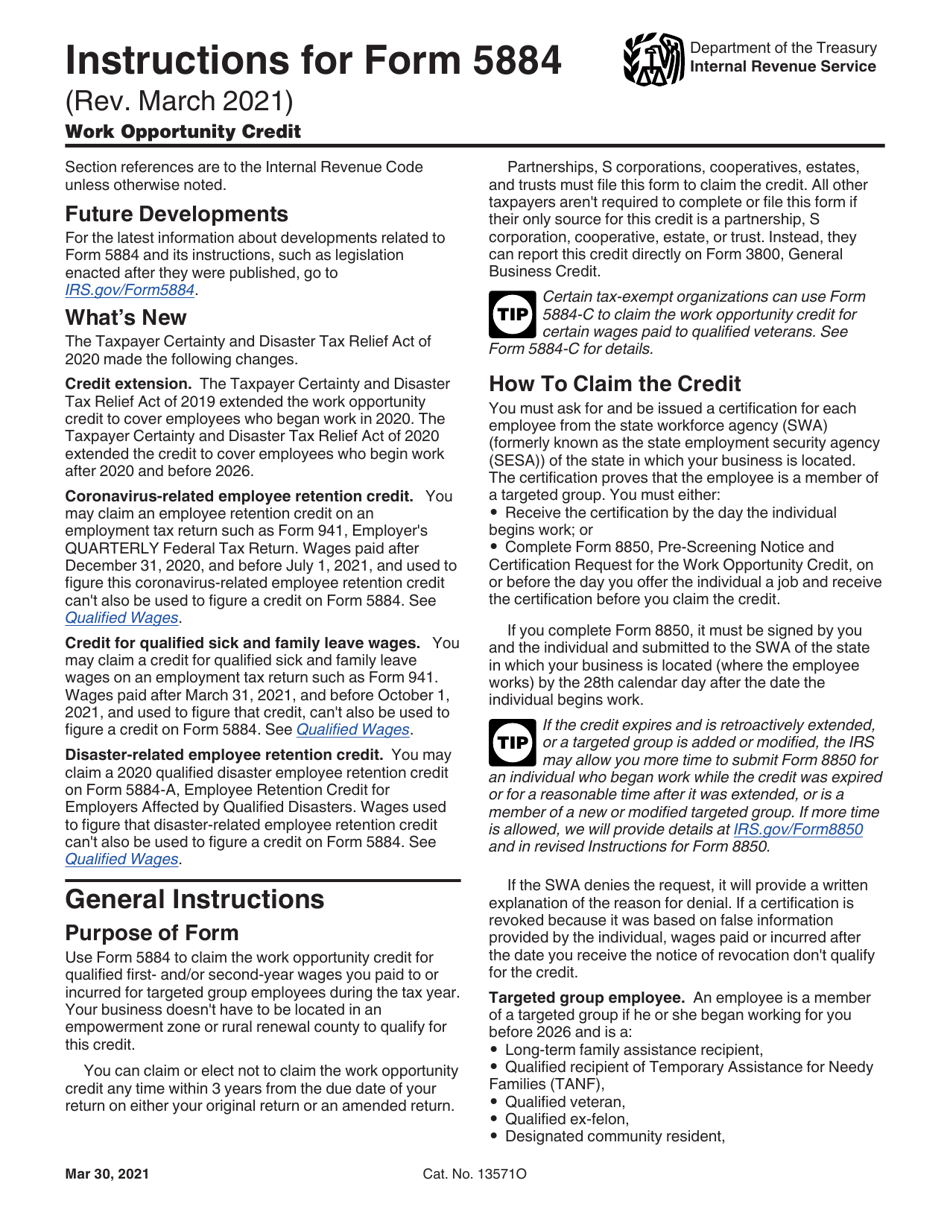

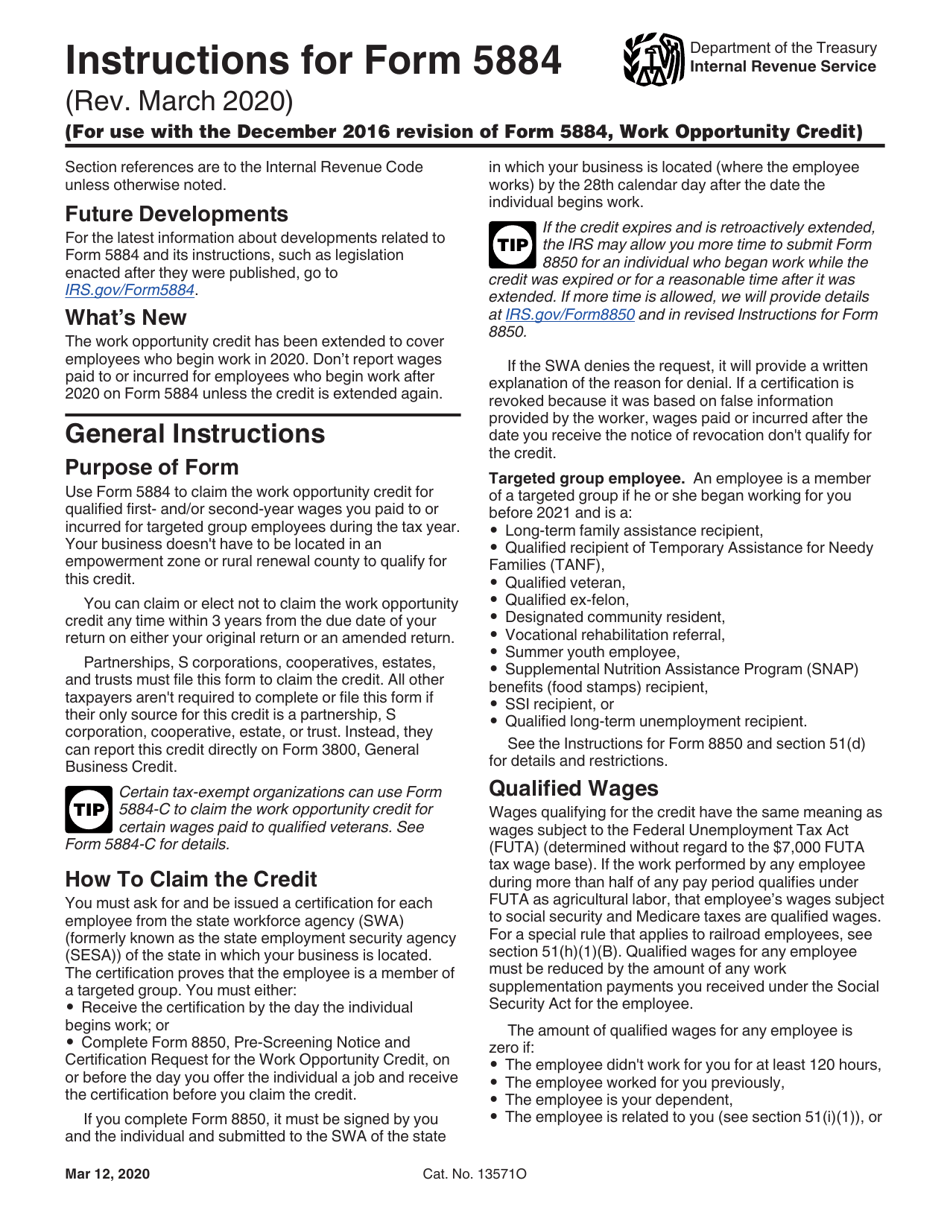

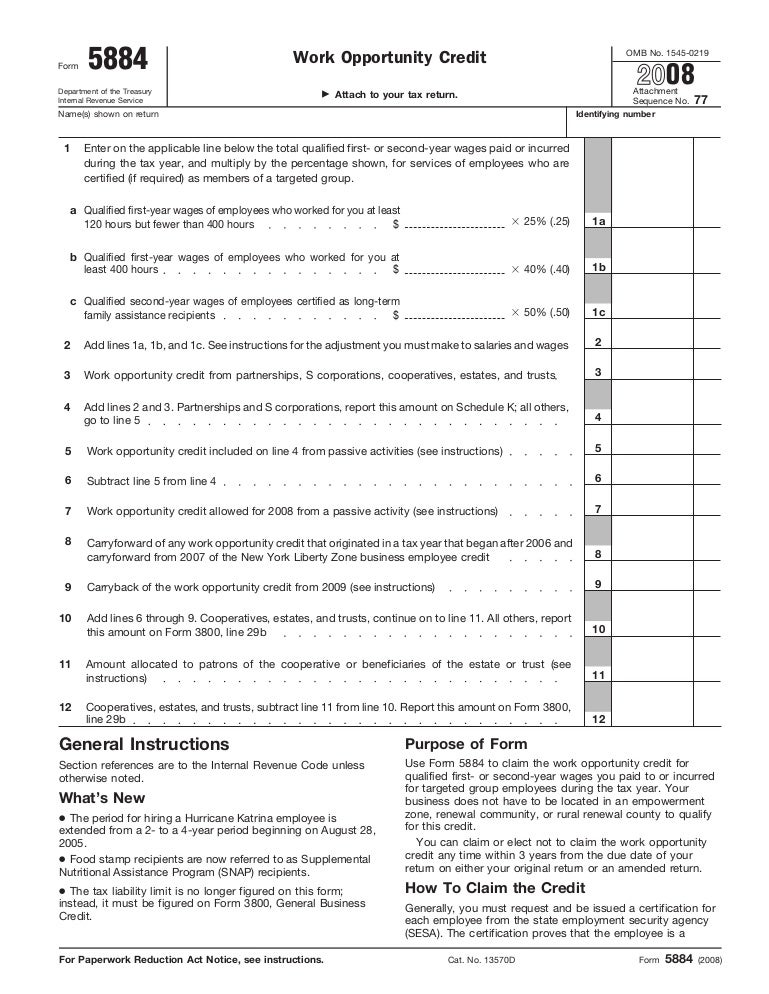

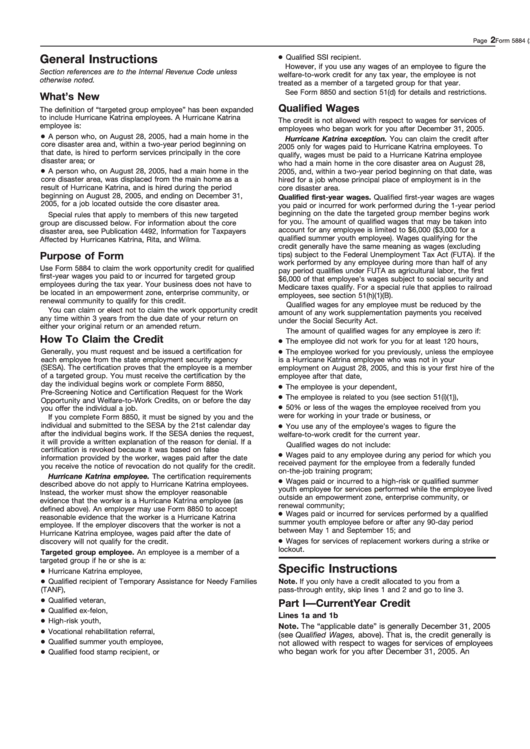

Form 5884 Instructions

Form 5884 Instructions - How to calculate & claim the work opportunity credit on. Complete, edit or print tax forms instantly. Attach to your tax return. December 2016) department of the treasury internal revenue service. Use prior revisions of the form for earlier tax years. Web instructions for form 5884(rev. Web for paperwork reduction act notice, see separate instructions. March 2021) department of the treasury internal revenue service. Claiming the work opportunity tax credit. Web the form is to be used to claim a new type of employee retention credit. Information about form 5884 and. Pdffiller allows users to edit, sign, fill & share all type of documents online. Cui (when filled in) controlled by: Claiming the work opportunity tax credit. Ad tax return preparation and expat tax advice. Qualified wages do not include the following. Ad tax return preparation and expat tax advice. Web the form is to be used to claim a new type of employee retention credit. How to calculate & claim the work opportunity credit on. In this article, we’ll walk through: In this article, we’ll walk through: Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web dd form 884, nov 2010. Pdffiller allows users to edit, sign, fill & share all type of documents online. To claim the work opportunity tax credit,. Web the form is to be used to claim a new type of employee retention credit. Ad tax return preparation and expat tax advice. Complete, edit or print tax forms instantly. March 2021) department of the treasury internal revenue service. Claiming the work opportunity tax credit. In this article, we’ll walk through: Web form 5884, work opportunity credit, with finalized instructions. Web for paperwork reduction act notice, see separate instructions. Claiming the work opportunity tax credit. December 2016) department of the treasury internal revenue service. Claiming the work opportunity tax credit. In this article, we’ll walk through: Ad tax return preparation and expat tax advice. December 2016) department of the treasury internal revenue service. To claim the work opportunity tax credit, most employers will use form 5884 to calculate their allowable. Information about form 5884 and. Ad tax return preparation and expat tax advice. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web employers claim the wotc on irs form 5884, work opportunity credit. March 2021) department of the treasury internal revenue service. Pdffiller allows users to edit, sign, fill & share all type of documents online. In this article, we’ll walk through: December 2016) department of the treasury internal revenue service. Your business doesn't have to be located in an empowerment zone or rural renewal county to. Ad tax return preparation and expat tax advice. Cui (when filled in) controlled by: Web employers claim the wotc on irs form 5884, work opportunity credit. Web instructions for form 5884(rev. To claim the work opportunity tax credit, most employers will use form 5884 to calculate their allowable. Web the form is to be used to claim a new type of employee retention credit. Web the form is to be used to claim a new type of employee retention credit. Ad tax return preparation and expat tax advice. Use prior revisions of the form for earlier tax years. Web employers claim the wotc on irs form 5884, work opportunity credit. Attach to your tax return. March 2021) department of the treasury internal revenue service. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web employers claim the wotc on irs form 5884, work opportunity credit. Web instructions for form 5884(rev. Attach to your tax return. Web for paperwork reduction act notice, see separate instructions. Qualified wages do not include the following. Web the form is to be used to claim a new type of employee retention credit. Ad tax return preparation and expat tax advice. Attach to your tax return. To claim the work opportunity tax credit, most employers will use form 5884 to calculate their allowable. Pdffiller allows users to edit, sign, fill & share all type of documents online. Use prior revisions of the form for earlier tax years. Claiming the work opportunity tax credit. Cui (when filled in) controlled by: December 2016) department of the treasury internal revenue service. In this article, we’ll walk through: Web dd form 884, nov 2010. Your business doesn't have to be located in an empowerment zone or rural renewal county to. Ad tax return preparation and expat tax advice.Download Instructions for IRS Form 5884 Work Opportunity Credit PDF

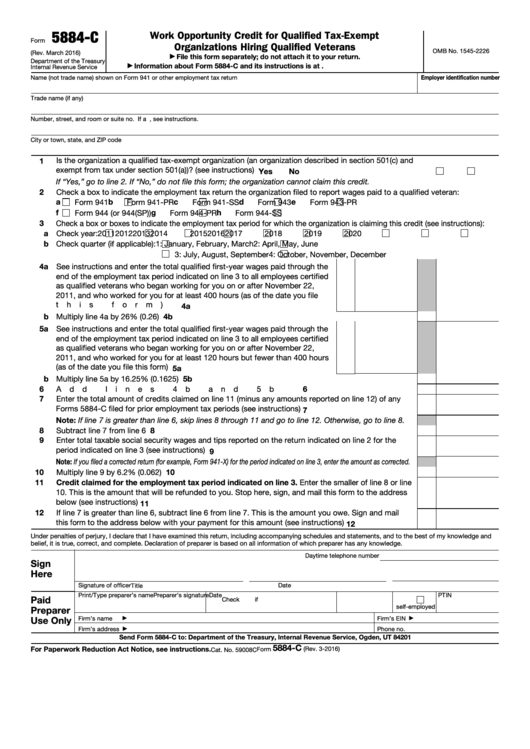

2020 Form IRS 5884C Fill Online, Printable, Fillable, Blank pdfFiller

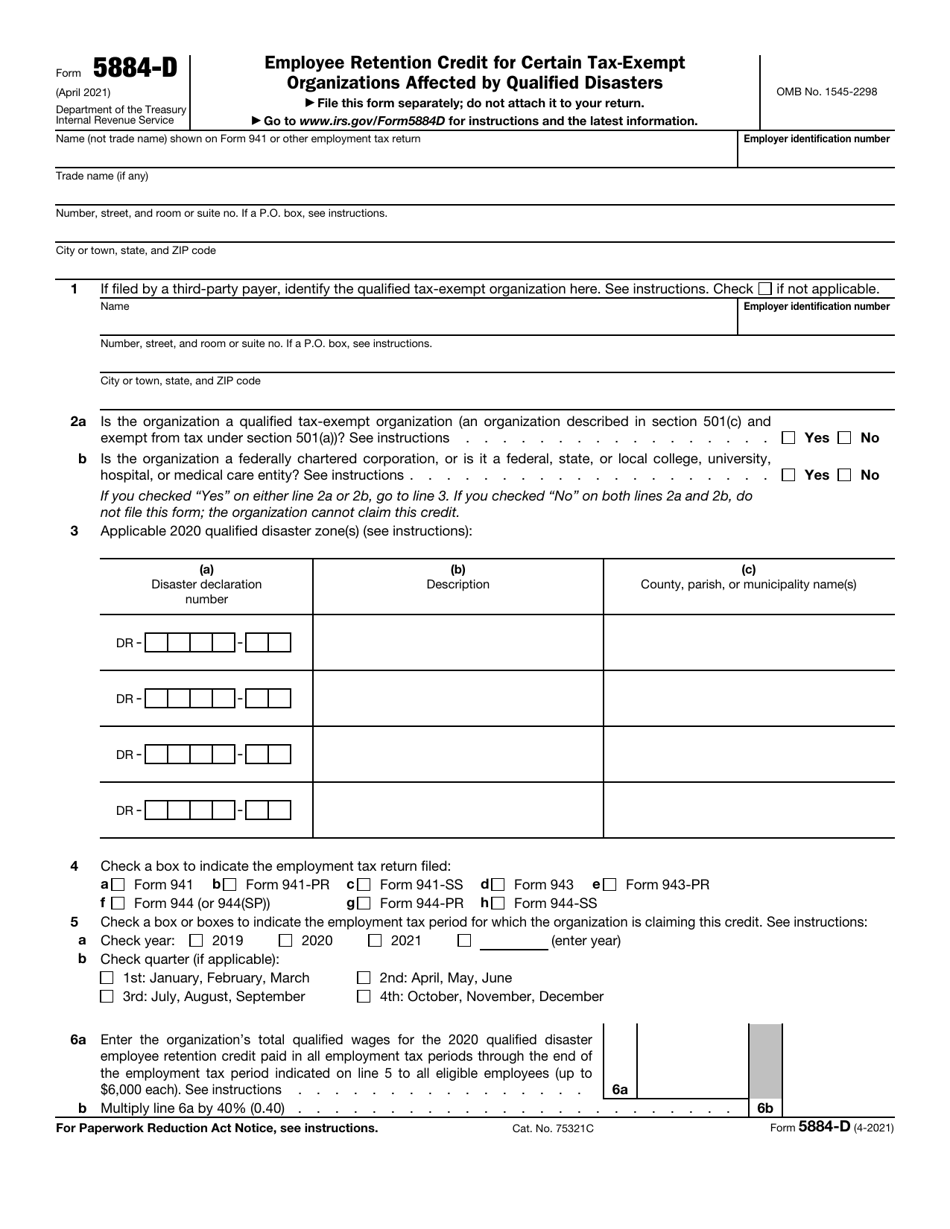

IRS Form 5884D Fill Out, Sign Online and Download Fillable PDF

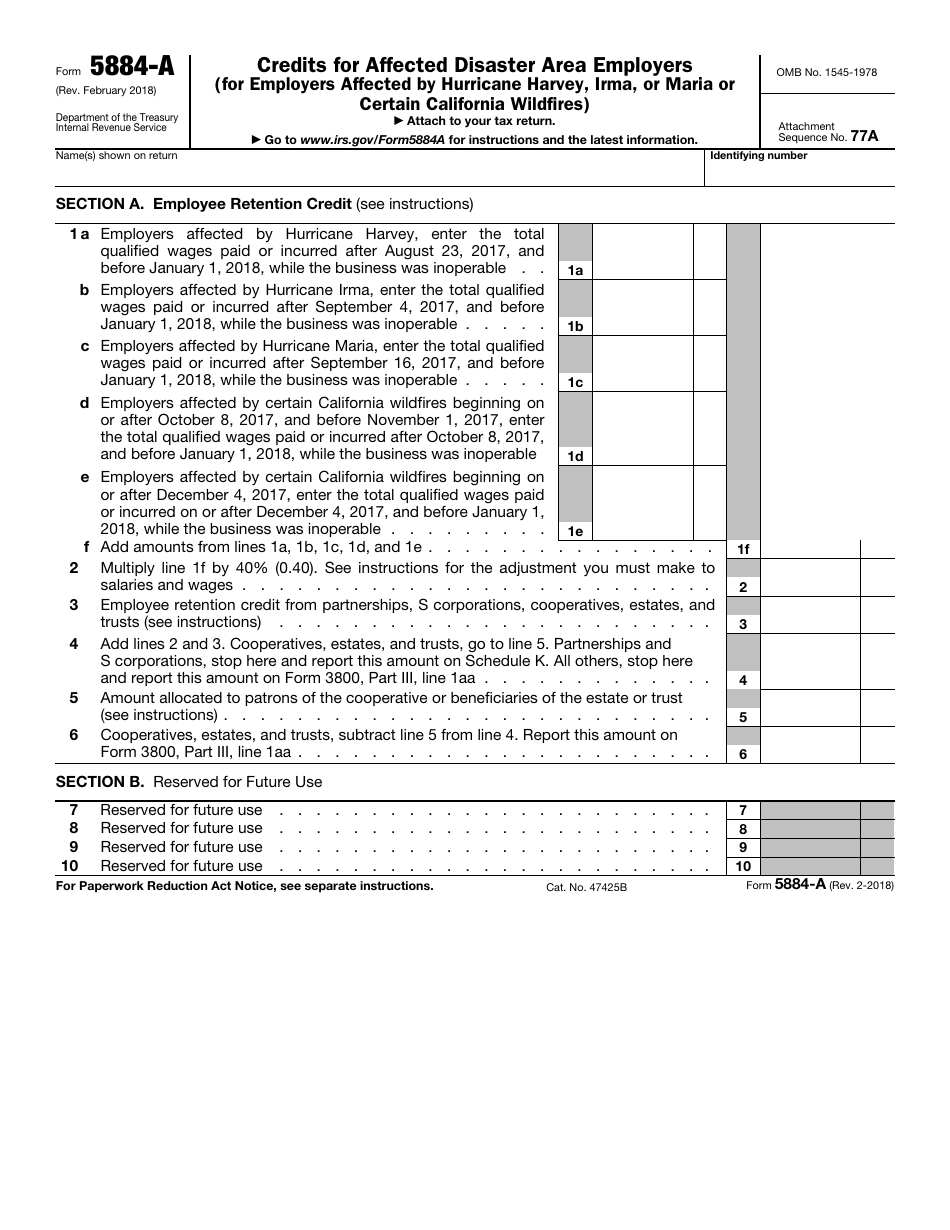

IRS Form 5884A Fill Out, Sign Online and Download Fillable PDF

Download Instructions for IRS Form 5884 Work Opportunity Credit PDF

Form 5884Work Opportunity Credit

Form 5884 Work Opportunity Credit (2014) Free Download

Instructions For Form 5884 Work Opportunity Credit 2005 printable

Top 13 Form 5884 Templates free to download in PDF format

Small Business Tax Credits The Complete Guide

Related Post: