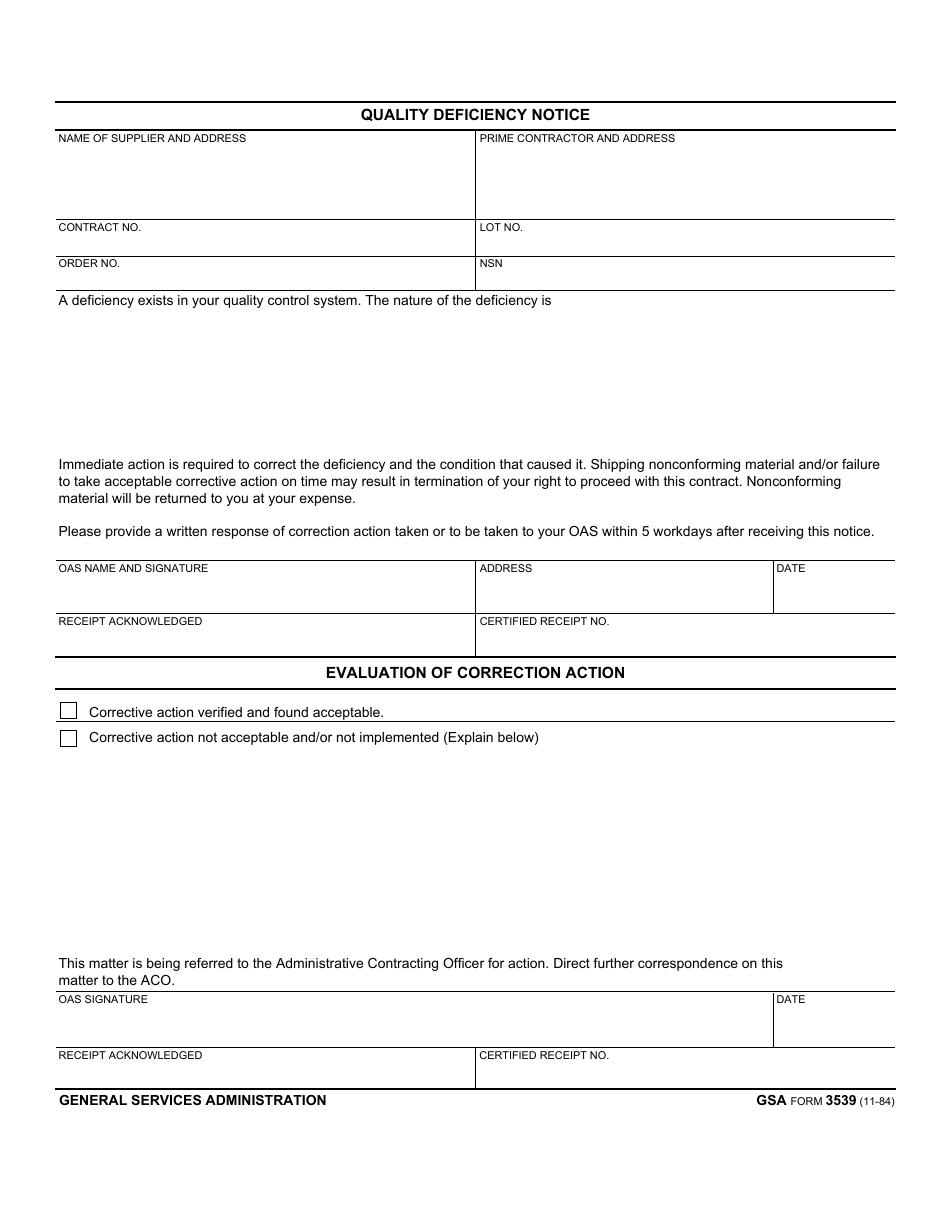

Form 5564 Notice Of Deficiency Waiver

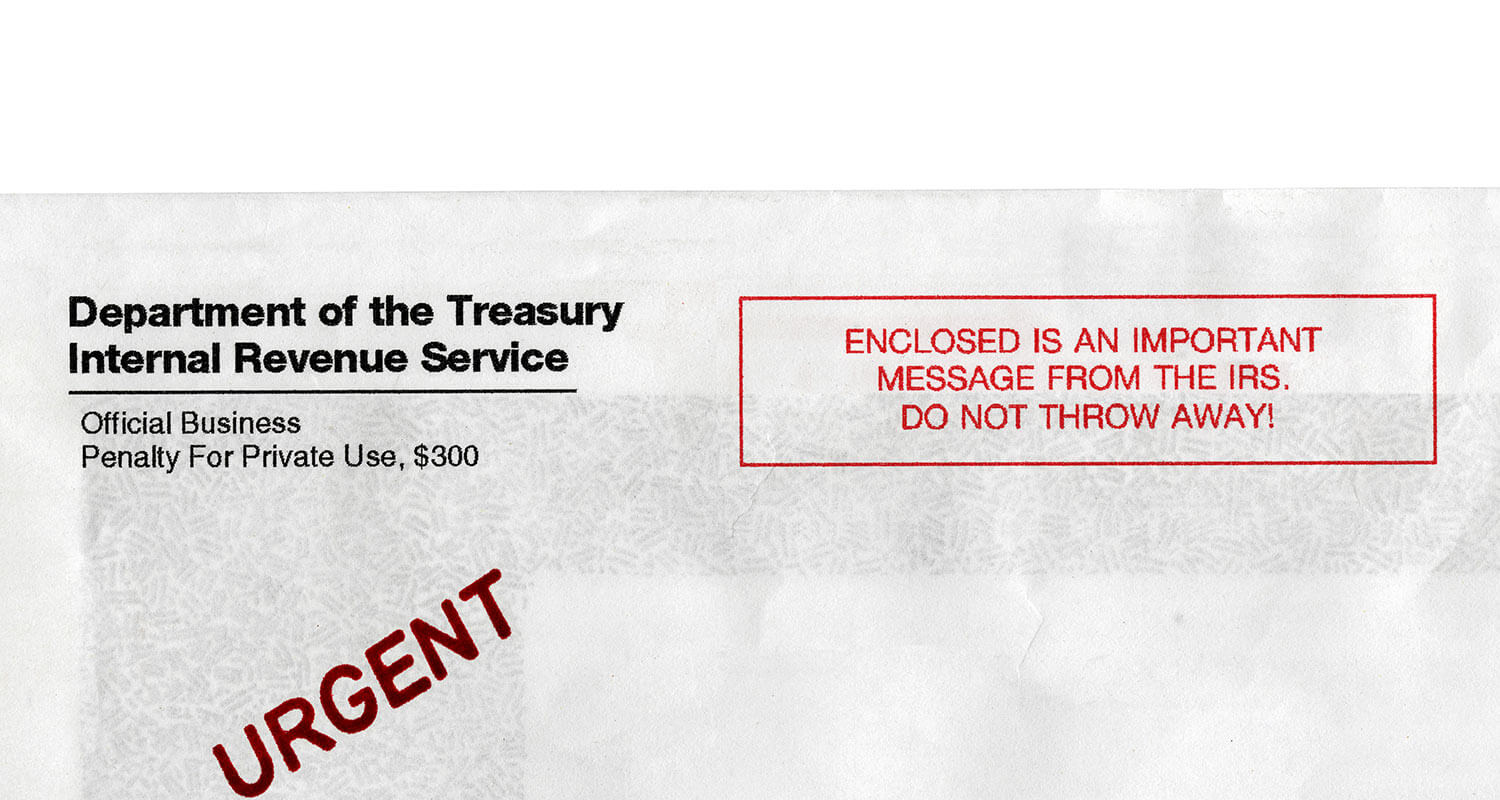

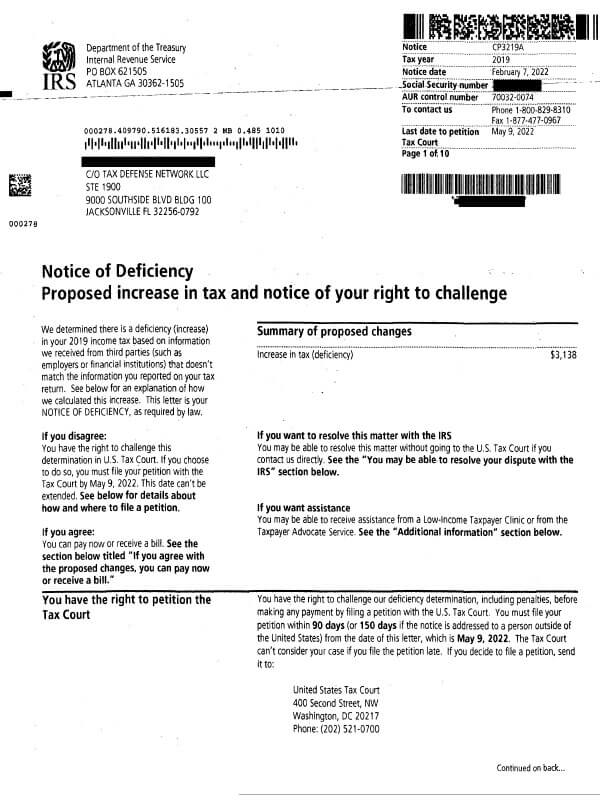

Form 5564 Notice Of Deficiency Waiver - If you agree with the changes, sign the enclosed form 5564, notice of. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: What is irs form 5564? Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. You should determine if you agree with the proposed changes or wish to file a petition with. You do not enter form 5564 in the program. Irs form 5564 is included when the federal tax agency. Web the notice of deficiency must state the last day when a petition must be filed with the tax court. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. Tax court in washington d.c. Tax court in washington d.c. This form need to be filled out by the current employer current employer you get your health insurance from, whether. It explains the proposed increase or decrease in your tax. Web this is how we calculate the case inquiry date: Web if you agree with the notice of deficiencies proposed increase in tax, consider filling. You do not enter form 5564 in the program. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: If. Web what is irs form 5564? Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. If you agree with the changes, sign the enclosed form 5564, notice of. A copy of any notice of deficiency,. The letter explains why there is a proposed. Web enclosed form 5564, notice of deficiency waiver, to the address below. Along with notice cp3219a, you should receive form 5564. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Irs form 5564 is included when the federal tax agency. What is irs. This form notifies the irs that you agree with the proposed additional tax due. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: Irs form 5564 is included when the federal tax agency. You will receive a bill for any unpaid tax, interest, and applicable. If you agree with the changes, sign the enclosed form 5564, notice of. What is irs form 5564? Web this is how we calculate the case inquiry date: Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. Web if you. In over 36 years working with. Web this notice is referred to as a “90 day letter.” gilbert az taxpayers have a right to file a petition with the u.s. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will.. Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. Web what is irs form 5564? If the irs believes that you owe more tax than what was reported on your tax return, the irs. How to complete the ir's. Web you should review the complete audit report enclosed with your letter. Web what is irs form 5564? Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. Web enclosed form 5564, notice of deficiency waiver, to the address below.. The letter explains why there is a proposed. If you agree with the. In over 36 years working with. Web the notice of deficiency must state the last day when a petition must be filed with the tax court. Web this is how we calculate the case inquiry date: Web you should review the complete audit report enclosed with your letter. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. If the irs believes that you owe more tax than what was reported on your tax return, the irs. Along with notice cp3219a, you should receive form 5564. Tax court in washington d.c. Irs form 5564 is included when the federal tax agency. You will receive a bill for any unpaid tax, interest, and applicable penalties. A copy of any notice of deficiency,. Web to help ensure that your case is properly processed, please enclose the following items when you mail your petition to the tax court: This form need to be filled out by the current employer current employer you get your health insurance from, whether. Web 1 best answer. If you agree with the changes, sign the enclosed form 5564, notice of. Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. Web enclosed form 5564, notice of deficiency waiver, to the address below. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will.GSA Form 3539 Fill Out, Sign Online and Download Fillable PDF

IRS Audit Letter CP3219A Sample 1

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

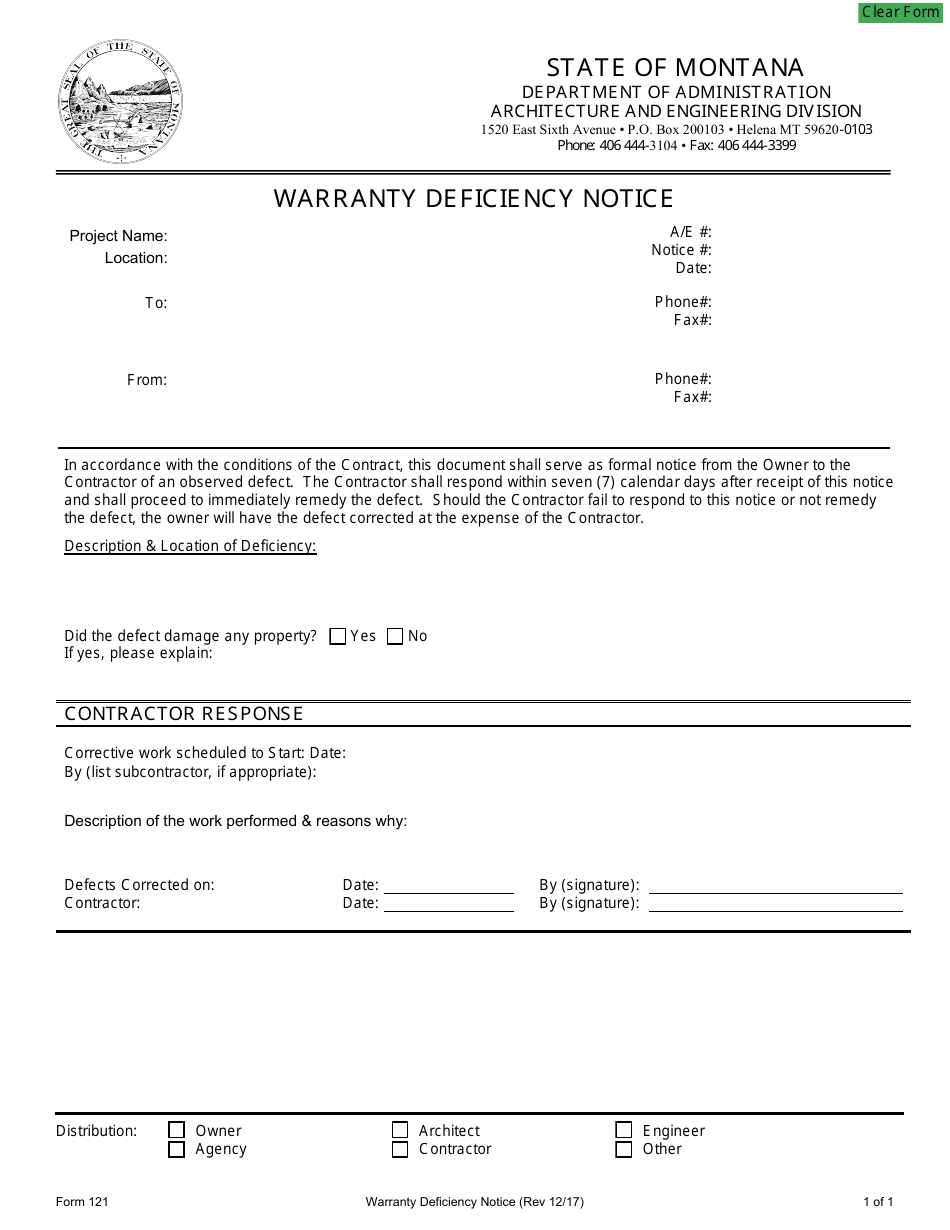

Form 121 Download Fillable PDF or Fill Online Warranty Deficiency

Form 5564 Notice of Deficiency Waiver

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Here's What to Do with an IRS Notice of Deficiency

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Aviso del IRS CP3219A Tax Defense Network

IRS Audit Letter CP3219A Sample 1

Related Post: