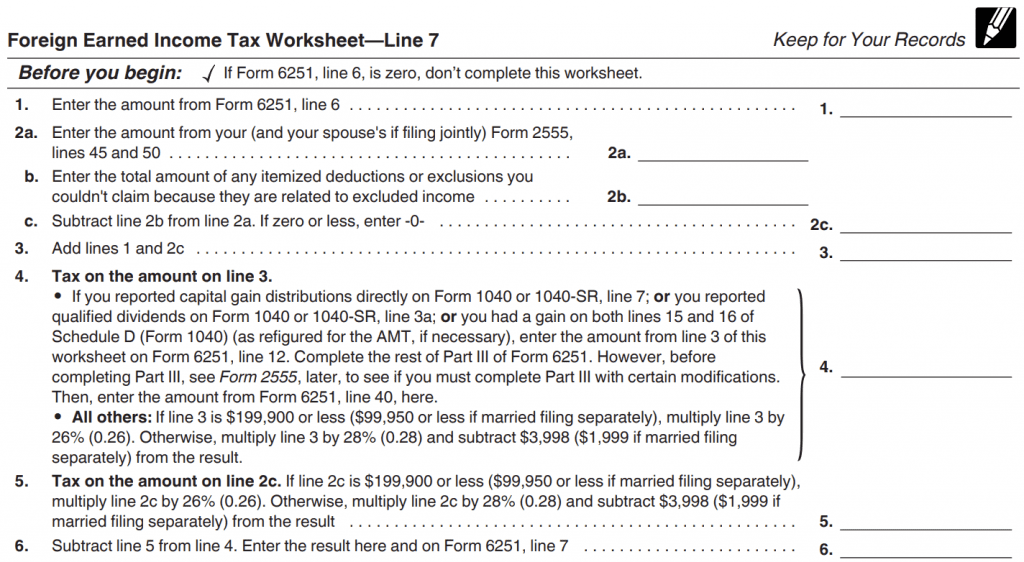

Form 6251 Instructions - You claim any general business credit, and either line 6 (in part i) of form 3800 or line 25 of form 3800 is more than zero. Other adjustments on federal form 6251. But if you bare filling form 2555, write the amount from. Ad access irs tax forms. Complete, edit or print tax forms instantly. Click on the button get form to open it and start editing. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Fill in form 6251 through minimum taxable any, of. Web solved•by intuit•14•updated june 13, 2023. Ad access irs tax forms. Tax preference items on federal form 6251; Other adjustments on federal form 6251. Web see the instructions for form 6251 for more details, what are the amt tax rates? For instructions and the latest. Web solved•by intuit•14•updated june 13, 2023. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers who have incomes that exceed the amt exemption may be subject to. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web see the instructions for form 6251 for. The amt is a separate tax that is imposed in addition to your regular tax. But if you bare filling form 2555, write the amount from. If there are no adjustments on form 6251, the. Department of the treasury internal revenue service. You may need to file form 6251 if you have specific amt items. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Get ready for tax season deadlines by completing any required tax forms today. Web solved•by intuit•14•updated june 13, 2023. Form 6251, line 7, is greater than line 10. Complete, edit or print tax forms instantly. For instructions and the latest. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web enter 1 to force form 6251 to print whenever there is an adjustment (other than itemized deductions) on form 6251. You may need to file form 6251 if you have specific amt items. Department of the treasury internal revenue service. Web tax computation using maximum capital gains rate. Get ready for tax season deadlines by completing any required tax forms today. Form 6251, line 7, is greater than line 10. On line 36, enter the amount on form 6251, line 30. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. On line 36, enter the amount on form 6251, line 30. Web enter 1 to force form 6251 to print whenever there is an adjustment (other than itemized deductions) on form 6251. Ad access irs tax forms.. For instructions and the latest. Ad access irs tax forms. Department of the treasury internal revenue service. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Other adjustments on federal form 6251. Fill out all needed lines in the file making use of our convenient. Web enter 1 to force form 6251 to print whenever there is an adjustment (other than itemized deductions) on form 6251. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Other adjustments on federal form 6251.. Get ready for tax season deadlines by completing any required tax forms today. Other adjustments on federal form 6251. Web see the instructions for form 6251 for more details, what are the amt tax rates? Fill out all needed lines in the file making use of our convenient. Web adjustments on federal form 6251 relative to itemized deductions; Fill out all needed lines in the file making use of our convenient. If there are no adjustments on form 6251, the. But if you bare filling form 2555, write the amount from. On line 36, enter the amount on form 6251, line 30. Department of the treasury internal revenue service (99) go to. Get ready for tax season deadlines by completing any required tax forms today. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Click on the button get form to open it and start editing. Web tax computation using maximum capital gains rate. Complete, edit or print tax forms instantly. Web see the instructions for form 6251 for more details, what are the amt tax rates? Complete, edit or print tax forms instantly. Web enter 1 to force form 6251 to print whenever there is an adjustment (other than itemized deductions) on form 6251. Other adjustments on federal form 6251. Ad access irs tax forms. Department of the treasury internal revenue service. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web solved•by intuit•14•updated june 13, 2023. You may need to file form 6251 if you have specific amt items. Ad access irs tax forms.Instructions for How to Fill in IRS Form 6251

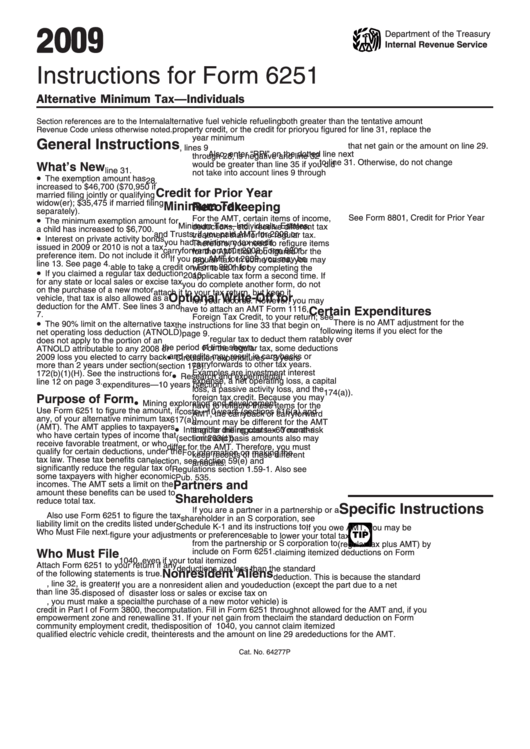

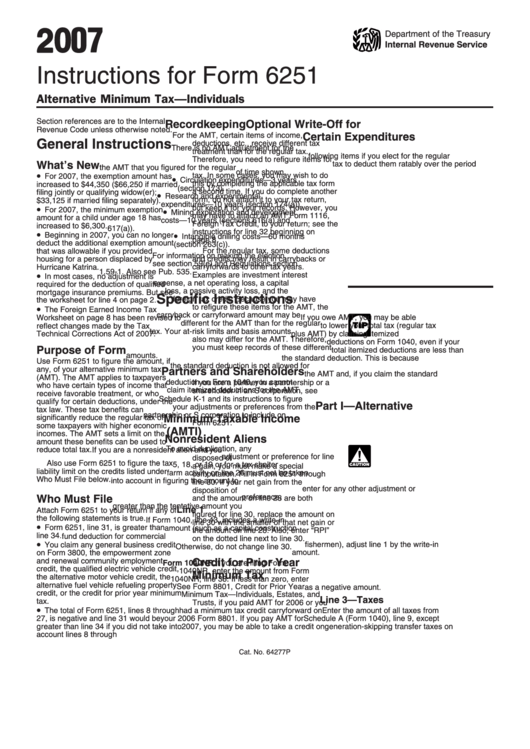

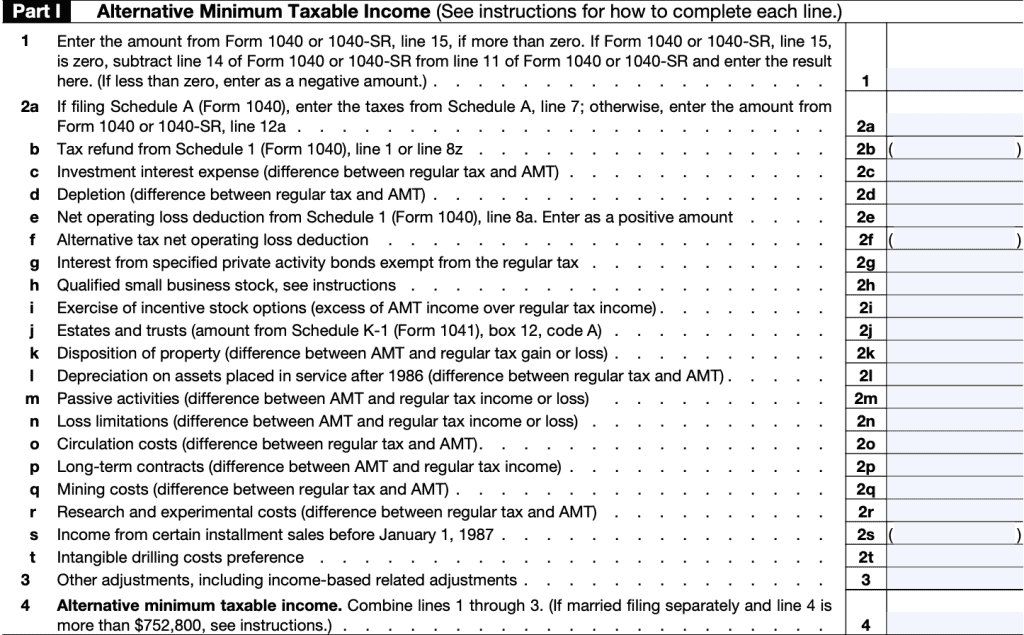

Instructions For Form 6251 Alternative Minimum Tax Individuals

Instructions For Form 6251 Alternative Minimum Tax Individuals

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

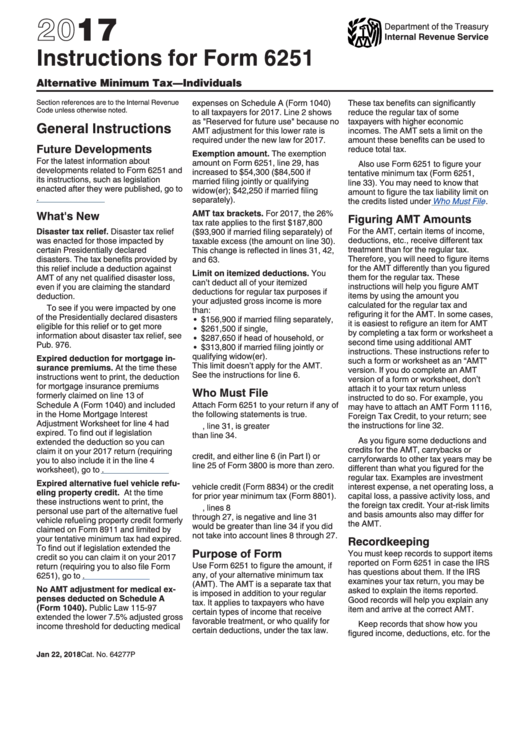

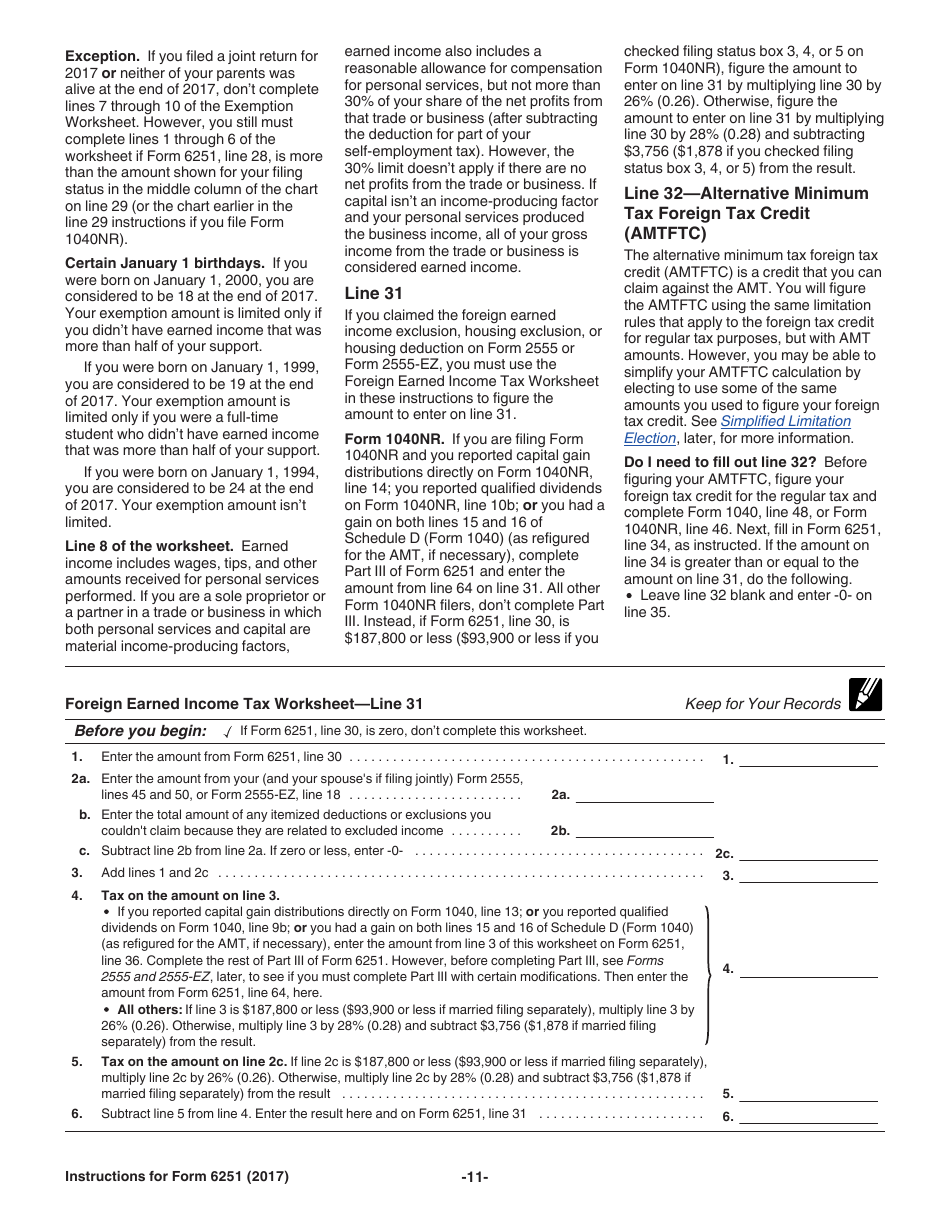

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2017

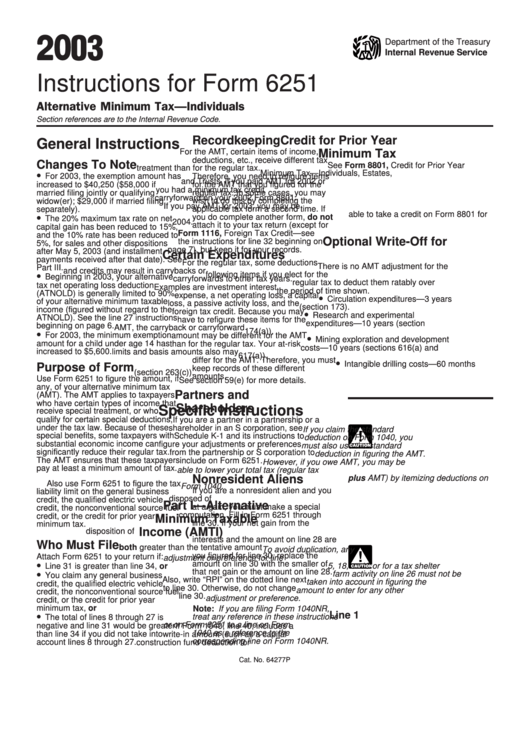

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2003

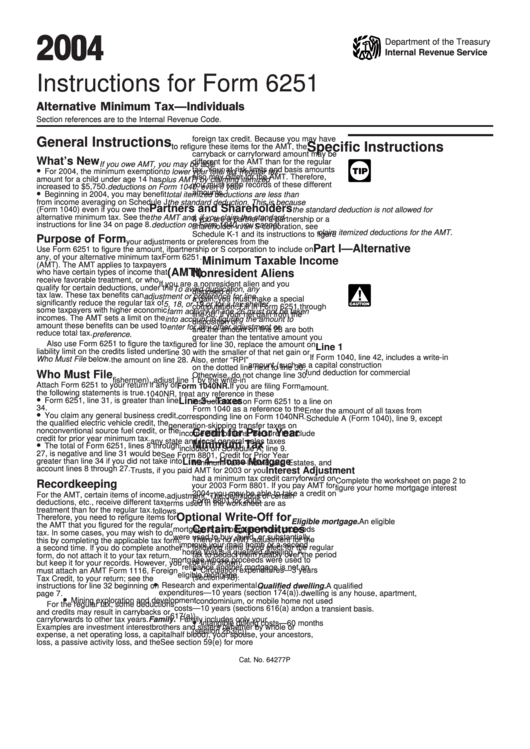

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

form 6251 instructions 2020 2021 Fill Online, Printable, Fillable

Download Instructions for IRS Form 6251 Alternative Minimum Tax

IRS Form 6251 Instructions A Guide to Alternative Minimum Tax

Related Post: