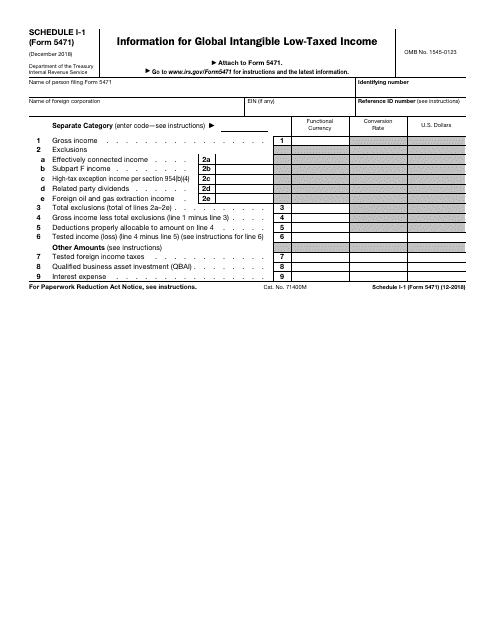

Form 5471 Schedule I-1 Instructions

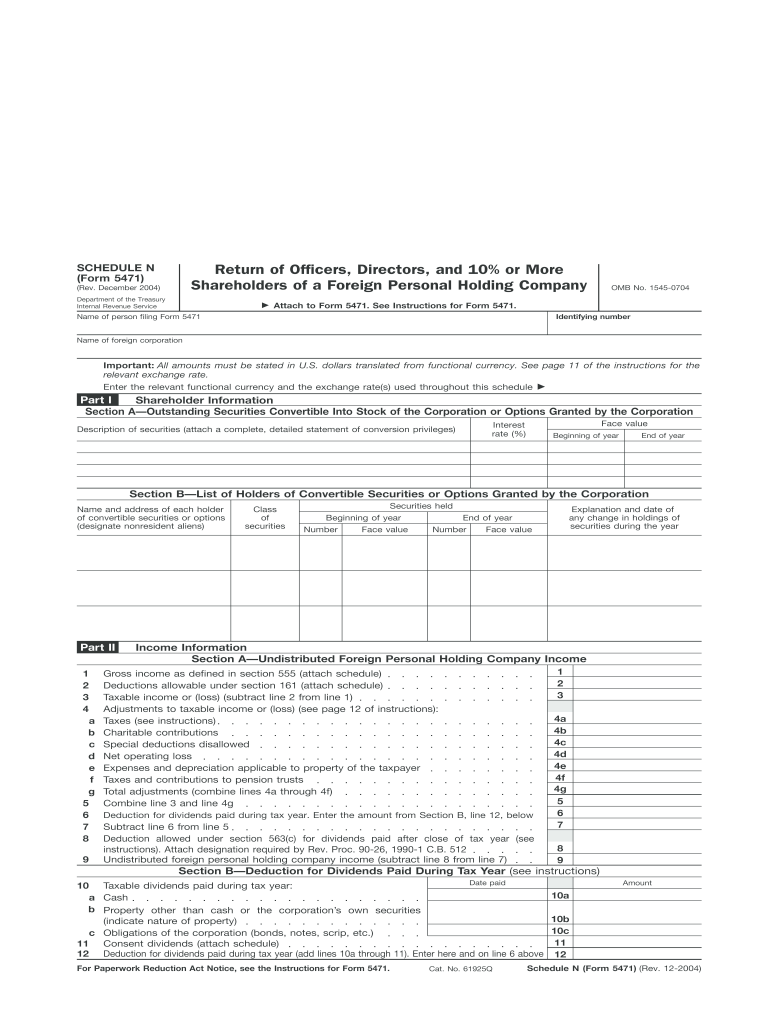

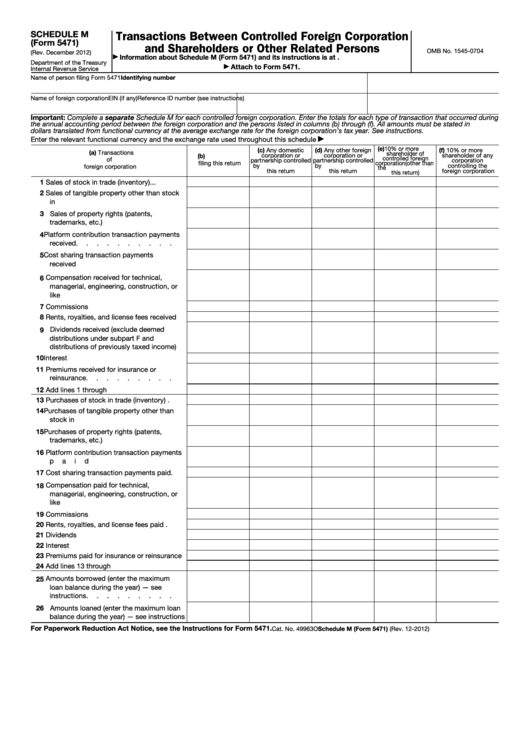

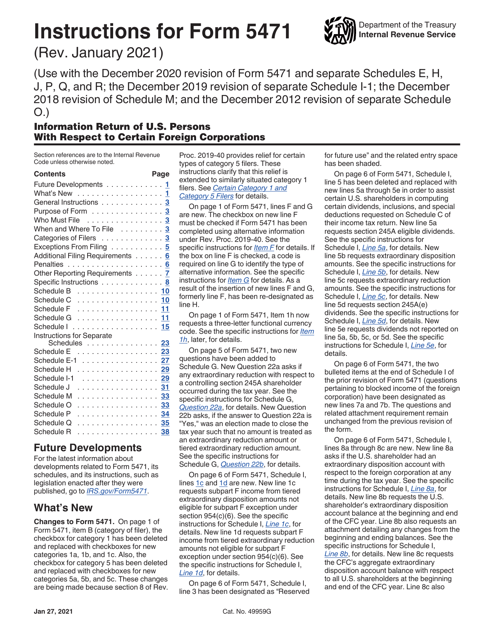

Form 5471 Schedule I-1 Instructions - Web form 5471 is a relatively detailed form. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. If “yes,” you are generally required to attach form 8858 for each entity (see. Transactions between controlled foreign corporation and. Web instructions for form 5471(rev. Hsa, archer msa, or medicare advantage msa information 2023 11/02/2022 form 5471 (schedule e) income, war profits, and excess profits taxes. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web instructions for form 5471(rev. Let's quickly review these three categories. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income,. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Web as if the comprehensive form 5471 is not in and of itself complicated enough, there are several potential separate schedules that you may also have to. Unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income,. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web instructions for form 5471(rev. Web instructions for form 5471(rev. Web as if the comprehensive form 5471 is not in and. Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “. If a cfc generates gilti income (section 951a) the earnings. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Let's quickly review these three categories. January 2021) (use with the december 2020 revision of form 5471 and separate. Let's quickly review these three categories. Summary of shareholder’s income from foreign corporation. 17 during the tax year, did the foreign corporation pay or accrue any foreign tax that was. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. Web as if the comprehensive form 5471 is not in and of. Web instructions for form 5471(rev. Unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income,. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Persons with interests in. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; If a cfc generates gilti income (section 951a) the earnings. Web instructions for form 5471(rev. Web instructions for form 5471(rev. Transactions between controlled foreign corporation and. Let's quickly review these three categories. Web as if the comprehensive form 5471 is not in and of itself complicated enough, there are several potential separate schedules that you may also have to complete in addition to. If “yes,” you are generally required to attach form 8858 for each entity (see. Web so, schedule q is a required schedule for. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). December 2021) department of the treasury internal revenue service. Web instructions for form 5471(rev. If “yes,” you are generally required to attach form 8858 for each entity (see. Hsa, archer msa, or medicare advantage msa information 2023 11/02/2022 form 5471 (schedule e) income, war profits,. Summary of shareholder’s income from foreign corporation. December 2021) department of the treasury internal revenue service. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). The december 2021 revision of separate. Web instructions for form 5471(rev. December 2019) department of the treasury internal revenue service. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “. 17 during the tax year, did the foreign corporation pay or accrue any foreign tax that was. Web current earnings. The december 2021 revision of separate. Summary of shareholder’s income from foreign corporation. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; December 2019) department of the treasury internal revenue service. Web instructions for form 5471(rev. Let's quickly review these three categories. But first, i want to put in a plug for the form 5471. If applicable, use the reference id number shown on form 5471, page 1, item 1b(2). Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. Web as if the comprehensive form 5471 is not in and of itself complicated enough, there are several potential separate schedules that you may also have to complete in addition to. Unlike the fbar or form 8938, form 5471 requires the taxpayer to provide information involving the corporate income,. December 2012) department of the treasury internal revenue service. Web instructions for form 5471(rev. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; 17 during the tax year, did the foreign corporation pay or accrue any foreign tax that was. If a cfc generates gilti income (section 951a) the earnings. Web instructions for form 5471(rev. If “yes,” you are generally required to attach form 8858 for each entity (see. Web instructions for form 5471(rev. December 2021) department of the treasury internal revenue service.IRS Issues Updated New Form 5471 What's New?

5471 Worksheet A

Form 5471 schedule j example Fill out & sign online DocHub

5471 Schedule I Worksheet Activities Gettrip24

5471 Schedule N Fill Out and Sign Printable PDF Template signNow

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

irs form 5471 Fill Online, Printable, Fillable Blank

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Fillable Form 5471 Schedule M Transactions Between Controlled

Download Instructions for IRS Form 5471 Information Return of U.S

Related Post: