Form 5564 Notice Of Deficiency

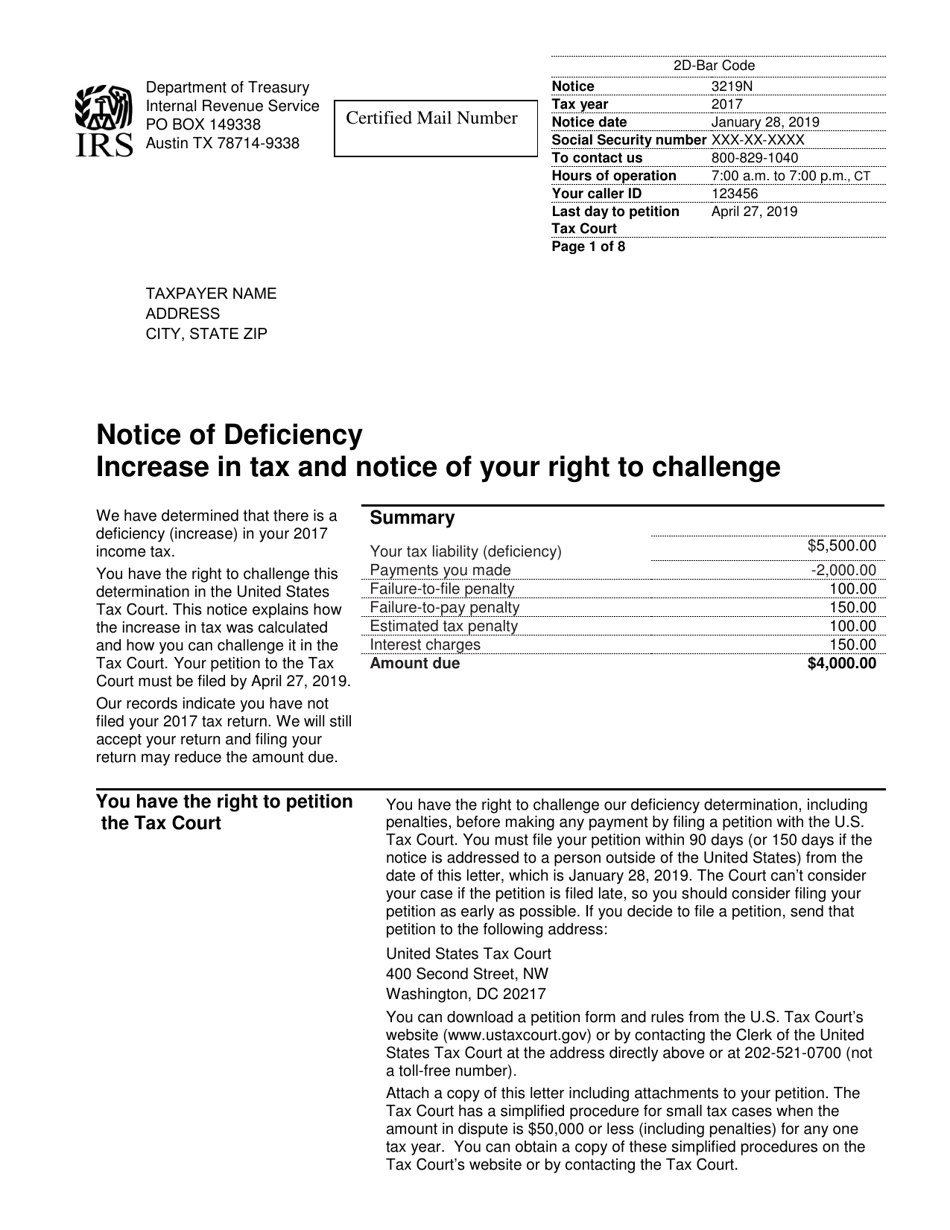

Form 5564 Notice Of Deficiency - Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. Web what is irs form 5564? Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you agree with the. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,. Web how to edit form 5564 notice of deficiency waiver: You do not enter form 5564 in the program. Web what is irs form 5564? Keeping accurate and full records. Web if you agree with the deficiency and are ready to fix it, sign the form 5564 and return it to the irs. Waiting until you get all your income statements before filing your tax return. Web calling as a response to an irs notice of deficiency. Contact the third party that furnished the. Web 1 best answer. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web this letter explains the changes and your right to challenge the increase in tax court. Web what is irs form 5564? Review the changes and compare them to your tax return. Web what. If you disagree you have the right to challenge this determination in u.s. Keeping accurate and full records. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you are making a. Waiting until you get all your income statements before filing your tax return. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web what is irs form 5564? Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. How to complete the ir's form 5564 notice of. If you are making. Web 1 best answer. This form notifies the irs that you agree with the proposed additional tax due. Web what is irs form 5564? If you agree with the. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Waiting until you get all your income statements before filing your tax return. Web you should review the complete audit report enclosed with your letter. You do not enter form 5564 in the program. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web 1 best answer. How to complete the ir's form 5564 notice of. Contact the third party that furnished the. Web calling as a response to an irs notice of deficiency. Web how to edit form 5564 notice of deficiency waiver: A taxpayer may notice that technically, there is no form to answer the cp3219a notice of deficiency directly. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. A taxpayer may notice that technically, there is no form to answer the cp3219a notice of deficiency directly. Web this letter explains the changes and your right to challenge the increase in tax court.. Web calling as a response to an irs notice of deficiency. Web what is irs form 5564? In order to dispute the deficiency, you will gather information. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web you should determine if you agree with the proposed changes or wish to file a petition with. Web calling as a response to an irs notice of deficiency. Web what is irs form 5564? In order to dispute the deficiency, you will gather information. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,. Web you should determine if. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. You do not enter form 5564 in the program. Review the changes and compare them to your tax return. How to complete the ir's form 5564 notice of. Web if you agree with the deficiency and are ready to fix it, sign the form 5564 and return it to the irs. Keeping accurate and full records. Web calling as a response to an irs notice of deficiency. If you are making a. You should determine if you agree with the proposed changes or wish to file a petition with. A taxpayer may notice that technically, there is no form to answer the cp3219a notice of deficiency directly. This form notifies the irs that you agree with the proposed additional tax due. Web this letter explains the changes and your right to challenge the increase in tax court. Along with notice cp3219a, you should receive form 5564. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web you should review the complete audit report enclosed with your letter. Web what is irs form 5564? If you disagree you have the right to challenge this determination in u.s. Web what is irs form 5564? Approve and share form 5564 notice of deficiency waiver along with any other business and. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,.IRS Audit Letter CP3219A Sample 1

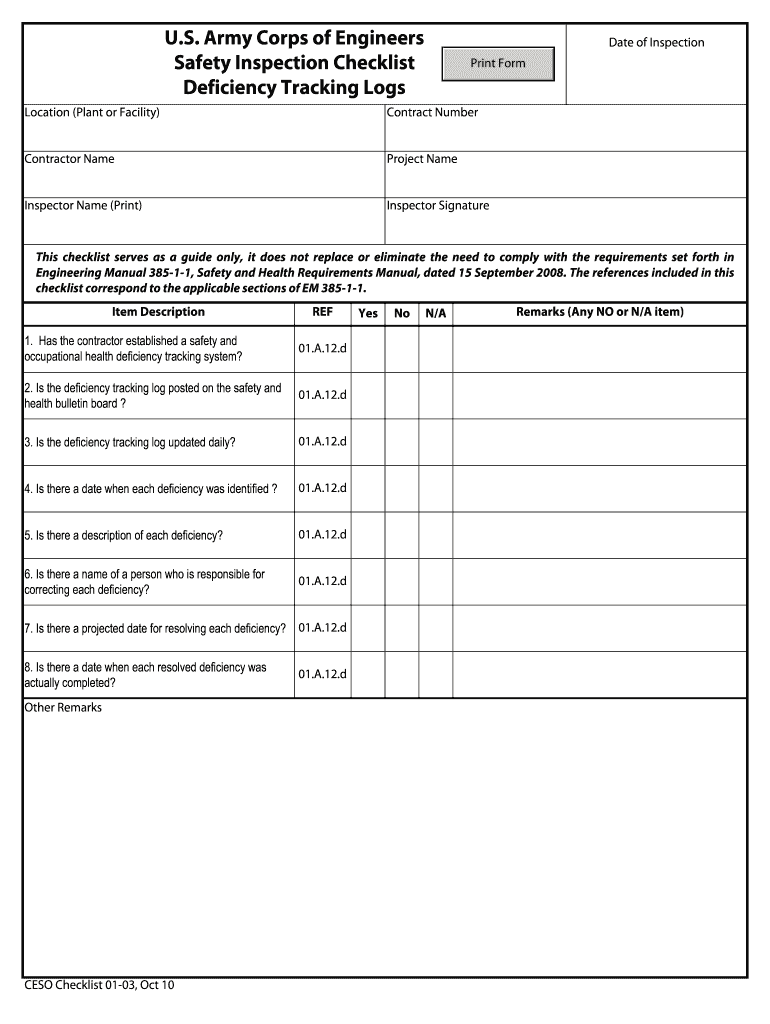

Deficiency Log Form Fill Out and Sign Printable PDF Template signNow

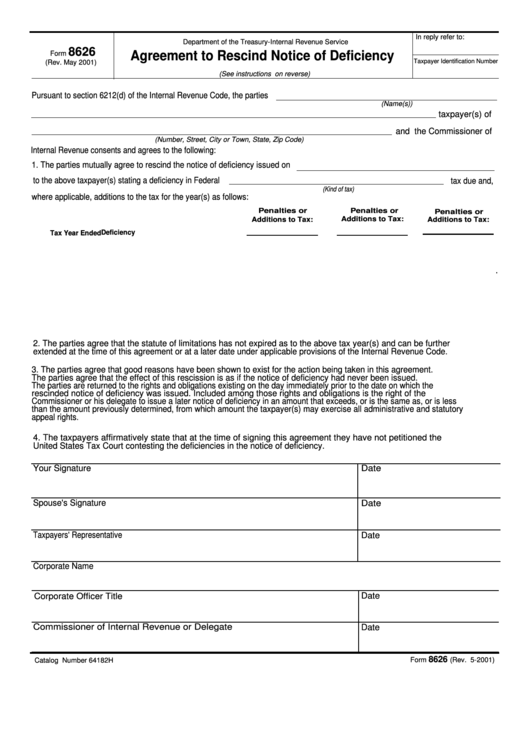

Fillable Form 8626 Agreement To Rescind Notice Of Deficiency

Delinquency Notice Template Master Template

Irs Statutory Notice Of Deficiency Kontaklik

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

IRS Notice of Deficiency Colonial Tax Consultants

IRS “Notice of Deficiency” addressed to Michael Jackson Estate (08/20

IRS Notice Cp3219n, Notice of Deficiency Fill Out, Sign Online and

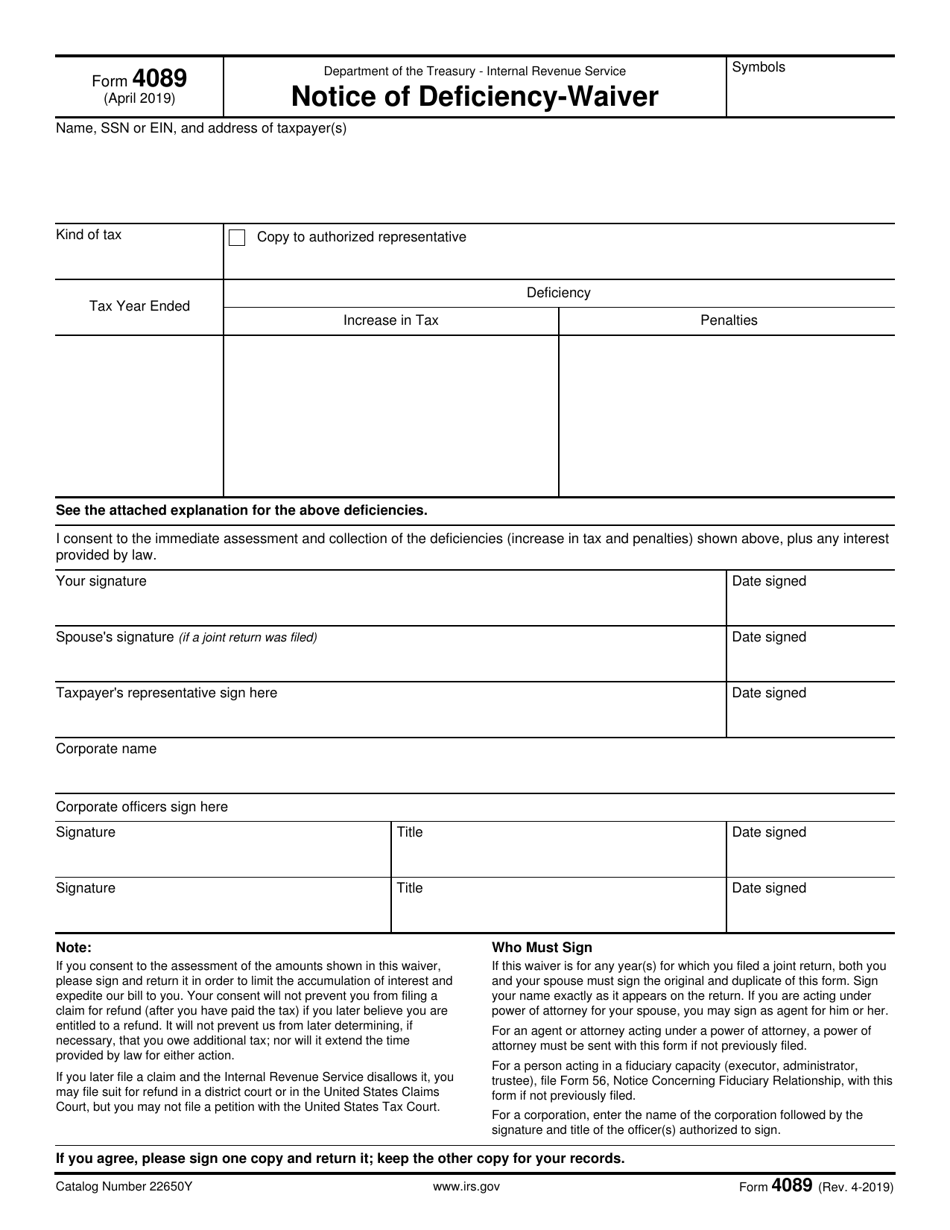

IRS Form 4089 Fill Out, Sign Online and Download Fillable PDF

Related Post: