Form 592 F

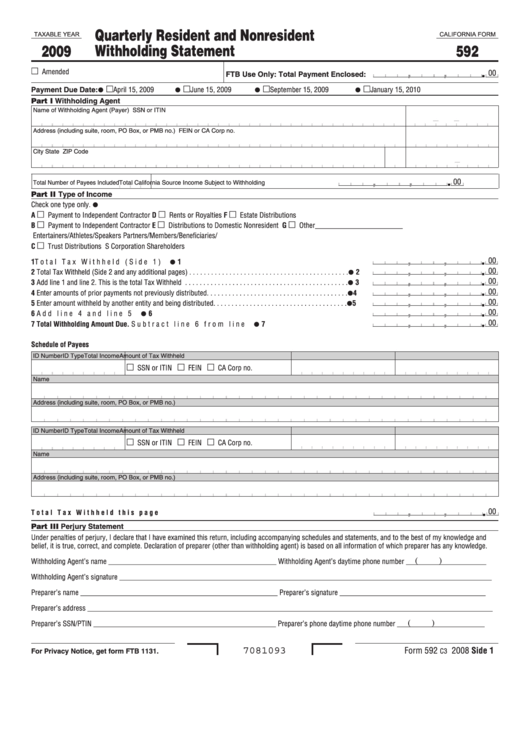

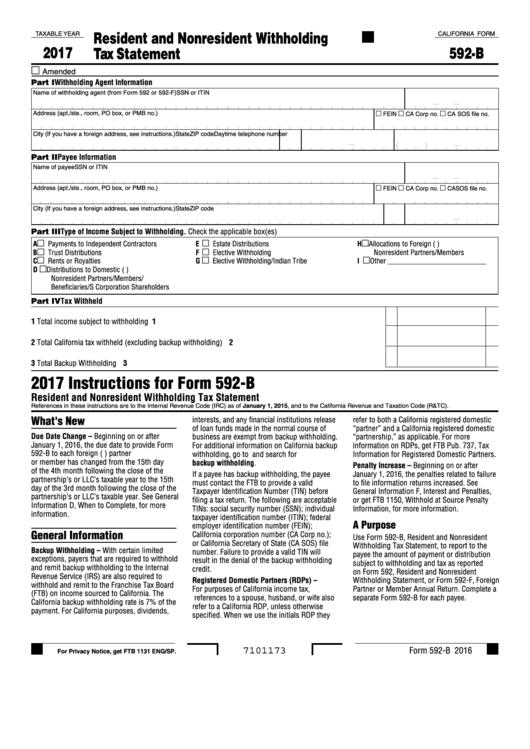

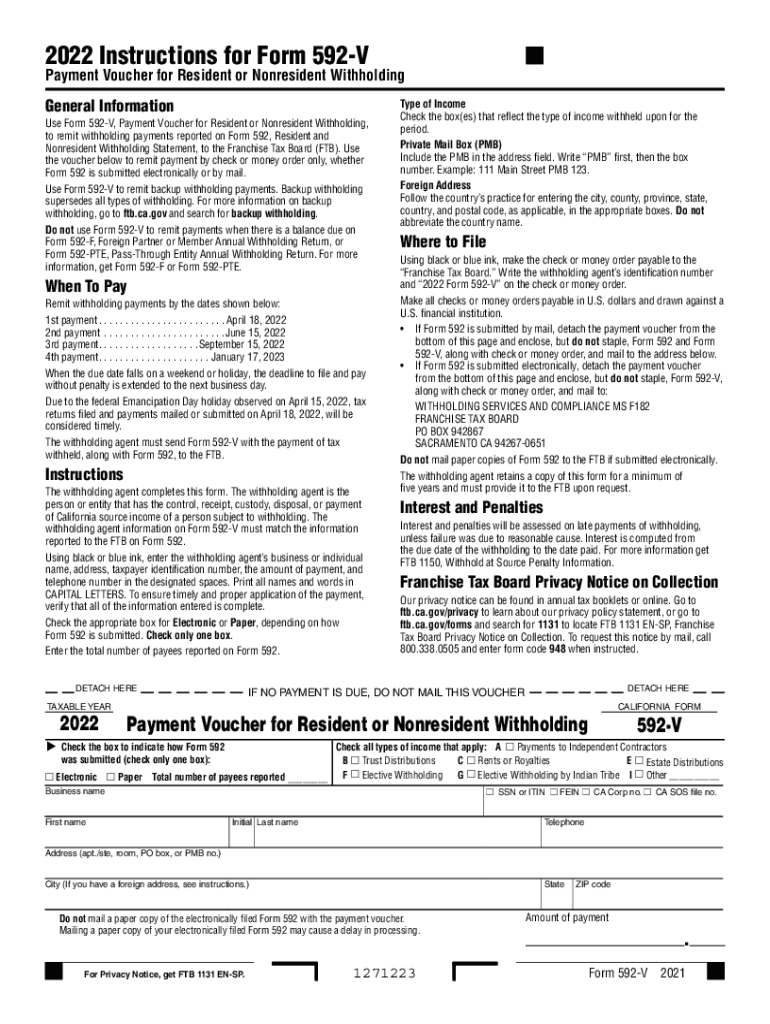

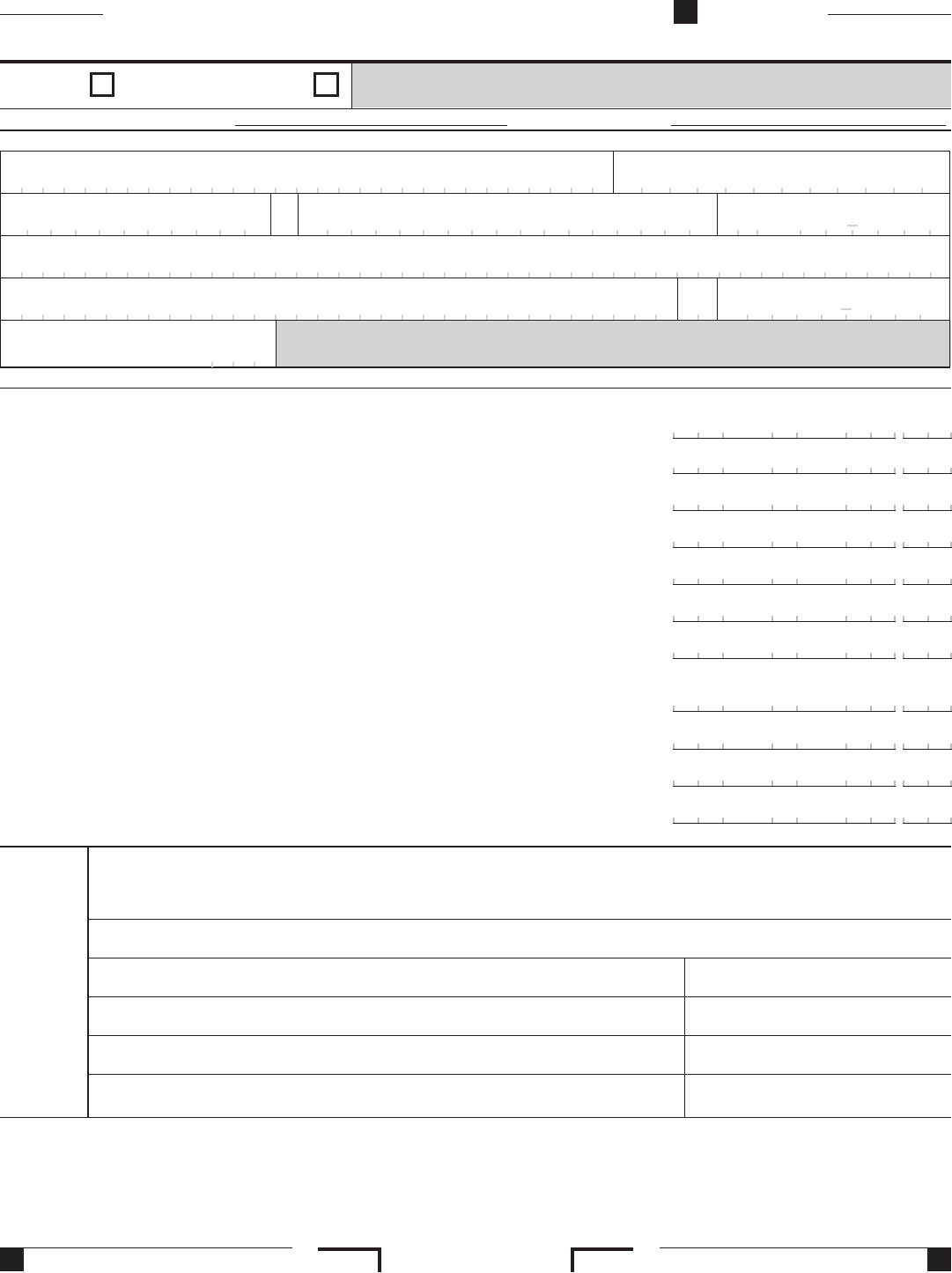

Form 592 F - All members or partners foreign. Web do not use form 592 if: Enter the beginning and ending dates for the. Web california — foreign partner or member annual return. You are reporting withholding on foreign partners or members. Web resident and nonresident withholding statement. Please use the link below. Use form 593, real estate. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. It appears you don't have a pdf plugin for this browser. Please use the link below. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Business name ssn or itin fein ca corp no. Form 592 is a california. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Enter the beginning and ending dates for the. View all 175 california income tax forms. College access tax credit tax credit: Total number of foreign partners or members included. Please use the link below. Part ii type of income. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale of real estate. Total number of foreign partners or members included. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Please use the link below. College access tax credit tax credit: Form 592 is a california. Use form 593, real estate. Web california — foreign partner or member annual return. Total number of foreign partners or members included. You are reporting withholding on foreign partners or members. View all 175 california income tax forms. Total number of foreign partners or members included. College access tax credit tax credit: Use form 593, real estate. View all 175 california income tax forms. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Form 592 is a california. All members or partners foreign. Web resident and nonresident withholding statement. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Total number of foreign partners or members included. Please use the link below. Web california — foreign partner or member annual return. All members or partners foreign. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Foreign partner or member annual return: Total number of foreign partners or members included.. View all 175 california income tax forms. Business name ssn or itin fein ca corp no. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Web california — foreign partner or member annual return. Total number of foreign partners or members included. Use form 593, real estate. Total number of foreign partners or members included. Web california — foreign partner or member annual return. Web resident and nonresident withholding statement. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Total number of foreign partners or members included. It appears you don't have a pdf plugin for this browser. Enter the beginning and ending dates for the. View all 175 california income tax forms. Please use the link below. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale of real estate. Total number of foreign partners or members included. Form 592 is a california. Web california — foreign partner or member annual return. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. College access tax credit tax credit: All members or partners foreign. Business name ssn or itin fein ca corp no. Foreign partner or member annual return: Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. All members or partners foreign. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. You are reporting withholding on foreign partners or members. Use form 593, real estate. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale.Fillable California Form 592 Quarterly Resident And Nonresident

592 f form Fill out & sign online DocHub

Form 592 Fillable Printable Forms Free Online

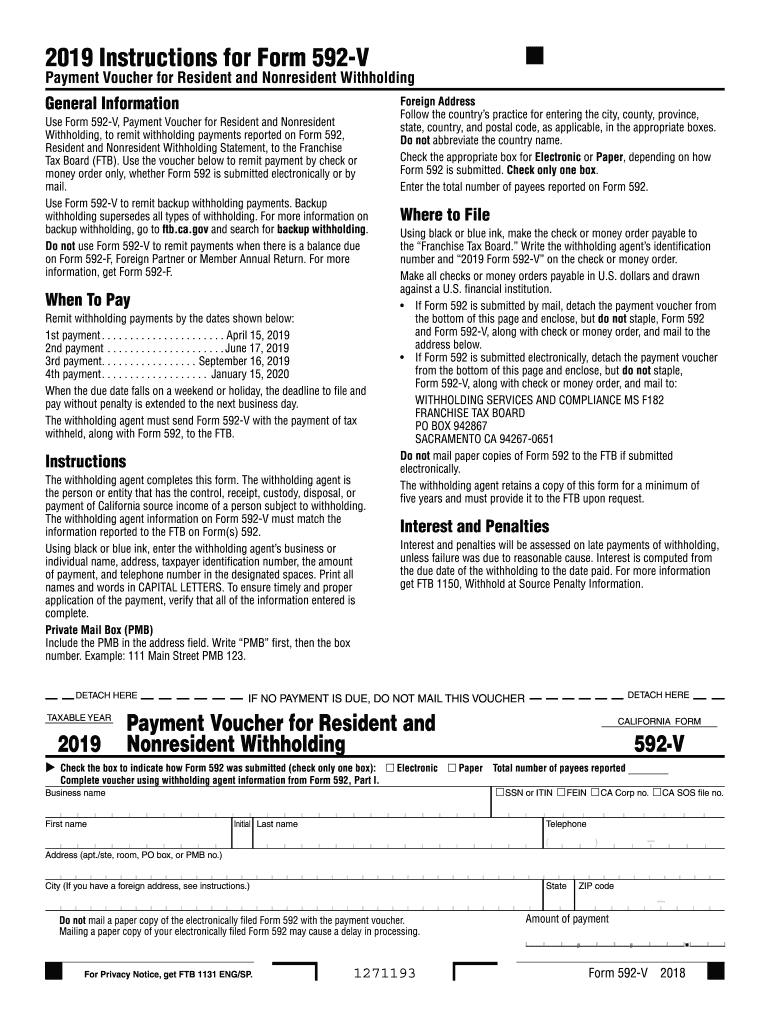

Form 592 V Fill Out and Sign Printable PDF Template signNow

2017 Form 592F Foreign Partner Or Member Annual Return Edit, Fill

California Form 592 V 2019 Fill Out and Sign Printable PDF Template

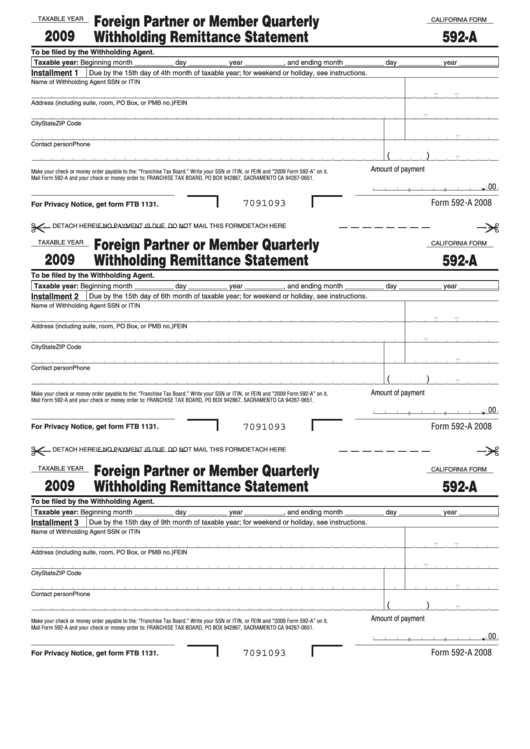

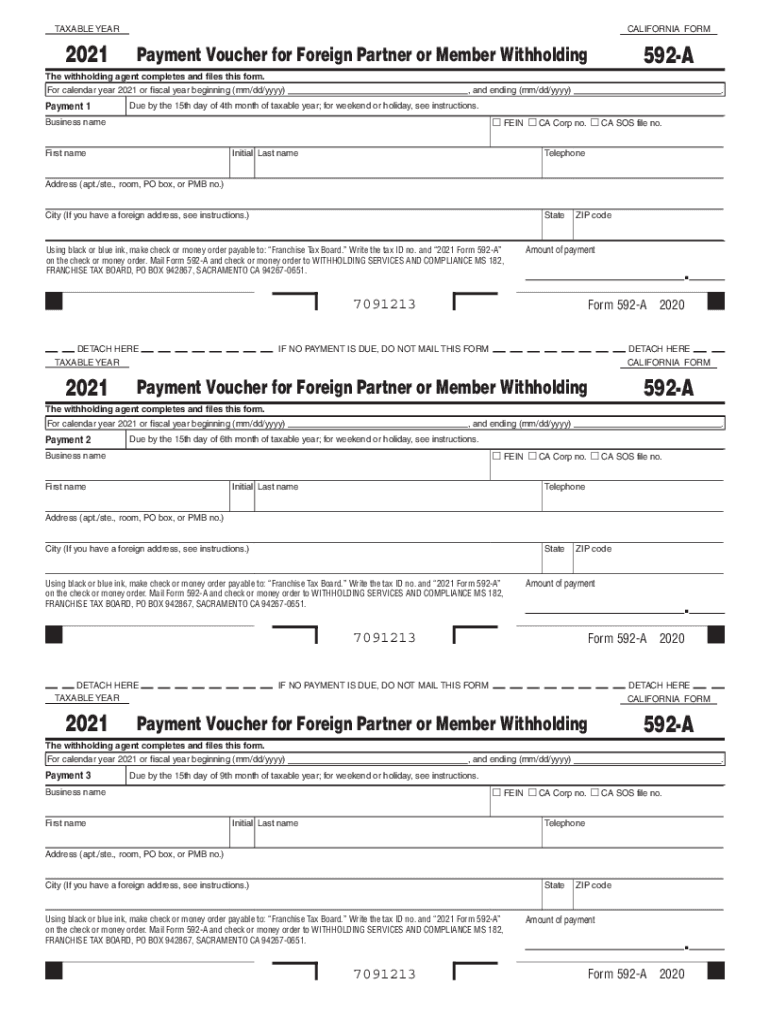

Fillable California Form 592A Foreign Partner Or Member Quarterly

2021 Form CA FTB 592F Fill Online, Printable, Fillable, Blank pdfFiller

Form 592 F ≡ Fill Out Printable PDF Forms Online

California 592 A Fill Out and Sign Printable PDF Template signNow

Related Post: