Form 6198 At-Risk Limitations

Form 6198 At-Risk Limitations - Web part iii detailed computation of amount at risk. December 2020) department of the treasury internal revenue service. Attach to your tax return. Make an assessment of the amount at risk in the business. Ad signnow.com has been visited by 100k+ users in the past month Form 6198 isn't currently supported in the fiduciary module, and must be. Second, the partner's amount at risk under. First, the adjusted tax basis of the partnership interest under sec. Generally, any loss from an activity (such as a. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web part iii detailed computation of amount at risk. Web these rules and the order in which they apply are: First, the adjusted tax basis of the partnership interest under sec. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web form 6198 consists of four sections and allows you to: Web part iii detailed computation of amount at risk. Web page last reviewed or updated: First, the adjusted tax basis of the partnership interest under sec. Estimate your current year's business losses. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Go to the income/deductions > partnership passthrough worksheet. First, the adjusted tax basis of the partnership interest under sec. Ad signnow.com has been visited by 100k+ users in the past month If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web part iii detailed computation of amount at risk. Web part iii detailed computation of amount at risk. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web form 6198 consists of four sections and allows you to: Form 6198 isn't currently supported in the fiduciary module, and must be. Ad signnow.com has been visited by 100k+ users in the. Web part iii detailed computation of amount at risk. First, the adjusted tax basis of the partnership interest under sec. Generally, any loss from an activity (such as a. Go to the income/deductions > partnership passthrough worksheet. Web part iii detailed computation of amount at risk. Attach to your tax return. Generally, any loss from an activity (such as a. Web part iii detailed computation of amount at risk. The following rules apply to amounts borrowed after may 3, 2004. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Generally, any loss from an activity (such as a. Estimate your current year's business losses. Make an assessment of the amount at risk in the business. Web part iii detailed computation of amount at risk. The following rules apply to amounts borrowed after may 3, 2004. Form 6198 isn't currently supported in the fiduciary module, and must be. The following rules apply to amounts borrowed after may 3, 2004. Web these rules and the order in which they apply are: If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web form 6198 consists of four sections and. December 2020) department of the treasury internal revenue service. Web part iii detailed computation of amount at risk. Generally, any loss from an activity (such as a. Estimate your current year's business losses. Web page last reviewed or updated: If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Estimate your current year's business losses. Generally, any loss from an activity (such as a. Form 6198 is used by individuals, estates, trusts, and certain corporations to. The following rules apply to amounts borrowed after may 3, 2004. First, the adjusted tax basis of the partnership interest under sec. Make an assessment of the amount at risk in the business. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web form 6198 consists of four sections and allows you to: Web part iii detailed computation of amount at risk. Generally, any loss from an activity (such as a. Web these rules and the order in which they apply are: Form 6198 is used by individuals, estates, trusts, and certain corporations to. Attach to your tax return. Second, the partner's amount at risk under. Ad signnow.com has been visited by 100k+ users in the past month Web part iii detailed computation of amount at risk. December 2020) department of the treasury internal revenue service. Estimate your current year's business losses. If you completed part iii of form 6198 for the prior year, see page 4 of the instructions. Web page last reviewed or updated: Generally, any loss from an activity (such as a. Go to the income/deductions > partnership passthrough worksheet. The following rules apply to amounts borrowed after may 3, 2004. Form 6198 isn't currently supported in the fiduciary module, and must be.Form 6198 atRisk Limitations Inscription on the Piece of Paper Stock

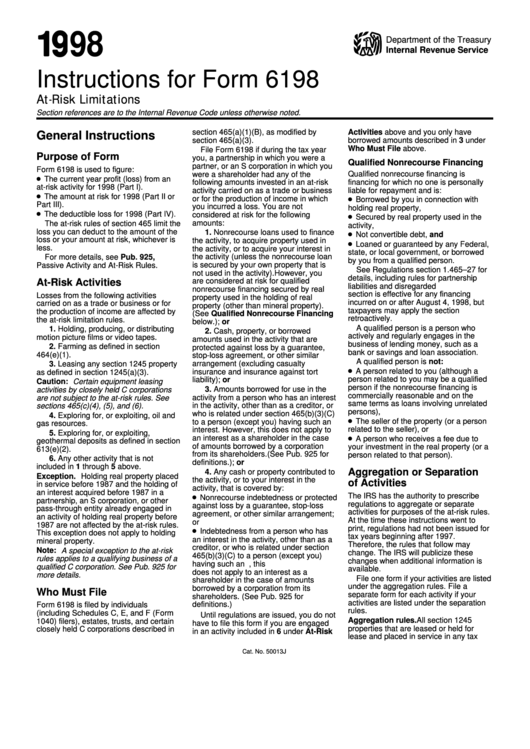

Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

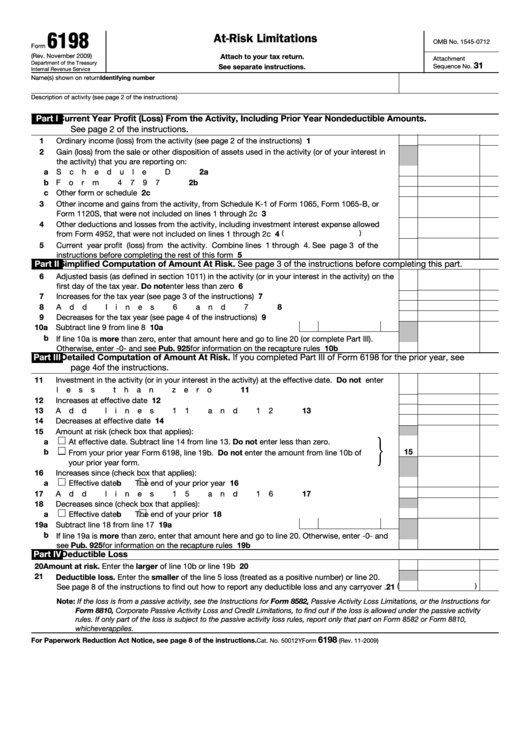

Form 6198 AtRisk Limitations (2009) Free Download

Fillable Form 6198 AtRisk Limitations printable pdf download

IRS "AtRisk" Overview TaxBuzz

What Is IRS Schedule C?

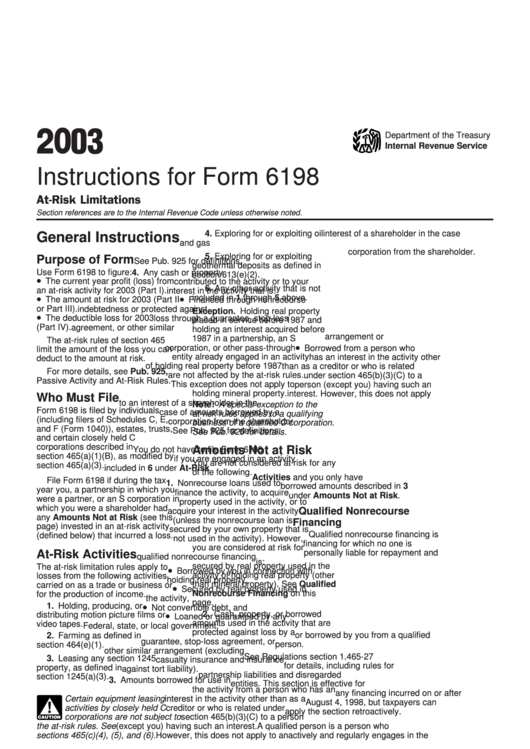

Instructions For Form 6198 AtRisk Limitations 2003 printable pdf

What Is Form 6198 AtRisk Limitations TurboTax Tax Tips & Videos

Fillable Online Irs Form 6198 Instructions 2014 Fax Email Print pdfFiller

Attorney Notes Pdf

Related Post:

:max_bytes(150000):strip_icc()/IRSScheduleC-33b3240fe6064e65aef7f2347f2fe1fa.jpg)