Form It 204 Ll Instructions

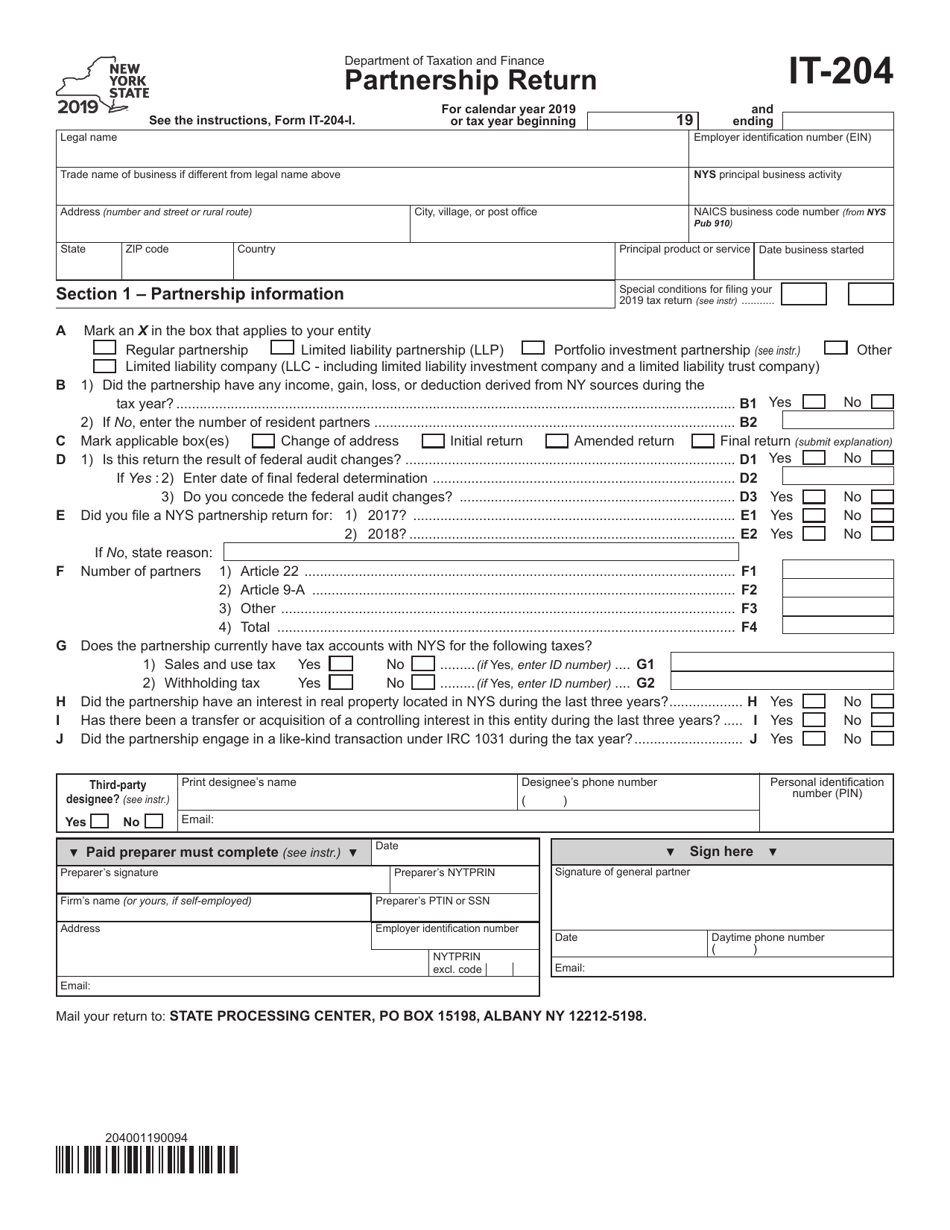

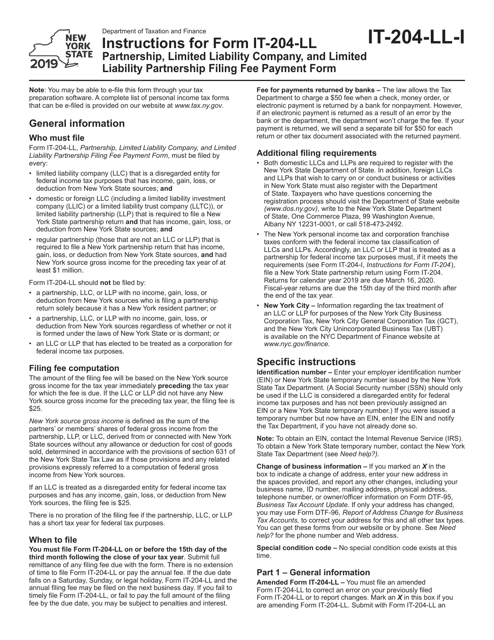

Form It 204 Ll Instructions - Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york. If the due date falls. For calendar year 2022 or tax year beginning 22 and ending. Web 19 rows partnership return; Address (number and street or rural. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Partnership, limited liability company, and limited liability partnership filing fee. Trade name of business if diferent from legal name above. It is used as a means of remitting the state filing. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions):. It is used as a means of remitting the state filing. If the due date falls. Trade name of business if diferent from legal name above. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Web 19 rows partnership return; Address (number and street or rural. For calendar year 2022 or tax year beginning 22 and ending. Web ein and 2019 filing fee on the remittance and submit it with this form. Web 19 rows partnership return; Web department of taxation and finance. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions):. Web ein and 2019 filing fee on the remittance and submit it with this form. For calendar year 2022 or tax year beginning 22 and ending. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Web department of. Full remittance of any filing fee due should be. Web ein and 2019 filing fee on the remittance and submit it with this form. Address (number and street or rural. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york. It is used as a means of remitting the. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions):. Web department of taxation and finance. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york. It is used as a means of remitting the state filing. Full remittance of any filing fee. It is used as a means of remitting the state filing. If the due date falls. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Web ein and 2019 filing fee on the remittance and submit it with this form. Trade name of business if diferent from legal name above. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york. Web department of taxation and finance. Partnership, limited liability company, and limited liability partnership filing fee. Address (number and street or rural. Partnership, limited liability company, and limited liability partnership filing fee. If the due date falls. Trade name of business if diferent from legal name above. Address (number and street or rural. Web 19 rows partnership return; Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Trade name of business if diferent from legal name above. Web ein and 2019 filing fee on the remittance and submit it with this form. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions):. Partnership, limited liability company,. Partnership, limited liability company, and limited liability partnership filing fee. Trade name of business if diferent from legal name above. Web ein and 2019 filing fee on the remittance and submit it with this form. If the due date falls. Web 19 rows partnership return; Trade name of business if diferent from legal name above. It is used as a means of remitting the state filing. Web department of taxation and finance. For calendar year 2022 or tax year beginning 22 and ending. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are. Full remittance of any filing fee due should be. If the due date falls. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions):. Llc that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from new york. Web 19 rows partnership return; Address (number and street or rural. Partnership, limited liability company, and limited liability partnership filing fee. Web ein and 2019 filing fee on the remittance and submit it with this form.Nys form it 204 Fill out & sign online DocHub

Form IT204 2019 Fill Out, Sign Online and Download Fillable PDF

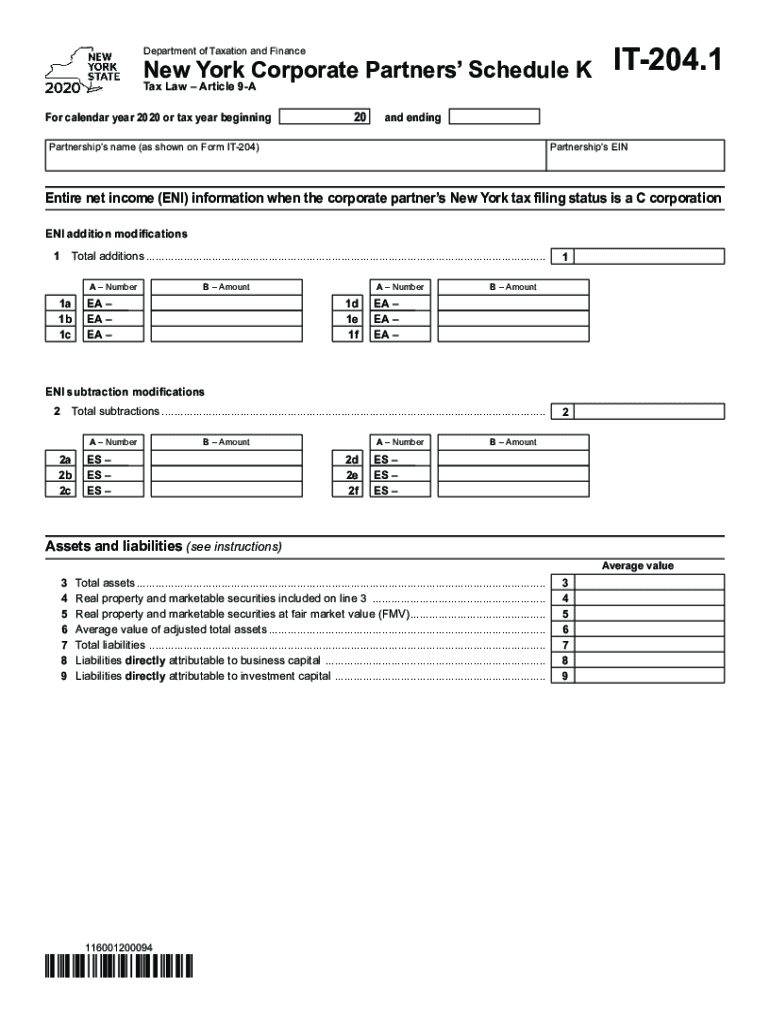

Download Instructions for Form IT204CP Schedule K1 New York

Download Instructions for Form IT204LL Partnership, Limited Liability

Form it 204 1 New York Corporate Partners Schedule K Tax Year Fill

It 204 instructions 2018 Fill out & sign online DocHub

Instructions for Form IT204CP New York Corporate Partner's DocsLib

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

Instructions For Form It204Ll Limited Liability Company/limited

Related Post: